Contents

the introduction

What is a golden cross?

What is death intersection?

What is the difference between a golden cross and a death cross?

How to Trade the Golden Cross and the Death Cross

Concluding thoughts

the introduction

There are many chart styles associated with technical analysis. We've already talked about them in our Beginner's Guide to Classic Chart Patterns and 12 Common Price Action Chart Patterns Used in Technical Analysis. But there are plenty of other styles that can benefit practitioners of day trading, swing trading and long-term investors. These patterns are the golden cross and the death cross.

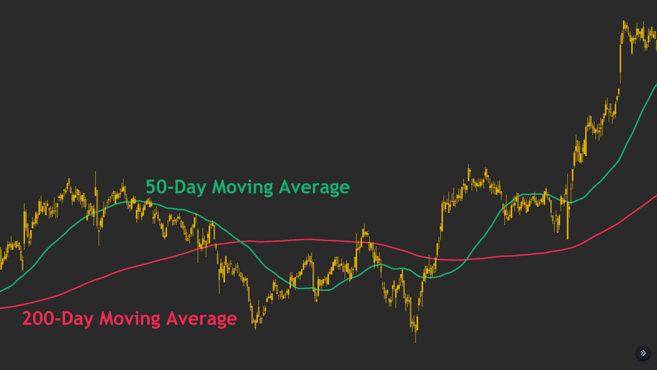

Before we move on to explaining what a golden cross and a death cross mean, we need to understand what a moving average (MA) means. In short, a moving average is a line drawn on a price chart that measures the average price of an asset in a given time frame. For example, the 200-day moving average measures the average price of an asset in the last 200 days. If you want to read more about moving averages, we have an article about them titled: Moving Averages Explained.

So what is the golden cross and the death cross? How can traders use them in their trading strategy?

What is a golden cross?

A golden cross is a chart pattern that involves a short-term moving average crossing above a long-term moving average. The 50-day moving average is usually used as the short-term average, and the 200-day moving average is used as the long-term average. But this is not the only way to think about the golden cross; This crossover can occur on any time frame, and the main idea behind it is that the short-term average crosses above the long-term average.

A golden cross usually occurs in three stages:

The short-term moving average is below the long-term moving average during a downtrend.

The trend reverses, and the short-term moving average crosses above the long-term moving average.

An uptrend begins as the short-term moving average stays above the long-term moving average.

A golden cross indicates a new uptrend in Bitcoin.

In many cases, a golden cross can be considered a signal of a bull market. How is that? The idea is simple. The moving average, as we know, measures the average price of an asset over a specific period. Therefore, when the short-term moving average is below the long-term moving average, it means that the short-term price movements are bearish compared to the long-term price movements.

But what happens when the short-term average crosses above the long-term average? The short-term average price becomes higher than its long-term average. This indicates a potential shift in the market's direction, which is why a golden cross is considered bullish.

According to the traditional interpretation, a golden cross involves the 50-day moving average crossing above the 200-day moving average. But the general idea behind a golden cross is that a short-term moving average crosses above a long-term moving average. Hence, golden crosses can also occur on other time frames (15 minutes, 1 hour, 4 hours, etc.). However, signals of higher time frames are usually more reliable than signals of lower time frames.

So far we've looked at the golden cross involving what's called a simple moving average (SMA). But another popular way to calculate a moving average is called Exponential Moving Average (EMA). This average uses a different equation that focuses more on more recent price movements.

Exponential Moving Averages (EMA) can also be used to look for bullish and bearish crossovers, including golden crossovers. Since EMAs react faster to recent price movements, the crossover signals they produce may be less reliable and many of them will be false. However, EMA crossovers are popular among traders as a tool for identifying trend reversals.

What is death intersection?

A death cross is, in fact, the opposite of a golden cross. It is a chart pattern in which a short-term moving average passes below a long-term moving average. For example, the 50-day moving average passes below the 200-day moving average. Accordingly, a death cross is usually considered a signal of a bear market.

Death cross typically occurs in three stages:

The short-term moving average is above the long-term moving average during an uptrend.

The trend reverses, and the short-term moving average passes below the long-term moving average.

A downtrend begins when the short-term moving average stays below the long-term moving average.

A death cross confirms a downtrend in Bitcoin.

Now that we understand what a golden cross means, it is easier to understand why a death cross is a sign of a bear market. The short-term average passes below the long-term average, indicating an expected market decline.

A death cross has provided signals that the market is falling before major economic recessions throughout history, such as in 1929 or 2008. But it can also provide false signals, as happened for example in 2016.

Death crossover signal on the SPX in 2016.

As shown in this example, the market showed a death cross, continued to rise, and then showed a golden cross shortly after.

What is the difference between a golden cross and a death cross?

We have discussed both, so it is not difficult to understand the difference between them. They are on opposite sides. A golden cross can be considered a sign of a bull market, while a death cross is a sign of a bear market.

Both can be confirmed by high trading volume. Other technical analysts may check for other technical indicators when looking at the context of the crossover. Common examples of these indicators are the Moving Average Convergence-Divergence (MACD) and the Relative Strength Index (RSI).

It is also important to remember that moving averages are lagging indicators and have no predictive power. This means that both crosses typically provide strong confirmation of a trend reversal that has already occurred – rather than a reversal that has not yet occurred.

➟ Do you want to start trading in cryptocurrencies? Buy Bitcoin (BTC) on Binance now!

How to Trade the Golden Cross and the Death Cross

The basic idea underlying these two patterns is quite simple and clear. If you know how traders use the Moving Average Convergence Divergence (MACD) indicator, you will easily understand how to trade these crossover signals.

When we talk about the traditional golden cross and death cross, we are usually looking at the daily chart. So, a simple strategy to follow is to buy at a golden cross and sell at a death cross. In fact, this has been a relatively successful strategy for Bitcoin in the past few years – although there have been a lot of false signals during that time. So, blindly following one signal is usually not the best strategy. Therefore, you should consider other factors when dealing with market analysis methods.

If you'd like to read about an easy strategy for creating a longer-term trade, see Dollar Cost Averaging (DCA) Explained.

The above crossover strategy is based on daily moving average crossovers. But what about other time periods? Golden crosses and death crosses happen in the same way, and traders can take advantage of them.

However, as with most chart analysis methods, signals on higher time frames are stronger than signals on lower time frames. A golden cross can occur on the weekly time frame, while you are looking at a death cross occurring on the hourly time frame. For this reason, it is always useful to look at the chart from a broader perspective, and to keep several readings in mind.

Another thing that many traders will look for when trading golden crosses and death crosses is trading volume. As with other chart patterns, volume can be a powerful tool for confirmation. So, when a rise in volume is accompanied by a crossover signal, many traders become more confident in the validity of this signal.

Once a golden cross occurs, the long-term moving average can be considered a potential support area. Conversely, once a death cross occurs, it can be considered as a potential area of resistance.

Crossover signals can also be compared with signals from other technical indicators to look for any correlation. Coupling traders combine multiple signals and indicators into a single trading strategy in an attempt to make trading signals more reliable.

Concluding thoughts

We have discussed two of the most common crossover signals – the golden cross and the death cross.

A golden cross involves a short-term moving average crossing above a long-term moving average. As for a death cross, it involves a short-term moving average crossing below a long-term moving average. Both crosses can be a reliable tool for confirming long-term reversals in trends, whether they impact the stock market, Forex, or cryptocurrencies.

Do you have any other questions about trading crossover signals, such as the golden cross and death cross? Check out our Q&A platform, Ask Academy where the Binance community will answer your questions.