Résumé

TradingView is a browser-based charting platform and screener for cryptocurrencies and other financial assets. Its charting tools are also available for native use in Binance's trading interface. Besides charts, you can also share your trading strategies and broadcast your analyzes live.

When it comes to free options, TradingView is a powerful tool for all experience levels. The basic features should be enough for most traders. However, be careful browsing other users' ideas and feeds. It is important to filter information that adds value to your strategy rather than blindly following others.

Introduction

For traders who enjoy technical analysis, robust charting tools are essential. TradingView is suitable for both amateur and experienced traders. It offers numerous trading and charting tools, as well as a free subscription option. Let's face it... not everyone has the means or the need to subscribe to the Bloomberg terminal.

If you have already traded on Binance, you may have already noticed the TradingView tools available on the exchange. But without understanding them, it can seem a little daunting. There are lots of features to try, but how do you get started? Explore our beginner's guide to discover what TradingView can offer you.

What does TradingView allow?

TradingView is a platform that allows you to customize technical indicators, create charts and analyze financial assets. These indicators are patterns, lines and shapes that millions of traders use every day. TradingView is entirely web browser based and does not require downloading a client. You can also download an app for iOS and Android if you prefer to use it on your mobile device.

Launched in Westerville, Ohio in 2011, TradingView today has a large user base, with eight million accounts created in 2020 alone. Users can view and analyze various stocks, commodities and cryptocurrencies like Bitcoin with a free or premium account. Once you have created strategies and templates, you can publish your analyzes and share them with the community. This way, you can strengthen your skills with feedback from other TradingView members.

TradingView on Binance

Binance has integrated TradingView tools into its trading interface, which allows users to create charts and trade at the same time. The tools you see on the left are just a small selection of what's available and offer a similar experience to TradingView's website.

For a quick tour of the interface, check out the How to Use the Binance TradingView Tool article.

How much does TradingView cost?

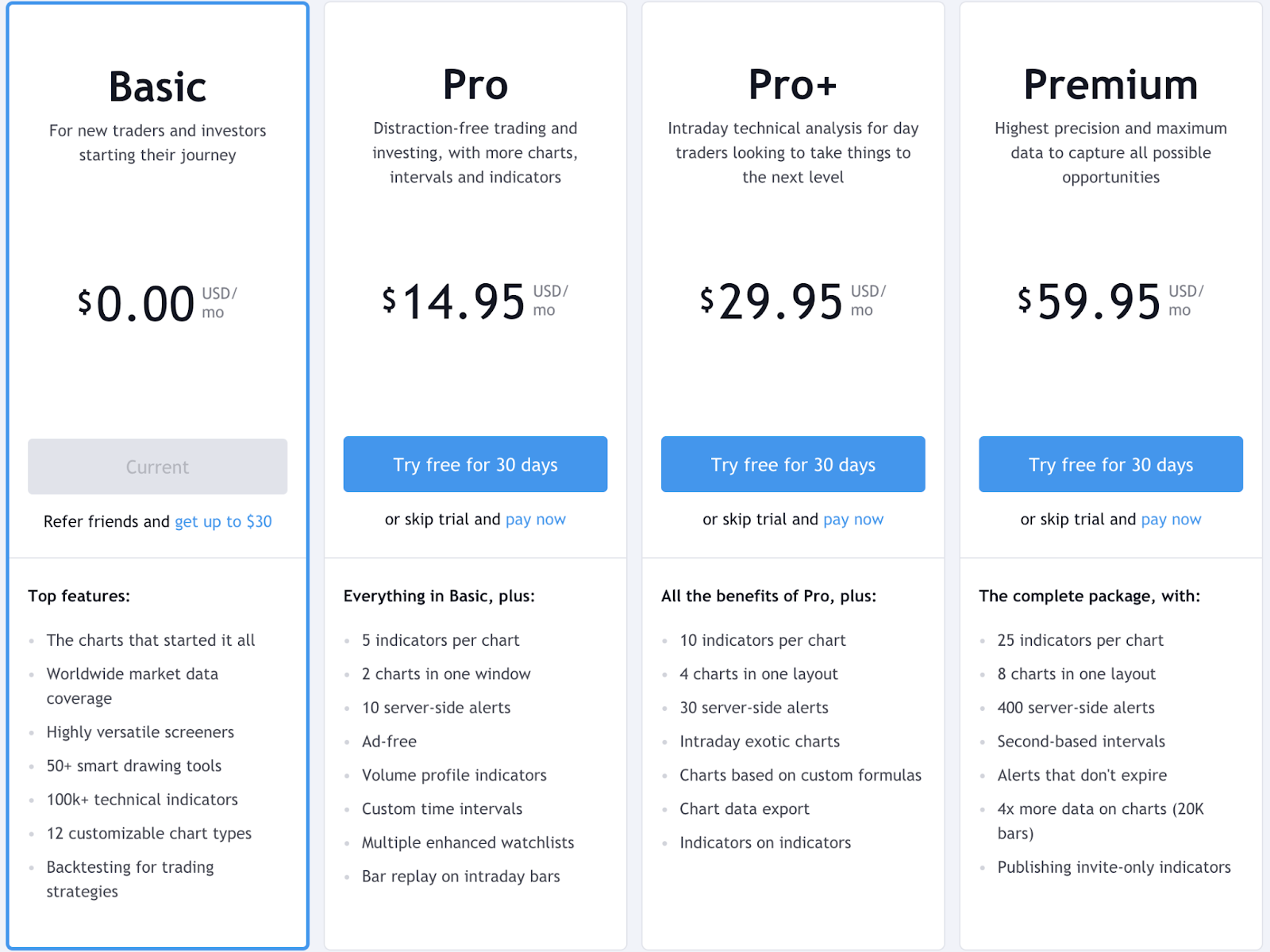

As we mentioned, TradingView is free for everyone. There are also premium subscriptions that increase the number of indicators and charts you can view simultaneously. For beginners, it is good to start with a free account with a chart and three indicators. You will also have to put up with ads, but they are not too intrusive. Below you will find more details on the differences between the different offers:

What is TradingView Social Network?

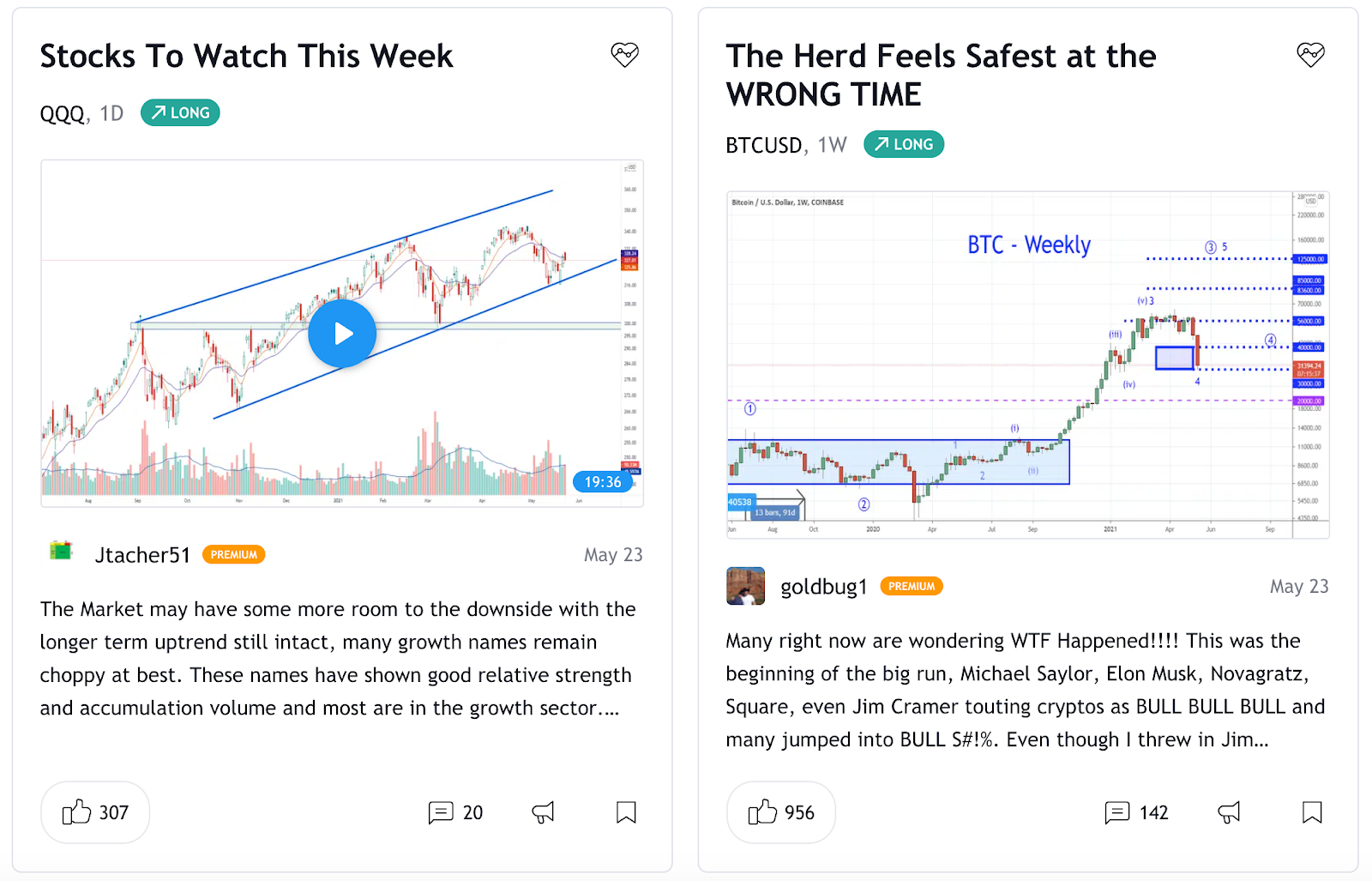

TradingView offers Instagram-like features for sharing and showing trading strategies. The “Ideas” and “Feeds” pages of the site give you the opportunity to gather advice or feedback. If you go to the Ideas page, you will see graphics, videos, and comments from other users. Community members can also get involved in discussions and chat rooms. But remember that any user can create and share ideas, so be careful. Every trader has a different style and strategy. You should therefore not consider this information as financial advice.

Just like you can watch a Twitch stream of your favorite gamer, TradingView Streams allows you to watch other traders create charts in real time. This is a fun additional feature, but still in beta, and the amount of content is relatively small.

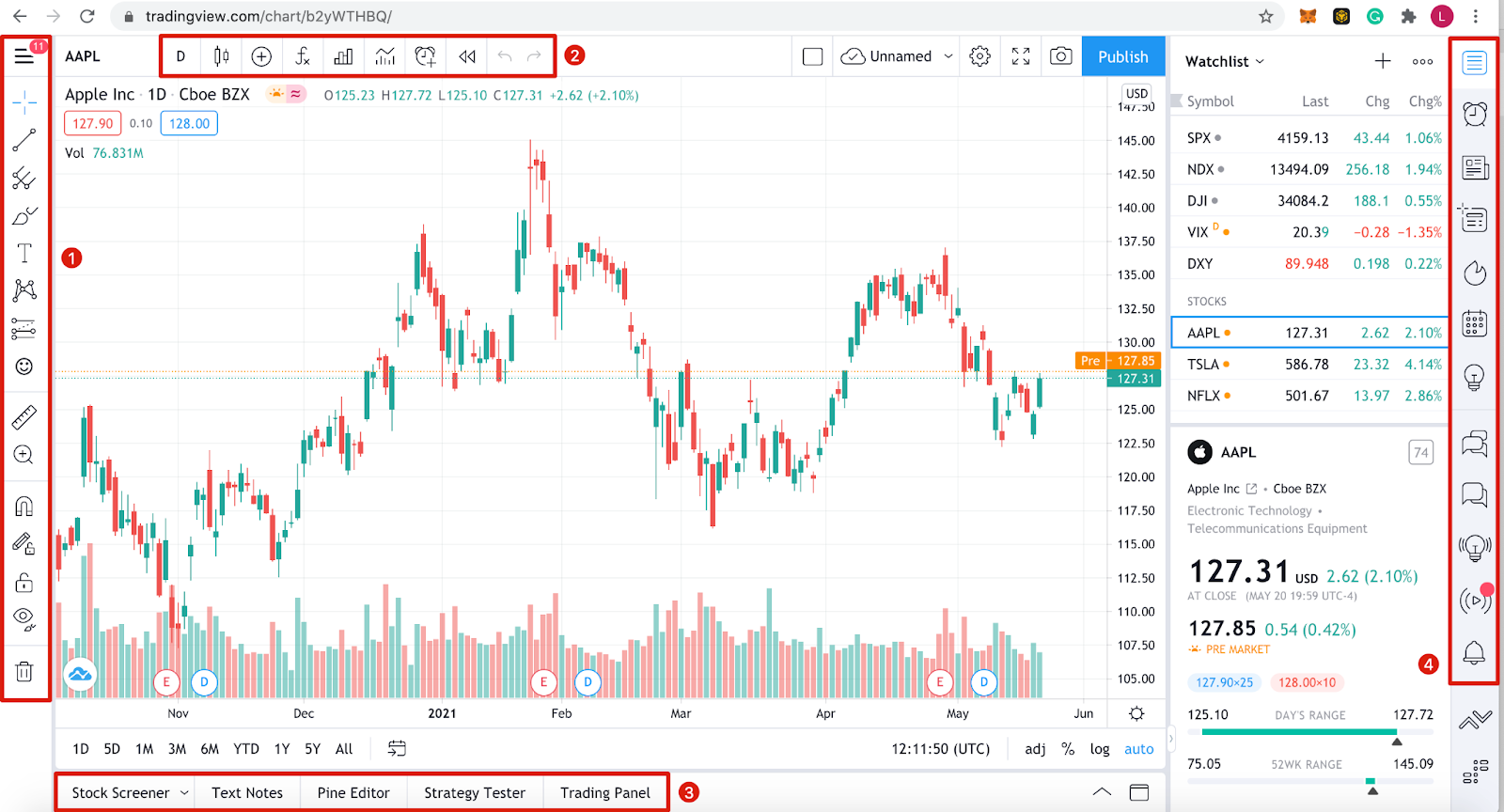

Understanding the TradingView UI

If you've never used charting tools before, TradingView may seem a little confusing. Let's look at what it has to offer element by element.

Toolbar 1

This toolbar contains all the charting and drawing tools you can use directly in the chart area. From single lines to long/short positions, there is a lot to explore. You can also right-click each tool to view an expanded selection. Some are more advanced than others, but the default range contains enough basic tools to get started.

Toolbar 2

Here you will find options to change the appearance of the chart. You can choose between candlesticks, line charts, area charts and much more. There is also a search bar on the left to change the displayed asset. Another tool worth noting is the [Indicators and Strategies] button, which allows you to insert predefined analysis models like a moving average.

Toolbar 3

TradingView does not offer a brokerage service, but you can trade from the website using the [Trading Panel] tab. You will find a list of partners with whom you can trade if you already have an account open with them. You can also test your policies using the [Policy Tester] feature.

Toolbar 4

This section mainly covers news and social elements of TradingView. You can customize your watchlist, send private messages to other users, explore ideas and feeds, and access a personalized calendar. You should go to this area if you need to find data, lists, or information.

Chart area

When you change the asset you display, use tools, or place indicators, you will find them displayed in the main chart area. You can also customize almost everything you see, which is what we'll cover in the next section.

Customize your TradingView charts

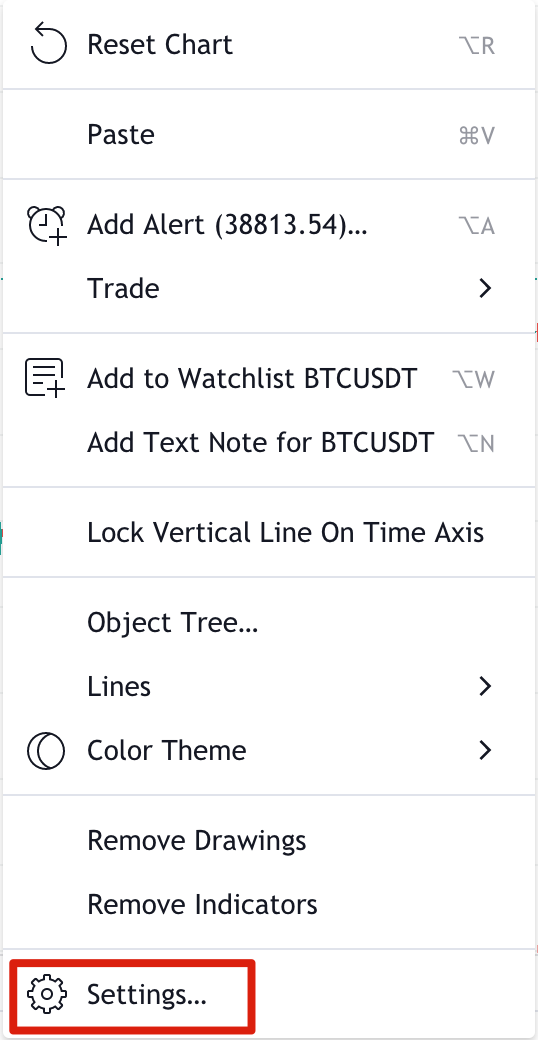

Everyone has their own preferences when it comes to chart presentation. Customizing colors, lines, and axes makes your charts easier to read and understand quickly. You can find all the options you need by right-clicking on the chart area and clicking [Settings...].

You can also reset your chart if it becomes messy and set custom price email alerts from the [Settings...] menu.

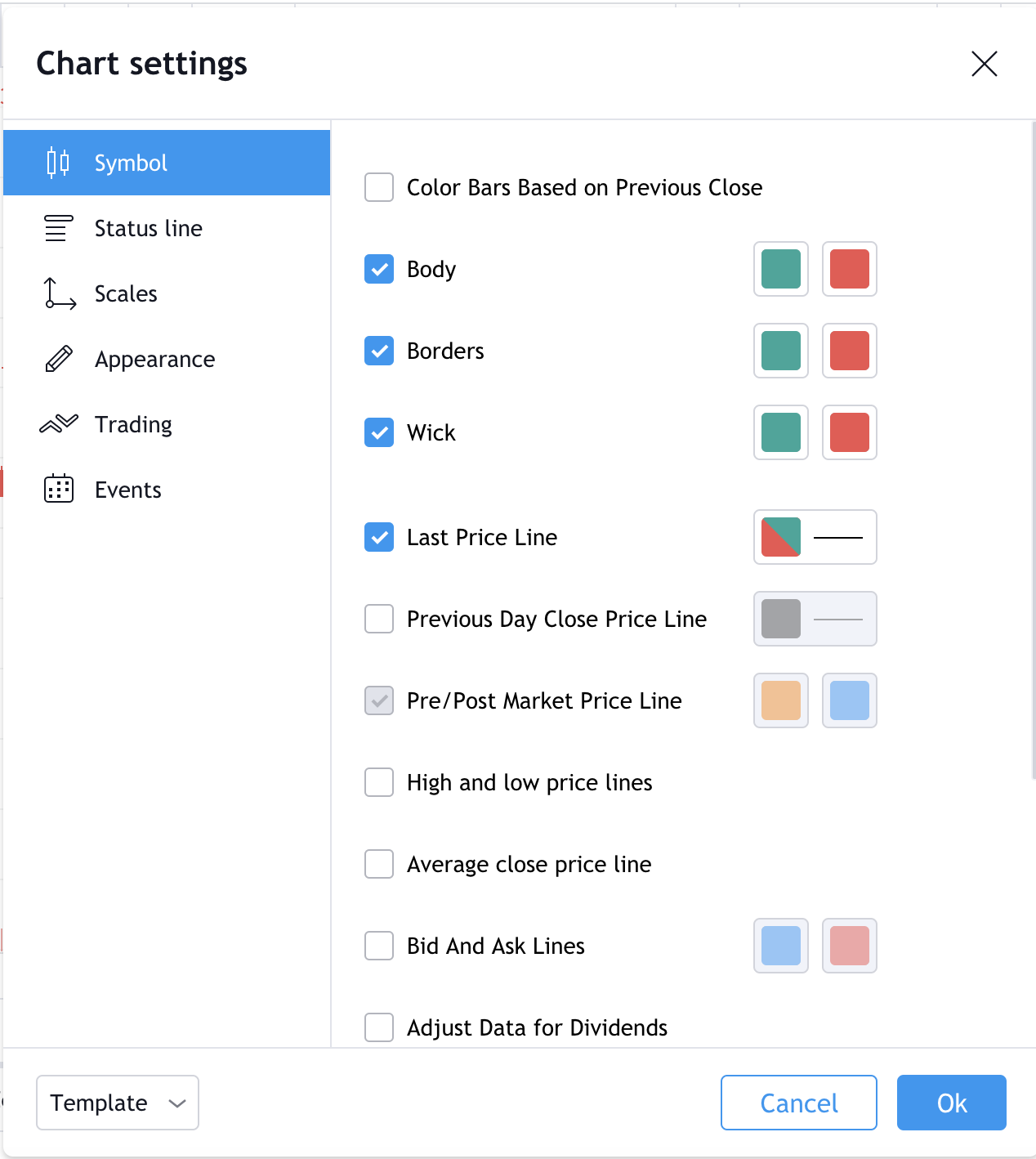

Once you click [Settings...], you will be taken to the [Chart Settings] window where you can play around with a series of options. Let's quickly go over the basics.

1. [Symbol] allows you to change the appearance of your candlestick charts. Each candlestick part can be color coded exactly how you want.

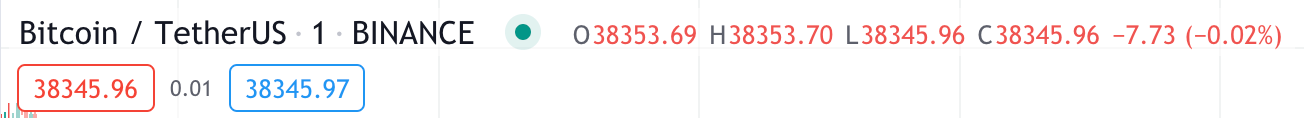

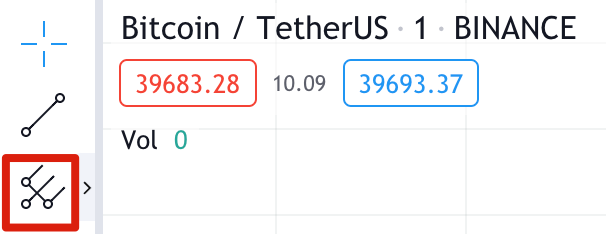

2. The [Status Line] option contains options to modify the information in the upper left part of the chart, such as OHLC data (opening, maximum, minimum and closing price) and buy and sell buttons. The red box shows the lowest asking price (38,345.96), and the blue box shows the highest offer (38,345.97). Between the two, you have the Bid-Ask spread (0.01).

3. The [Scales] option provides options for changing the plotters you can see on the right axis. For example, you can add today's high and low prices or the countdown to the bar close.

4. [Appearance] allows you to change grid lines, background color, axes and other appearance-related features.

5. [Trading] allows you to customize visual elements if you are connected to a brokerage account.

6. [Events] allows you to display dividends, splits and other events on the chart area.

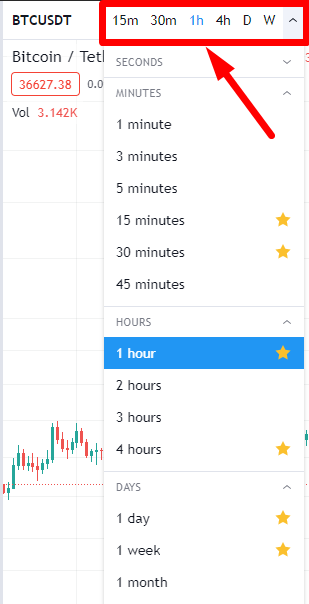

Besides setting up the chart view, you can also change the intervals of your candlesticks or other symbols. To do this, go to the top bar and click the button on the far left. A long list of different intervals is displayed, ranging from a few seconds to several months. You can also add intervals to your favorites so that they appear on your top bar.

Once you start customizing your diagram, you no longer need to save it manually. TradingView saves all your changes in real time so you can log out and come back to them later.

Drawing trend lines

For your first chart, you can't go wrong with a trendline. It is an easy way for beginners to model price action and one of the most commonly used chart patterns for day trading and swing trading.

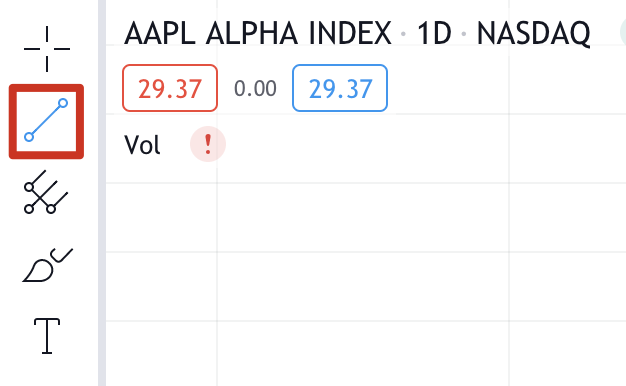

1. To begin the tutorial, select the line tool from the left toolbar.

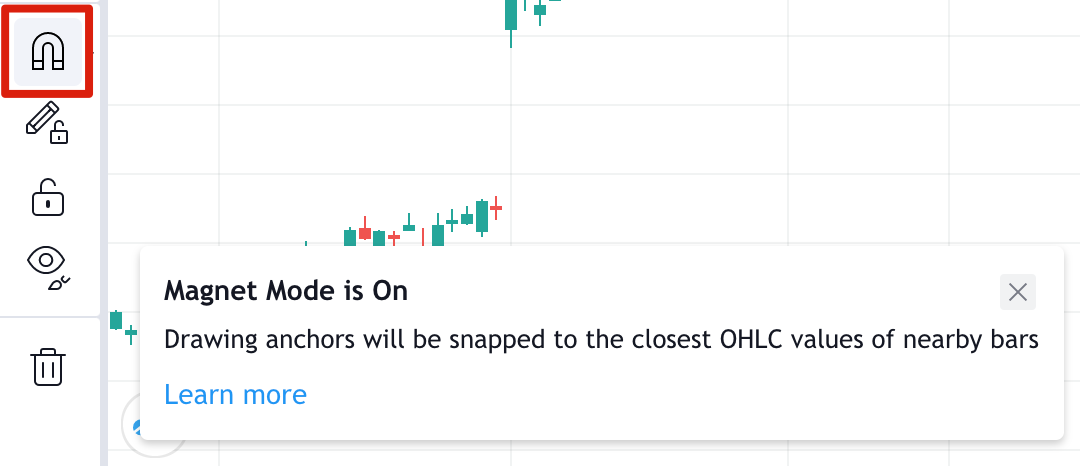

2. You can also activate the magnetic tool. Your lines will snap to any nearby OHLC points, which is useful for improving accuracy.

3. For a downtrend, start at a local high point (point 1) before a drop in price, called a swing high. Click where you want the line to start and try to include as many high points as possible. Click again when you want to place your trend line.

Points 1, 2 and 3 indicate resistance points. It is always best to have at least three points testing your trendline, as any two points could coincide. Point 4 shows a change in the trend, which means it is better to draw a new trend line.

Once you have an established downtrend, one possible strategy is to sell when the price hits and tests your line. If you decide to draw an uptrend, make sure to start your line using a low price so that the line is below your candlestick.

For more information on this, please see the article Support and Resistance Basics Explained.

Draw a fork

A fork is a more advanced chart that expands on the concept of a trendline. The technical indicator was created by Alan Andrew, a famous 20th century American investor and educator. It's easy to draw and provides more information than a simple trend line, so let's move on to the next step.

1. To begin, select the fork tool below the Line tool.

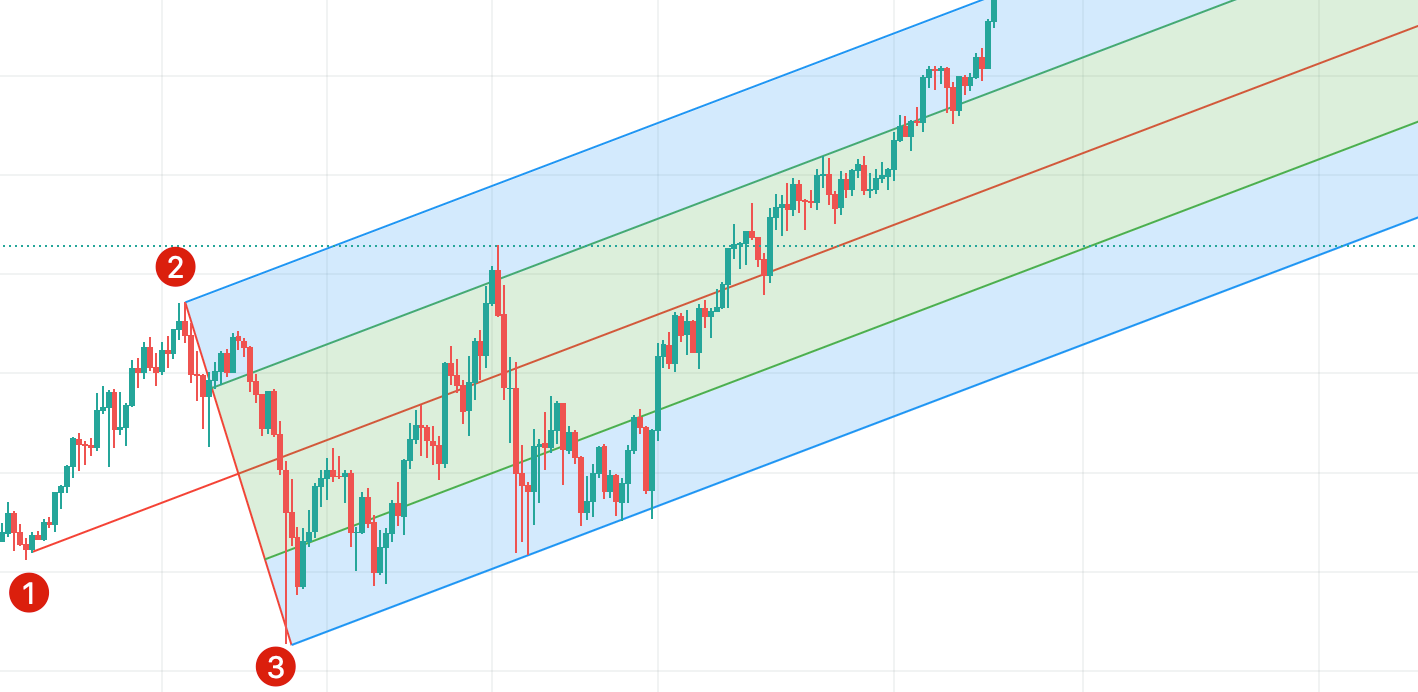

2. We will create our fork by choosing three points at the start and end of the trends.

3. You can see in the example below that we started at point 1, the swing low of a downtrend. We then clicked on point 2, the swing high of an uptrend, followed by point 3, the swing low of the next downtrend.

4. These points create a fork shape, with the upper line from point 2 indicating the resistance level and the lower line from point 3 indicating the support level. The middle line is where price should be attracted towards.

5. As in our trend example, the support line shows areas of buying and the resistance line shows areas of selling. You can also place a stop-loss order just below the lower trend line as a method of risk management. Note that, like any other indicator, the fork will not always perform as expected. Consider combining it with other tools and strategies to reduce risk.

If you want to learn more, check out How to Create AT Indicators on TradingView.

Advantages and Disadvantages of TradingView

TradingView is just one of many choices when it comes to asset screeners. Most offer a similar set of charting and trading tools, but let's look at the main aspects. TradingView certainly does some things very well, but there are also areas for improvement.

Benefits

HTML5 Chart - Any device with an internet browser can access TradingView. You don't need to install any software and you can view your charts anywhere.

Free offer - Everyone can access the majority of available features.

Server-side alert system - If you set an alert, TradingView tracks it on its servers. You do not need to have TradingView open to receive these alert notifications.

Binance Compatibility – Although you cannot access Binance from the TradingView website, you can use TradingView in the Binance trading UI. You can easily buy and sell cryptocurrencies with Binance and also create charts on the fly.

Scripts - More advanced users can create custom indicators saved on TradingView's servers. This feature is handled by Pine Script, TradingView's custom programming language that is simple to use.

Asset Selection - There is a considerable amount of stocks, securities, commodities and currency information available for charting. We're not just limiting ourselves to cryptocurrencies here!

Backtesting – Once you have a strategy in place, it is easy to backtest using the built-in feature.

Disadvantages

Community Questions - While the concept of the “Feeds and Ideas” tab is interesting, the quality of what you find there varies greatly. Many of the tips given are highly speculative and not very useful for new users. The comments section is also home to trolls.

Customer Support – The TradingView community frequently reports issues with TradingView customer support. Only paying customers can raise issues, and free users receive no support.

Integration with Brokers – TradingView has integrated some brokers and trading platforms, but the options are still quite limited.

Cboe BZX Data - TradingView prices for US stocks are not taken directly from their associated stock markets. For example, NASDAQ stocks get their price from the Cboe BZX exchange, which may differ slightly from the actual price. Real-time data from an exchange is available for a fee.

To conclude

For anyone looking for a free solution with a significant amount of tools to use, TradingView is a relevant option to explore. Their educational materials are also free to access and cover the basics of graphics and technical indicators in detail.

However, the social side is not so good. Chat rooms often contain speculative advice that you should avoid. This factor makes the social aspects less interesting for beginners, because you have to sift through good and bad advice.

Still, TradingView is worth trying for its own charting tools alone and is a great place to backtest one's trading strategies. Technical analysis is a deep subject, and you'll have more than enough to explore with just a free account.

Disclaimer: The content presented here is for educational purposes. This article does not constitute advice or a recommendation, and the information provided should not be considered investment advice. All screenshots were taken from the official TradingView website and comply with their Terms of Service.