TL;DR

DeFi, the only place where unicorns and cartoon sushi face off in a battle for liquidity. Uniswap has been one of the most successful DeFi protocols for swapping tokens on Ethereum. It was created by a small team of passionate developers who made the source code publicly available (open-source). And that's exactly what SushiSwap did!

SushiSwap is a fork of Uniswap that adds the tasty SUSHI token. It grants token holders control over the protocol and a portion of the fees. Let's see how SushiSwap works!

Introduction

As the Decentralized Finance (DeFi) sector evolves, an increasing number of new financial platforms continue to emerge. We've already seen how investors use tools like flash loans and yield farming (or liquidity mining) to multiply their earnings.

Uniswap has solidified its position as one of the top DeFi protocols with one of the highest trading volumes. Despite its decentralized nature and heavy reliance on smart contracts, users do not have much information about the next steps related to the development of the protocol.

SushiSwap, a new member of the DeFi sector, has promised to change that. The milestone of more than $1 billion in value locked in the protocol – just days after launch – suggests that many are interested in this change. In this article, we will discuss the Uniswap fork that is taking the crypto sector by storm.

What is SushiSwap?

SushiSwap was launched in September 2020 by two anonymous developers using the nicknames Chef Nomi and 0xMaki. It is one of the most popular decentralized applications (DApp) on the Ethereum blockchain. SushiSwap adopts the automated market-making (AMM) model for its decentralized exchange (DEX) protocol. Basically, there is no order book on SushiSwap. Instead, the buying and selling processes of cryptocurrencies are carried out through smart contracts.

SushiSwap started as a fork of Uniswap. It used Uniswap's code to build its foundation and at the same time introduced some key differences – among them, its rewards are distributed in SUSHI tokens. Liquidity providers on SushiSwap are rewarded with the protocol's native token (SUSHI), which is also a governance token. Unlike Uniswap (UNI), SUSHI holders can continue receiving rewards even after stopping liquidity provision.

When it launched, SushiSwap incentivized liquidity providers to stake their liquidity pool (LP) tokens on Uniswap, offering extra rewards in SUSHI with a high annual percentage yield (APY). In one week, SushiSwap attracted over $1 billion of liquidity and the total value locked reached over $150 million dollars. The staked LP tokens were then migrated from Uniswap to SushiSwap after two weeks. This means that all Uniswap LP tokens staked on SushiSwap have been redeemed on Uniswap in exchange for the respective tokens they represent. With this, new liquidity pools were also created on SushiSwap, marking the launch of the SushiSwap exchange.

In Q2 2021, the SushiSwap ecosystem revealed its latest addition, a non-fungible tokens (NFTs) platform called Shoyu. In fact, the idea for the platform came from a member of SUSHI governance, who proposed transforming Shoyu into an easy-to-use NFT platform. It aims to address current shortcomings in NFT markets, such as limited file format options, image size limits, and the high transaction fees on Ethereum.

What is SUSHI?

SUSHI is SushiSwap's native token. It is an ERC-20 token distributed to liquidity providers on SushiSwap via liquidity mining. The SUSHI token has a maximum supply of 250 million tokens. The supply of SUSHI depends on the block rate. As of November 2021, the token is created at a rate of 100 tokens per block and its circulating supply has already reached approximately 50% of the total, with 127 million tokens.

SUSHI provides its holders with governance rights and part of the fees paid to the protocol. In a simplified way, we can say that it is the SUSHI community that controls the protocol. Why did this spark so much interest? Well, the community governance model is strongly interconnected with the DeFi sector proposal. The growth of liquidity mining (yield farming) as a valid method for token distribution has given rise to many other token launches.

These fairer token launch models aim to level the playing field for everyone involved and generally do not include pre-mines, have little or no allocation for founders, and more equal distribution based on the amount of funds provided by each user. . In most cases, distributed tokens also grant governance rights to token holders.

And what can holders do with these governance rights? On SushiSwap, anyone can submit an improvement proposal - SushiSwap Improvement Proposal (SIP). SUSHI token holders can vote on the proposals. These could be small changes or even major updates to the SushiSwap protocol. Instead of a traditional team like Uniswap, the development of SushiSwap is in the hands of SUSHI holders.

A strong community is a powerful asset for any token project, and this is especially true for a DeFi protocol. The Minimal Initial SushiSwap Offering (MISO) - SushiSwap's minimum initial offering, for example, is a product that emerged from a governance proposal. It is a token launch platform (launchpad) in the SushiSwap ecosystem, adapted to meet the expectations of the SUSHI community. MISO allows individuals and communities to launch their new token projects through the SushiSwap platform.

How does SushiSwap work?

As mentioned, SushiSwap is an automated market maker (AMM) protocol that functions as a decentralized broker/exchange. There is no order book and no central authority. Cryptocurrency trades on SushiSwap are processed by smart contracts in liquidity pools. A liquidity pool is where SushiSwap users become liquidity providers (LP) by locking up their crypto assets. Anyone can be a liquidity provider on SushiSwap and receive rewards proportional to their participation in the pool. This process requires depositing equivalent amounts of two tokens into the pool. Each pool functions as a market, where other users can buy and sell tokens. To learn more details about how an AMM works in DEX protocols, check out our Uniswap article.

As with other DEX protocols, on SushiSwap you can swap ERC-20 tokens. For example, you can exchange stablecoins like USDT and BUSD for cryptocurrencies like Bitcoin (BTC) and Ether (ETH). Furthermore, there are different functions to obtain passive income. For example, you can stake SUSHI on SushiBar and receive xSUSHI. Staking xSUSHI provides holders with a 0.05% reward rate on all trades across all liquidity pools. After the launch of the Shoyu platform, SUSHI holders who stake their tokens for xSUSHI will also be able to receive 2.5% of all NFT trades on the NFT marketplace.

BentoBox is another feature to earn rewards on SushiSwap. It is an innovative type of vault that offers users the benefits of all yield-earning tools available on SushiSwap. In other words, when depositing assets in BentoBox, it is possible to automatically earn staking interest in SushiBar, as well as make loans to other users. At the same time, xSUSHI holders also earn rewards from BentoBox's accumulated transaction fees.

Uniswap vs. SushiSwap

The strong relationship between cryptocurrencies and open-source development is no secret. Many think that Bitcoin and a growing number of permissionless DeFi protocols act as new types of public goods, in the form of software. Since these designs are easily copied and relaunched with minor changes, it is natural for this to generate competition between similar products. However, as a consequence, we can assume that this will provide better products to users.

There is no doubt that much of the advancements in the DeFi sector have been made possible thanks to the Uniswap team. In the future, it is likely that Uniswap and SushiSwap (or other forks) will develop further and reach another stage of prosperity. Uniswap should continue to be the frontrunner in terms of innovation in the AMM sector, while SushiSwap could provide a greater focus on community-driven features.

With that said, fragmentation of liquidity between similar protocols is not ideal. If you read our Uniswap article, you know that AMMs work best with as much liquidity in the pools as possible. If much of the DeFi sector's liquidity is split between many different AMM protocols, then the end user experience could be of lower quality.

How to provide liquidity for SushiSwap?

So you decided to stake tokens in exchange for SUSHI. The first step is to acquire these tokens. You can buy cryptocurrencies for staking on centralized exchanges (crypto brokers) like Binance or on decentralized exchanges like Uniswap and 1inch.

In this example, we will provide liquidity for BNB-ETH, but feel free to use another pair (as long as LP tokens can be used on SushiSwap).

1. Go to Sushi and click [Enter App] to enter the SushiSwap app.

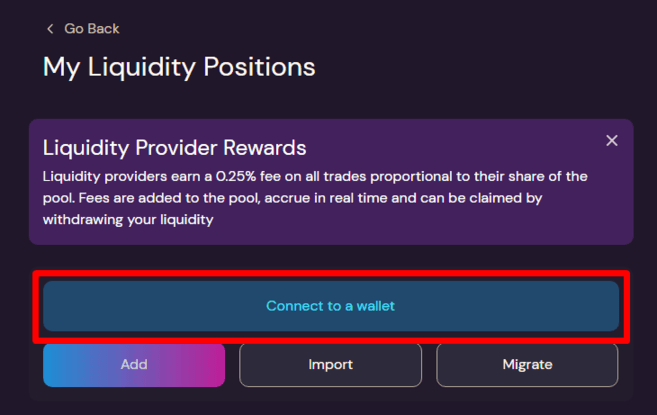

2. Click [Pool] on the top navigation bar. To get started, you need to connect your wallet. You can use Binance Wallet, MetaMask, WalletConnect, or any other Ethereum-compatible wallet. In this example, we will use Binance Wallet.

3. After clicking [Binance], a new window will appear (pop-up). Enter your password to unlock the wallet or click [Create a new wallet] if you don't already have one.

4. Click [Connect].

5. You will be redirected back to the SushiSwap Pool. Click [Add] to add liquidity.

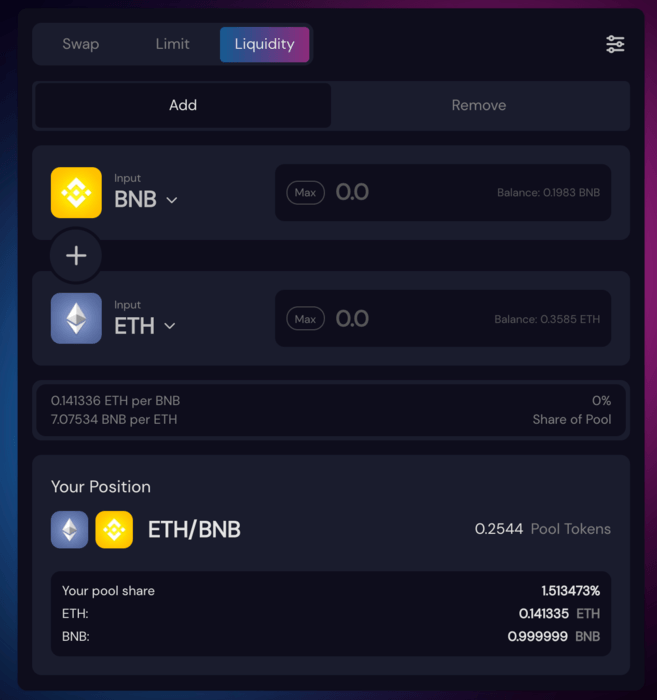

6. Click [Select a token] to find the cryptocurrency pair you want to provide liquidity for. Then enter the amount of one of the tokens (for example, 1 BNB). The system will automatically calculate the amount needed for the other token.

You can also see your pool share at the bottom. Click [Approve ETH] to confirm.

7. Another additional window will be displayed with the details and the Gas fee for this transaction. Click [Confirm] to approve or [Reject] to edit.

8. Click [Confirm Liquidity Add] and [Confirm Supply] to add liquidity to the BNB-ETH pool.

Note: Due to the potential for impermanent loss, at the time of redemption you may receive a different token distribution than the amount initially added. Make sure you understand the risks before adding liquidity.

9. Confirm the transaction in the additional window (pop-up) of your wallet.

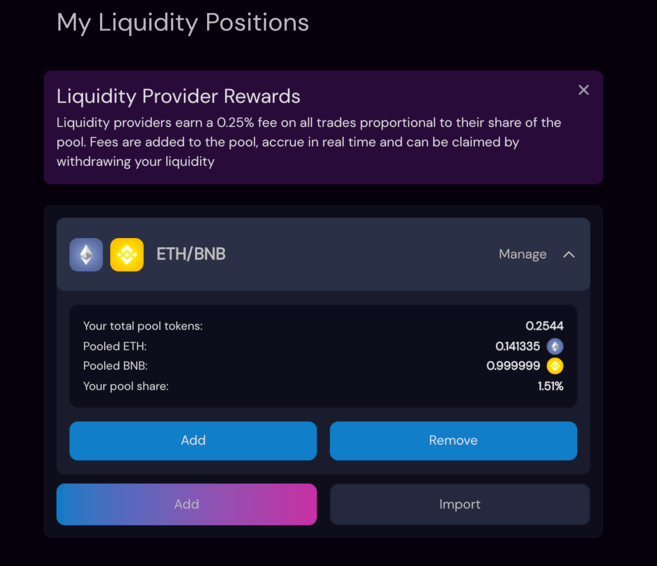

10. Done. You have added liquidity to the BNB-ETH pool. You can see your position and your participation in the pool. Now, when users trade BNB/ETH, you will receive trading fee rewards.

11. To manage your positions, access the [Pool] tab in the top navigation bar, select your position and click add/remove liquidity.

After the transaction, your wallet will have some SLP tokens. SLPs are Sushiswap LP tokens and represent your share deposited into the pool. All liquidity pools are labeled as SLP on SushiSwap, but they actually represent different pools.

How to buy or sell SUSHI on Binance?

In addition to earning SUSHI with SushiSwap, it is possible to buy the token on cryptocurrency brokers such as Binance. On the other hand, if you want to sell SUSHI tokens received from SushiSwap, you can transfer them to your wallet and sell them on crypto exchanges such as Binance.

1. Log in to your Binance account and go to [Trade] on the top bar to select the trading page with classic or advanced interface.

2. On the right side of the screen, type “SUSHI” in the search bar to see available trading pairs. In this example, we will use the [SUSHI/BUSD] pair. Click [SUSHI/BUSD] to open the trading page.

3. Scroll down until you find the [Spot] box. Here, you can buy or sell SUSHI. Enter the amount of SUSHI you want to buy or sell. Then select the order type. In this example, we will use a market order. Click [Buy SUSHI] or [Sell SUSHI] to confirm the order.

Is SushiSwap safe?

When depositing funds into a smart contract, there are always risks of bugs, even for audited and reputable projects. Never deposit more than you can afford to lose and always do your own research (DYOR) before investing. Furthermore, due to the high Gas costs on Ethereum, smaller investments may require much more farming time to generate profits.

Final considerations

SushiSwap is an exciting experiment that challenges the competitive advantage of an already successful DeFi protocol – Uniswap. Despite being a fork of Uniswap, SushiSwap has added new features to its protocol. The main difference is the community governance system. In 2021, SushiSwap will also introduce an NFT platform, thus including the growing and promising NFT market.

Since its launch, in terms of total value locked, SushiSwap has quickly surpassed many other projects in the DeFi sector. It is very likely that its popularity will continue to increase. On the other hand, it doesn't matter how successful SushiSwap is. The project proved that, in the DeFi sector, no product or service has absolute dominance.