Carefully! Lots of text.

In crypto trading, leverage refers to the use of borrowed capital to make trades. Leveraged trading provides additional amounts of money, thereby enhancing the trader's buying and selling power. Even a small initial capital can be used as collateral for leveraged trading. While this allows you to increase your profit potential, this method also comes with high risks, especially in the volatile cryptocurrency market. Use leverage when trading cryptocurrency with caution, as there is always a risk of serious losses if the market moves against you.

Introduction

Trading with leverage can seem quite complicated, especially for beginners. It is extremely important to understand how leverage works before experimenting with your funds. In this article we will focus on trading with leverage in the cryptocurrency markets, but most of the information will also be relevant to traditional markets.

What is leverage in crypto trading

Leverage allows you to use borrowed funds to trade cryptocurrencies or other financial assets. This method enhances a trader's buying or selling power by giving him the opportunity to trade with more funds than he has available. Depending on the cryptocurrency exchange, you can even borrow up to 100 times your balance.

The amount of leverage is indicated as a ratio, for example 1:5 (5x), 1:10 (10x) or 1:20 (20x), which shows how many times the initial capital is increased. Let's say we have $100 in the exchange, but we want to open a position of $1000 in Bitcoin (BTC). With 10x leverage, our $100 would be exactly equal to $1000.

Leverage can also be used to trade various cryptocurrency derivatives. Common types of leveraged trading include margin trading, leveraged tokens, and futures contracts.

How does leverage trading work?

You can borrow funds and start trading with leverage only after replenishing the balance on your trading account. The initial capital is called collateral, or security. The amount of collateral required will depend on the leverage used and the total value of the position you plan to open (known as margin).

Let's say we want to invest $1000 in Ethereum (ETH) with 10x leverage. The required margin will be 1/10 of $1000, which means you will need to have $100 in your account as collateral for the borrowed funds. If the leverage is 20x, then the required margin will become even lower (1/20 of $1000 = $50). However, remember that high leverage increases the risk of liquidation.

Apart from the initial margin deposit, the trader also needs to maintain a margin threshold for trades. When the market moves against your position and your margin falls below your maintenance threshold, you will need to top up your balance again to avoid liquidation. This threshold is also known as the maintenance margin.

Leverage can be used to open both long and short positions. Opening a long position is designed to increase the price of an asset. Opening a short position, on the contrary, implies an expected fall in the price of the asset. While this may sound like regular spot trading, leverage allows you to buy and sell assets based on collateral rather than using available funds. This way, even if you don't own any assets, you can borrow them and sell them (go short) if the price is expected to fall.

Example of a long position with leverage

Let's say you want to go long $10,000 worth of BTC with 10x leverage. The deposit in this case will be $1000. If the price of BTC rises by 20%, the net profit will be $2,000 (less commissions), which is much higher than the $200 profit from regular non-leveraged trading.

However, if the BTC price drops by 20%, the position will fall by $2,000. Since the initial capital (collateral) is only $1000, a drop of 20% will result in liquidation (the balance will be zero). Liquidation can also occur even if the market falls by only 10%. The exact amount of liquidation will depend on the exchange used.

To avoid liquidation, you need to deposit more funds into your wallet and increase your collateral. In most cases, the exchange will send a margin call before the liquidation occurs (for example, an email asking you to deposit more funds).

Example of a short position with leverage

Let's say you want to short $10,000 worth of BTC with 10x leverage. In this case, you need to borrow BTC from someone else and sell it at the current market price. The deposit will be $1,000, and since you are trading with 10x leverage, you will be able to sell $10,000 worth of BTC.

Let's imagine that the current price of BTC is $40,000. You decide to borrow and sell 0.25 BTC. If the price of BTC falls by 20% (to $32,000), then 0.25 BTC can be redeemed for just $8,000. As a result, the net profit will be $2,000 (less commissions).

However, if BTC rises by 20% to $48,000, you will need to deposit another $2,000 to buy back 0.25 BTC. The position will be liquidated if the balance reaches $1000. To avoid liquidation, it will be necessary to deposit more funds into the wallet and increase the collateral until the liquidation price is reached.

Why use leverage in crypto trading

Traders use leverage to increase the size of their positions and increase their profit potential. However, as demonstrated above, trading with leverage can also lead to serious losses.

Another reason for using leverage is to increase capital liquidity. For example, instead of holding a position with 2x leverage on one exchange, you can choose 4x leverage to maintain the same position size with less collateral. This will allow some of the money to be used elsewhere (for example, trading another asset, staking, providing liquidity to decentralized exchanges (DEX), investing in NFTs, etc.).

How to Manage Risks When Trading with Leverage

Trading with high leverage may require a smaller amount of collateral, but increases the chances of liquidation. If your leverage is too high, even a 1% price move can result in huge losses. The higher the leverage, the lower the resistance to volatility. Using lower leverage is an opportunity to insure yourself against serious losses resulting from trading mistakes. This is why Binance and other cryptocurrency exchanges have limited maximum leverage for new users.

Risk management strategies such as stop loss and take profit help minimize losses when trading with leverage. Stop loss orders can be used to automatically close positions at a specific price, which is very useful when the market is moving against you. Stop loss orders help protect against serious losses. Take profit orders do the opposite: they are automatically closed when profits reach a certain value, allowing you to maintain profits until market conditions change.

It should already be clear that trading with leverage is a rather controversial method that can increase not only profits, but also losses. It involves a high level of risk, especially in the volatile cryptocurrency market. Binance encourages traders to trade mindfully and take responsibility for their actions. To better control transactions, we offer tools such as anti-addiction notifications and blocking periods. Always exercise extreme caution and remember to do your own research to ensure you are using leverage correctly and planning your trading strategies most effectively.

How to Use Margin Trading on Binance

Leverage can be used to trade cryptocurrencies on crypto exchanges such as Binance. We'll cover how to do margin trading, but the concept of leverage can be applied to other types of trading as well. First of all, create a margin account. Detailed instructions for creating an account can be found in the Frequently Asked Questions section.

1. Go to the “Trading” - “Margin” tab in the panel at the top of the page.

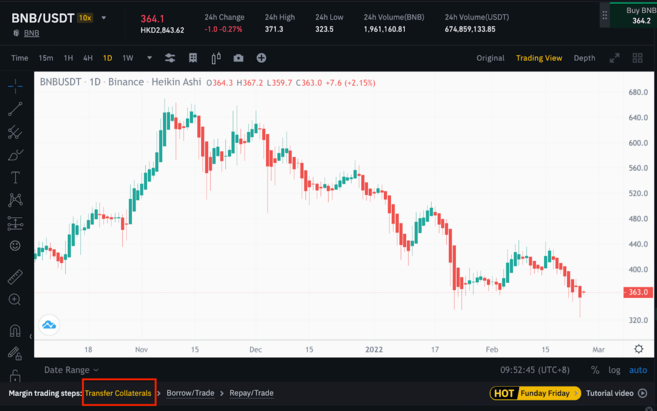

2. Click BTC/USDT to select your desired pair. In our example, we will use the BNB/USDT pair.

3. Transfer funds to your margin wallet. Click “Transfer Collateral” under the candlestick chart.

4. Select the wallet to transfer funds, target margin account and coin to transfer. Enter the amount and click "Confirm". In this example, we are transferring 100 USDT to a cross margin account.

5. Now let's turn to the window on the right. Select Cross 3x or Isolated 10x. Cross margin mode distributes margin between margin accounts, while isolated margin mode distributes margin independently for each trading pair. You can read more about the difference between them in the FAQ section.

6. Select Buy (long) Sell (short) and select the order type, such as a market order. Click the "Borrow" button and the 100 USDT transferred to the cross margin account will be multiplied by 3x, resulting in you receiving 300 USDT.

7. BNB is also available for purchase with leverage. Enter the amount in USDT in the "Total" field or the amount of BNB to purchase in the "Amount" field. You can also drag the slider below to select leverage by percentage of your available balance. The loan amount for this transaction will be reflected below. Click "BNB Margin Buy" to open a position.

Please note that you cannot use your entire available balance as you will need to pay a trading fee. The system automatically deducts the commission amount depending on your VIP level.

Summary

Leverage is the ability to start trading with a lower initial investment and potentially higher profits. However, leverage during market volatility can lead to quick liquidations, especially when using 100x leverage. Always exercise caution and be aware of the risks. Trade only with funds you are willing to lose, especially when using leverage.