Main Takeaways

Traditional financial institutions, family offices, and even non-financial public companies are recognizing the value of digital assets as part of their investment portfolios.

The inclusion of cryptocurrencies like BTC and ETH in a diversified portfolio offers a means to potentially boost returns while mitigating risks associated with market volatility.

Data show that even a small allocation to crypto can enhance a portfolio’s performance by improving the risk/return trade-off.

The recent wave of second-quarter 13F disclosures by U.S. financial institutions revealed that some Wall Street investment giants have significantly increased their exposure to cryptocurrencies. Specifically, Goldman Sachs and Morgan Stanley reported purchasing over $600 million in spot bitcoin ETFs, marking a significant uptick from the previous quarter. This move is part of a broader trend where traditional financial (TradFi) institutions, family offices, and even non-financial public companies are recognizing the value of digital assets as part of their investment portfolios.

The rise of cryptocurrencies is no longer a trend confined to tech enthusiasts and retail investors. Digital assets are now being embraced by some of the most conservative and risk-averse entities in the financial world. This shift is a testament to the evolving perception of digital assets, which are now being viewed as a viable and strategic component of diversified portfolios. Here’s what attracts them to an asset class that would be unthinkable to see in their portfolios just a few years ago.

The Qualities of Crypto as an Investment

Cryptocurrencies offer unique qualities that make them an attractive investment option, as well as a way to diversify a portfolio. Considered a risk-on asset, crypto and related products are sensitive to macroeconomic trends. For example, the market downturn last month saw some investors retreat from riskier assets, while the anticipated change in the U.S. Federal Reserve’s monetary policy is widely expected to boost investor interest in digital assets.

Over the last few years, the perception surrounding crypto has shifted significantly, transitioning from that of an obscure and overlooked asset class to one of the hottest Wall Street trends. This shift has been underscored by major regulatory milestones, such as the SEC's approval of spot BTC and ETH ETFs earlier this year, significantly enhancing crypto’s legitimacy.

Granted, asset managers and capital allocators remain heavily concentrated in traditional investments. For example, the UK asset management Industry, which manages nearly £8.8 trillion in assets, invests predominantly in equities and fixed income, comprising 42.4% and 28.1% of the total, respectively. Yet, there is a growing recognition of the benefits that assets like bitcoin and ether can bring to investment portfolios.

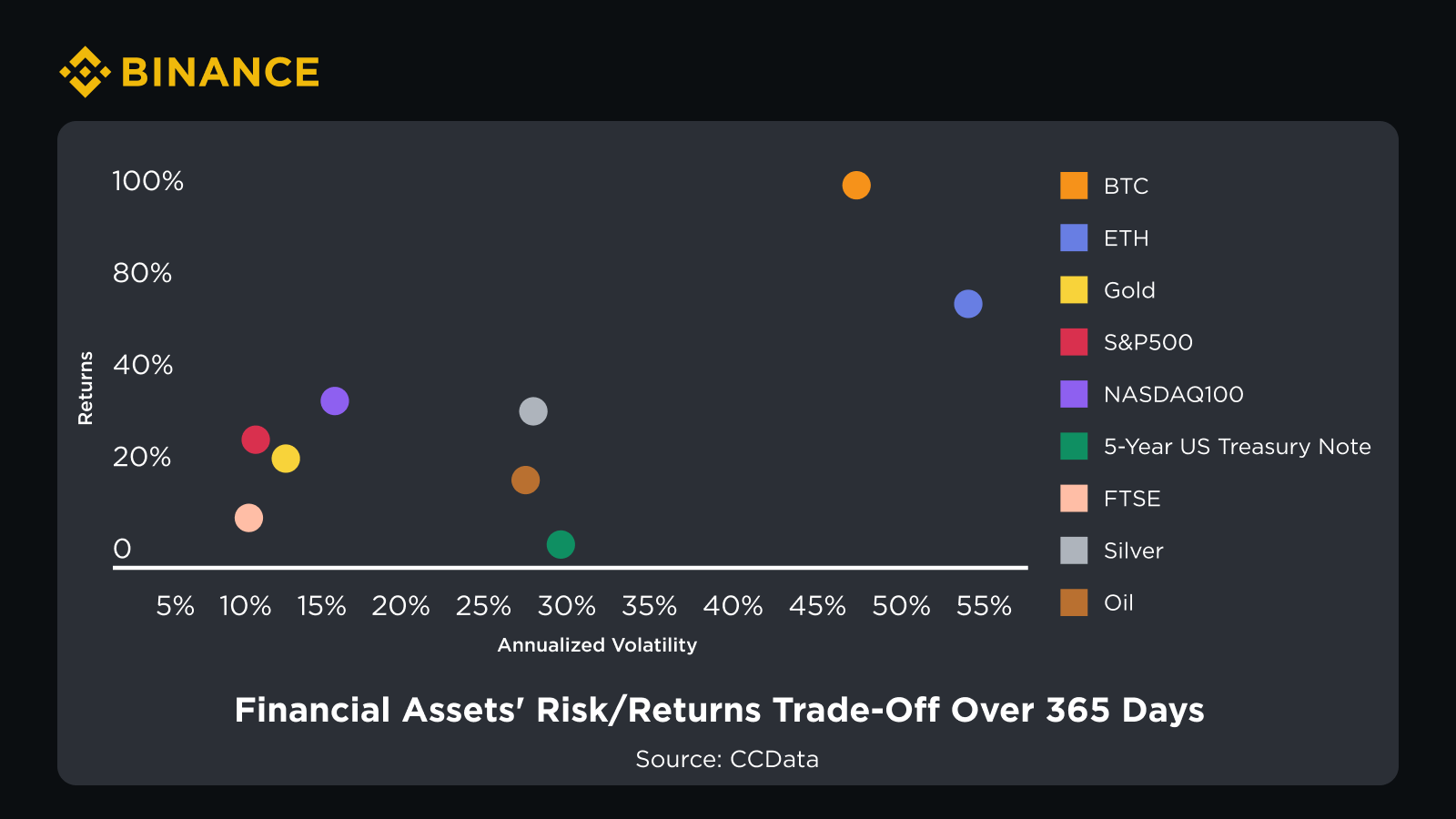

Historical data referenced in a CCData report suggests that these crypto assets can provide high risk-adjusted returns and exhibit low correlation with public equities. This unique combination can not only improve portfolio returns but also enhance diversification. Based on the risk/return trade-off over the past year, BTC and ETH demonstrated strong performance, offering attractive alternatives to traditional investments.

What this means in practice is that the inclusion of blue-chip cryptocurrencies like BTC and ETH in a diversified portfolio offers a means to potentially boost returns while mitigating risks associated with market volatility.

The same analysis reveals that portfolios incorporating cryptocurrencies have the potential to achieve higher risk-adjusted returns and benefit from greater diversification and reduced volatility. For example, a portfolio optimized to include digital assets could achieve an annual return of 17.5% with lower annualized volatility of 6.25%, compared to a portfolio without digital assets, which exhibited an annualized volatility of 7.46% for the same return. This demonstrates that even a small allocation to crypto can enhance a portfolio’s performance by improving the risk/return trade-off while giving investors more opportunities to achieve optimal portfolio configurations that align with their risk tolerance and return expectations.

Diverse Players in the Crypto Investment Space

The increasing involvement of financial institutions like Goldman Sachs and JPMorgan is just the tip of the iceberg. Family offices, which traditionally manage the wealth of ultra-high-net-worth individuals, are also venturing into the crypto space.

According to the inaugural Family Office Investment Insights report by BNY Mellon, cryptocurrencies now account for 5% of family office portfolios — an allocation that would have been unimaginable a decade ago. Furthermore, 33% of family office professionals indicate that they are actively investing in cryptocurrencies and may increase their holdings, while 30% claim to have limited exposure or are currently exploring these assets.

With the regulatory environment around digital assets still taking shape, the lack of regulatory certainty and harmonization still acts as a significant barrier to investment. However, as the regulatory space becomes more structured thanks to regulatory efforts such as the EU’s MiCA regulation and ETF approvals in the United States, we can expect the entry of more and more institutions and capital.

Crypto on Corporate Balance Sheets: A Strategic Move

It's not just financial institutions that are increasingly interested in crypto; several public companies outside the financial sector are also holding digital assets on their balance sheets. Companies like MicroStrategy and Block, formerly known as Square, have made headlines for their substantial BTC holdings. These companies view crypto not just as an investment, but as a strategic reserve that can enhance corporate treasuries and provide liquidity options in uncertain economic times.

MicroStrategy was the first public company to make a substantial allocation to bitcoin, starting with a first $250 million investment in 2020 and adopting it as its primary treasury reserve. Today, MicroStrategy holds 226,331 BTC, with a total value close to $14 billion. This investment represents a significant part of the company's financial strategy and illustrates its commitment to bitcoin as a primary asset.

The company's approach involves utilizing proceeds from capital market activities and excess cash reserves to fund these purchases. This strategy aims to generate a positive “BTC yield,” a key performance indicator that measures the effectiveness of its bitcoin investments. This metric reflects the difference between the current market value of BTC and MicroStrategy’s purchase price. By mid-2024, the BTC yield stood at 12.2%, highlighting substantial gains relative to their acquisition costs.

Block, Inc., under CEO Jack Dorsey’s leadership, made its first major bitcoin investment of $50 million – approximately 1% of its total assets at the time – in 2020. This move was part of a broader strategy that aligns with Block's mission of fostering economic empowerment and supporting a more inclusive financial system. Today, Block's BTC holdings are valued at approximately $518 million, reflecting the importance of bitcoin in its long-term financial strategy.

These corporate moves into Bitcoin are driven by a variety of motivations. Some companies view cryptocurrencies as a hedge against the devaluation of fiat currencies, while others are attracted by the potential for substantial long-term capital appreciation. Companies like Block and MicroStrategy have seen the value of their Bitcoin holdings surge, significantly outperforming traditional cash reserves, which have shown minimal appreciation after adjusting for inflation.

The Future of Crypto in Investment Portfolios

As the adoption of digital assets continues to grow, we may see an even broader array of players entering the space. The idea of including cryptocurrencies in sovereign wealth funds, for instance, is gaining traction. Notably, Norway's sovereign wealth fund, the world's largest, has significantly increased its indirect bitcoin holdings this year. By mid-2024, the fund held approximately 2,446 BTC, reflecting a 62% increase over six months, mainly through increased stakes in crypto-related companies like MicroStrategy and Block, Inc., marking a significant shift in how national governments view and utilize digital assets as part of their broader investment strategies.

Meanwhile, global interest in cryptocurrencies among sovereign wealth funds continues to build. Funds from countries like Singapore and the UAE have explored investments in the crypto sector, viewing digital assets as a potential hedge against inflation and an opportunity for portfolio diversification.

The increasing institutional and corporate interest in cryptocurrencies underscores a broader trend: digital assets are becoming a mainstream component of modern investment portfolios. As the financial landscape continues to evolve, the role of cryptocurrencies is likely to expand, offering new opportunities for diversification, growth, and risk management.