Main Takeaways

By setting stop orders, futures traders can prepare for unexpected market changes, and capitulations during periods of high volatility.

On Binance Futures, stop orders are primarily utilized to secure profits and limit losses through take-profit and stop-loss orders, respectively.

When placing a stop order in Binance Futures, there are three factors to consider: the stop price (also called the trigger price), execution price, and stop order type.

Crypto traders on Binance Futures can utilize tools such as stop orders to trade futures efficiently and reduce potential losses. Stop orders help traders to draw up a predetermined exit strategy and avoid the stress of making emotionally-driven decisions.

There is no one-size-fits-all approach when using stop orders on Binance Futures. Each strategy has its advantages and disadvantages, depending on market conditions and the user's specific goals.

This article explores the various types of stop orders available on Binance Futures and what each one offers futures traders.

What Is a Stop Order?

On Binance Futures, stop orders are primarily utilized to help limit losses and lock in profits using stop-loss and take-profit orders, respectively. When placing a stop order in Binance Futures, it's important to consider three key factors: the stop price (also known as the trigger price), execution price, and stop order type.

The stop price is the price at which a buy or sell order is triggered. You can choose either the Last Price or Mark Price as the trigger type and control the execution price by choosing the stop order type.

If a stop-market order is selected, the order will be executed at the best available price in the order book. If a stop-limit order is chosen, the order will be executed at the predetermined limit price or a better price.

Trigger Type: Mark Price versus Last Price

There are two types of stop / trigger prices: Last Price and Mark Price. On Binance Futures, the Last Price is the latest trade price of a contract and the Mark Price is the estimated fair value of a contract.

Using the Last Price to trigger a stop order ensures the stop price is closer to the order’s execution price. However, it is not a foolproof method to avoid liquidation since the liquidation price is always the Mark Price.

If you intend to place a stop order to avoid liquidation, it's better to use the Mark Price as the trigger, as it always coincides with the liquidation price of a futures contract. However, this also means the price at which your stop order is executed may deviate further from your trigger price.

In the case of a stop-limit order, for instance, your order may not be executed at all; this is because the Mark Price is the average price and cannot be used to fill an order. This applies especially during high-volatility periods, when the gap between the Last Price and the Mark Price can widen.

In summary, using the Last Price to trigger a stop order may bring you closer to the actual execution price. However, it does not guarantee liquidation avoidance. As such, choosing the Mark Price as the trigger for your stop order is a better option for avoiding liquidation.

Stop Order Type: Market Order versus Limit Order

In Binance Futures, the stop order type determines the type of order the system places once the asset reaches the stop price. There are two stop order types: stop-market (a market order) and stop-limit (a limit order).

With a stop-market order, you only need to select the stop price. Once this price is activated, the system will automatically execute the order at the best available price.

With a stop-limit order, you need to select both the stop price and limit price. The order will be executed only at the specified limit price or a better price. Once the asset reaches the stop price, the system will seek to match your order within the order book.

However, the order will only be filled if the specified price or a better price — which is typically closer to the Last Price — is available. If the limit price or a better price is unavailable in the order book, the order will expire. To avoid this, the limit price should be lower than the trigger price.

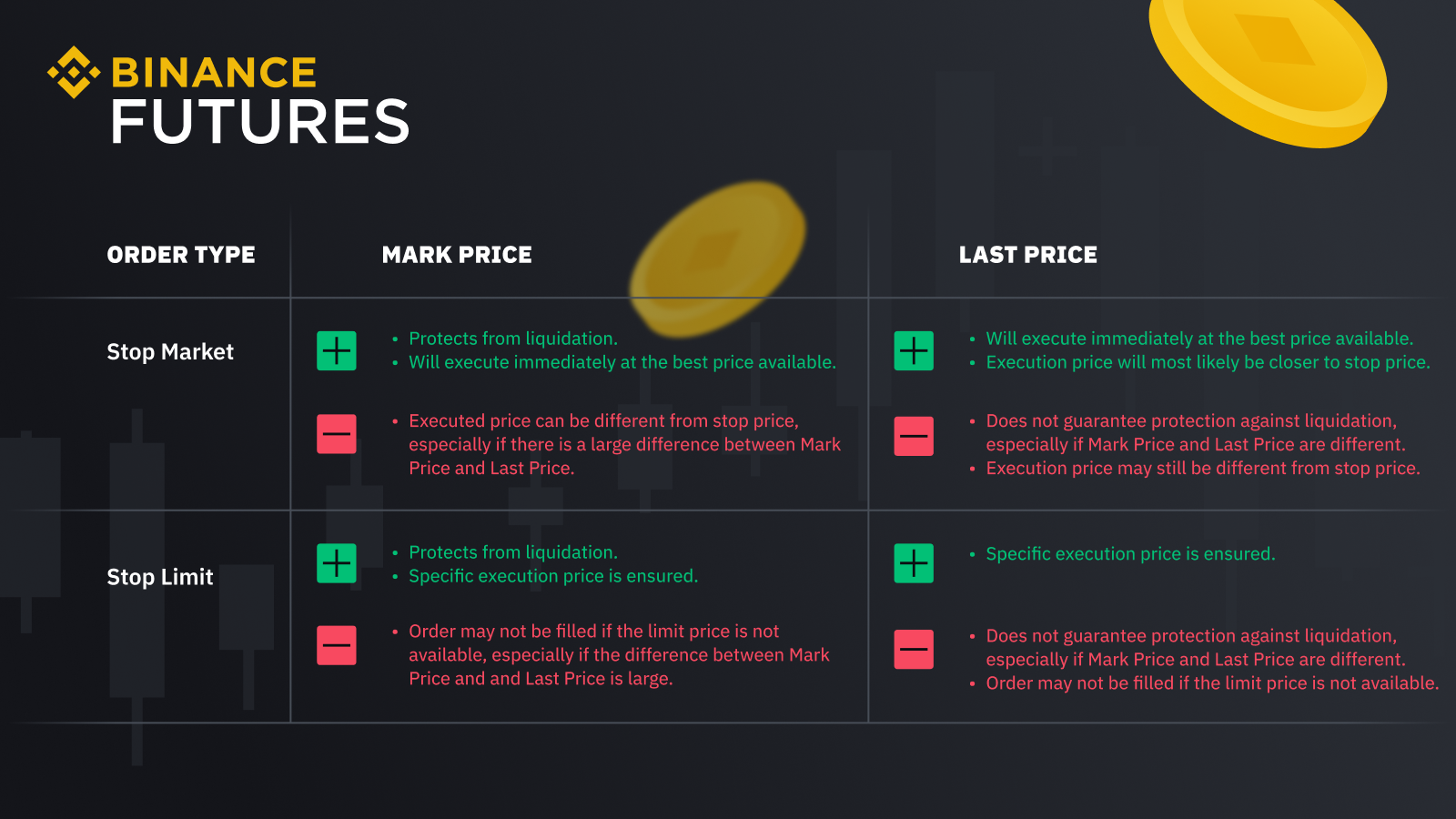

As shown in the image below, there are four different combinations of stop order types, each with its advantages and disadvantages. It's important to note that there is no perfect combination, and the choice ultimately depends on your personal preferences and trading strategy.

Important Facts About Stop Orders

Stop orders are not a foolproof measure against liquidation

Even if you set a stop-loss order with the Mark Price as the stop price, it's important to note that a stop order is not a foolproof measure against liquidation. The liquidation price can change and the stop-loss order may not protect positions from liquidation.

Stop orders are different from limit orders

A limit order and a stop order serve different purposes and should not be confused with each other. The former is an order to buy or sell an asset at a specific or better price, while the latter is triggered when a certain price level is reached and is used to pick up on an upward or downward trend.

Stop orders can be used to open and close positions

A stop order is not limited to closing a position; it can also be used to open one. As such, it is possible to use a stop order to enter a new position on the market, in addition to exiting an existing position.

Orders may expire for several reasons

When a contract's Last Price and Mark Price exceed a predetermined threshold, the Price Protection function will prevent the stop order from being triggered, thereby causing the order to expire. At the same time, a stop-limit order may expire if the specified limit price is not available in the order book.

You can place multiple stop orders on the same contract

Binance Futures allows you to place multiple stop orders at varying price levels on the same contract. For instance, you can place one with the Last Price as the trigger to prevent excessive losses, and another with the Mark Price as the trigger to avoid liquidation.

Your order may not be filled at your chosen stop price

A stop-market order will be filled at the next available market price, which may be different from the specified stop price.

Closing Thoughts

Stop orders are a great trading tool when you want to open or close a position in a futures contract. It can help you draw up a predetermined exit strategy, minimize losses, and maximize returns. However, before choosing a combination of stop order types, it is best to understand the options available to you and evaluate how each one can influence your strategy.

Further Reading

(Blog) Three Misconceptions About Liquidations in Binance Futures

(Blog) How Take-Profit and Stop-Loss Orders Can Help Traders Manage Risk Better

(FAQ) What Is Stop Order

Risk Warning: Digital asset prices can be volatile. The value of your investment can go down or up and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not liable for any losses you may incur. Futures trading, in particular, is subject to high market risk and price volatility. All of your margin balance may be liquidated in the event of adverse price movement. Past performance is not a reliable predictor of future performance. Before trading, you should make an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances, including the risks and potential benefits. Consult your own advisers, where appropriate. This information should not be construed as financial or investment advice. To learn more about how to protect yourself, visit our Responsible Trading page. For more information, see our Terms of Use and Risk Warning.