Solana’s price has fallen more than 63% in just a month. It reached $38 on November 5, 2022, and has now fallen to the levels of $14-$15. Solana fell on speculations that FTX and Alameda would dump their share to raise funds after bankruptcy. This, combined with on-chain data shows a very bad near-term future for Solana.

Also Read: Solana Technical Analysis: Coin Might Crash Further as Unstaking Nears

Unlocked SOL in FTX and Alameda

FTX Exchange collapsed in a dramatic series of events with Binance CEO Changpeng Zhao making a failed rescue attempt. One of the most devastating spillover effects was for Solana. Both FTX and its sister firm Alameda Research hold vast amounts of $SOL Tokens in their balance sheets.

FTX holds about $982 Billion in $SOL Tokens

Alameda Research holds an additional $292 Million in $SOL Tokens

The current Solana Token supply is near $5.1 Billion. The sale of additional tokens worth $1.3 Billion would increase the market supply by 20% which could result in a 20% further drop in Token Value if prices are to adjust accordingly.

Why is On-Chain data important?

On-Chain data shows the most reliable and accurate state of a cryptocurrency. Since it is reported without any human interference, on-chain data does not have any bias. Further, it also shows the state of the cryptocurrency and blockchain in real-time.

On-Chain data gives you critical market insights that set you ahead of others. It also shows you where the smart money flows. Smart Money refers to funds that are controlled by top financial institutions, large firms, and top investors.

Solana On-Chain Data

We have compared Solana’s on-chain data with Ethereum to show that the data for Solana looks particularly bad and is not the secular impact of Crypto Winter. The data for the first 3 metrics were taken from The Block.

Data shows that Solana has seen an overall decline in its adoption in the last 3 to 6 months. Further, the decline has been consistent without any recovery. The same effect is not seen in Ethereum which has also declined not by such a huge margin as Solana.

1. Lowest Number of New Addresses in 6 Months

October 2022 saw the lowest number of new addresses on the Solana blockchain. More than 11.72 million new addresses were created in May 2022 as compared to just 5.52 Million new addresses in October 2022. Further, there was a decreasing trend since May. Compared with Solana, Ethereum added 2.79 Million new addresses in October and 2.5 Million new addresses in May, which is a net increase.

2. Lowest Number of Active Addresses in 6 Months

Solana had more than 37 Million active addresses in May 2022. However, that figure dropped down to 50% to reach about 18.17 Million active addresses in October 2022. Meanwhile, Ethereum saw just a 7.9% fall in the number of active addresses.

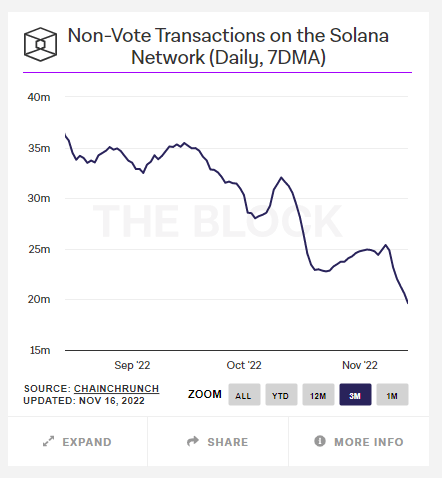

3. Regular Transactions Fall to 3-Month Low

Regular transactions on the Solana chain are those which interact with Solana blockchain through direct transfers or through DApps. Solana Blockchain marks the lowest levels of regular transactions in the past 3 months. The daily transactions were 9.63 Million transactions on November 14, 2022, as compared to 36.18 Million transactions on August 14, 2022.

Ethereum saw no net change that was considered during this period. On August 14, 2022, there were 1.14 Million Transactions as compared to 1.13 Million Transactions on November 14, 2022.

Conclusion

Solana has dropped more than 60% in the last month but that drop was largely incoming as we can see from the slow decline which started in the last 6 months. Crypto Hodlers and Investors are best advised to stay away from Solana and monitor the situation closely. Any significant price drop can further aggravate your loss.

Disclaimer: We are not criticizing any project. We are just pointing out the unfavorable situation.