Main Takeaways

In this blog series, we summarize our research team’s findings, inviting you to dive deeper into the original reports.

This article previews the Binance Research report on Telegram bots with crypto-related functionalities, which have gained significant traction recently.

Telegram bots can enable the execution of crypto activities via mobile devices, thereby offering a user-friendly way of accessing crypto markets.

Thanks to Binance Research, you can take advantage of industry-grade analysis of the processes that shape Web3. By sharing these insights, we hope to empower our community with the latest knowledge from the field of crypto research. For a deeper dive, the full reports are available on the Binance Research website.

Chatbots on the messaging platform Telegram have emerged as a new trend in the crypto community, offering a user-friendly alternative to existing decentralized finance (DeFi) applications. These bots have gained significant attention in part due to the surging prices of associated tokens as well as heightened media coverage driving attention to this space. Today, we will examine various metrics that describe the current landscape of crypto bots on Telegram as well as risks and potential future developments in this space.

This article has been adapted from a Binance Research report published on August 4, 2023, and as such it does not cover relevant data and developments beyond this date.

How Crypto Telegram Bots Work

Telegram bots allow users to execute various functions by simply sending messages on their mobile devices. As the interfaces of existing DeFi apps are generally more complex than that, crypto-enabled Telegram bots provide a convenient way to access crypto markets that may appeal to less experienced users. The typical process of operating a bot with crypto functionality involves the following steps:

Users enter a command in the channel of the Telegram bot.

A main menu is generated in which users can choose to set up a new wallet or connect an existing wallet.

Once the wallet is set up, users can fund the wallet with the address provided.

Users are prompted with an additional menu in which they can execute different types of transactions.

While crypto-enabled Telegram bots differ in the services they provide, the most common features include trading, sniping, copy trading, and airdrop farming.

Trading: Buying and selling tokens directly through Telegram.

Sniping: Automatically buying a token once it’s listed.

Copy trading: Emulating the moves of other traders.

Airdrop farming: Automatically executing a series of actions to increase the chance of receiving airdrops.

Depending on the project, Telegram bots can also provide a range of other features, such as wallet tracking or analytics. Additionally, Telegram bot projects often offer their own native cryptocurrencies, which has led to the rise of Telegram bot tokens.

The Telegram Bots Landscape

Telegram reportedly has over 800M monthly active users, representing a huge market for the potential expansion of crypto. Supporters of crypto-enabled Telegram bots argue that they could potentially help new users enter the digital-asset space by improving accessibility and ease of use. Interest in Telegram bots has escalated in recent weeks, propelled by soaring token prices and media coverage.

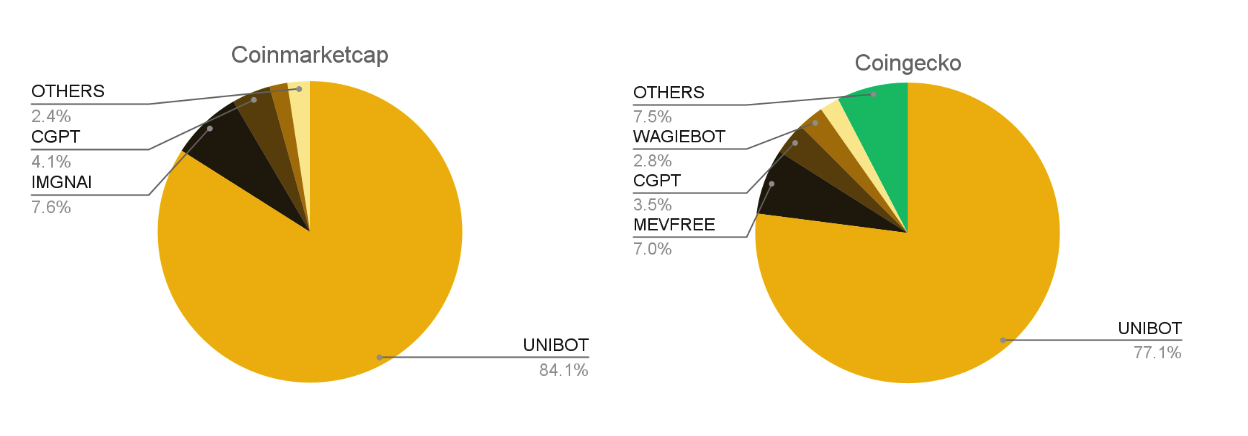

According to CoinGecko data, the current market capitalization of Telegram bot tokens is over $300M, with numerous tokens showing rapid growth recently. A key contributor has been the Unibot token, representing over 77% of the segment’s market capitalization.

Market share of Telegram bot tokens by market capitalization

Source: Coinmarketcap, CoinGecko, Binance Research, as of August 2, 2023

Adoption and activity

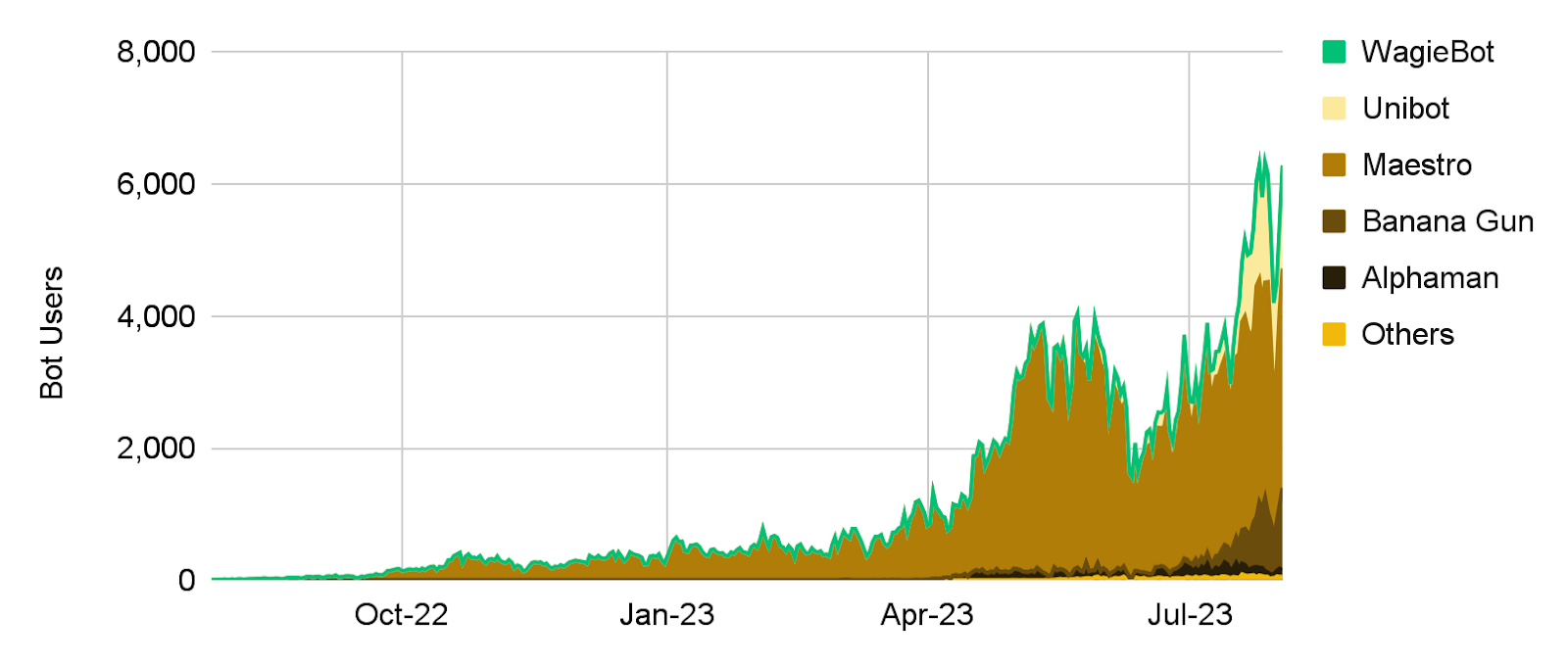

User metrics of Telegram bots hit a record high in July, with over 6K unique daily users. As a pioneer in the space, Maestro holds the lead with around 2-3K daily active users. Nevertheless, Unibot is catching up and has narrowed the gap significantly.

Number of daily active Telegram bot users

Source: Dune Analytics (@whale_hunter), Binance Research, as of August 2, 2023

“Others” include Bolt, Ready Swap, and Swipe

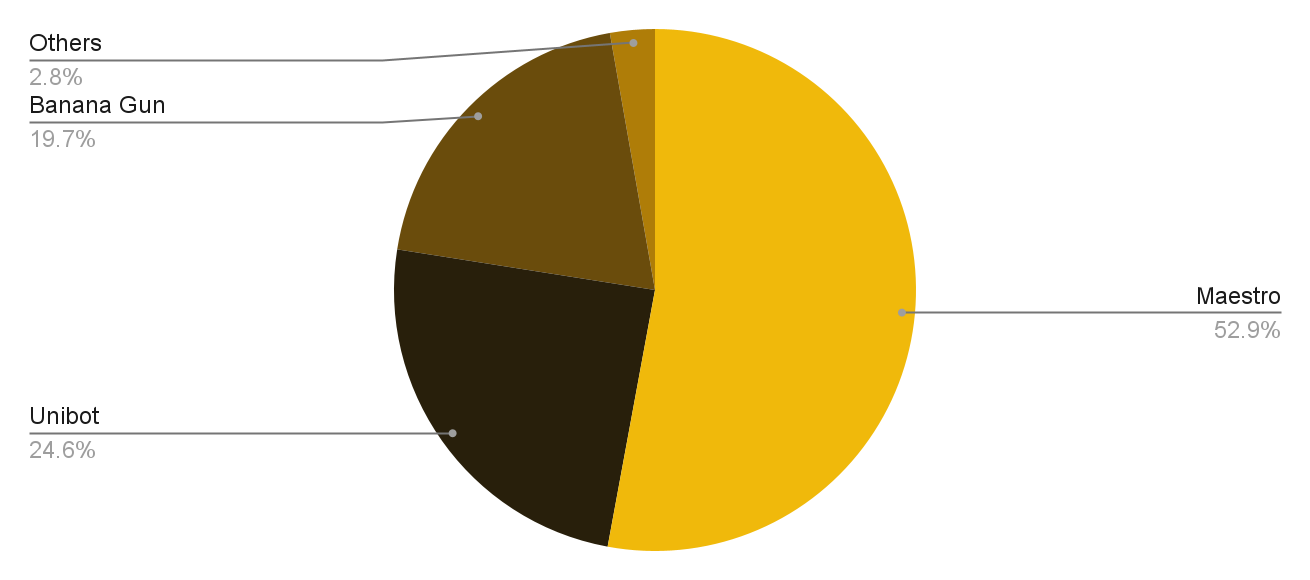

Market share of Telegram crypto bot projects by daily active users

Source: Dune Analytics (@whale_hunter), Binance Research, as of August 2, 2023

“Others” include Alphaman, Bolt, Ready Swap, Swipe, and WagieBot

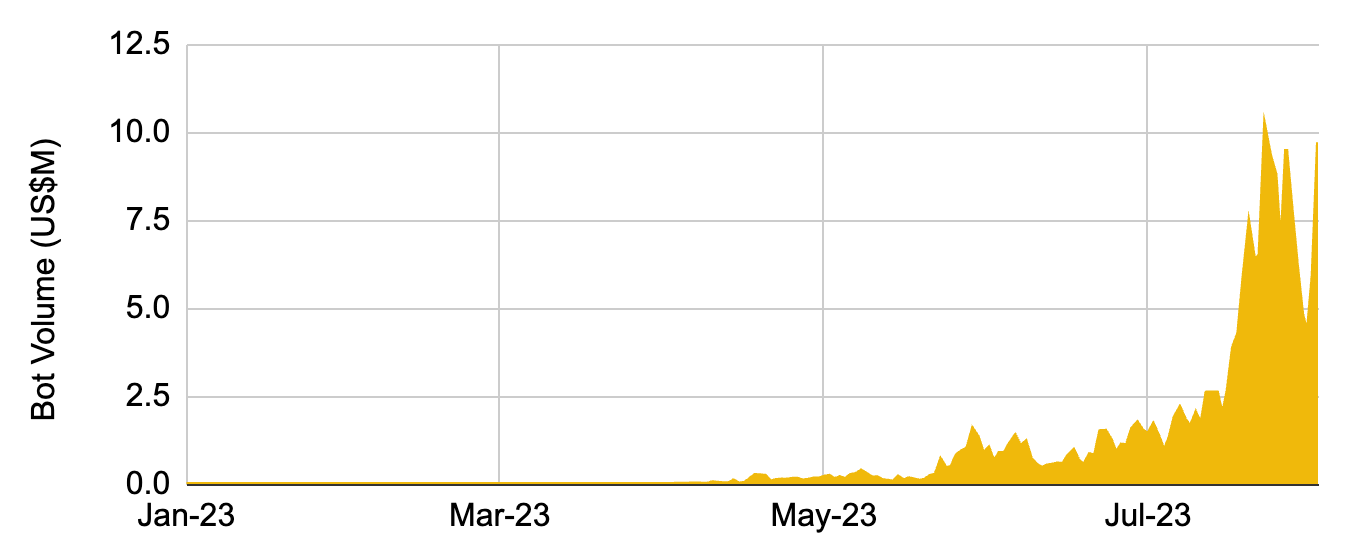

Overall, adoption of Telegram crypto bots has increased as users test out their features. Daily trading volume via Telegram bots reached a record high on July 23, 2023, exceeding $10M. The cumulative lifetime trading volume has also surpassed $190M. Note that the actual volume is likely higher, as not all data is readily available.

Daily trading volume on Telegram bots

Source: Dune Analytics (@whale_hunter), Binance Research, as of August 2, 2023

Coverage: Alphaman, Banana Gun, Ready Swap, and Unibot

Rising prices and volumes drive attention and vice versa. While still relatively high, the trading volume of Telegram bot tokens has declined recently, coinciding with a general decline in user activity. Regardless, considering the nascency of the sector and the volatility of emerging innovations, it is too early to tell if recent data suggests a trend reversal or merely represents a blip before activity increases again.

Risks

It is important to recognize that interacting with Telegram bots comes with risks. Given the nascency of the sector, it is essential for users to understand them and conduct thorough due diligence before interacting with any Telegram bot. Below are the most conspicuous risks of using crypto-enabled Telegram bots.

Security of assets: Telegram bots have different setups but generally allow users to either create a dedicated wallet or connect an existing wallet. In both cases, the bots will have access to the private keys, which could present a risk.

Smart contract risks: Considering how bots operate, interaction with smart contracts is inevitable. While not foolproof, projects that have undergone rigorous audits would allow developers to identify and resolve critical issues, thus reducing smart contract risks.

Users could be able to mitigate risks by trading in smaller sums, especially with bots that they haven’t used before; keeping minimal funds on the wallet; and creating a new wallet instead of using their main one. Note that these techniques are only examples and should not be relied on as financial advice.

By offering a smoother user experience and increased accessibility compared to DeFi apps, crypto-enabled Telegram bots could potentially carve out a niche in the ecosystem by appealing to certain categories of users. Their success will largely depend on projects introducing upgrades that mitigate risks and creating helpful new features.

Binance Research

The Binance Research team is committed to delivering objective, independent, and comprehensive analyses of the crypto space. They publish insightful takes on Web3 topics, including but not limited to the crypto ecosystem, blockchain applications, and the latest market developments.

This article is only a snapshot of the full report, which features a deeper exploration of the Telegram bot ecosystem, protocol revenues, future outlooks, and more. To read the full version of the report, click here.

You can find other in-depth Web3 reports on the Insights & Analysis page of the Binance Research website. Don’t miss the opportunity to empower yourself with the latest insights from the field of crypto research!

Further Reading

General Disclosure: This material is prepared by Binance Research and is not intended to be relied upon as a forecast or investment advice and is not a recommendation, offer, or solicitation to buy or sell any securities or cryptocurrencies or to adopt any investment strategy. The use of terminology and the views expressed are intended to promote understanding and the responsible development of the sector and should not be interpreted as definitive legal views or those of Binance. The opinions expressed are as of the date shown above and are the opinions of the writer; they may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Binance Research to be reliable, are not necessarily all-inclusive, and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given, and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Binance. This material may contain ‘forward-looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. This material is intended for information purposes only and does not constitute investment advice or an offer or solicitation to purchase or sell in any securities, cryptocurrencies, or any investment strategy, nor shall any securities or cryptocurrency be offered or sold to any person in any jurisdiction in which an offer, solicitation, purchase, or sale would be unlawful under the laws of such jurisdiction. Investment involves risks.