Disclaimer: Digital asset prices can be volatile. Do your own research. See our terms of use here and our risk warning here and below. Binance Futures products are restricted in certain countries and to certain users. This communication is not intended for users/countries to which restrictions apply.

Main Takeaways

As perpetual futures contracts do not have an expiration date, the Funding Rate mechanism is used to balance traders’ long and short positions.

Futures funding rate arbitrage constitutes a trader simultaneously opening long and short positions in Spot and Futures market respectively to collect the funding rate.

The Binance funding rate arbitrage bot allows traders to capitalize on the fees by conducting a delta neutral strategy across spot and futures markets.

What Is Futures Funding Rate Arbitrage?

Futures funding rate arbitrage is a trading strategy that allows traders to hedge their positions in the futures market by taking an opposite position for the same trading pair in the spot market.

It involves a trader simultaneously opening both long and short positions in different markets to profit from the funding fees. This delta-neutral strategy allows traders to hedge their positions. Any loss incurred from the futures market can be offset by the profit made in the spot and vice versa whilst allowing traders to earn funding fees. Before we dig deep into how this strategy works and why it is relevant for the cryptocurrency futures market, let’s understand the schematics of a perpetual futures contract.

What Is a Perpetual Futures Contract?

A perpetual futures contract is an agreement to buy or sell an asset in perpetuity or at an unspecified date in the future. Perpetual contracts are quite similar to traditional futures contracts. What separates them from the conventional futures contract is that there is no settlement and expiration date in perpetual contracts.

Since there is no expiration date, a mechanism called funding rate is used to balance traders’ long and short positions. Its purpose is to ensure there is a relative convergence between the prices of the perpetual contract and the underlying asset. To learn more about price convergence in futures trading, refer to this blog article.

The funding rate determines who pays or receives the funding fees based on market movement and their open positions. So when the funding rate is positive i.e. trading above the underlying asset price, the long positions pay funding fees to short positions, and vice versa.

The futures funding rate arbitrage leverages this opportunity by executing two trades of the same trading pair of equal quantity in both spot and futures markets.

How to Use the Binance Funding Rate Arbitrage Bot?

The Binance futures funding rate arbitrage bot automatically opens positions in opposite directions in both markets. This involves going short in one market and long in the other to receive the funding fee. Opening long and short positions allows traders to offset losses incurred in one position with profits gained from the other trade.

Suppose an arbitrageur selects a crypto trading pair the bot will automatically initiate the transactions after analyzing the funding rate. The trades are determined based on the direction of the 3-day cumulative funding rate. If the 3-day cumulative funding rate is negative (negative arbitrage), it suggests that the shorts pay the longs. In this scenario, the trading bot automatically opens a long position in the perpetual contracts and sells the same digital assets of equal quantity in the spot market.

If the cumulative funding rate is positive (longs pay shorts), the bot automatically shorts the perpetual contracts and purchases an equal quantity of digital assets on the spot market.

The funding rate can fluctuate every funding interval time, which is typically eight or four hours long. The arbitrage bot allows traders to capitalize on the variations in funding rates to profit from price movements without constantly monitoring the markets.

For example, let’s consider the scenario where the funding rate is positive (i.e., longs pay shorts), with a 3-day (3D) funding rate of 0.09%. The trader wants to use the trading bot for arbitrage on the ZECUSDT symbol in the USDs-M Futures Markets.

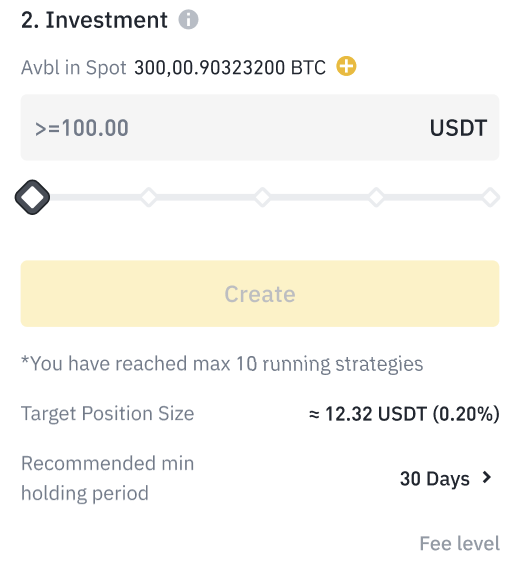

Using the bot, a trader invests 10,000 USDT in a BTCUSDT strategy. 10% of the 10,000 USDT funds will be kept as reserved funds to ensure positions are built successfully and maintained through different market conditions. The bot places a short order of 9,000 USDT in BTCUSDT perpetual contracts and simultaneously buys 9,000 USDT worth of BTC in the spot market.

If the BTC price rises, the short position in the futures market incurs a loss, while the position in the spot market makes a profit. The loss on the short futures position is offset by the profit in the spot market.

If the BTC price drops, the short position in the futures market gains, while the spot position incurs a loss. The loss in the spot position is offset by the profit in the futures position.

Assuming the 3D Funding Rate remains constant at 0.09%, the trader will receive 0.09% of the position as the funding rate after 3 days, which equals 8.1 USDT, and corresponds to an APR of 10.95% (with a 985.5 USDT profit over a year assuming this funding rate remains constant).

Importance of Spread in Arbitrage Strategy

You can either benefit or lose from the spread when conducting funding rate arbitrage strategies.

Spread rate = (The last price of the sell pair - the last price of the buy pair) / the last price of the buy pair * 100%.

Therefore, the optimal scenario for spread management is to enter a position when the spread rate is positive (spread rate > 0) and exit when the spread rate turns negative (spread rate < 0). Conversely, the least favorable scenario is entering with a negative spread rate (spread rate < 0) and exiting with a positive spread rate (spread rate > 0).

Spread Favorable Movement Example:

Let’s assume you create a positive carry arbitrage strategy at the following BTC pair prices: Entry: BTC/USDT last price: 59,963.47 USDT, BTCUSDT Perp last price: 59,930.50 USDT, Spread: -0.055%Spread %= ( last price of sell pair - the last price of buy pair) / last price of buy pair * 100% = −0.05497% ≈ −0.055%

You decide to close your arbitrage strategy at the following price levels: Exit: BTC/USDT last price: 59,940.01 USDT, BTCUSDT Perp last price: 59,915.30 USDT, Spread: -0.0412%Spread %= ( last price of sell pair - the last price of buy pair) / last price of buy pair * 100% ≈ −0.0412%

Change in Spread: +0.01377%Gain: +1.38 USDT for a 10,000 USDT investment

The change in spread is 0.01377%. Since this change is positive, it narrowed during the time interval during which you held your arbitrage positions / your arbitrage strategy was running. You made money on the spread. E.g. + 1.38 USDT for an initial investment of 10,000 USDT

Now let’s imagine the spread move against you:

Entry: BTC/USDT: 60,009.60 USDT, BTCUSDT Perp: 59,989.90 USDT, Spread: -0.0329%

Exit: BTC/USDT: 60,004.01 USDT, BTCUSDT Perp: 59,978.60 USDT, Spread: -0.0424%

Change in Spread: -0.0095%/ This means the spread has widened by 0.0095%.

In this scenario, you incurred a loss of −0.95 USDT from an initial investment of 10,000 USDT.

Maximizing Gains or Mitigating Losses from the Spread

The Binance Arbitrage Bot has a Spread Control mechanism, which ensures that the trades are executed within predefined spread limits to maximize profitability and minimize risks.

According to the spread control rule, the maximum spread for entry is −0.1% and 0.1% for exit (positive carry). For reverse carry, the maximum spread is reversed. This means the maximum potential spread change, in either direction, is 0.2%, representing the maximum possible gain or loss.

Timing Your Entry and Exit: Entering and Exit your position when the spread is at its most favorable can help you make additional gains on top of the funding fees. Monitoring the market and using technical analysis tools can aid in identifying the optimal entry point.

The Importance of Leaving your position open long enough to breakeven from trading fees

As of August 2024, the trading fees for VIP0 traders on Binance are 0.3% in total for opening and closing positions in both spot and futures markets (fees are subject to adjustment; you can refer to the latest spot fees and futures fees).

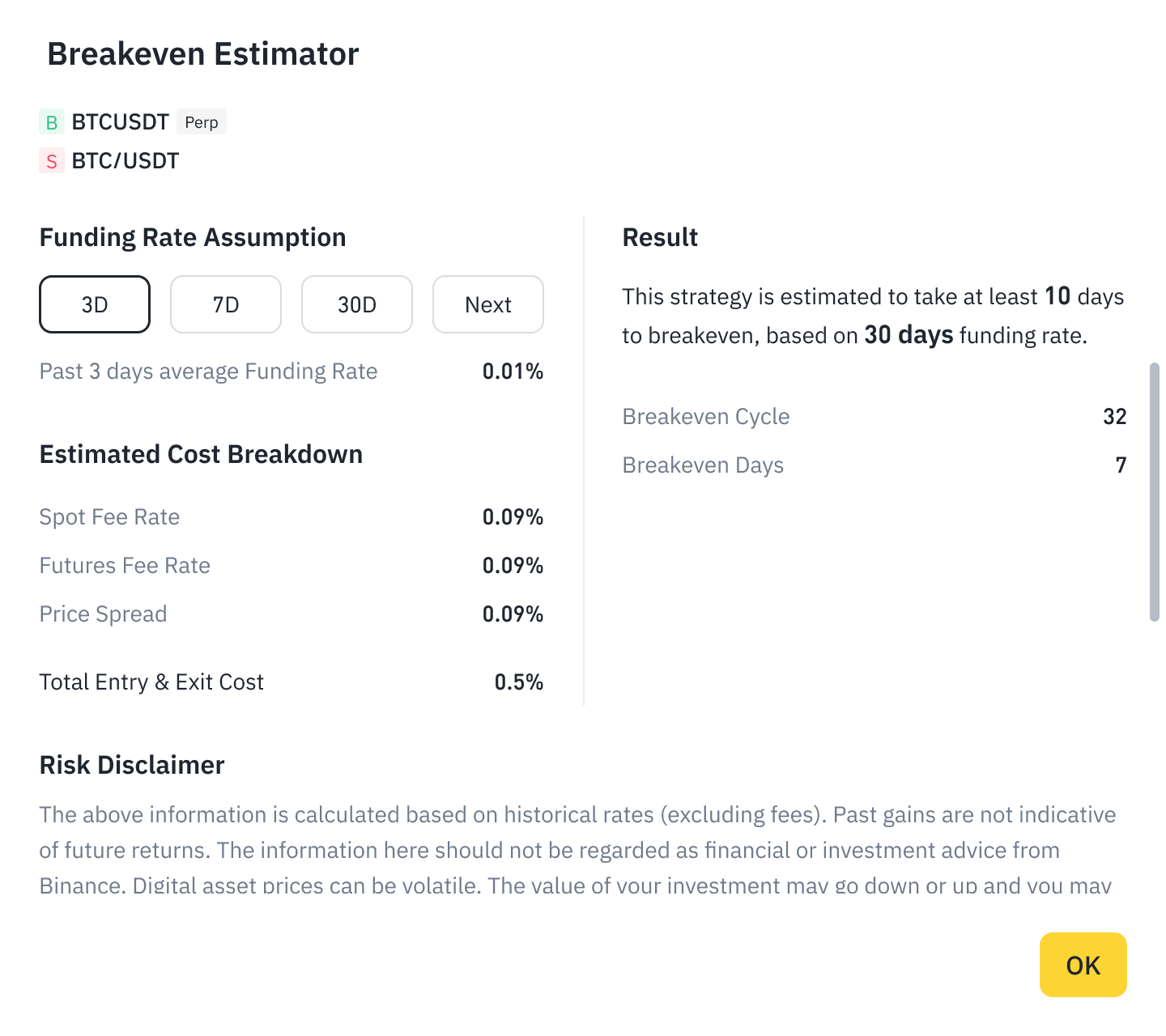

For a VIP0 trader, considering a funding rate of 0.01% per 8-hour interval, and assuming no price spread PnL (0 USDT), it would take approximately 10 days to breakeven from the fees and achieve a positive PnL.

The breakeven estimator feature gives an estimate of the holding period required to breakeven from trading fees, based on the various funding rates parameters (3D, 7D, 39D, Next Funding Rate), as illustrated below:

Potential benefits of funding rate arbitrage

Potential benefits of funding rate arbitrage

Earn fixed income stream with low maintenance effort

Lower investment risks – Holding both long and short positions, in futures and spot markets, hedges against the risk of market movement. This allows the successful trade to cancel out the losing trade.

Considerations for Perpetual Contract Funding Rate Arbitrage

Funding rate arbitrage has the potential for returns, but there are concerns that a trader should be aware of.

Liquidation – Although uncommon, perpetual contracts in this strategy can expose arbitrageurs to liquidation during periods of high volatility, causing significant deviations between spot prices and futures prices. Therefore, it is crucial to monitor positions carefully, especially during extreme market conditions.

Shifts in funding rate direction – In most cases, longs pay shorts. In cases where shorts pay funding fees to longs, traders may pay interest rate expenses rather than receiving interest income. However, the subsequent trades may often offset the losses.

Optimal arbitraging conditions

Favorable Historical Funding Rates

A funding rate’s profitability is indicated by how high the absolute value of the funding rate is. Traders engaging in positive carry strategies benefit from high positive funding rates, while those using reverse carry strategies benefit from high negative funding rates.While past performance is not a guarantee of future performance, a good approach is often to look at the historical performance of a symbol. Binance Trading Interface provides past performance data over various periods such as 3 days (3D), 7 days (7D), and 30 days (30D). Reviewing this data can help traders select symbols that have performed well over these periods, potentially indicating favorable funding rates and market conditions for arbitrage strategies.

Timed Strategy entry / exit to benefit from the spread

Entering and exiting your positions when the spread is most favorable can enhance your gains beyond the funding fees. By monitoring the market and utilizing technical analysis tools, you can identify the optimal entry and exit points for your trades.

Importance of Holding Positions Long Enough – Holding positions for a longer interval between opening and closing can help ensure that the funding profits exceed the transaction costs.

Bottom Line

The Binance funding rate arbitrage bot includes risk management features, such as buffer rates for position sizing, compliance checks, and leverage settings, to help traders speculate price movements. While the bot has the potential to maximize profits, it is important to do your due diligence and practice risk management when trading cryptocurrencies.

Further Reading

(Blog) What are Funding Fees in Binance Futures?

(FAQ) How to Use the Funding Rate Arbitrage on Binance Futures

The Binance Trading Bot Terms (available here) apply to the use of the Binance funding rate arbitrage bot.

Risk Warning:

No Representation

This content is presented to you on an "as is" basis for general information and educational purposes only, without representation or warranty of any kind. It is not intended or should not be construed as financial or investment advice, nor is it to recommend or intend to recommend the purchase or sale of any specific product(s) or service(s).

Hypothetical Performance Results

Digital asset prices can be volatile. The value of your investment may go down or up, and you may not get back the amount invested. Any results posted herein are intended as examples only to provide you with a reference of what potentially could have made or lost trading with the technical indicators and tools, but are in no way a reflection of what you could have made or lost in the same situation. Therefore, you should not rely on the results as a representation of what your returns or losses would have been utilizing such technical indicators. There are numerous other factors related to the market in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. The Binance funding rate arbitrage bot will consistently execute orders when specified parameters are reached. Execution of trades may even apply in situations of a rapid collapse or strong rise of a digital asset. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance.

Responsibilities

You are solely responsible for your investment decisions, and Binance is not liable for any losses or damages you may incur. The risk warning described herein is not exhaustive, therefore you should carefully consider your investment experience, financial situation, investment objective, risk tolerance level and consult your independent financial adviser as to the suitability of your situation prior making any investment. For more information, see our Terms of Use and Risk Warning and Responsible Trading Page.

The products and services referred to herein may be restricted in certain jurisdictions or regions or to certain users in accordance with applicable legal and regulatory requirements. You are solely responsible for informing yourself about and observing any restrictions and/or requirements imposed with respect to the access to and use of any products and services offered by or available through Binance in each country or region from which they are accessed by you or on your behalf. Binance reserves the right to change, modify or impose additional restrictions with respect to the access to and use of any products and/or services offered from time to time in its sole discretion at any time without notification.