Main Takeaways

In this blog series, we summarize our research team’s findings, inviting you to dive deeper into the original reports.

This article previews the recent Binance Research report examining the current state of real-world assets (RWAs) in crypto.

The tokenization of RWAs is a growing sector with significant potential, representing the eighth-largest DeFi sector today.

Thanks to Binance Research, you can take advantage of industry-grade analysis of the processes that shape Web3. By sharing these insights, we hope to empower our community with the latest knowledge from the field of crypto research. For a deeper dive, the full reports are available on the Binance Research website.

A key trend in the crypto world recently has been the blending of traditional finance (TradFi) with digital assets as large institutional players enter the space. An important component in this integration that continues to gain traction is the tokenization of real-world assets (RWAs), a process whereby off-chain financial assets are brought onto the blockchain.

Today, the tokenization of RWAs is a growing sector with significant potential. This article will examine the current state of tokenized RWAs, delving into their background, outlook, and growth. This article has been adapted from a Binance Research report published on July 25, 2023, and as such, it mostly covers data and developments from before this date unless specified otherwise.

What are Real-World Assets?

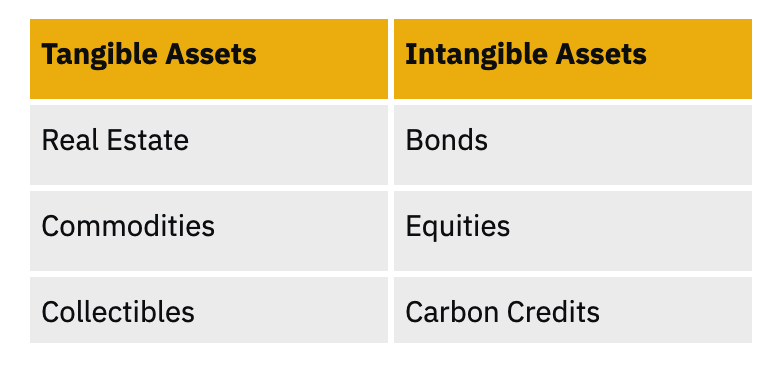

Real-world assets (RWAs) refer to tangible and intangible assets in the physical world (e.g., real estate, bonds, commodities, etc.). The tokenization of RWAs brings these off-chain assets onto the blockchain, thereby opening new possibilities and potential use cases. Tokenized RWAs can be stored and tracked on-chain, thereby increasing efficiency and transparency while reducing the potential for human error.

Examples of RWAs

Source: Binance Research

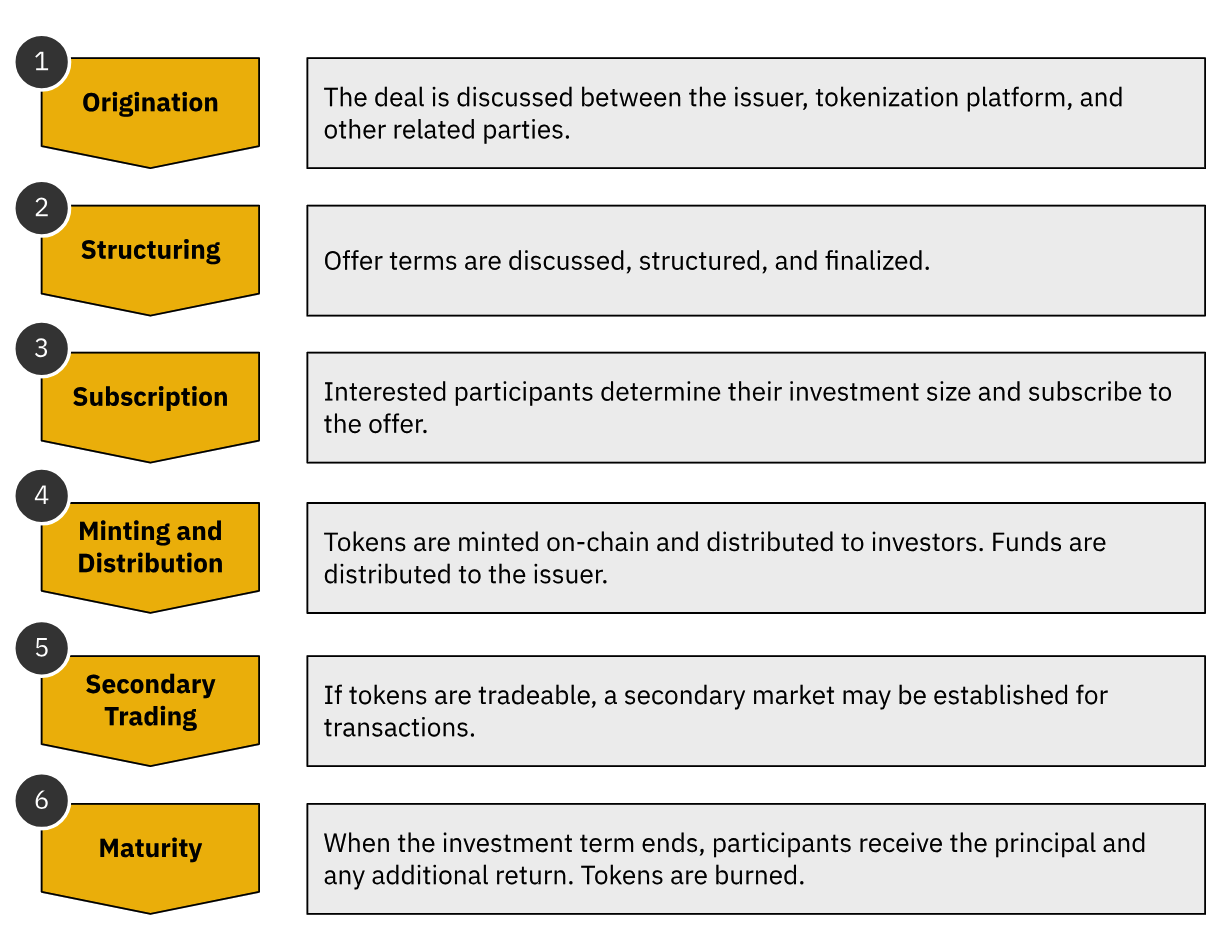

The tokenization process

For RWAs to exist on-chain, their ownership and representation must also be accounted for on the blockchain. While the exact mechanics may vary, the general process involves establishing the terms before minting tokenized representations of the asset on-chain. This general tokenization process is shown in the following figure.

On-chain tokenization process

Source: Boston Consulting Group, Binance Research

RWA Growth and Outlook

While the RWA market is still in its early stages of development, it has seen signs of increased adoption and growing total value locked (TVL). As of September 1st, RWAs are the eighth-largest sector in DeFi based on data tracked by DeFi Llama, with a combined TVL of $1.3B. Considering they only ranked 13th at the end of June, this rise is a testament to the increasing adoption of RWA protocols.

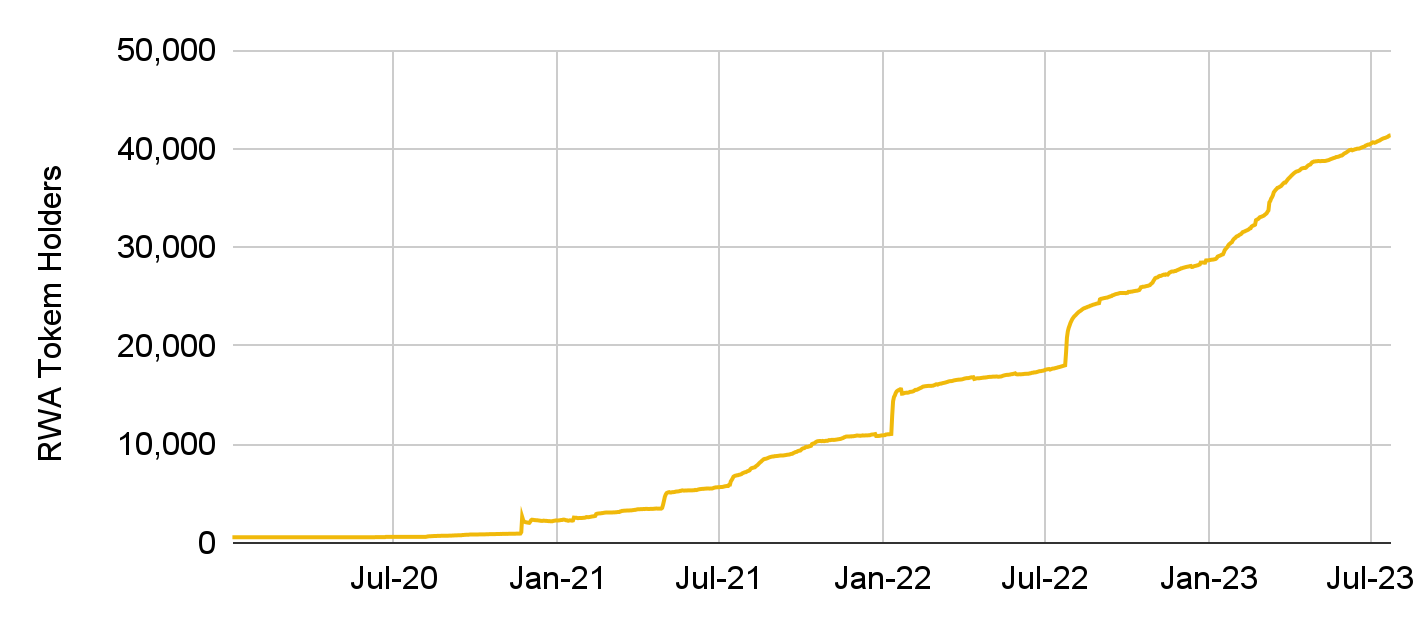

We have also observed a steady rise in the number of RWA token holders. As of July 24, 2023, there were over 41.3K RWA token holders on the Ethereum blockchain. This was more than double the numbers from roughly a year ago, when there were only around 17.9K token holders. As of September 3, 2023, the number of RWA token holders has further increased to just over 43.4K.

RWA token holders

Source: Dune Analytics (@j1002) (July 24, 2023)

RWA tokens tracked: wCFG, MPL, GFI, FACTR, ONDO, RIO, TRADE, TRU, BST

The tokenization of illiquid assets is a growing market with significant potential. Several reputable entities expect it to achieve significant capitalization in the future. For example, the Boston Consulting Group has estimated the tokenization of global illiquid assets to be a $16T business opportunity by 2030.

Even capturing a small percentage of the market could benefit the blockchain industry. Still, when comparing it to the total value of global assets, which are estimated to be worth $900T, tokenized assets represent a small fraction. Considering this, one could argue there is even more headroom for growth.

Notable Developments

Beyond DeFi protocols, institutions in TradFi have also shown increasing acceptance of RWAs. Some have even begun exploring and building their own private blockchains to tokenize assets. As adoption rises, we could see traditional exchanges facilitating the secondary trading of RWAs. With the sector growing more mature, regulatory developments will be the driving force behind mainstream adoption. The following chart shows the main milestones in the institutional adoption of RWAs so far this year.

Timeline of institutional adoption and market developments in 2023

Source: Binance Research (July 19, 2023)

Note: This is not an exhaustive list of all ongoing RWA projects.

Closing Thoughts

The tokenization of real-world assets presents a strong use case for blockchain technology with significant potential. By providing greater transparency and efficiency, tokenization can serve as a viable alternative to existing mechanisms. We have witnessed early signs of institutional adoption as traditional firms explore technologies that could help address current inefficiencies.

The proliferation of RWAs has also been a positive development for crypto investors, who can now access opportunities outside of the crypto ecosystem. The integration of RWAs has introduced more stable assets into DeFi and increased the diversity of collaterals in the space. We look forward to continuing to watch the development and innovation in this space.

Binance Research

The Binance Research team is committed to delivering objective, independent, and comprehensive analyses of the crypto space. They publish insightful takes on Web3 topics, including but not limited to the crypto ecosystem, blockchain applications, and the latest market developments.

This article is only a snapshot of the full report, which features a deeper exploration of the RWA ecosystem, its outlook and development, and the impact of tokenized Treasurys. It also examines the performance of numerous RWA protocols, including Maple Finance, MakerDAO, and Ondo Finance.

To read the full version of the report, click here. You can find other in-depth Web3 reports on the Insights & Analysis page of the Binance Research website. Don’t miss the opportunity to empower yourself with the latest insights from the field of crypto research!

Further Reading

General Disclosure: This material is prepared by Binance Research and is not intended to be relied upon as a forecast or investment advice and is not a recommendation, offer, or solicitation to buy or sell any securities or cryptocurrencies or to adopt any investment strategy. The use of terminology and the views expressed are intended to promote understanding and the responsible development of the sector and should not be interpreted as definitive legal views or those of Binance. The opinions expressed are as of the date shown above and are the opinions of the writer; they may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Binance Research to be reliable, are not necessarily all-inclusive, and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given, and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Binance. This material may contain ‘forward-looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. This material is intended for information purposes only and does not constitute investment advice or an offer or solicitation to purchase or sell in any securities, cryptocurrencies, or any investment strategy, nor shall any securities or cryptocurrency be offered or sold to any person in any jurisdiction in which an offer, solicitation, purchase, or sale would be unlawful under the laws of such jurisdiction. Investment involves risks.