TL;DR

Forex is the world's largest market by trading volume and liquidity. Brokers, businesses, governments, and other economic agents trade currencies and forex derivatives to enable international commerce.

Traders also use the market for speculative reasons. There are various arbitrage opportunities to be found with exchange rates and interest rates, making the market a popular one to trade in large volume or on leverage.

The forex market consists of fiat currency pairs and their relative market prices. These pairs are typically bought and sold by the lot. A standard lot contains 100,000 units of the pair's base currency, but other smaller sizes are available, ranging down to 100 units.

Traders commonly use leverage to increase the amounts they can invest with their capital. You can also offset risk by using forwards and swaps to trade a currency pair for a specific price in the future. Combining these two instruments with other trading strategies and products creates a variety of investment opportunities for forex traders.

Introduction

Even if you don't trade forex yourself, the international currencies market often plays a significant role in your daily life. While the effects of a drop in the stock market aren't always so obvious, a change in your currency's value may affect the price of goods and services. If you've been abroad, you've also likely had to exchange your currency and pay a rate that depends on current forex quotes and rates.

Forex is a unique asset class that differs from stocks, commodities, and bonds. When we dive into what makes it different, it’s plain to see why there is such a large market and need for the truly global forex market.

What is Forex?

Forex or FX trading (from foreign exchange) is the purchasing and selling of sovereign currencies and other forex products. When exchanging currencies at a bank or bureau de change, the rates we find are determined directly by what happens in the forex market.

Exchange rate movements are based on a mixture of economic conditions, world events, interest rates, politics, and other factors. As a result, forex is highly liquid and has the largest trading volume compared to other financial markets.

The forex market comprises two main activities: trading facilitating economic transactions and speculative trading. For companies and other entities operating in international markets, purchasing and selling foreign currencies are a must. Getting your funds back home or purchasing goods abroad is a key forex market use case.

Speculators make up the other side of FX trading. Short-term, high-volume trading that takes advantage of very small fluctuations in currency prices is common. Forex is a market full of arbitrage opportunities for speculators, in part explaining the vast trading volume in the market.

Traders also look to make money with long-term opportunities such as fluctuating interest rates. Economic events and geopolitics also cause serious fluctuations over time in the currency markets. By purchasing a currency now and holding, there’s profit to be made long-term. You can also agree on exchange rates years in advance with futures contracts in a bet for or against the market.

Forex trading can be challenging for smaller users. Without borrowing or having a high amount of initial capital, arbitrage and short-term trading become much more difficult. This aspect has led to international banks and financial institutions providing most of the volume we see in the foreign exchange market.

What is a forex pair?

At the most basic level, the forex market contains pairs of currencies describing the relative price between the two. If you’ve traded cryptocurrencies already, you’ll be a bit familiar with how the FX market works. The first currency shown in a pair is the base currency. The second is the quote currency, sometimes known as the counter currency. We express the quote currency as a value related to one single unit of the base currency.

GBP/USD shows the price of £1 quoted in USD. This ratio is shown as a number, such as 1.3809, demonstrating £1 is worth $1.3809. GBP/USD is one of the most frequently traded pairs and is known as cable. This nickname comes from a transatlantic cable in the 19th century that would relay this rate between exchanges in London and New York.

When it comes to forex trading, you can find many liquid markets. Some of the pairs with the highest trading volume include USD/JPY, GBP/USD, USD/CHF, and EUR/USD. These pairs are known as the majors and consist of the US dollar, Japanese yen, British pound sterling, Swiss franc, and euro.

Why do people trade forex?

The forex market isn’t just about speculation. Banks, businesses, and other parties who need access to foreign cash take part in FX trading to facilitate international transactions. Companies also in advance agree on FX rates to fix the costs of future currency exchanges, known as hedging. Another use case is for Governments to build up reserves and meet economic objectives, including currency pegging or boosting imports/exports.

For individual traders, there are attractive features to the forex market too:

Leverage allows even small traders to invest with larger sums of capital than they directly have access to.

The entry costs are low, as it's possible to buy small amounts of currency. Buying a share in the stock market may set you back thousands of dollars, compared to entering the FX market for $100.

You can trade at almost any time, making forex suitable for all schedules.

There's high liquidity in the market, as well as a low bid-ask spread.

Options and futures are standard products. Shorting the market is possible for traders who don't just want to spot buy and sell at the current market price.

Where do people trade forex?

Unlike stocks that trade mainly on centralized exchanges like the NYSE or NASDAQ, FX trading occurs in hubs worldwide. Participants can deal directly with each other through over-the-counter (OTC) trades or enter a huge network of banks and brokers in the interbank market.

Supervising this international currency trade can be tricky due to the different regulations of each currency. While many jurisdictions do have agencies that supervise trading within the domestic market, their international reach is limited. While You may need to acquire a license or go through an accredited broker for your FX trading, this doesn’t stop traders from simply using other, less regulated markets for their activities.

Four major zones make up the most of the FX trading volume: New York, London, Tokyo, and Sydney. As the FX market has no central point, you should be able to find a brokerage that can help you trade FX across the world.

There's a wide variety of options available for online brokerage services that are typically free. You won't pay a direct commission, but forex brokers will maintain a spread on the price they offer and the actual market price. If you're starting out, choose a brokerage that lets you trade micro-lots. We'll cover this point further on, but it's by far the most accessible way for you to start trading forex.

What makes forex trading unique?

Forex has many aspects that make it different from other financial markets:

It has huge geographical coverage. There are 180 recognized foreign currencies around the world, creating markets for them in almost every country.

It’s extremely liquid and has massive trading volume.

Its market prices are affected by numerous global factors. These include politics, economic conditions, speculation, remittances, and more.

It’s open for trading approximately 24 hours a day, five days a week. Because the market isn’t wholly centralized, an exchange or brokerage is almost always open for you to use. Markets are closed on the weekend, but there is still after-hours trading available on some platforms.

Its profit margins can be low unless trading in high volume. Slight differences in the exchange rate can be made profitable through large trades.

How do people trade forex?

There are a few choices when it comes to forex that individual traders can take. The simplest way is to buy a currency pair on the spot market and hold it. For example, you purchase EUR in the USD/EUR pair. If the counter currency appreciates, you can sell it for your base currency and take home a profit.

You can also leverage your funds to increase the amount of capital available to you. In this case, you can trade using borrowed funds as long as you cover your losses. Another possibility to consider are forex options that allow you to buy or sell a pair for a set price on a specific date. Futures contracts are also popular, obliging you to enter into a trade at an agreed-upon price in the future.

One exciting aspect of forex trading is the possibility of making a profit through interest rate differentials. Central banks worldwide set differing interest rates that provide investment opportunities for forex traders. By exchanging your cash and depositing it in a foreign bank, it's possible to earn more money than leaving your funds at home.

There are extra costs, however, including remittance fees, banking charges, and differing tax regimes. You should consider all the possible additional costs to make your strategies work. Arbitrage opportunities and gains are often minimal, so your margins will be tight. An unexpected fee can wipe out all your expected gains.

What is a pip?

A pip (percentage in point) is the smallest price increment possible that a forex pair can make. Looking at GBP/USD again:

A movement up or down 0.0001 would be the minimum amount the pair can move (1 pip). However, not all currencies trade to four decimal places. Any pair with the Japanese yen as the quote standardly has a pip of 0.01 due to no decimalization of the currency.

Pipettes

Some brokers and exchanges break the standard and offer pairs that extend the number of decimal places. GBP/USD, for example, will go to five decimal places rather than the usual four. USD/JPY typically is two decimal places but can go to three. This extra decimal place is known as a pipette.

What is a lot in forex trading?

In forex trading, currencies are bought and sold in specific amounts known as lots. Unlike stock markets, these lots of foreign currencies are traded at set values. A lot is typically 100,000 units of the base currency in a pair, but there are smaller amounts you can purchase too, including mini, micro, and nano lots.

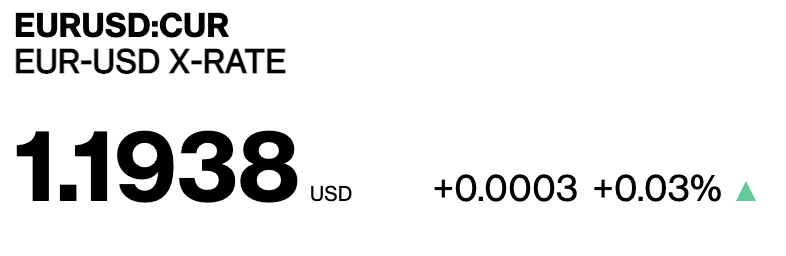

When working with lots, it's easy to calculate your gains and losses with pip changes. Let's look at EUR/USD as an example:

If you purchase one standard lot of EUR/USD, you've bought €100,000 for $119,380. If the pair increases its price by one pip and you sell your lot, this is equal to a change of 10 units of the quote currency. This appreciation means that you will sell your €100,000 for $119,390 and have made a $10 profit. If the price increases ten pips, then it will be a $100 profit.

As trading has become increasingly digitized, standard lot sizes have decreased in popularity in favor of more flexible options. On the other side of the spectrum, large banks have even increased the size of their standard lots up to 1 million to accommodate the large volume they trade.

How does leverage work in forex trading?

One of the forex market's unique traits is its relatively small profit margins. To improve your gains, you'll need to increase the volume you're trading. Banks can do this fairly easily, but individuals may not have access to enough capital and can instead use leverage.

Leverage lets you borrow money from a broker with a relatively small collateral. Brokers display leverage amounts as a multiplication of the capital provided, for example, 10x or 20x being equal to 10 times or 20 times your money. $10,000 leveraged 10x would give you $100,000 to trade.

To borrow this money, traders maintain a margin amount that a broker uses to cover possible losses. A 10% margin is 10x, a 5% margin is 20x, and a 1% is 100x. Through leveraging, you experience the full losses or gains of an investment based on the total leveraged amount. In other words, leverage amplifies your profit and losses.

Let's take a look at a EUR/USD example. If you wanted to purchase one lot of this pair (€100,000), you would need roughly $120,000 at the current rate. If you're a small trader without access to these funds, you might consider getting 50x leverage (2% margin). In this case, you only need to provide $2,400 to access $120,000 in the currency market.

If the pair goes down by 240 pips ($2,400), your position will be closed, and your account will be liquidated (you lose all your funds). When leveraged, small movements in the price can lead to sudden, large changes in your profits or losses. Most brokers will allow you to increase the margin on your account and top it up as needed.

How does hedging work in forex?

With any floating currency, there is always the chance that the exchange rate will move. While speculators try to make profits from volatility, others value stability. For example, a company planning to expand internationally may want to lock in an exchange rate to better plan its expenses. They can do this quite easily with a process called hedging.

Even speculators might want to lock in a specific exchange rate to protect against an economic shock or financial crisis. You can start hedging your FX rates with various financial instruments. The most common methods are using futures or options contracts. With a futures contract, an investor or trader is obliged to trade at a specific rate and amount at a future date.

Futures contracts

Suppose you enter a futures contract to buy one lot of USD/EUR at 0.8400 (purchase $100,000 for €84,000) in a year. You may, perhaps, be selling in the Eurozone and want to repatriate your profits in one year. A futures contract removes the risk of a possible appreciation in the U.S. dollar against the euro and helps you better plan your finances. In this case, if the US dollar appreciates, each euro will purchase fewer dollars when repatriating the funds.

If the US dollar appreciates and USD/EUR is at 1.0000 in a year, without a futures contract, the spot rate would be $100,000 for €100,000. However, instead of this rate, you would enter the previously agreed-upon contract of one lot of USD/EUR at 0.8400 ($100,000 for €84,000). In this simple example, you will have saved on a cost of €16,000 per lot, not considering any fees.

Options

Options offer a similar way to reduce risk through hedging. But unlike futures, options give you a choice to buy or sell an asset at a predetermined price on or before a specific date. After paying a purchase price (the premium), an option contract can protect you from unwanted appreciation or depreciation in a currency pair.

For example, if a British company sells goods and services in the US, they could purchase a GBP/USD call option. This instrument allows them to buy GBP/USD in the future at a predetermined price. If the pound has appreciated or maintained its rate when the US dollar payment is made, the company has only lost the price paid for the options contract. If the pound depreciates against the dollar, they will have hedged their rate already and can get a better price than offered on the market.

For more on futures and options contracts, check out What Are Forward and Futures Contracts? and What Are Options Contracts?.

Covered interest rate arbitrage

With interest rates varying worldwide, forex traders can arbitrage these differences while offsetting the risk of an exchange rate moving. One of the most common ways to do this is with covered interest rate arbitrage. This trading strategy hedges future price movements of the currency pair to reduce risk.

Step 1: Finding an arbitrage opportunity

Take, for example, the EUR/USD pair with a 1.400 rate. The interest rate for deposits in the Eurozone is 1%, whereas it's 2% in the USA. So €100,000 invested in the Eurozone will give you back €1,000 in profit after a year. However, if you could invest the money in the USA, it would provide you with €2,000 in profit if the exchange rate holds. However, this simplified example doesn’t take into account fees, banking costs, and other expenses you should also factor in.

Step 2: Hedging your FX rate

Using a EUR/USD one-year futures contract with a forward rate of 1.4100, you can take advantage of the improved interest rate in the USA and guarantee a fixed return. The forward rate is the agreed FX rate used in the contract.

A bank or broker calculates this rate with a mathematical formula that considers different interest rates and the current spot price. The forward rate adds a premium or discount compared to the spot rate depending on market conditions. In preparation for the arbitrage, we enter a futures contract to buy one lot of EUR/USD at a rate of 1.41 in one year.

Step 3: Completing the arbitrage

In this strategy, you sell one lot of EUR/USD at 1.400 on the spot market to give you $140,000 at a cost of €100,000. Once you have the funds from your spot trade, deposit them in the USA for a year with 2% interest. When the year is up, you’ll have $142,800 in total.

Next up is for you to convert the $142,800 back to euros. With the futures contract, you sell back the $142,800 at the 1.4100 rate agreed, giving you roughly €101,276.60.

Step 4: Comparing profits

Let's compare the profit you get here with and without hedging the rate, assuming everything else holds. After going through the covered interest arbitrage strategy in the USA, you'll have €101,276.60. If you didn't hedge, you would have €102,000, as mentioned before. So why do people hedge if it leads to fewer profits?

Primarily, traders hedge to avoid the risk of fluctuations in the exchange rate. A currency pair will rarely stay stable over a year. So while the profit is €723.40 less, we've managed to at least guarantee €1,276.60. Another factor is that we assume that the central bank won't change the interest rate over the year, which is not always the case.

Closing thoughts

For anyone interested in international economics, trade, and global affairs, the forex market provides a unique alternative to stocks and shares. Forex trading can seem less accessible than crypto or stocks for small investors. But with the rise of online brokers and increasing competition in bringing financial services to the public, forex isn't so out of reach. Many forex traders rely on leverage to make decent profits. These strategies carry a high risk of liquidation, so make sure you understand the mechanisms very well before taking risks.