Main Takeaways

Binance’s Dual Investment allows you to buy or sell crypto at a predetermined price on a future date, earning interest regardless of market direction, and eliminating trading fees for filled orders.

Our recent revamp enhances the user experience with streamlined asset selection, simplified settlement date viewing, and a more efficient subscription process.

Built for both new and seasoned users, the Dual Investment update delivers a more intuitive product — with the goal of making crypto more accessible.

This is a general announcement. Products and services referred to here may not be available in your region.

In an ever-evolving digital landscape, our recent Dual Investment product update signifies our commitment to constant improvement and responsiveness to user feedback. This revamp focuses on enhancing user experience through simplification and efficiency, aiming to make crypto even more accessible and understandable. But before we delve into the specifics of these changes, it’s also a good time to revisit the fundamentals of Dual Investment, ensuring a solid foundation for both new and seasoned users interested in exploring this update.

What is Dual Investment?

Dual Investment combines the potential for earning interest with the flexibility of setting limit orders for cryptocurrencies. This means you commit to buying or selling a digital asset at a predetermined price on a specific future date. The unique appeal of Dual Investment lies in its ability to let investors earn passive income — regardless of market direction — while waiting for their target buy or sell conditions to be met.

The Mechanics of ‘Buy Low’ and ‘Sell High’ Products

Let’s break down the mechanics:

‘Buy Low' Product: This allows you to set a target price below the current market price at which you wish to purchase a cryptocurrency. If the market price drops to or below your target price on the settlement date, you’ll buy the cryptocurrency at the price you specified, earning interest on your capital in the meantime.

‘Sell High’ Product: Conversely, this product enables you to set a target price above the current market price at which you’re ready to sell a cryptocurrency. If the market reaches or exceeds this price by the settlement date, you’ll sell your cryptocurrency at your desired price, again earning interest until that point.

Examples to illustrate the ‘Buy Low’ and ‘Sell High’ products

To better understand these products, let’s consider two scenarios:

1. ‘Buy Low’ Example

Scenario: Imagine Bitcoin (BTC) is currently trading at $60,000. You believe it has the potential to drop to $55,000 in the next month but will eventually rebound.

Strategy: You decide to use the ‘Buy Low’ product to set a target purchase price at $55,000, with a settlement date one month from now.

Outcome if Target is Reached: If BTC drops to $55,000 or lower by the settlement date, you'll automatically purchase it at $55,000, utilizing both your initial investment and the interest earned during the period.

Outcome if Target is Not Reached: If BTC remains above $55,000, you won’t buy BTC but will still receive the interest earned on your stablecoin investment.

2. ‘Sell High’ Example

Scenario: Ethereum (ETH) is valued at $3,000, and you predict it might rise to $3,500 shortly.

Strategy: You opt for the ‘Sell High’ product, setting a target sell price at $3,500, with a future settlement date.

Outcome if Target is Reached: Should ETH reach or exceed $3,500 by the settlement date, you’ll sell your ETH at $3,500, plus earn interest on your holdings until that point.

Outcome if Target is Not Reached: If ETH fails to hit $3,500, the sale won’t proceed, but you will have earned interest on your ETH holdings.

Benefits of Dual Investment

One of the most attractive features of Dual Investment is the opportunity to earn interest, irrespective of whether the market is bullish or bearish. Traditional financial products often tie your earnings to market performance, but Dual Investment breaks this mold. By locking in your crypto or fiat with a ‘Buy Low’ or ‘Sell High’ order, you earn interest until the settlement date.

Another significant advantage of using Dual Investment is the elimination of trading fees for orders that are filled. Typically, buying or selling crypto incurs a fee, which can add up, especially for active traders. However, when your ‘Buy Low’ or ‘Sell High’ Dual Investment order is executed, Binance waives these fees, making it a cost-effective option for trading.

Understanding the Risks of Dual Investment Products

Dual Investment products, while versatile and potentially profitable, require a nuanced understanding of the risks involved:

1. Market Price Volatility Risk: The crypto market is known for its high volatility. When you commit to a Dual Investment product, you’re locking in a future buy or sell price based on your predictions. However, the market could move in an unforeseen direction, leading to missed opportunities. For example, if you set a ‘Buy Low’ target but the market price significantly drops below your target, you may end up buying at a higher price than the new market norm.

2. Opportunity Cost: Engaging in a Dual Investment product means your assets are locked until the settlement date. During this period, you might miss out on other opportunities, including favorable market movements that could offer higher returns.

3. Interest Rate Fluctuation: The interest earned on Dual Investment products is attractive, but these rates are fixed upon subscription. Market interest rates or yields on other opportunities could increase, presenting a potential opportunity cost for locking in your assets.

Dual Investment Product Revamp: What’s New

Binance’s commitment to user satisfaction and feedback has led to a significant revamp of the Dual Investment user experience and interface (UX/UI). This update is designed to further streamline the process, making it more intuitive, efficient, and responsive to user needs. With a cleaner look and simplified view, the revamp addresses common user feedback and enhances the overall usability of Dual Investment. Let’s dive into the details of this exciting update.

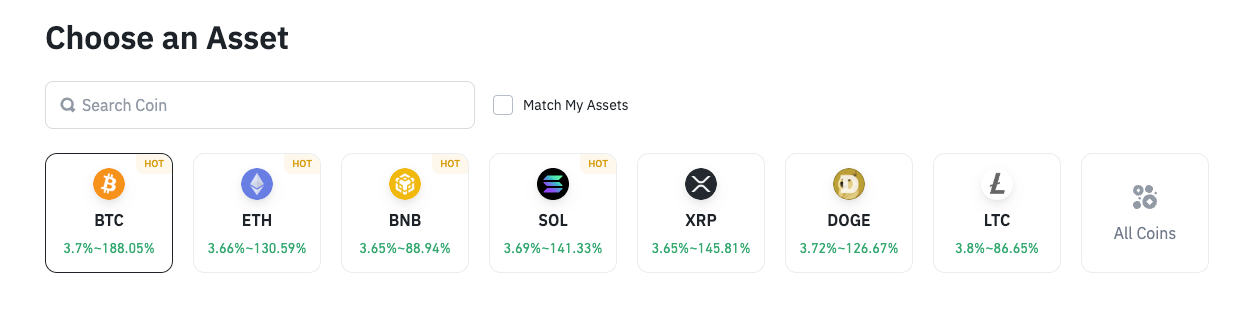

Simplification of Asset Selection

The process of selecting which asset to invest in has been streamlined, making it easier for users to navigate through available options and make informed decisions quickly.

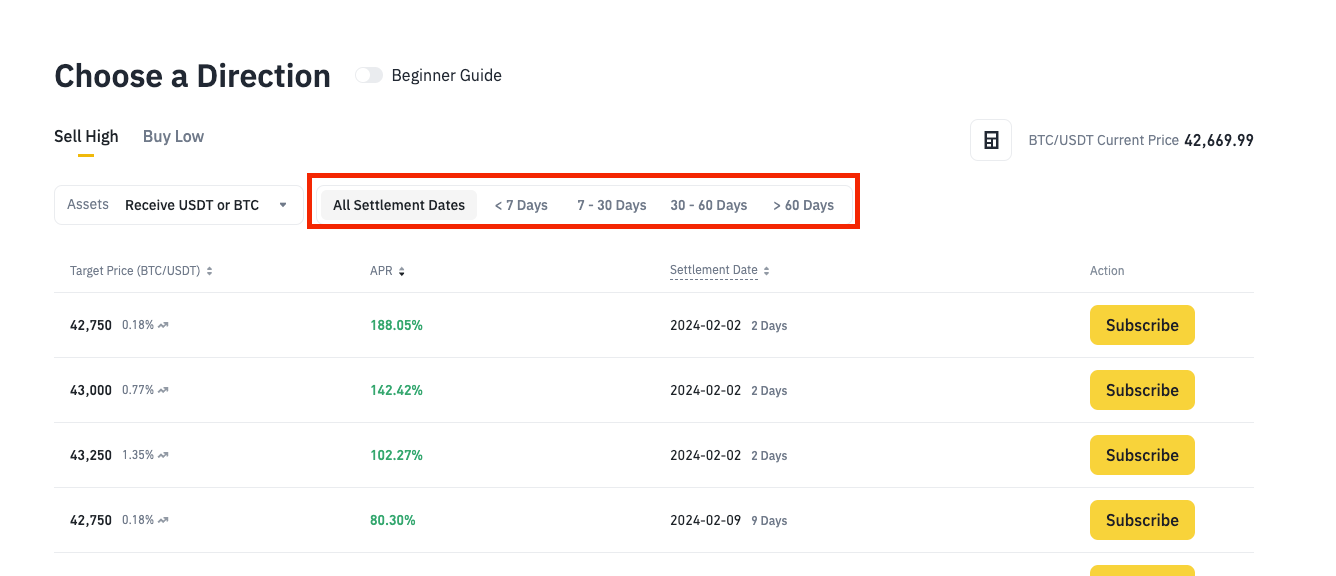

Simplification of Viewing Settlement Dates

Viewing and selecting settlement dates is now more straightforward, allowing users to easily plan their Dual Investment strategy around their preferred timeline.

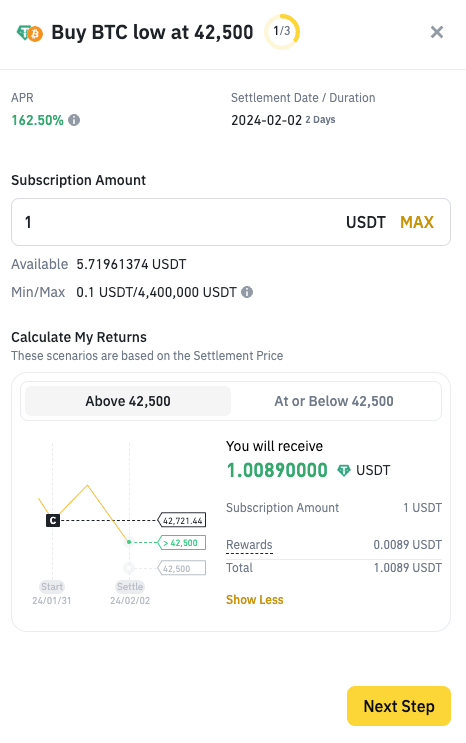

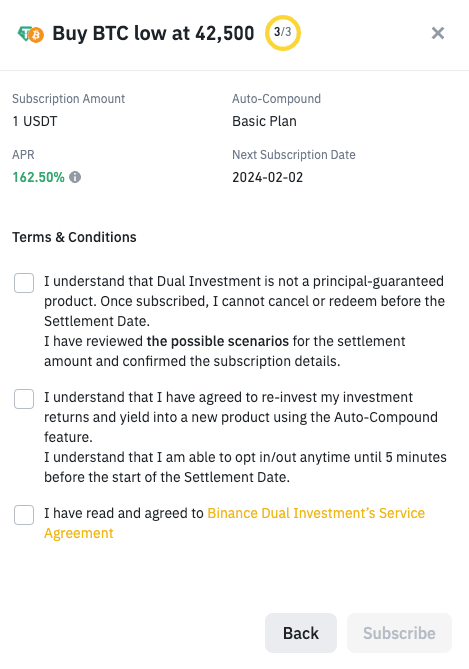

Simplified Subscription Flow

The subscription process has been overhauled for clarity and efficiency, reducing the number of steps and potential confusion for users subscribing to Dual Investment products.

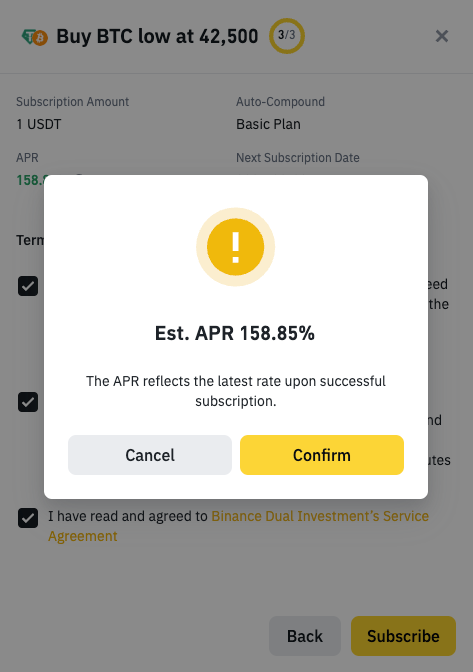

APR Confirmation Pop-Up

Perhaps the most significant update is the introduction of an APR confirmation pop-up. This feature locks in the Annual Percentage Rate (APR) at the time of subscription, addressing the issue of fluctuating APRs during periods of high market volatility.

Product Update: A Cleaner Look and Improved Functionality

The Dual Investment UX/UI revamp represents another step forward in making crypto more accessible, understandable, and user-friendly. By addressing key areas of user feedback and simplifying the process, Binance continues to demonstrate its commitment to enhancing user experience and satisfaction. Whether you’re a seasoned trader or new to crypto, these updates make Dual Investment an even more attractive option for earning rewards on your terms.

Further Reading

Top 6 Dual Investment Trading Strategies

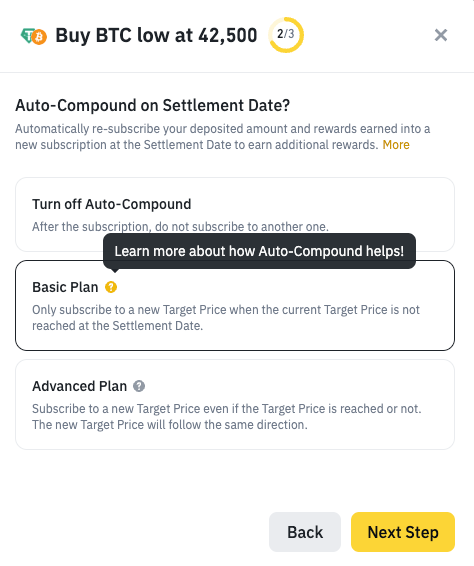

Exploring Dual Investment’s New Auto-Compound Feature

Binance Earn Dual Investment: Cross Crypto Pairs Launch

Disclaimer: Digital asset prices can be volatile. The value of your investment may go down or up and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not liable for any losses you may incur. For Dual Investment products, your return is fixed at the Deposit Currency APR, which refers to cryptocurrency rewards in the Deposit Currency, not actual or predicted returns in fiat or the Target Currency. You may be better off holding your cryptocurrency, and may be required to trade at a rate less favourable than the market rate on the Settlement Date. Not financial advice. For more information, see our Terms of Use and Risk Warning.