One of the key features of cryptocurrencies is that they are open source. This means that aggregate user data, like the number of unique addresses or the volume of daily transactions, is freely available online. But cryptocurrencies are also designed to prioritise privacy, so breaking that data down to understand demographics, or use by country, is challenging, but not impossible. We’ll explain why that is, the common workarounds and summarise the best available figures on which countries have adopted crypto the most.

Why measuring crypto adoption by country is difficult?

Bitcoin, the first cryptocurrency, was designed to work as a new form of money, prioritising these key features:

No central authority

Open to anyone

No geographic restrictions

Private & pseudonymous

Resistant to any form of censorship

In practice, this means that you don’t have to create an account to send or receive bitcoin, in the sense that you might with a bank or payment provider. In fact, you don’t have to provide any personal information.

All transactions are stored in a database that is shared across a distributed computer network - the Bitcoin blockchain. Transactions contain no private information and no IP addresses. This is hard for newcomers to understand in a web2.0 world where we give up some much personal information so regularly and freely allow online services to know so much about us including our country of origin.

The many thousands of cryptocurrencies that Bitcoin inspired work in a very similar way. This makes it challenging to understand where most transactions are taking place; but not impossible. This is because of the concept of pseudonymity.

How to estimate crypto usage by country

Pseudonymity is one of the least understood aspects of cryptocurrency. A pseudonym is a consistent identifier that is not your real name but might reveal your real name by association.

As already mentioned, you don’t need to create an account to use Bitcoin. You just need a Bitcoin wallet that will generate an address - like an email address - that can send and receive funds.

That address has no identifying information. It is just a long string of letters and numbers. But if you, for example, include your Bitcoin address within your Twitter profile, as many people do, and your Twitter account identifies you, then it is simple to connect the two bits of information, revealing you as the owner of that Bitcoin address.

The same is true with the businesses that serve the crypto ecosystem, the most important being exchanges. Though you don’t need to create an account to use Bitcoin, the most common route to acquiring some is through a centralised cryptocurrency exchange, where you do need to create an account and provide identifying information.

Exchanges act as the custodian of cryptocurrency on behalf of their customers. They have ultimate control of the addresses that hold the funds but give customers access to their funds via a website or app and a personal account.

Exchanges publicly share details of those deposit/withdrawal addresses, so it isn’t difficult to connect an exchange to a range of addresses, the activity for which is freely available because crypto is open source.

Connecting the dots

A whole industry has grown up to derive these patterns and behaviours from blockchain usage. Blockchain analysis uses data science to make the connections between known entities - like exchanges - and the amount of crypto held in the addresses they can be publicly connected to.

Exchanges are businesses that protect their users’ data, so for blockchain analysts to break down the volume of data from an exchange by country or demographic, they need to combine it with other sources of information and make some assumptions.

Here’s how one blockchain analysis firm, Chainalysis, goes about connecting the dots. They take the known crypto activity and combine it with a Web Traffic Methodology.

An index is used because otherwise the data would simply reflect populace countries with high GDP and wouldn’t tell us anything we didn’t already know. To address that these three aspects of the trackable crypto activity are combined to create the overall index.

the total value of crypto received by country

crypto exchanged by non-professional crypto investors (transactions <$10,000)

P2P exchange-traded volume

These three metrics are then weighted by purchasing power parity (PPP) per capita, which measures the ability of an individual in a given country to purchase a set “basket” of goods.

The Web Traffic Methodology takes the geographic breakdown of web traffic to each exchange from public website monitoring resources like Similar Web, and combines it with other known factors:

Time zone of the crypto activity

The fiat trading pairs offered

The range of languages offered

Where the exchange is headquartered

Information provided in labels given to crypto addresses

If this sounds like a lot of guesswork, it is. The approach used by Similar Web to identify where the traffic to a given website comes from isn’t an exact science either. The approach doesn’t factor in the use of VPNs, and it gives all traffic to the exchange equal weight when in reality only a small proportion will be active users and many bots.

What Chainalysis end up with is the best guess for an index of global grassroots crypto adoption based on their model and all its assumptions.

The Top Ten Countries For Crypto Activity

Based on their methodology, Chainalysis’s ‘Geography of Cryptocurrency Report for 2020’ ranked countries as follows:

1. Vietnam

2. India

3. Pakistan

4. Ukraine

5. Kenya

6. Nigeria

7. Venezuela

8. United States

9. Togo

10. Argentina

Source: https://blog.chainalysis.com/reports/2021-global-crypto-adoption-index/

On the face of it, the list is a bit of a surprise, but remember this isn’t measuring absolute numbers of users - which would reflect GDP per capita and population - but an index of adoption.

The top country for crypto adoption based on the Chainalysis Index is Vietnam, a young and tech-savvy country, with a speculative culture that favours gambling and investment and where remittance is an important component of GDP (just over 6% in 2020 according to World Bank data). This provides a fertile ground for cryptocurrency adoption.

India and Pakistan’s appearance in positions two and three of the global crypto adoption index shouldn’t be a surprise either. Remittance is again important in both countries which boast youthful demographics, increasing mobile penetration, and growing middle classes who are well-educated, and financially astute yet lacking in opportunities to invest in alternatives to national currencies.

Four of the countries within the top 10 - Nigeria, Venezuela, Argentina and Kenya - underline crypto’s power as a hedge against the hyperinflation each is suffering to varying degrees.

For all the countries in the list - barring the United States - remittance makes up a significant part of GDP, for which crypto is an increasing solution competing with comparatively expensive existing options like Western Union or Moneygram.

P2P Crypto Activity

Of the three elements of crypto activity that the Chainalysis research uses, the last, P2P exchange-traded volume, is the only one that allows for breakdown by country. P2P stands for peer-to-peer.

The website Coin Dance pulls in data from three major P2P exchanges - Localbitcoins, Paxful and Bisq - and charts trading volume by country. That data isn’t aggregated across the three P2P exchanges listed and doesn’t include Binance P2P, which has significant volume, but it provides reliable data showing a different aspect of crypto adoption.

A P2P exchange facilitates trading directly between users and is very popular in countries where face-to-face trading is still how most commerce happens, and trust in centralised financial institutions is low.

P2P exchanges also offer a wider variety of payment methods, again helpful in countries where the majority of the population doesn’t have a traditional bank account.

The data from Coin Dance and Chainalysis points to the importance of P2P Exchange in Africa, Asia and South/Central America, and shows how the adoption of an entirely new form of digital money is in part being driven by some very traditional values.

Survey Data

Outside of the Chainalysis methodology the most common approach to gauging adoption is through surveys. But there are numerous problems with survey data:

conclusions are drawn on small/biased samples

survey methodologies are notoriously weak

it is very hard to verify claims from respondents to proof of ownership

survey results are often used as a means to attract an audience suggesting methodologies aren’t particularly robust

That said, there is survey data that independently reaches similar conclusions to Chainalysis, lending some weight to their data.

According to Statista Global Consumer Survey, around 27 per cent of Vietnamese respondents are reported to have owned or used cryptocurrencies in 2021. While a more recent Finder.com survey (from April 2022) suggests that 26.2% of Vietnamese own cryptocurrency - behind India and Nigeria.

However, survey findings aren’t consistent with Pew Research in November 2021 suggesting 16% of Americans have invested in or traded some form of cryptocurrency, (which amounts to over 50million people) whereas Finder.com had that number at 9.5%.

The Financial Conduct Authority, which is responsible for regulating financial institutions in the UK, conducted a survey in January 2021 which showed that 4.4% of adults owned cryptocurrency (around 2,3 million people). This again contradicts Finder,com which put adoption in the UK at 7%.

If in doubt, ask Google

If you want a simple proxy for global crypto adoption you can always base it on the number of Google searches. Google Trends shows that global aggregate interest in the term ‘Bitcoin’ is well below its peak of 2017, and over the last year is relatively flat.

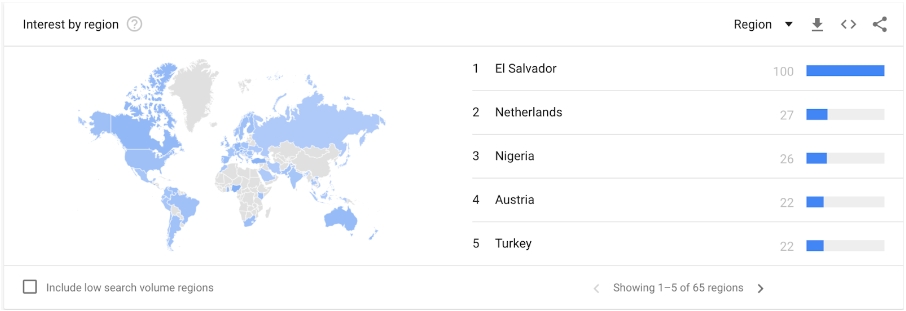

Digging into Google Trend’s data by country and it is El Salvador that tops the index, unsurprising given that in June 2021 it became the first country to make Bitcoin legal tender.

It will be interesting to see when Chainalysis update their data for 2021 and whether actual activity in El Salvador matches the demand to find out more via a Google Search.

Nayib Bukele, El Salvador’s President, is acting as a Bitcoin ambassador on the global stage as illustrated by his welcoming representatives from 44 countries in May 2022 to share his experiences.

The current Bear Market will make it much harder for Bukele to bring more nations into the Bitcoin fold, and will even put pressure on his own decisions to continually ‘buy the dip’ but El Salvador is not alone in making Bitcoin legal tender. The Central African Republic followed in their footsteps in April 2022.

The news received a far more muted response with the motivation for the move unclear. CAR is one of the world’s poorest nations with very low internet penetration and a legacy of internal conflict much of which centres around control of its natural resources - diamonds, gold and uranium.

CAR is in a tug of war with France and Russia both of whom want greater influence. Along with many other ex-colonies, the Central African Republic’s official currency is the French-backed CAF franc so this move has been seen by some as a challenge to that historic link.

The only other country that appears in both Google Trends data for ‘Bitcoin’ searches over the last year and Chainalysis bespoke index data for 2020, is Nigeria which Learn Crypto has written about in separate blog articles.

How to buy Bitcoin in Nigeria

The importance of cryptocurrency in Nigeria

Nigeria has a weak national currency - the Naira - suffering multiple recent devaluations and struggles with political instability. Nevertheless, it is a youthful and entrepreneurial nation eager to embrace financial alternatives. This is backed up by the Statista data already mentioned where 42% of respondents from Nigeria indicated that they owned or had used a digital coin.

Google’s data might just highlight a disconnect between a desire to understand - via a keyword search - and actual use. It is also difficult to know whether it is a ‘leading’ indicator telling is where adoption is coming, or a ‘lagging’ indicator confirming existing trends.

We simply aren’t going to know with any certainty because crypto was designed to make understanding demographic or geographic trends in use hard.