The world's largest asset manager, BlackRock, has finally disclosed its much-anticipated investment approach for 2025, and it’s making waves in the financial world. As part of its new vision, BlackRock is heavily focusing on U.S. stocks, especially due to the nation's dominance in the artificial intelligence (AI) sector. This technological revolution is extending beyond just the tech industry, creating a significant investment opportunity for those positioned correctly.

The firm forecasts that AI will require an astounding $700 billion in infrastructure investments by 2030—this includes data centers, chips, and electrical networks—which represents about 2% of the U.S. GDP. This presents an extraordinary growth prospect for investors keen to capitalize on the technological boom. However, BlackRock also sees potential risks on the horizon, particularly with the possibility of a heightened U.S.-China trade conflict. The firm warns that Trump's return to office could accelerate tariffs and technological decoupling, further impacting global supply chains.

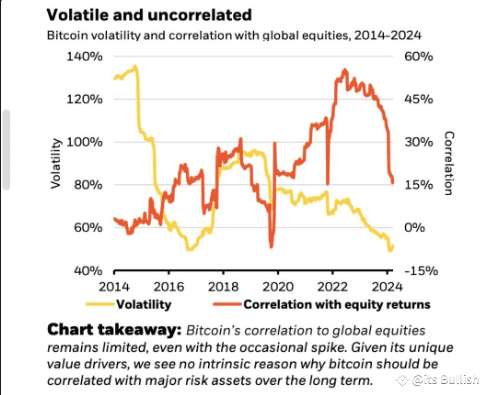

To adapt to these evolving risks, BlackRock is advising a departure from the traditional 60/40 stocks-to-bonds strategy. Instead, it recommends a more dynamic approach that focuses on thematic investments rather than sticking to conventional asset classes. One of the most surprising moves is BlackRock’s endorsement of Bitcoin as a portfolio diversification tool. The firm sees cryptocurrency as a unique, uncorrelated asset that can serve as a hedge in the current market environment.

In an unexpected twist, BlackRock also highlights Japan as a standout investment opportunity. Corporate reforms combined with a resurgence of inflation create a favorable environment for Japanese stocks—marking a rare positive outlook for the country’s economy in the past 30 years. This forward-thinking strategy signals a major shift in traditional investment paradigms.

#BlackRock2025 #AIInvesting #BitcoinDiversification #USStocks