Main

Analytics in trading, and in particular in the volatile cryptocurrency market, allows you to draw conclusions based on data and make more informed decisions.

A variety of analytical tools are available on Binance, including data sources for technical and fundamental analysis, historical price analysis, real-time market data, and charts with technical indicators.

Developing analytical skills takes time and practice.

The world of analytics for trading is extremely diverse. Learn how to get started on Binance and access the tools you need.

Analytics is one of the most important aspects of trading. Data-driven insights and trading patterns help traders make better decisions, which is critical in the volatile cryptocurrency space. Using analytics tools, you can better understand market trends, price movements and trading volumes in the market. On the Binance platform you can find a lot of information for analysis and further application in trading.

Users have access to a variety of tools that are easy to master: from real-time price charts to customizable technical indicators. Check out this guide to our analytics tools and start your crypto trading journey with more confidence in your decisions.

What is cryptocurrency analytics

First, let's define analytics and learn how traders use it. Analytics is the study of data to identify important patterns, find trends, and formulate conclusions. Blockchain networks and the marketplace generate a huge amount of data that can be used for trading. Analytics involves taking this data and analyzing it further.

There are two main techniques used for data analytics:

Technical Analysis (TA): involves studying price charts and performing mathematical calculations based on the data obtained. These calculations, also called technical indicators, are then displayed on the price chart.

Technical indicators can be simple, such as moving averages (MA), or complex, such as Bollinger Bands. The data available on Binance is mainly suitable for technical analysis, so that is what we will focus on in this guide. Read our article5 main indicators used in technical analysis on Binance Academy to learn more about TA and available indicators.Fundamental Analysis (FA): Includes studying the technology behind a project or cryptocurrency, use cases, development team, partners, and other developments. Fundamental analysis is used to evaluate the long-term potential and value of a project rather than short-term price fluctuations. Read A Guide to Fundamental Analysis of Cryptocurrencies on Binance Academy to learn more.

Using Binance Analytics Tools and Data Sources

Binance provides a lot of information and analysis features, but users should also consider data from other platforms.

Historical price analysis and real-time market data

Whether you're interested in trading the spot or futures market, you'll be able to freely view historical price data for a wide range of cryptocurrencies. This information can be used to study past price trends and identify patterns or cycles.

Using a data-driven approach, it is possible to understand how specific assets perform under different market conditions. Armed with this knowledge, you can make more accurate predictions about possible future price movements.

In addition to historical data, users also have access to accurate cryptocurrency prices based on the industry's most liquid and high-volume markets. The cryptocurrency market operates 24/7 and can be extremely volatile. On Binance, you can easily find up-to-date information on prices, trading volumes, and order book depth.

This real-time data allows you to see potential opportunities and respond to market fluctuations in a timely manner. For example, a large number of sell orders at the same price in the order book may indicate a potential resistance point in the price of an asset.

TradingView integration for technical analysis indicators

By adding integration with the TradingView charting platform, Binance has introduced a number of technical analysis indicators such as moving averages, relative strength index (RSI), and Bollinger Bands. These indicators help identify price trends, momentum and possible reversals in the market. By analyzing data from these indicators, traders make predictions about the direction of the market and adjust their strategies accordingly.

In the upper right corner of the price chart you can see the Trading View function. In this chart, we have selected the moving average indicator, which is displayed on top of the candlestick chart.

Our integration with TradingView is a powerful tool in the hands of users who want to conduct in-depth analysis. Read our Beginner's Guide to TradingView to learn more about using this feature.

Market Sentiment Analysis

Understanding market sentiment is a key aspect of successful trading. Binance Feed allows you to follow the latest news, discussions and industry trends to gauge current market sentiment. With this data, Binance users can understand whether the market is bullish or bearish, and also make more informed and thoughtful decisions.

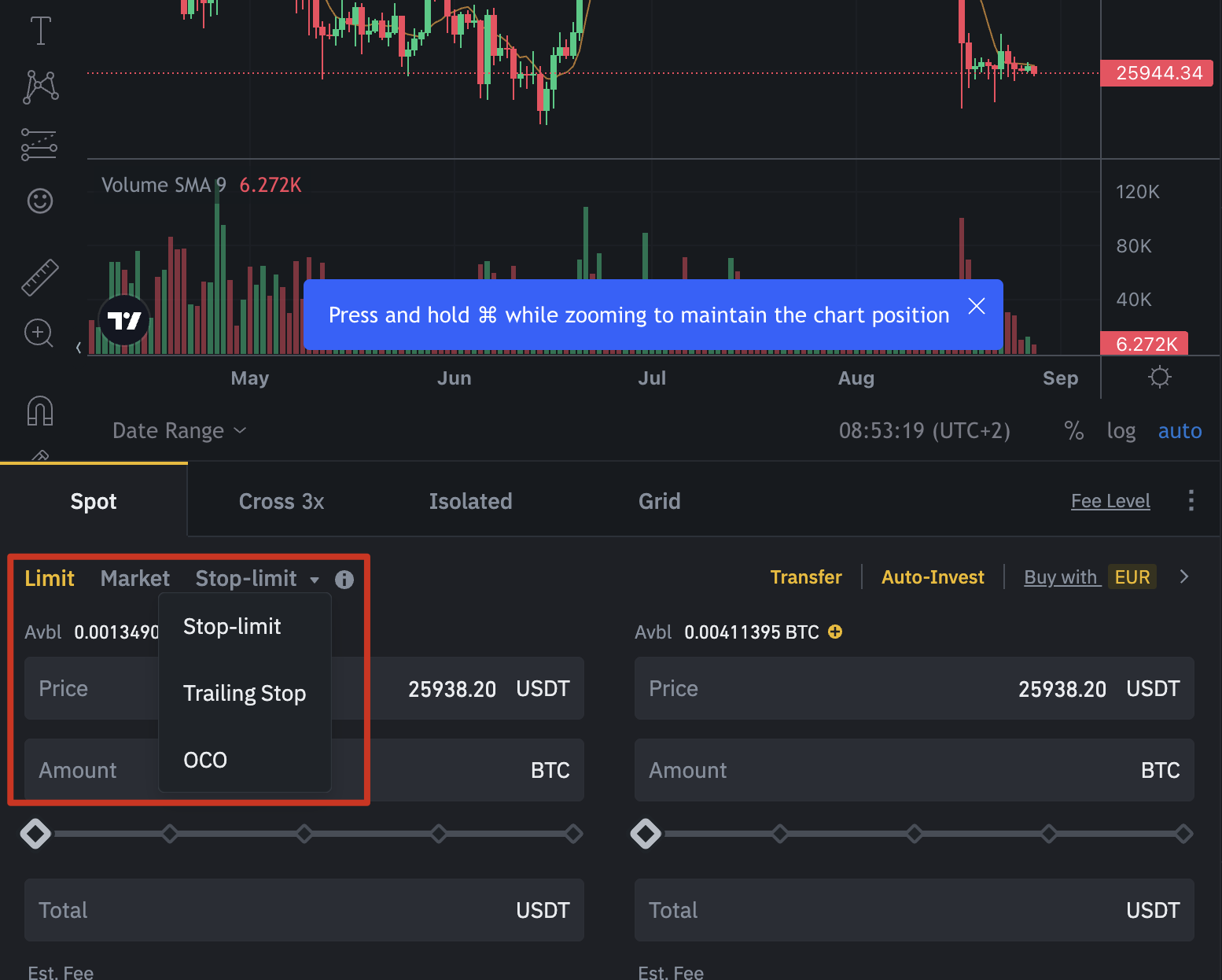

Customizable alerts and advanced order types

Often, it is important for traders analyzing the market to know the exact moment when a certain price is reached. For example, you want to determine a potential selling price or resistance point. In this case, it's worth set up price alerts to stay on top of market prices without constant tracking.

You can even improve this mechanism. Depending on the results of the analysis and the chosen strategy, place an order in advance. In this case, you can use a limit order, limit stop order, or other type of order. This way you will have better control over entering and exiting the market.

Let's give an example. According to Binance Academy, limit stop orders “allow you to set a minimum amount of profit that traders are willing to make or a maximum amount that they are willing to risk during a trade. When the activation price is reached, a limit order will be placed automatically, even if the user is logged out.”

Backtesting strategies

Binance tools allow you to test trading strategies based on historical data for specific markets and pairs. In other words, users can simulate new strategies developed using analytics and learn how they would have performed in the past. Backtesting helps you refine strategies, identify strengths and weaknesses, and optimize your trading approach to achieve better results in real time.

Check out our guide How to Set Up Indicators and Backtest a Strategy on Binance Futures to learn more.

Education and knowledge

Binance not only provides tools, but also offers educational resources and training materials. Our users and others in the blockchain community can explore articles, guides, and tutorials on the Binance Blog and Binance Academy. These resources provide deeper insight into market dynamics, fundamentals, analytics and news.

Basic Analytics Process

So, we've looked at some of Binance's analytics tools and platform capabilities, and now we can dive into the basic steps of analysis. Each trader has his own style and individual methodology, and therefore the instructions below are the basics to help you begin your journey in analytics.

Learning the Basics

Understanding Blockchain: Become familiar with the fundamental concepts of blockchain. Explore the features of decentralized ledgers, smart contracts, and the cryptographic principles that underlie cryptocurrencies.

Variety of tokens: Explore the cryptocurrencies available on the market. Different tokens are used for different purposes: from payments (for example, Bitcoin) to platform-specific tasks (for example, Ether on the Ethereum network) and so on.

Development of a trading strategy

Setting Goals: Decide what your goal is to trade (for short-term profit, long-term investment, or both). It is the strategy that will determine the analytical approach.

Risk assessment: Determine your acceptable risks. Blockchain markets can be extremely volatile, so it is important to determine the level of risk you are willing to take.

Gathering market information

Select Reliable Data Sources: Use trusted platforms like CoinMarketCap and Binance to get accurate market data, including prices, trading volumes, and market capitalization.

Track the latest developments: Subscribe to trusted sources of blockchain and cryptocurrency news. Events that change the market situation can significantly affect asset prices.

Conducting technical analysis

Studying Price Charts: Learn to read and interpret candlestick charts. You must understand chart patterns, trend lines, and important indicators like moving averages, relative strength index (RSI), and moving average divergence and convergence (MACD).

Trend Detection: Analyze historical price data to identify current trends such as uptrends, downtrends and sideways trends.

Conducting fundamental analysis

Studying projects: read detailed information about the projects of the cryptocurrencies that interest you. Find out what these coins are used for, who developed them, who the project is collaborating with, and what technological advances it has.

Application Assessment: Find out how your chosen cryptocurrency can be used within its ecosystem. The ability to use cryptocurrency for various tasks increases its potential value.

Market Sentiment Tracking

Social networks and forums: Monitor discussions and sentiments in crypto communities on platforms such as Twitter, Reddit and Telegram.

Sentiment Analysis Tools: Master market sentiment analysis tools to determine community sentiment based on social media data and trending news.

Understanding Market Dynamics

Market Order Books: Learn to read order books on exchanges. From them you can learn about current buy and sell orders, as well as assess the level of supply and demand.

Liquidity: Learn what liquidity is. Cryptocurrency prices with higher liquidity tend to decline more smoothly.

Stay up to date with the latest news and events

Important Events: Stay on top of important events such as protocol updates, regulatory changes, partnerships with other projects, and security breaches that could impact pricing.

Regulatory Framework: Stay up to date with changes in laws in various countries, as regulations can influence market sentiment.

Risk management in practice

Setting Stop Loss and Take Profit: Determine the price points at which you will automatically sell assets to cut losses and secure profits.

Diversification: Spread your investments across multiple cryptocurrencies to protect against the impact of low performance in one asset.

Remember that improving your trading and analytical skills takes time and practice. It is recommended to start with a small investment and increase your investment as you gain skills and confidence. Be patient, stay tuned and constantly improve your trading approach based on your skills and the current market situation.

Analytics skills require practice

The role of analytics in the cryptocurrency space is extremely important. It can be used for a variety of purposes, from predicting market trends to analyzing market sentiment and mitigating risks. If you want to improve your trading skills, then you will have to spend a lot of time practicing. Luckily, Binance is a great place to gain new knowledge and master your skills.

Additional Information

Risk Warning and Disclaimer. The following materials are provided “as is” without warranty of any kind for general reference and educational purposes only. This information should not be considered financial advice or a recommendation to purchase any specific product or service. The value of digital assets may be volatile, increasing the risk of loss of investment. You are solely responsible for your investment decisions. Binance is not responsible for your possible losses. This information does not constitute financial advice. Please see Terms of Use and Disclaimer for details.

Access to the products and services mentioned in this article may be restricted in certain jurisdictions or regions or by certain users due to legal and regulatory requirements. The information on this page is intended only for users authorized to access such products and services and is not intended for users to whom restrictions apply. By using any products or services offered or made available on the Binance Platform, you are responsible for reviewing any applicable restrictions and requirements regarding those products and services that apply in the country or region from which you (or another person on your behalf) are accessing them. Binance reserves the right to change the terms and conditions and impose further restrictions on access to and use of any products and/or services offered at its sole discretion at any time and without notice.