Main Takeaways

Binance Margin offers automated features like Auto-Transfer, Auto-Borrow, and Auto-Repay to streamline your trading experience.

These features allow users to open, manage, and close positions with fewer steps.

This guide explains how to set up and use the Binance Margin’s automated features.

Margin trading can get complex, especially for those who are new to it. Luckily, Binance Margin’s automated tools are here to help by simplifying the process. Whether you're transferring funds, borrowing for leverage, or paying back loans, Binance has designed features like Auto-Transfer, Auto-Borrow, and Auto-Repay to make the entire process as seamless as possible. Think of these tools as your personal assistants, handling the details while you focus on making smart trades.

Smart Automation

Imagine you’ve spotted a market opportunity, but your Margin Wallet doesn’t have enough funds. Instead of manually moving money from one wallet to another, Auto-Transfer steps in and transfers the funds from your Spot Wallet to your Margin Wallet for you.

Gone are the days of wasting time switching between wallets and making manual transfers. With Auto-Transfer, everything happens behind the scenes, so you can focus on seizing opportunities quickly. Here’s how else Auto-Mode features can help you.

Auto-Transfer

This feature allows you to place orders using the funds in your Spot Wallet as collateral. For example, if your Margin Wallet is short on USDC but you have some in your Spot Wallet, Auto-Transfer will automatically shift those funds, making them available for margin orders.

Auto-Borrow

Auto-Borrow makes it easier to leverage your trades by automatically borrowing the amount of crypto you need for a trade. If you’ve got 10 USDC and want to purchase 50 USDC worth of bitcoin, Auto-Borrow will handle the difference, borrowing 40 USDC for you.

Auto-Repay

Once you’ve made a profit and want to settle your loans, Auto-Repay takes the funds from your completed trades and automatically pays down your borrowed amount. No more worrying about calculating repayments or missing deadlines.

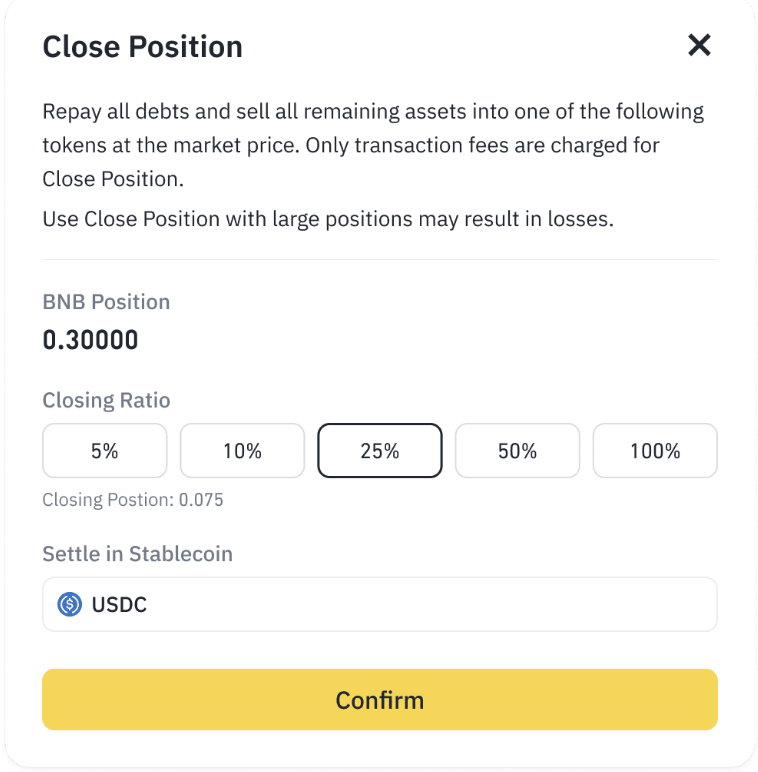

Close Position

When you’re ready to close out a trade, the Close Position feature automatically repays your debt and converts any leftover assets into your chosen token. It’s a fast and simple way to tidy up your open trades without leaving anything behind.

How Auto-Mode Works in Margin Trading: Examples

Imagine you’re new to margin trading, and all your funds are sitting in your Spot Wallet, for example, in USDC. You see a great opportunity in the market and want to buy some BTC. However, you don’t have enough funds in your Margin Wallet. Here’s how Auto-Mode makes this simpler when relevant features are enabled.

Steps 1 & 2: You place a buy order for BTC using the Auto-Borrow feature. If Auto-Transfer is on, the system will automatically move the USDC from your Spot Wallet to your Margin Wallet. It will also borrow additional USDC if needed to ensure you have enough to complete the order.

For example, if you have no USDC in your Margin Wallet but have 10 USDC in your Spot Wallet, the system will use those 10 USDC for the order. If you need more, the system will borrow it for you.

Step 3: Let’s say the price of BTC goes up, and you want to sell the asset to repay your loan to make a profit. You place a sell order using Auto-Repay, and the system will automatically sell your BTC, use the proceeds to repay the USDC you borrowed, and leave you with the rest.

For example, if you borrow 50 USDC and sell BTC to receive 20 USDC, the system will use those 20 USDC to start repaying your loan right away.

Step 4: If you’re done trading and want to close out your position, just hit the Close Position button and select USDC as your currency. The system will convert any leftover BTC to USDC, repay any debt, and close your position for you.

In short, with Auto-Mode, the system handles all the heavy lifting: it moves your funds, borrows what you need, and repays your debt without you having to think about it. No more manual transfers or extra steps!

How to Set up Auto Featured: A Step-by-Step Guide

Step 0: Auto-Transfer is enabled by default for all Margin users. When your Margin Wallet lacks the necessary funds, the system will automatically use your Spot Wallet balance to cover the trade.

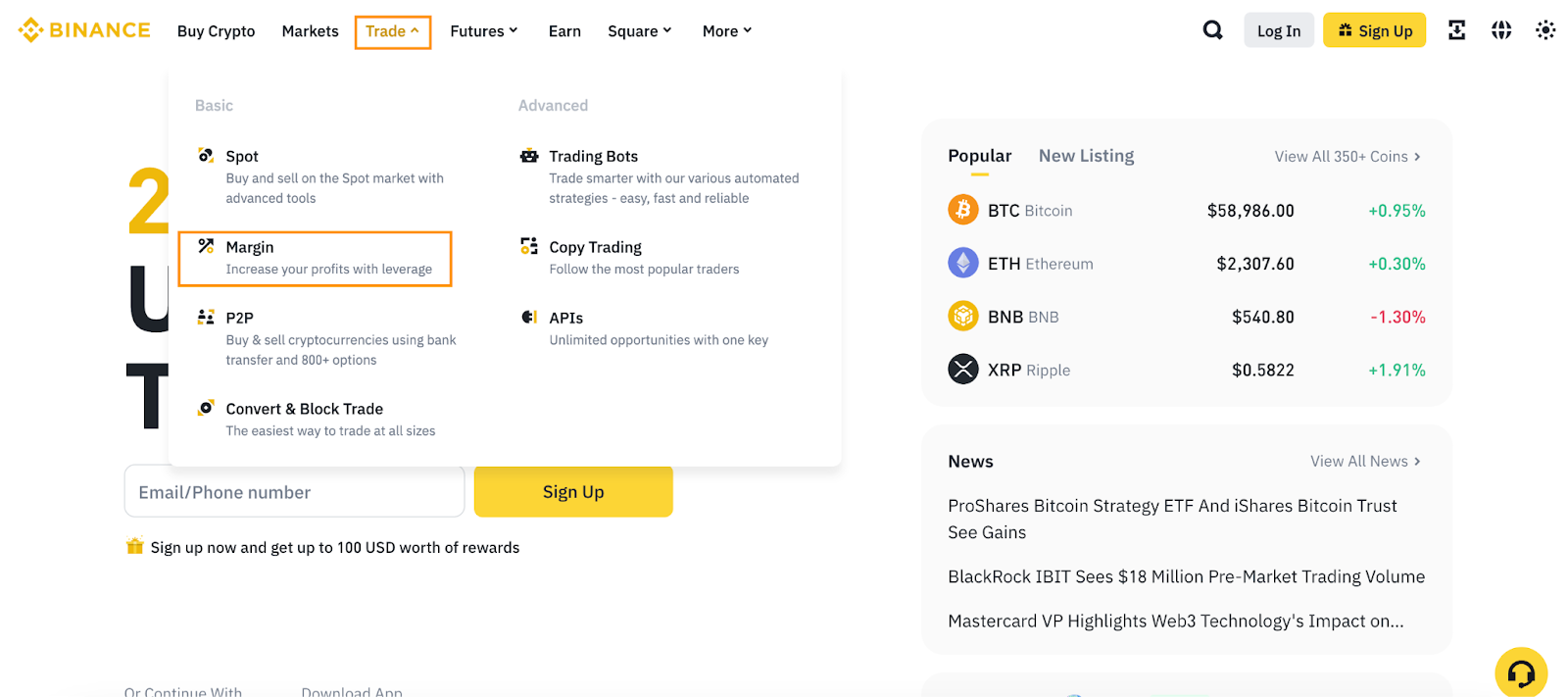

On the Binance website, click on [Trades] and then [Margin].

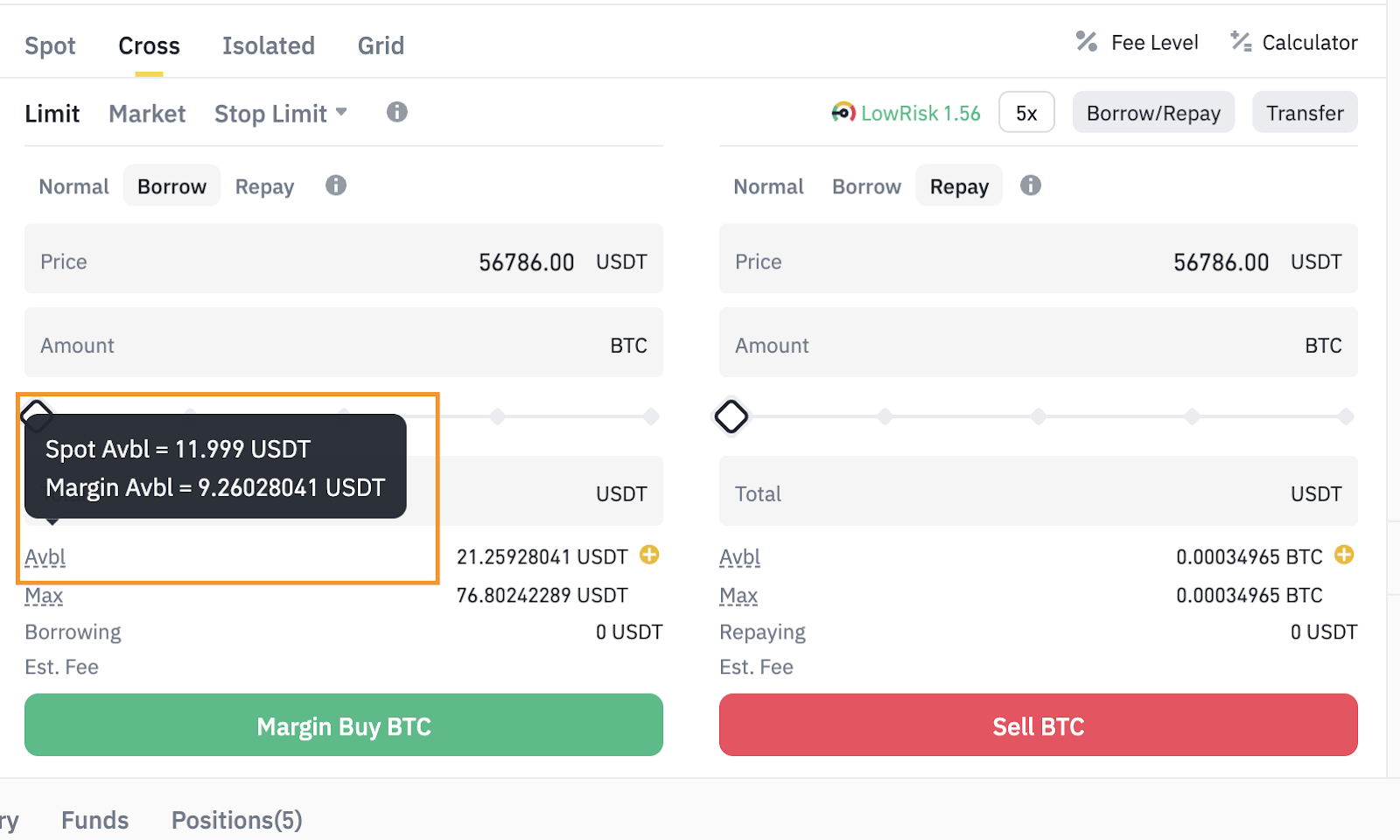

Then scroll down to the order section. Here, if you hover over [Avbl] (Available balance), you will see both your Spot and Margin available balances that can be used.

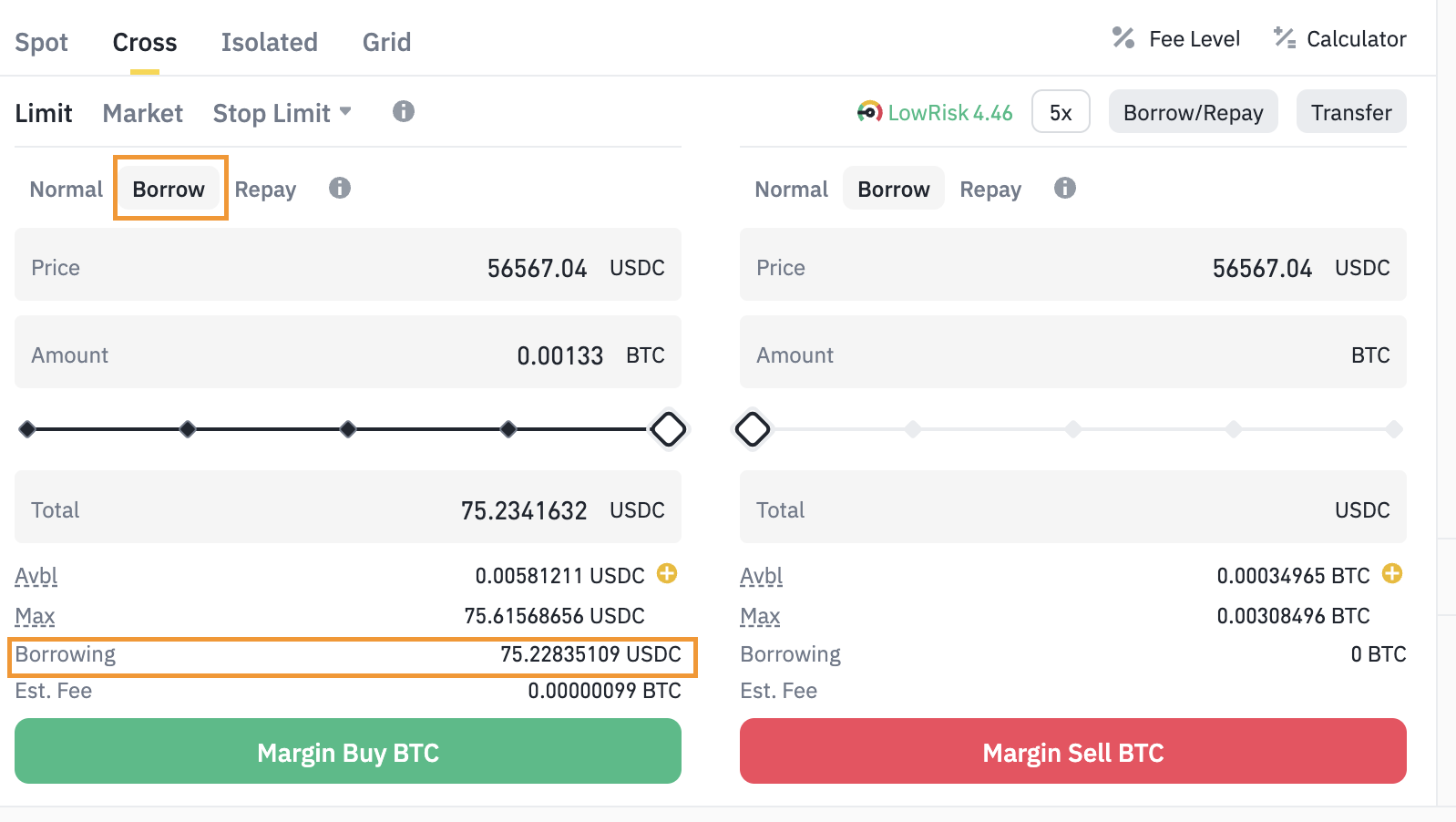

Step 1: On the same screen, select [Borrow] to place an Auto-Borrow order when placing a buy order. If the amount needed for the order exceeds your available balance, the system will automatically borrow what’s required.

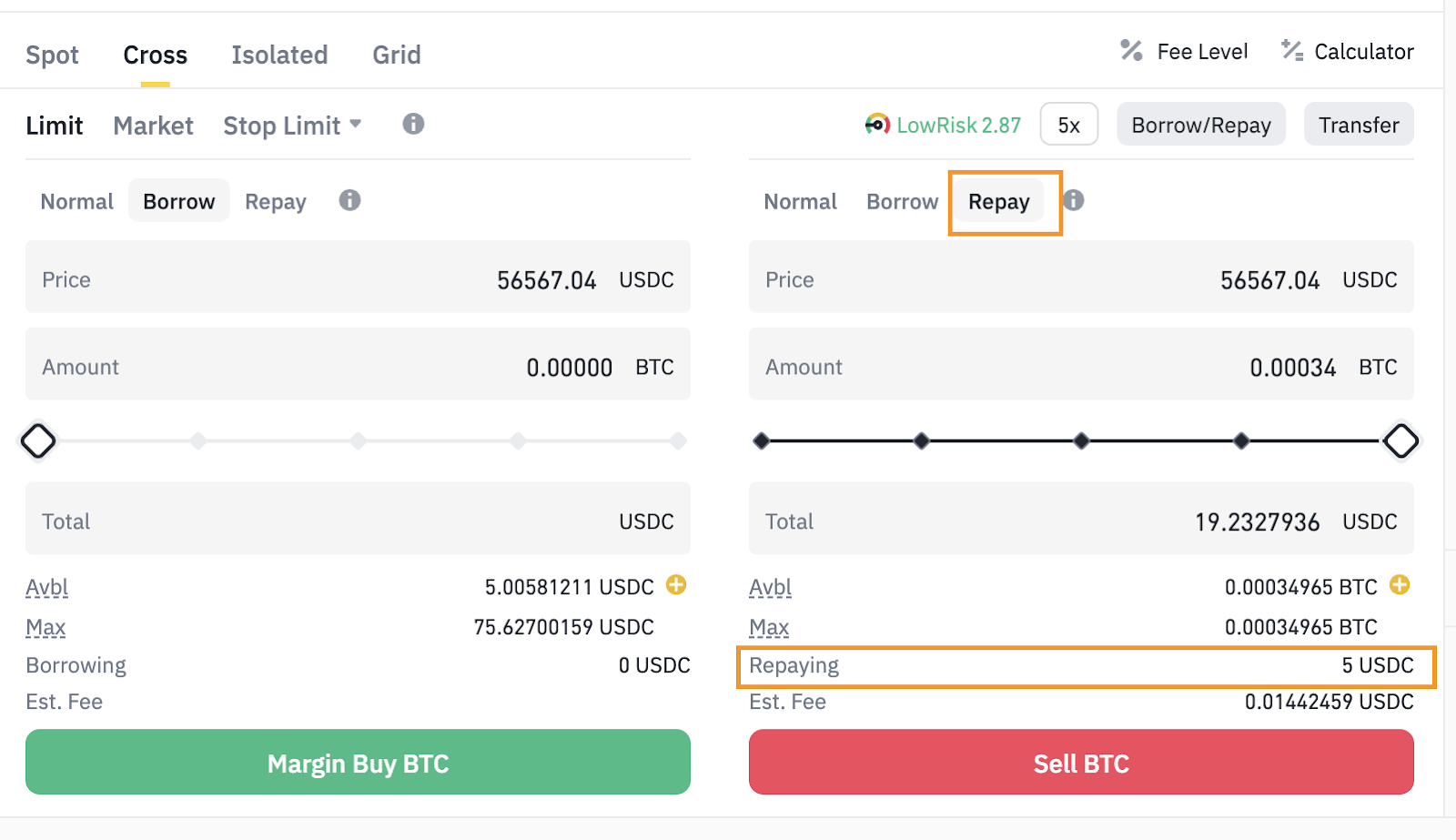

Step 3: To place an Auto Repay order, select [Repay] after completing a trade. The system will use your available balance to repay as much debt as possible.

Step 4: To close your position, click [Close Position]. After choosing a stablecoin for settlement, the system will automatically handle the rest, converting remaining assets and repaying debts.

Final Thoughts

With the automated features on Binance Margin, trading becomes smoother and more efficient. The system takes care of tasks like fund transfers, borrowing, and repayments automatically, letting you focus on your trades. It's a user-friendly way to manage trades without unnecessary steps, enhancing your trading experience.

Further Reading

Disclaimer and Risk Warning: This content is presented to you on an “as is” basis for general information and educational purposes only, without representation or warranty of any kind. Digital assets are subject to high market risk and price volatility. The information provided does not constitute, in any way, a solicitation or recommendation or inducement to buy or sell the products. The value of your investment may go down or up, and you may not get back the amount invested. Comments and analysis do not constitute a commitment or guarantee on the part of Binance. You are solely responsible for your investment decisions and Binance is not liable for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment. This material should not be construed as financial advice. This product may not be available in certain countries and to certain users. This content is not intended for users/countries to which prohibitions/restrictions apply. For more information, see our Terms of Use and Risk Warning. To learn more about how to protect yourself, visit our Responsible Trading page.