TL;DR

The stop-limit order combines the stop trigger of a stop order with a limit order. Stop-limit orders allow traders to set the minimum amount of profit they want to make or the maximum amount they are willing to lose on a trade. After setting a stop-limit order, when the activation price is reached, a limit order will be created automatically, even if you are disconnected or offline. You can create stop-limit orders strategically, considering support and resistance levels and an asset's volatility.

In a stop-limit order, the stop price is the activation price for the broker to create the limit order. The limit price is the corresponding price for creating your order. You can customize the limit price, which is usually set above the stop price for a buy order and below the stop price for a sell order. This difference takes into account market price changes between the times the stop price is triggered and the limit order is created.

Introduction

If you want to start actively trading instead of HODLing, you will probably need to use other order types in addition to market orders. A stop-limit order offers more control and customization. The concept can be confusing for beginners, so first let's evaluate the main differences between limit, stop-loss and stop-limit orders.

Limit order, stop-loss order and stop-limit order

Limit orders, stop-loss orders, and stop-limit orders are some of the most common order types. Limit orders allow you to set a wide range of prices at which you want to trade. The stop-loss order defines a stop price that triggers a market order. A stop-limit order combines aspects of the two previous types. Let's analyze each of them:

Limit order

When you set up a limit order, you set a maximum buy price or a minimum sell price. Your broker will attempt to automatically fill the limit order when the market price reaches your limit price (or a better price). This type of order is useful when you have a target entry or exit price and don't mind waiting until the market meets your conditions.

Typically, traders place sell limit orders above the current market price and buy limit orders below the current market price. If you create a limit order at the current market price, it will likely be executed within a few seconds (unless it is a low liquidity market).

For example, if the market price of Bitcoin is $32,000 (BUSD), you can set a buy limit order at $31,000 to buy BTC once the price reaches $31,000 or less. You can also create a sell limit order at $33,000. In other words, the broker will sell your BTC if the price rises to US$33,000 or more.

Stop-Limit Order

As mentioned, the stop-limit order combines the stop trigger of a stop order with a limit order. A stop order adds an activation price for the broker to add your limit order to the order book. Let's see how this works.

How does a stop-limit order work?

The best way to understand a stop-limit order is to break it down into parts. The stop price acts as an activation price to create the limit order. When the market reaches the stop price, it automatically creates a limit order with a custom price (limit price).

Although the stop price and limit price can be the same, this is not a requirement. In fact, it is safer to set the stop price (activation price) slightly above the limit price for sell orders. For buy orders, you can set a stop price slightly below the limit price. This increases the chances of your limit order being filled after triggering.

Examples of buy and sell stop-limit orders

Buy stop-limit

Imagine that the current price of BNB is $300 (BUSD) and you would like to buy when it starts to enter an uptrend. However, you don't want to pay too much for BNB in case it starts to rise quickly, so you need to limit the purchase price.

Let's assume that your technical analysis indicates the beginning of an uptrend if the market price exceeds $310. So you decide to open a position with a buy stop-limit order in case this upward movement materializes. You set your stop price at $310 and your limit price at $315. Once BNB reaches $310, a limit order will be created to buy BNB at $315. Your order can be filled at a price of 315 or lower. Note that $315 is your limit price, so if the market rises too quickly above this value, it is possible that the order will not be completely filled.

Stop-limit sell

Suppose you bought BNB for $285 (BUSD) and now the price is $300. To avoid losses, you decide to use a sell stop-limit order in case the BNB price drops to the entry value. You set up a sell stop-limit order with a stop price of $289 and a limit price of $285 (the price at which you purchased BNB). If the price reaches $289, a sell limit order at $285 will be created. Your order can be filled at a price of 285 or higher.

How to create a stop-limit order on Binance?

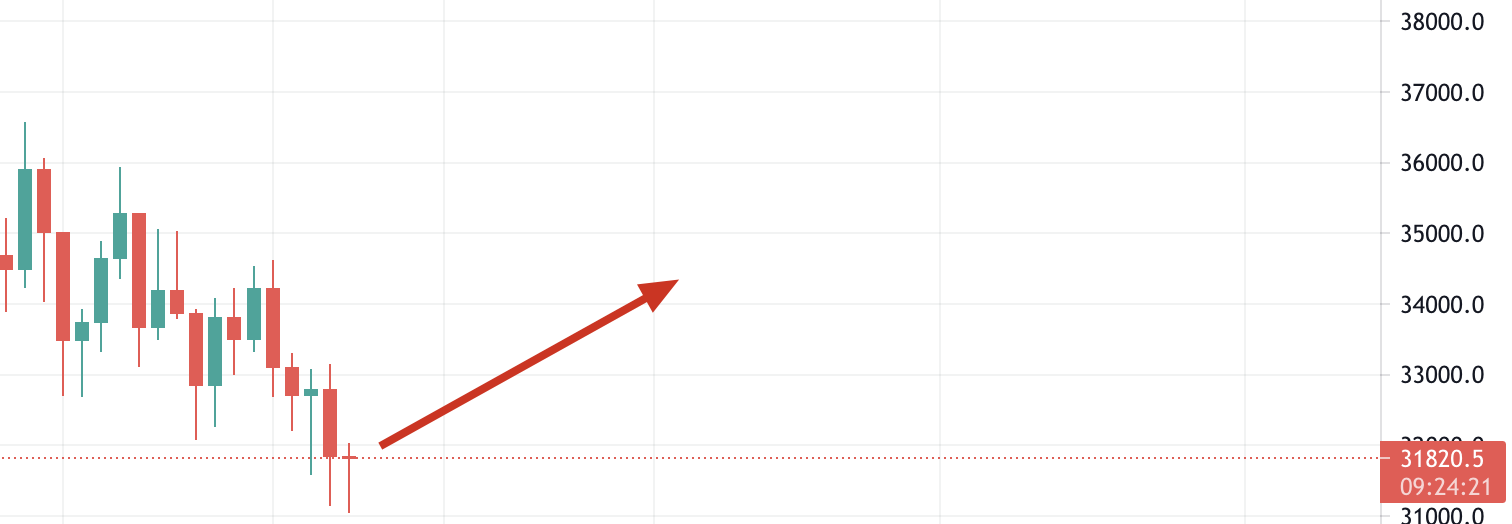

Let's assume you just bought five BTC at $31,820.50 (BUSD) because you believe the price will rise soon.

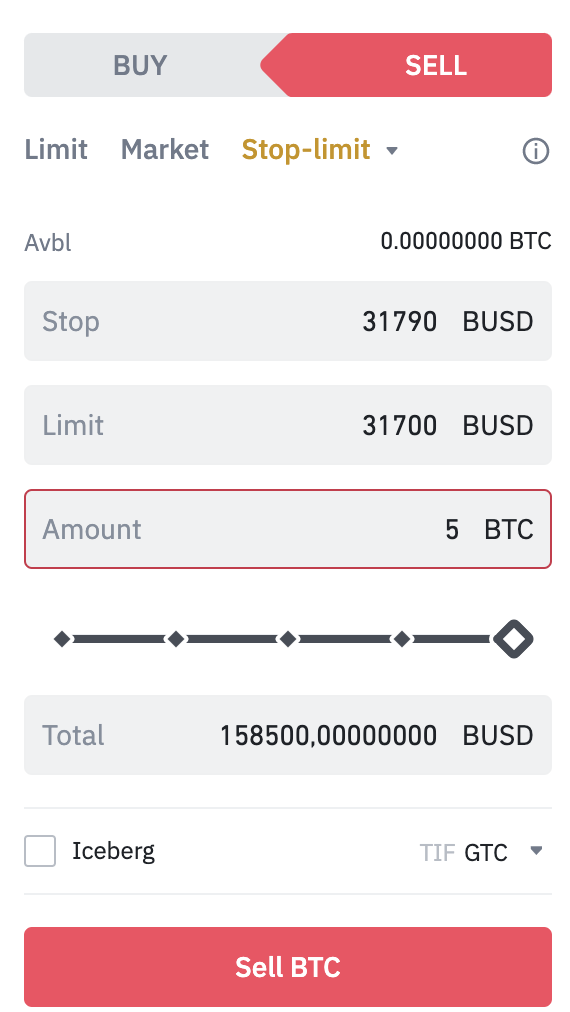

In this situation, you may want to set a sell stop-limit order to minimize your losses in case your assumption is wrong and the price starts to fall. To do this, log into your Binance account and access the BTC/BUSD market. Then click on the [Stop-limit] tab and define the stop price, limit price and the amount of BTC to be sold.

If you believe that $31,820 is a reliable support level, you can set a stop-limit order just below that price (in case it does not hold). In this example, we will place a stop-limit order for 5 BTC with the stop price at $31,790 and the limit price at $31,700. Let's do it step by step.

When you click [Sell BTC], a confirmation window will appear. Verify that the information is correct and select [Create Order] to confirm. After creating your stop-limit order, you will see a confirmation message. You can also scroll down to view and manage your open orders.

Note that the stop-limit order will only be executed if and when the stop price is reached. The limit order will only be filled if the market price reaches your limit price or a better price. If your limit order is triggered (by the stop price) but the market price does not reach the price you set or a better price, the limit order will remain open.

Sometimes the price drops too fast and your stop-limit order is ignored without being executed. In this case, you can resort to market orders to quickly exit the trade.

Advantages of using a stop-limit order

A stop-limit order allows you to customize and plan your trades. We are not always able to monitor price changes, especially in the cryptocurrency market that operates 24 hours a day, 7 days a week. Another advantage is that a stop-limit order allows you to set an appropriate amount of profit to be taken. Without a limit, your order would be filled at any market price. Some traders prefer to hold (hold assets) rather than sell at any price.

Disadvantages of using a stop-limit order

Stop-limit orders have the same disadvantages as limit orders, mainly because there is no guarantee that they will be executed. A limit order will only begin filling when it reaches a specific price or better. However, the price may never reach the set value. Even though it is possible to create a gap between the stop price and the limit price, sometimes it is not enough. Highly volatile assets can exceed the spread you place on your order.

Liquidity can also be an issue if there are not enough buyers to fill your order. If you are concerned about your orders being partially filled, consider using fill or kill orders. This option defines that your order will only be executed if it can be completely filled. However, note that the more conditions you add to your order, the lower the probability of execution.

Strategies for creating stop-limit orders

Now that we've studied stop-limit orders, what's the best way to use them? We will mention some basic trading strategies to increase the effectiveness of your stop-limit orders and minimize some of the disadvantages.

1. Study the volatility of the asset for which you are creating the stop-limit order. We recommend setting a small difference (spread) between the stop order and the limit order to increase the chances of filling the limit order. However, if the traded asset is very volatile, it may be necessary to set a slightly higher spread value.

2. Assess the liquidity of the asset you are trading. Stop-limit orders are particularly useful when trading assets with a large spread between the bid and ask price (bid-ask spread) or with low liquidity (to avoid unwanted prices caused by slippage).

3. Use technical analysis to determine price levels. It's a good idea to set your stop price at an asset's support or resistance level. One way to determine these levels is through technical analysis. For example, you can use a buy stop-limit order with a stop price just above a resistance level to take advantage of a potential breakout. Or a sell stop-limit order just below a support level to ensure you exit the position before the market drops further.

If you don't know what support and resistance levels are, see the Support and Resistance Basics Guide.

Final considerations

A stop-limit order is a powerful tool that can provide you with more trading power than simple market orders. There is also the added benefit of not having to actively trade for the order to be filled. By combining several stop-limit orders, it is easy to manage your equity, regardless of price movement.