An investment bubble refers to a situation where the price of certain assets significantly exceeds their actual value. This situation is usually caused by market speculation and excessive optimism. In this case, asset prices will rise rapidly, attracting more investors to join, forming a speculative boom, and ultimately leading to a collapse in asset prices and a market crash.

Such bubbles can lead to huge profits, but they can also result in huge losses. Being able to identify bubbles can have a huge impact on your investment decisions and portfolio.

What are the characteristics of foam?

Rapid price increases

The characteristic of a bubble is that asset prices have increased significantly in a relatively short period of time. The rise in asset prices does not conform to the fundamental economic laws. This price increase is usually driven by people's speculative purchases. As prices rise, more and more people will have a strong urge to buy, and ultimately the asset price is far higher than its actual value.

General optimism and enthusiasm

During a bubble, market participants generally believe that the price increase trend will continue. Investors are overly optimistic and selectively ignore the risks associated with investment. A large number of investors pour into the market, exacerbating the rise in asset prices.

LUNA is one of the most representative cases. When it was launched, it was considered to have a ‘perfect’ working mechanism. At the same time, its founder: Do Kwon has great influence. Investing in Luna products also has a fixed annualized rate of return of 12%, and related tokens will also bring other ‘certain’ benefits.

This led people to believe that all these factors combined would cause prices to continue to soar, but it ultimately proved to be a huge investment bubble.

How to identify investment bubbles?

Sudden increase in trading volume and liquidity

Bubbles are also accompanied by increased trading volume and high liquidity as investors rush to buy assets in the hope of profiting from further price increases.

This surge in trading activity is often accompanied by a decrease in market depth. When trading volume surges in a short period of time, we have to consider the risk of a financial bubble.

Excessive leverage and debt

Bubbles are typically driven by ever-increasing lending and ever-higher leverage.

When prices keep rising, a large number of investors may use loans and take on large amounts of debt to invest in order to increase returns, but this also increases the risk of significant losses when the bubble bursts.

When the bubble bursts, investors may face huge losses because they used too much borrowing or took on too much debt to invest, which made their losses worse. So, excessive leverage and debt are an important factor in the formation of bubbles.

During the Bitcoin bubble in 2017, the number of people using leverage and taking on debt increased dramatically.

Many investors use stock loans, credit cards, traditional loans, etc. to expand their investments.

These phenomena indicate that there is a bubble in the market and it may be about to burst, which is often an obvious sign of identifying a bubble that is about to burst.

Extensive media coverage

Financial bubbles attract a lot of media coverage, further driving public attention and participation in the market.

This phenomenon contributes to the formation of bubbles by creating a positive feedback loop of hype and speculation.

Media attention and public participation are important factors in the formation of bubbles.

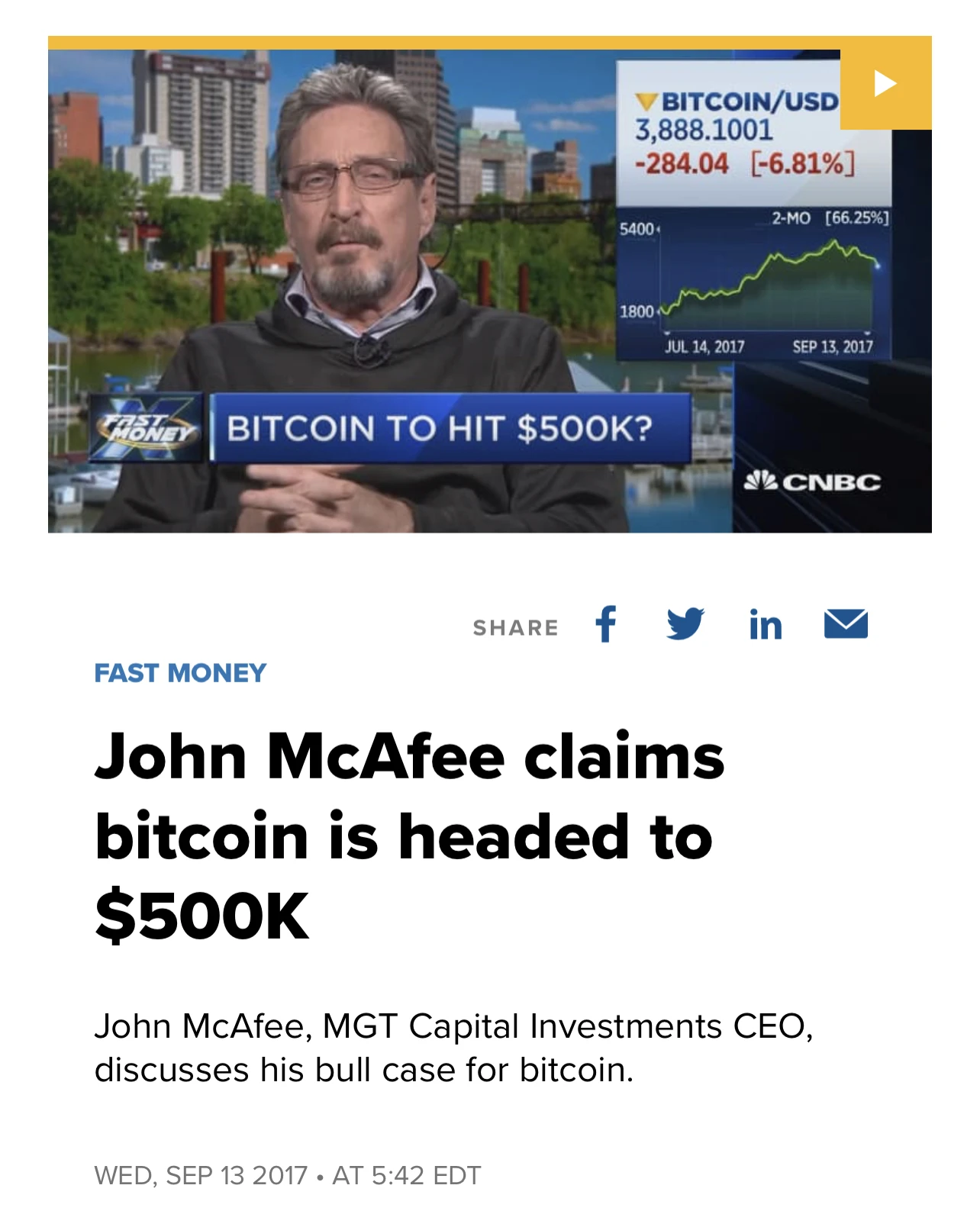

During the 2017 bull run, John McAfee made two statements:

“Bitcoin price will reach $500,000 in 2020”;

"Under the new technology of blockchain, data analysis shows that there is no bubble at present."

These remarks attracted many people at the time, but ultimately proved to be an investment bubble trap.

Warning Signals

There may be a minority among market participants and analysts who raise concerns or doubts about the sustainability of price increases and fundamentals.

At the peak of a bubble, these warning signs are usually ignored and dismissed by most people.

Warning signs are one of the important factors in identifying a bubble.

The three stages of financial bubble development

The formation of foam is generally divided into five stages:

Trigger period

Prosperity

Expansion period

Profit period

Panic period

These phases match the characteristics of bubbles, further helping us detect potential bubbles.

Trigger period

Investors will warm to new technologies or narratives, especially when current market sentiment is favorable.

In the past, technologies such as artificial intelligence and the metaverse have sparked this kind of craze in the cryptocurrency market, which provided people with a "reason" to invest, thereby driving the market boom.

Prosperity

In the first stage, prices rise slowly, then reach a point where they begin to accelerate.

This accelerating upward trend attracts more and more new buyers and retail investors into the market, and the boom period is a key period for attracting new buyers and retail investors.

Expansion period

The number of people being sucked into rising assets is growing at an unimaginable rate.

This causes prices to expand to extremely high levels, while media coverage creates new analyses and assessments to "justify" this surge, fueling the market's exuberance.

Profit period

This is the stage where smart money sells their holdings and starts to watch out for "bubble burst signals".

Panic period

Panic is, of course, the last phase, where people expect the market to "reload" and explode again. In this phase, investors see market prices falling and are unsure when they will rebound. They panic and start to panic. Entering a death spiral, when confidence weakens, the bubble bursts, and asset prices decline rapidly and significantly, often referred to as a "market correction." Market correction is usually a self-correcting mechanism after a bubble bursts, which can clear the market of excessive valuations and unreasonable prices and restore normal operation of the market. Therefore, bubble bursting and market adjustment are inevitable processes in a market economy.

Before deciding to invest, we need to ask ourselves a few questions?

Is this asset really worth investing in?

Does it have an actual product?

What stage of development is it in? (final product or test product)

How good or bad is the market sentiment related to the asset, that is, the market's views and expectations about the asset?

Keep in mind that bubbles often last longer than expected and timing is often very difficult. As an investor, you need to be able to identify potential risks and opportunities, such as market hype, asset intrinsic value, and price behavior phases. These factors can have a significant impact on the performance of an asset. Finally, investors should remain calm and not be swayed by market sentiment to avoid losses when a market bubble bursts.