Bitcoin’s role in DeFi (decentralized finance) is changing dramatically. From being a simple peer-to-peer transfer, the world’s first cryptocurrency is now gradually emerging as a powerful force in the DeFi field, beginning to challenge Ethereum’s long-standing dominance.

By comprehensively interpreting the current status and growth trajectory of the Bitcoin ecosystem through on-chain data, we have found a clear picture: BTCFi (the combination of Bitcoin and DeFi) is not just a technological shift, but may also trigger a paradigm shift in the role of Bitcoin in DeFi. As we will explore in depth, the impact of this shift may redefine the landscape of the entire DeFi field.

01

The rise of BTCFi

In 2008, Satoshi Nakamoto launched Bitcoin, which was originally designed as a peer-to-peer electronic cash system. Although this architecture is revolutionary in the field of crypto assets, it has obvious limitations in more complex financial applications such as DeFi.

02

Bitcoin’s original design and its limitations in DeFi

Core design elements and their limitations:

1) UTXO model: Bitcoin uses the unspent transaction output (UTXO) model, which is effective in processing simple transfers but lacks the flexibility required to support complex smart contracts.

2) Limited scripting language: Bitcoin’s scripting language is limited by design, mainly to avoid security vulnerabilities. However, this limitation also prevents it from supporting complex DeFi applications because it has a limited number of executable opcodes.

3) Lack of Turing Completeness: Unlike Ethereum, Bitcoin’s script is not Turing complete, which makes it difficult to implement complex state-reliant smart contracts, which are critical to many DeFi protocols.

4) Block size and transaction speed: Bitcoin’s 1MB block size limit and 10-minute block generation time result in its transaction processing speed being much lower than other blockchains focused on DeFi.

While these design choices enhance Bitcoin’s security and decentralization, they also create obstacles to implementing DeFi functionality directly on the Bitcoin blockchain. The lack of native support for features such as loops, complex conditions, and state storage makes it very difficult to build applications such as DEX, lending platforms, or liquidity mining protocols on Bitcoin.

03

Early attempts and developments in introducing DeFi on Bitcoin

Despite these limitations, Bitcoin’s strong security and widespread adoption have prompted developers to find innovative solutions:

1) Colored coins (2012-2013): This was one of the early attempts to expand the functionality of Bitcoin. Colored coins represented and transferred real-world assets by “coloring” specific Bitcoins and attaching unique metadata. Although this was not true DeFi, it laid the foundation for the development of more complex financial applications on Bitcoin.

2) Counterparty (2014): This protocol introduced the ability to create and trade custom assets on the Bitcoin blockchain, including the first NFT. Counterparty demonstrated the potential for developing more complex financial instruments on Bitcoin.

3) Lightning Network (2015 to present): Lightning Network is a second-layer protocol designed to improve transaction scalability. It opens up the possibility for more complex financial interactions, including some preliminary DeFi applications, by introducing payment channels.

4) Discrete Log Contract (DLC) (2017-Present): Proposed by Tadge Dryja, DLC allows complex financial contracts to be implemented without changing the Bitcoin base layer, providing new possibilities for derivatives and other DeFi tools.

5) Liquid Network (2018-Present): This is a sidechain-based settlement network developed by Blockstream that supports the issuance of crypto assets and more complex Bitcoin transactions, paving the way for DeFi-like applications.

6) Taproot Upgrade (2021): By introducing the Merkle Alternative Script Tree (MAST), Taproot compresses complex transactions into a single hash, reducing transaction fees and memory usage. Although it is not a DeFi solution in itself, it improves Bitcoin's smart contract capabilities, making it easier and more efficient to implement complex transactions, laying the foundation for the future development of DeFi.

These early developments laid the foundation for Bitcoin's functionality to expand from simple transfers to more applications. Despite the challenges of introducing DeFi on Bitcoin, these innovations also demonstrated the potential of the Bitcoin ecosystem. These foundations paved the way for the second-layer solutions, sidechains, and a wave of innovation in Bitcoin DeFi, which we will explore in depth next.

04

Key innovation: Implementing smart contracts on Bitcoin

2) Core: Core is a Bitcoin-based blockchain that is closely integrated with Bitcoin and compatible with the Ethereum Virtual Machine (EVM).

Core stands out for its innovative dual-staking model, which combines Bitcoin and Core together. Through non-custodial Bitcoin staking, Core establishes a risk-free rate of return for Bitcoin, effectively turning Bitcoin into a yield asset. Core reports that 55% of Bitcoin mining power is delegated to its network, which helps enhance its security in DeFi applications.

3) Merlin Chain: Merlin Chain is a relatively new Bitcoin layer 2 network that is dedicated to unlocking the DeFi potential of Bitcoin and is gaining more and more attention. It integrates ZK-Rollup technology, decentralized oracles, and on-chain fraud prevention modules, providing Bitcoin holders with a full set of DeFi features. Merlin's M-BTC is a wrapped Bitcoin asset that can earn staking rewards, opening up new avenues for yield generation and participation in DeFi.

4) BEVM: BEVM represents an important step forward in bringing Ethereum’s extensive DeFi ecosystem directly to Bitcoin. As the first fully decentralized and EVM-compatible Bitcoin layer 2 network, BEVM uses Bitcoin as fuel, allowing Ethereum’s decentralized applications (DApps) to be seamlessly deployed on Bitcoin. BEVM is supported by mining giant Bitmain and has pioneered the concept of “computing power RWA”, which may unlock new value dimensions for the Bitcoin ecosystem.

Key innovations of Bitcoin's second-layer network and sidechain:

Tokenize Bitcoin assets;

Smart contracts and EVM compatibility;

Bitcoin with earnings;

Scalability and privacy enhancements.

05

The Current State of Bitcoin DeFi

As the Bitcoin DeFi ecosystem continues to grow, some key projects have emerged as important players, driving innovation and user adoption. These projects rely on Bitcoin's second-layer solutions and sidechains to provide a variety of DeFi services:

1) Main BTCFi projects

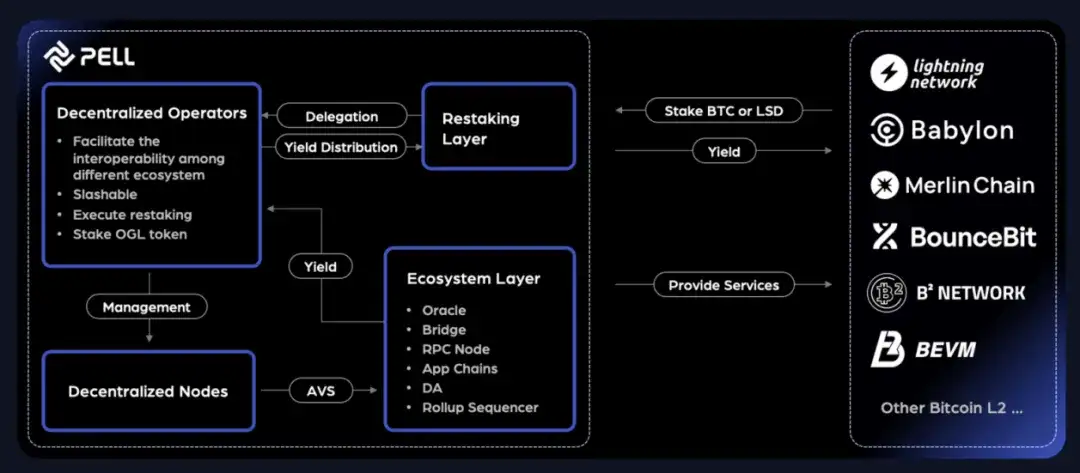

Pell Network (Multi-chain)

Pell Network is a cross-chain re-staking protocol designed to improve the security of the Bitcoin ecosystem and optimize returns. Users earn rewards by staking Bitcoin or Liquid Staking Derivatives (LSD), while decentralized operators are responsible for running verification nodes to ensure the security of the network. Pell provides a range of active verification services such as oracles, cross-chain bridges, and data availability to support the broader Bitcoin Layer 2 ecosystem. With its strong infrastructure, Pell aims to become an important player in providing liquidity and securing the crypto economy, driving sustainable growth in the Bitcoin economy.

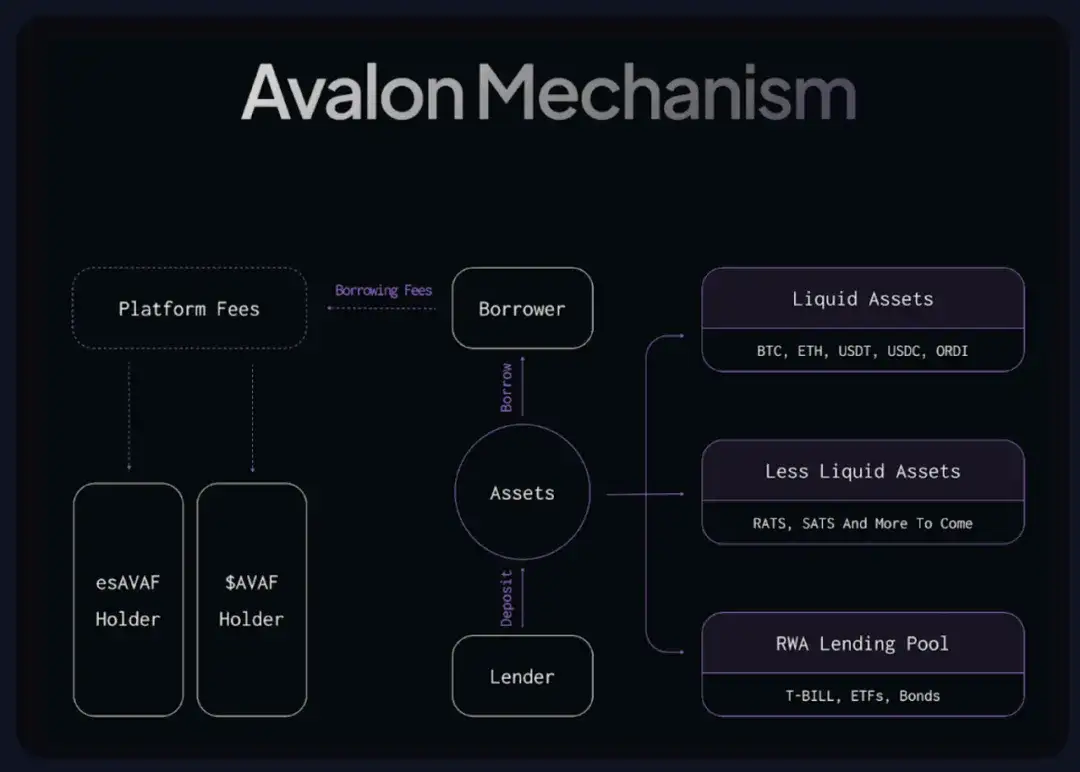

Avalon Finance (Multi-chain)

Avalon Finance is a multi-chain DeFi platform spanning Bitlayer, Core, and Merlin Chain, known for its comprehensive lending and trading services in the BTC DeFi ecosystem. Avalon's main services include over-collateralized lending for major assets and less liquid assets, with dedicated segregated pools. The platform has also integrated derivatives trading, enhancing the functionality of its lending services. In addition, Avalon has launched an algorithmic stablecoin designed to optimize capital efficiency, making it a versatile and secure DeFi solution in the Bitcoin ecosystem. Its governance token AVAF adopts the ES Token model to incentivize liquidity provision and protocol usage.

Colend Protocol(Core)

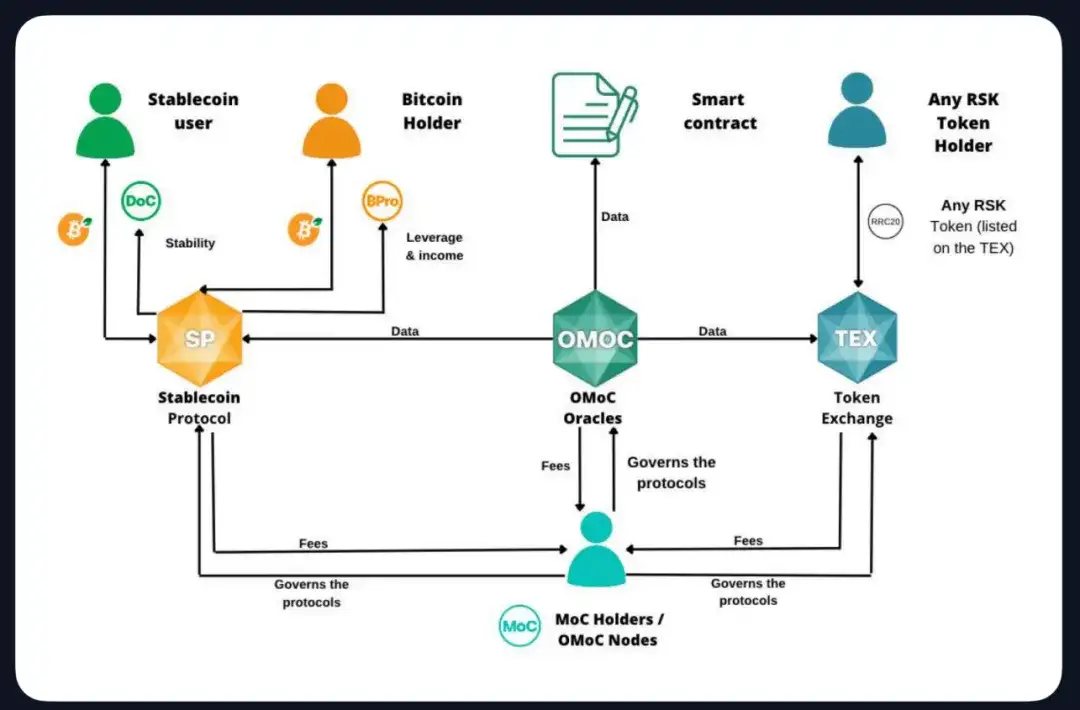

Colend Protocol is a decentralized lending platform built on the Core blockchain where users can securely lend Bitcoin and other assets.By leveraging Core's dual-collateral model, Colend seamlessly integrates with the broader DeFi ecosystem, increasing Bitcoin's utility in DeFi. Its key features include decentralized and immutable transactions, multiple liquidity pools with dynamic interest rates, and a flexible collateral system.MoneyOnChain(Rootstock)

MoneyOnChain is a comprehensive DeFi protocol built on Rootstock that allows Bitcoin holders to increase the yield on their assets while retaining full control of their private keys. The core of the protocol is the issuance of a stablecoin called Dollar on Chain (DoC), a stablecoin fully collateralized by Bitcoin, designed for users who want to keep the value of their Bitcoin holdings pegged to the US dollar. In addition, MoneyOnChain also offers Token BPRO, which enables users to gain leveraged exposure to Bitcoin and thus realize passive income.

The protocol is based on a risk-sharing mechanism and uses a proprietary financial model to cope with extreme market fluctuations. It also includes a decentralized Token trading platform (TEX), a decentralized oracle (OMoC), and a governance token (MoC), enabling users to participate in protocol decision-making, stake, and obtain rewards.

Sovryn (Multi-chain)