Key Points:

Bitcoin is currently in an important price zone.

A break above this important level will create a strong bullish momentum.

However, if BTC.D has a downtrend, it will help investors to re-accumulate.

Bitcoin is in a tug-of-war between buyers and sellers as it continuously fluctuates around the $28,000 level. So how will the clear signal appear, and when will it start? Let’s analyze with Coincu.

The recent flurry of negative news stemming from the ambiguity in Arbitrum’s token allocation has made the market situation even more negative.

Another notable expectation is that BTC has continuously increased in the first 3 months of 2023, it has been quite a while since we have seen 3 green candles continuously appear in its monthly cycle.

The price of Bitcoin is poised to surpass the 30,000 mark, which is a significant and volatile level. This is shown by the fact that the five largest acquisitions in 2023 all occurred in March.

After rallying about 80% from a low of $16,000 in late 2022, this seems to be the consequence of investors collecting gains and fear of the peak. Also, the decrease in the number of wallets holding BTC from 10-10,000 BTC is a warning for whether BTC will reach the $35,000 thresholds, which it lost at this time last year.

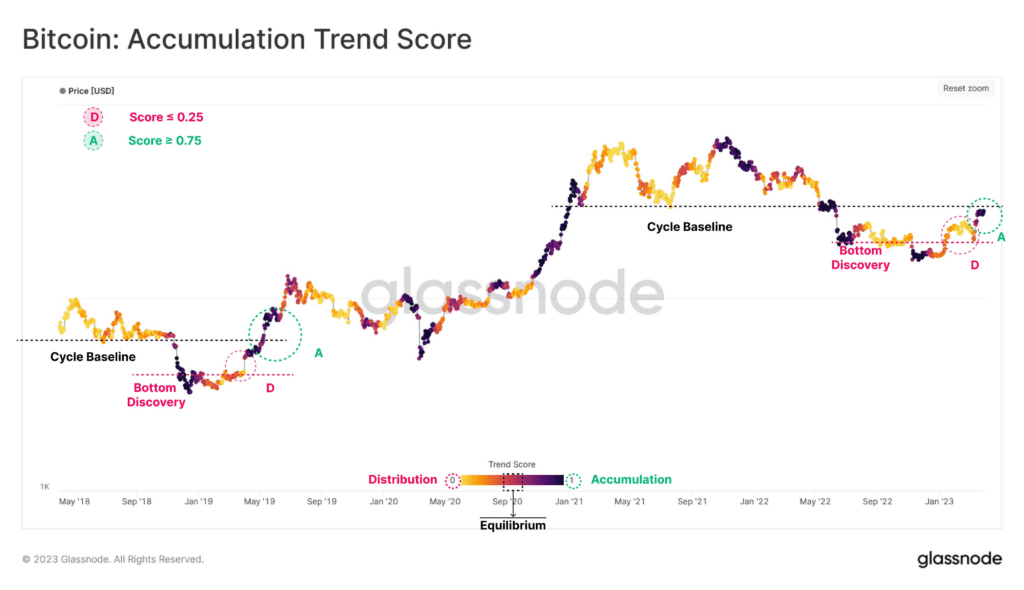

But in terms of price history, this cycle is quite similar to the big bull run that took place in 2018-2019.

Currently Bitcoin Dominance (BTC.D) is about to reach its critical resistance area of 48.34%. If the BTC price drop leads to BTC.D returning to 45-45%, then investors who missed the previous bull run will have the opportunity to hold more. A level of bullish confidence reinforcement for Bitcoin.

BTC.D chart. Source: TradingView

BTC.D chart. Source: TradingView

The current price level is also important for Bitcoin to gain solid momentum. Watch the price for the next 2-3 weeks. If it just breaks through this price zone strongly, the next bull run will be exciting, in other words, we can completely hope for a return to the $35,000 price area in the short term.

BTC price chart. Source: TradingView

BTC price chart. Source: TradingView

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News