When to use a Volume Participation algorithm?

| Market Situation | Market Order | Volume Participation Order |

| Low market volume, stable price | Large notional market order may create market price impact that make the executed price unfavorable | VP order may execute within the average market price without impacting the market |

| High market volume, volatile market price | Market order might be able to capture the market liquidity available immediately. It could also capture the market price movement | VP order might not be able to execute in urgency and may result in adverse executed price |

POST sapi/v1/algo/futures/newOrderVp

API details: https://binance-docs.github.io/apidocs/spot/en/#volume-participation-vp-new-order-trade

| Parameters | Description |

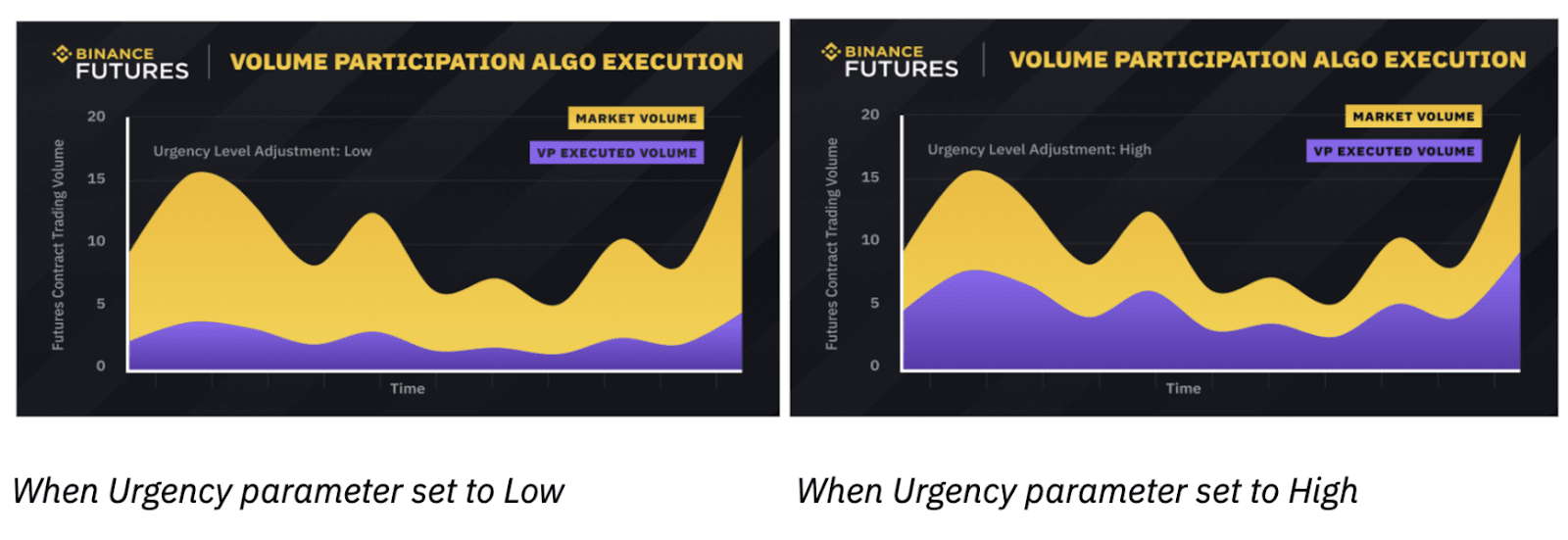

| Urgency | Participation rate relative to Market Volume, Supported urgency type: Low, Medium, High |

| limitPrice | Order’s limit price if unspecified, the order will be placed at market price |

| Endpoint | Description | Link |

| DELETE sapi/v1/algo/futures/order | Cancel an active order | https://binance-docs.github.io/apidocs/spot/en/#cancel-algo-order-trade |

| GET sapi/v1/algo/futures/openOrders | Get all running orders | https://binance-docs.github.io/apidocs/spot/en/#query-current-algo-open-orders-user_data |

| GET sapi/v1/algo/futures/historicalOrders | Get historical orders | https://binance-docs.github.io/apidocs/spot/en/#query-historical-algo-orders-user_data |

| GET sapi/v1/algo/futures/subOrders | Get respective sub orders for a specified algo ID | https://binance-docs.github.io/apidocs/spot/en/#query-sub-orders-user_data |

Additional Notes on Volume Participation Algorithm

1. What are the order limitations when using the Volume Participation algorithm?

- Notional Limit - The notional (Order Quantity * `Mark Price (base asset)`) must be higher than the equivalent of 1,000 USDT and lower than the equivalent of 1,000,000 USDT.

- Eligible Contract Type - Currently, the VP algorithm only supports USD-Margined contracts.

2. What are the expected error responses from the Volume Participation order endpoint?

| External code | External msg |

| 0 | OK |

| -1000 | An unknown error occurred while processing the request. |

| -1102 | A mandatory parameter was not sent, empty/null, or malformed. |

| -20121 | Invalid symbol. |

| -20130 | Invalid data sent for a parameter. |

| -2013 | Order does not exist. |

| -5007 | Quantity must be greater than zero. |

| -20124 | Invalid algo id or it has been completed. |

| -20132 | The client algo id is duplicated. |

| -20194 | Duration is too short to execute all required quantity. |

| -20195 | The total size is too small. |

| -20196 | The total size is too large. |

| -20198 | Reach the max open orders allowed. |