Binance Research: LSDFi – Liquid Staking Meets DeFi

Main Takeaways

In this blog series, we summarize our research team’s findings, inviting you to dive deeper into the original reports.

This article previews the Binance Research report from June 16, 2023, which examines LSDFi – the blending of liquid staking derivatives with decentralized finance.

Though still nascent, liquid staking protocols are already the largest DeFi sector by TVL, indicating considerable potential for the future of LSDFi.

Thanks to Binance Research, you can take advantage of industry-grade analysis of the processes that shape Web3. By sharing these insights, we hope to empower our community with the latest knowledge from the field of crypto research. For a deeper dive, the full reports are available on the Binance Research website.

With Ethereum’s transition to proof-of-stake (PoS) in 2022 and the subsequent enablement of staked ETH withdrawals following the Shapella upgrade in April 2023, we have witnessed considerable growth in staking on the Ethereum blockchain. Correspondingly, there’s also been significant growth in the liquid staking derivatives (LSDs) space, which are tokens that represent staked ETH positions and accrue additional staking rewards. Another term describing the same class of assets is liquid staking tokens, or LSTs.

The term LSDFi refers to decentralized finance (DeFi) protocols built on top of LSDs, offering additional opportunities for holders to generate yield with lower barriers to entry. Today, we will explore the state of LSDFi, delving into the background of LSDs, the broader market ecosystem, and attendant risks. Note that this article has been adapted from a Binance Research report published on June 16, 2023, and as such, it mostly covers data and developments from before this date, unless specified otherwise.

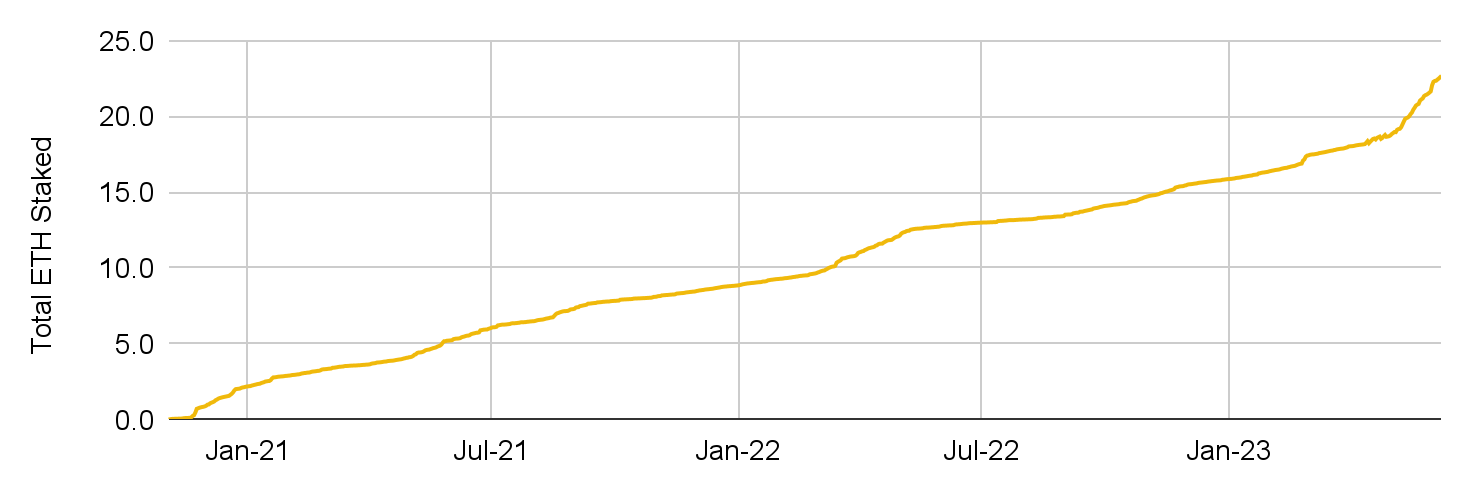

Liquid Staking Derivatives

LSDs have been one of the most significant developments of 2023 in the blockchain space, and there’s been a rapid acceleration in total ETH staked throughout the year. As of October 2023, liquid staking is the biggest protocol category on the DeFiLlama aggregator, with a combined total value locked (TVL) of $23.02B across 119 protocols. While the figure below shows data from June 2023, the total amount of staked ETH has since surpassed 27.2M as of October 2, 2023.

Total ETH staked

Source: Dune Analytics (@hildobby) (June 14, 2023)

By issuing their own LSDs, liquid staking providers unlock further liquidity and allow holders to take advantage of a broader range of opportunities within the crypto ecosystem. The main benefit of these protocols is that more users can participate in staking and the larger ecosystem with lower barriers to entry.

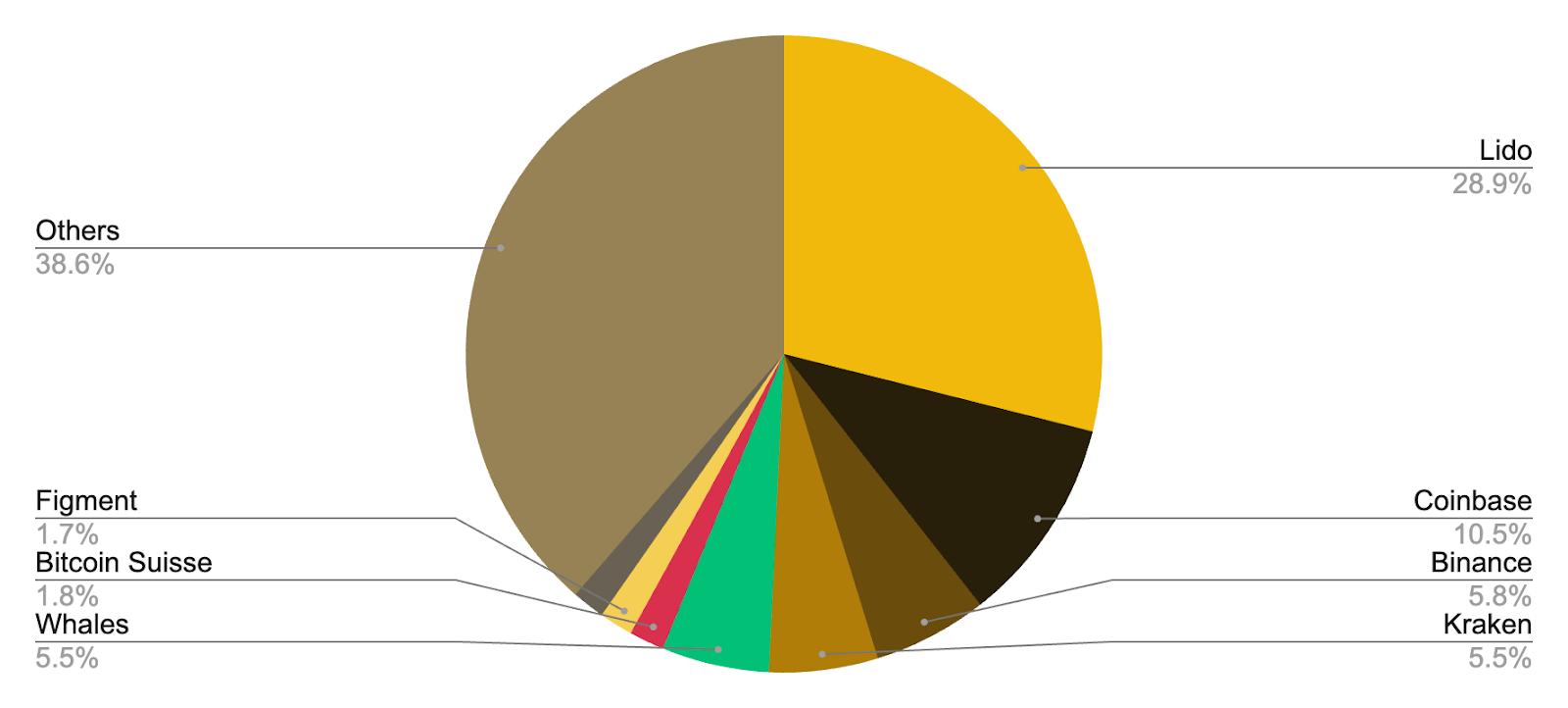

Examining the overall ETH staking landscape, Lido is the biggest player, followed by centralized exchanges such as Coinbase, Binance, and Kraken. There are also various other liquid staking providers, accounting for a smaller fraction of staked ETH.

Market share of ETH staking providers based on deposits

Source: Etherscan (June 14, 2023)

There are two main types of LSDs: rebasing tokens and reward-bearing tokens. Rebasing tokens change in balance as the token supply changes according to staking rewards or slashing penalties. Conversely, reward-bearing tokens reflect accrued yields through changes in token values rather than balances.

The LSDFi Ecosystem

The LSDFi ecosystem mainly consists of mature DeFi protocols that have integrated LSDs into their product suite, as well as more recent projects based on LSDs. Note that the figure below is not an exhaustive map.

Liquid staking and LSDFi map

Source: Binance Research (June 14, 2023)

The categories included in the figure above involve the following:

DeFi liquid staking providers: DeFi providers that enable users to partake in staking and receive LSDs in return.

CEX liquid staking providers: Centralized exchanges (CEXs) offering liquid staking services.

CDP stablecoins: Collateral debt position (CDP) protocols allowing users to mint stablecoins while using LSDs as collateral.

Index LSDs: Tokens representing a stake in a basket of LSDs.

Yield strategies: Protocols enabling users to access additional yield opportunities.

Money market: Protocols facilitating lending and borrowing activities using LSDs.

Market share

As of October 2, according to Dune Analytics data, LSDFi protocols have a TVL of more than $317.9M. The LSDFi landscape is relatively concentrated, with the top five protocols consolidating over 74% of the market share by TVL. Curve Finance is the current market leader, with its crvUSD protocol boasting a TVL of over $77.5M, which corresponds to a 24.4% market share.

Risks

Given the nascency of LSDFi markets, and as is the case with all emerging technologies, users should be aware of the risks associated with interacting with such projects. These include risks related to liquid staking in general.

Slashing risks: When validators face penalties for failing to achieve certain staking parameters, holders of LSDs may be exposed to slashing risks.

LSD price risks: Prices of LSDs may fluctuate and differ from the underlying token due to market forces, which could expose users to price volatility and potential liquidation risks if used as collateral.

Smart contract risks: Every smart contract that a user interacts with presents new layers of potential smart contract vulnerabilities.

Third-party risks: Projects may utilize other dApps in their operations, which could expose users to additional counterparty risks.

Additionally, the aforementioned factors do not include project-specific risks that differ across protocols. As always, users should conduct thorough due diligence before interacting with any Web3 project, particularly in emerging spaces such as LSDFi.

Closing Thoughts

LSDFi protocols have opened up new opportunities for LSD holders. By providing additional use cases, LSDFi incentivizes staking participation and has the potential to accelerate the growth of liquid staking. Given that the sector is in its early stages of development, it will be key to observe further innovations in the space and to monitor the adoption of LSDFi. Liquid staking is a burgeoning ecosystem, and we are just starting to scratch the surface.

Binance Research

The Binance Research team is committed to delivering objective, independent, and comprehensive analyses of the crypto space. They publish insightful takes on Web3 topics, including but not limited to the crypto ecosystem, blockchain applications, and the latest market developments.

This article is only a snapshot of the full report, which features a deeper exploration of liquid staking and the LSDFi ecosystem, including its growth and future outlook. To read the full version of the report, click here. You can find other in-depth Web3 reports on the Insights & Analysis page of the Binance Research website. Don’t miss the opportunity to empower yourself with the latest insights from the field of crypto research!

Further Reading

General Disclosure: This material is prepared by Binance Research and is not intended to be relied upon as a forecast or investment advice and is not a recommendation, offer, or solicitation to buy or sell any securities or cryptocurrencies or to adopt any investment strategy. The use of terminology and the views expressed are intended to promote understanding and the responsible development of the sector and should not be interpreted as definitive legal views or those of Binance. The opinions expressed are as of the date shown above and are the opinions of the writer; they may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Binance Research to be reliable, are not necessarily all-inclusive, and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given, and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Binance. This material may contain ‘forward-looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. This material is intended for information purposes only and does not constitute investment advice or an offer or solicitation to purchase or sell in any securities, cryptocurrencies, or any investment strategy, nor shall any securities or cryptocurrency be offered or sold to any person in any jurisdiction in which an offer, solicitation, purchase, or sale would be unlawful under the laws of such jurisdiction. Investment involves risks.