Résumé

The Bid-Ask spread is the difference between the lowest price asked for an asset and the highest price offered. Liquid assets like Bitcoin have a lower spread than assets with less liquidity and trading volume.

Slippage occurs when a trade settles at a different average price than originally asked. This often happens when executing Market orders. If there is not enough liquidity to fill your order or if the market is volatile the final order price could change. To avoid slippage with illiquid assets, you can try splitting your order into several smaller orders.

Introduction

When you buy and sell assets on an exchange, market prices are directly linked to supply and demand. Besides price, other important factors to consider are trading volume, market liquidity, and order types. Depending on market conditions and the order types you use, you will not always get the price you want for a trade.

There is a constant negotiation between buyers and sellers which creates a gap between the two sides (Bid-Ask spread). Depending on how much of an asset you want to trade and how volatile it is, you may also experience slippage (more on this later). To avoid any surprises, acquiring basic knowledge of an exchange's order book will go a long way.

What is the Bid-Ask spread?

The Bid-Ask spread is the difference between the highest ask price and the lowest bid price in an order book. In traditional markets, the spread is often created by market makers or liquidity providers. In cryptocurrency markets, the spread is due to the difference between buyers' and sellers' Limit orders.

If you wish to make an instant purchase at market price, you agree to pay a seller's lowest asking price. If you want to make an instant sale, you will benefit from a buyer's highest asking price. More liquid assets (like forex) have a lower Bid-Ask spread, meaning buyers and sellers can execute their orders without significantly changing the price of an asset. This is due to a large volume of orders in the order book. A larger Bid-Ask spread will result in larger price fluctuations when closing large volume orders.

Market Makers and Bid-Ask Spread

The concept of liquidity is essential for financial markets. If you try to trade in markets with low liquidity, you might wait hours or even days until another trader fills your order.

It is important to create liquidity, but the liquidity provided by individual traders is not necessarily enough. In traditional markets, for example, brokers and market makers provide liquidity in exchange for arbitrage profits.

A market maker can take advantage of a Bid-Ask spread by buying and selling an asset simultaneously. By selling at the highest bid price and buying at the lowest ask price over and over again, the market maker can take the spread as arbitrage profit. Even a small spread can generate significant profits in case of high trading volume on the day. Assets with high demand have lower spreads because market makers compete and reduce the spread.

For example, a market maker may simultaneously offer to buy BNB for $350 and sell BNB for $351, creating a spread of $1. Anyone who wants to make instant trades in the market will have to respect these positions. The spread now represents a pure arbitrage profit for the market maker, who sells what traders buy and buys what they sell.

Depth Charts and Bid-Ask Spread

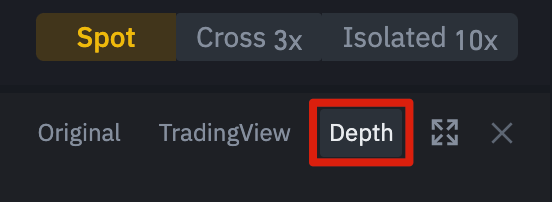

Let’s look at some real-world examples of cryptocurrency and the relationship between volume, liquidity, and Bid-Ask spread. In the Binance exchange UI, you can easily see the Bid-Ask spread by switching to the [Depth] chart view. This button is in the upper right corner of the chart area.

The [Depth] option displays a graphical representation of an asset's order book. You can see the demand quantity and price in green, and the supply quantity and price in red. The gap between these two areas is the Bid-Ask Spread, which you can calculate as follows: red bid price - green ask price.

As we mentioned earlier, there is an implicit relationship between liquidity and low Bid-Ask Spread. Trading volume is a commonly used indicator of liquidity, so we expect to see higher volumes with smaller Bid-Ask Spreads as a percentage of an asset's price. Cryptocurrencies, stocks, and other heavily traded assets face much greater competition among traders looking to take advantage of the Bid-Ask spread.

Pourcentage de spread Bid-Ask

To compare the Bid-Ask spreads of different cryptocurrencies or assets, we need to evaluate them as a percentage. The calculation is simple:

(Bid price - Ask price)/Bid price x 100 = Bid-Ask spread percentage

Let's take BIFI as an example. At the time of writing, BIFI had a bid price of $907 and an ask price of $901. This difference gives us a bid-ask spread of $6. $6 divided by $907, then multiplied by 100, gives us a final Bid-Ask spread percentage of approximately 0.66%.

Now suppose Bitcoin has a Bid-Ask Spread of $3. Although this is half of what we saw with BIFI, when we compare them in percentage terms, Bitcoin's Bid-Ask Spread is only 0.0083%. BIFI also has significantly lower trading volume, which supports our theory that less liquid assets tend to have larger Bid-Ask spreads.

The lower spread of Bitcoin allows us to draw some conclusions. An asset with a lower Bid-Ask Spread percentage is likely to be much more liquid. If you want to execute large market orders, there is generally less risk of having to pay a price you did not anticipate.

What is slippage?

Slippage is a common occurrence in markets with high volatility or low liquidity. Slippage occurs when a trade settles at a different price than expected.

For example, let's say you want to place a large market buy order at $100, but the market doesn't have the liquidity to fill your order at that price. Therefore, you will need to fill subsequent orders (over $100) until your order is fully filled. The average price of your purchase will then be over $100, and this is what we call slippage.

In other words, when you create a market order, an exchange associates your buy or sell with the Limit orders in the order book. The order book will match your order to the order with the best price, but you will move further back in orders if there is insufficient volume for the desired price. This process causes the market to fill your orders at different and unexpected prices.

In the cryptocurrency space, slippage is a common phenomenon on automated market makers and decentralized exchanges. Slippage can be more than 10% of the expected price for volatile or low liquidity Altcoins.

Positive slippage

Slippage is not always against you. Positive slippage can occur if the price decreases while you place your buy order or if it increases if you place a sell order. Although infrequent, positive slippage can occur in certain highly volatile markets.

Slip tolerance

Some exchanges allow you to manually set a slippage tolerance level to limit any slippage you may experience. This option will appear when using automated market makers such as PancakeSwap on Binance Smart Chain and Uniswap on Ethereum.

The slippage amount you set may have an effect on the time it takes for your order to close. If you set slippage to low, your order may take a long time to execute or may not execute at all. If you set it too high, another trader or robot may see your pending order and beat you to it.

In this case, front running occurs when another trader pays a higher gas fee than you to buy the asset first. It then creates another transaction to sell you the asset at the maximum price you are willing to accept based on your slippage tolerance.

Minimize negative slip

While you can't always prevent slippage, there are some strategies you can use to try to minimize it.

1. Instead of making one large order, try breaking it down into smaller chunks. Closely monitor the order book to spread out your orders, making sure you do not place orders that exceed the available volume.

2. If you use a decentralized exchange, don't forget to take transaction fees into account. Some networks have high fees based on blockchain traffic that can offset any gains you make, preventing slippage.

3. If you trade assets with low liquidity, such as a small liquidity pool, your trading activity could have a significant impact on the price of the asset. A single trade may experience small slippage, but a large number of smaller trades will affect the price of the next block of trades you make.

4. Use Limit orders. These orders allow you to get the prices you want or better when you trade. Although you sacrifice the speed of a Market order, you can be sure that you will not experience negative slippage.

To conclude

When trading cryptocurrencies, remember that a bid-ask gap or slippage can change the final price of your trades. You can't always avoid them, but it's worth considering them in your decisions. For smaller trades this may be minimal, but remember that with a large volume order the average price per unit may be higher than expected.

For anyone using decentralized finance, understanding slippage is basic trading knowledge that is necessary to master. Without some basic knowledge, you run a great risk of losing your money by experiencing front-running or excessive slippage.