Binance Research: Key Trends in Crypto – September 2023

Main Takeaways

In this blog series, we offer concise summaries of the Binance Research team’s findings, inviting you to take a deeper dive into the original reports.

This article previews the recent Binance Research report discussing key developments in crypto markets over the past month.

August 2023 was a rather difficult month for crypto, with total market capitalization decreasing 8.8% against the backdrop of macroeconomic uncertainties.

Thanks to Binance Research, you can take advantage of industry-grade analyses of the processes that shape what the Web3 space will look like tomorrow. By sharing these insights, we hope to empower our community with the latest knowledge from the field of crypto research. For a deeper dive, the full reports are available on the Binance Research website.

In financial markets, knowledge is power. Gone are the days when only big institutions and sophisticated financiers used high-quality research to navigate the digital asset space. Thanks to Binance Research, you can empower yourself with the latest data and insights from the field of crypto intelligence.

Today’s article explores key Web3 developments in August 2023 to provide an overview of the crypto ecosystem’s current state. We analyze the performance of crypto, DeFi, and NFT markets before previewing the major events to look out for in September 2023.

Crypto Market Performance in August 2023

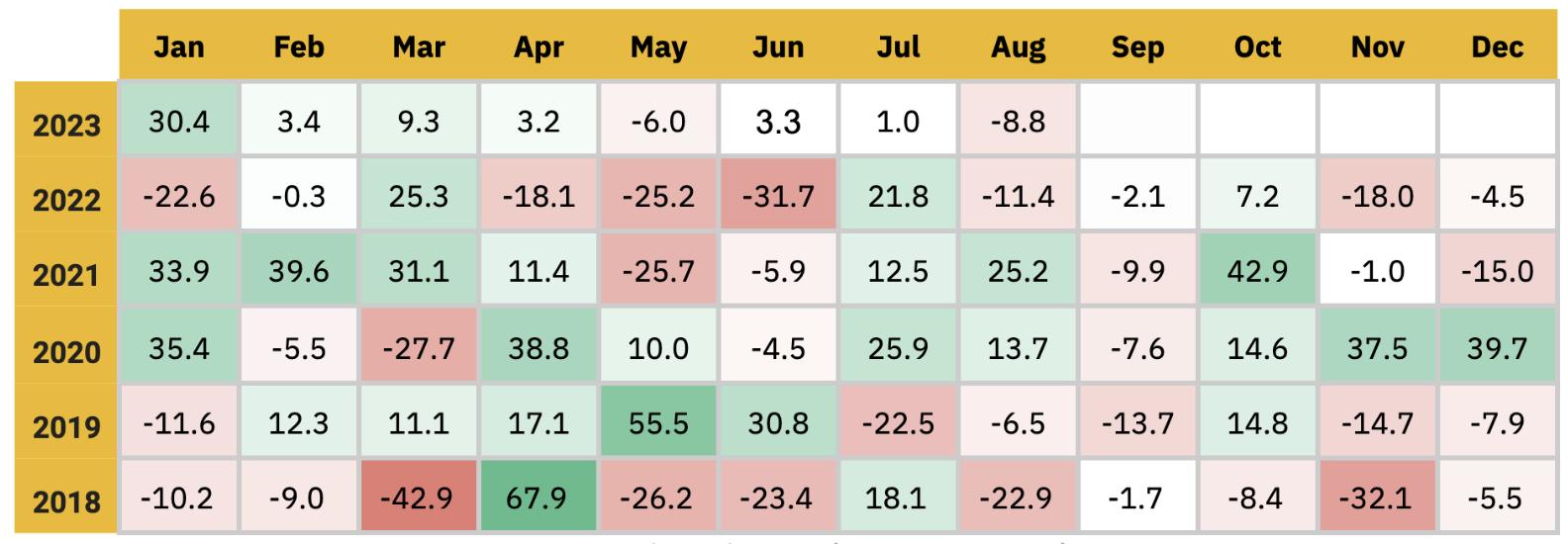

August 2023 was a relatively tough month for crypto, with total market capitalization decreasing 8.8% – the steepest monthly decline of the year thus far. In the background of these market developments, US Federal Reserve Chair Jerome Powell discussed the need to raise interest rates to combat persistently high inflation. With investors already bracing for challenging market conditions, this news has likely furthered the adoption of risk-averse mindsets across markets.

Nevertheless, some optimism surrounding the prospect of spot Bitcoin ETFs emerged toward the end of the month. Grayscale prevailed in its lawsuit against the US Securities and Exchange Commission (SEC) regarding the conversion of its Grayscale Bitcoin Trust (GBTC) into an exchange-traded fund (ETF).

Monthly change in crypto market capitalization (%)

Source: CoinMarketCap (August 31, 2023)

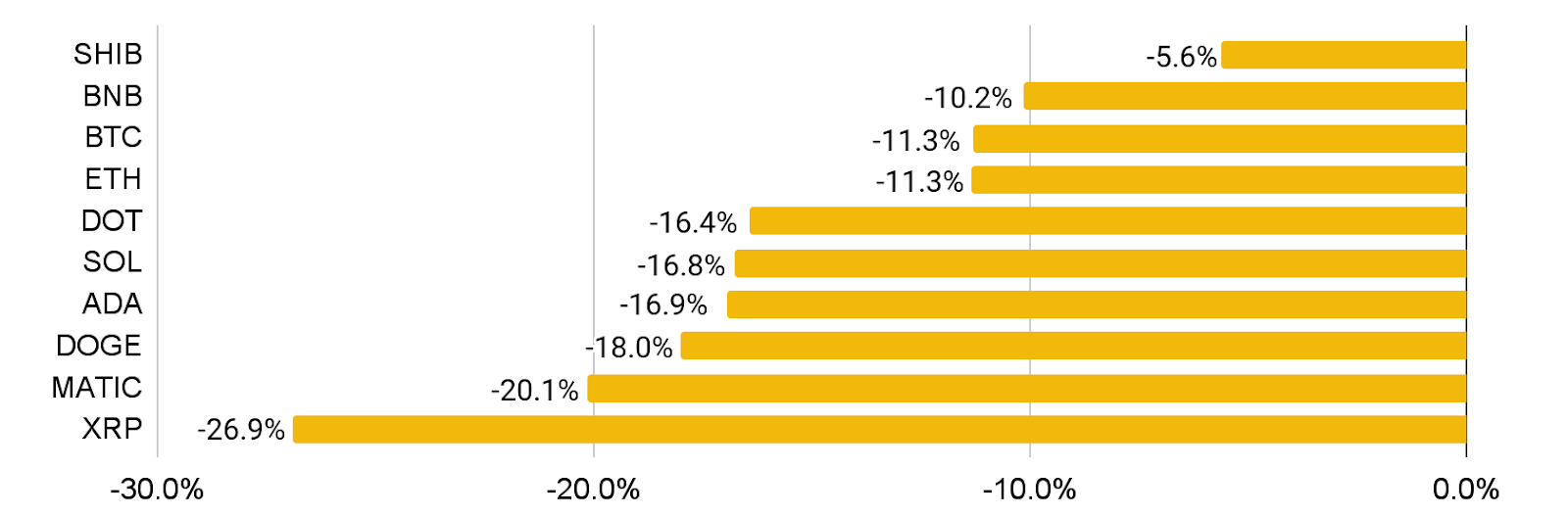

Monthly price performance of the top 10 coins by market capitalization

Source: CoinMarketCap (August 31, 2023)

Against the backdrop of the macroeconomic uncertainties discussed above, all of the top 10 coins by market capitalization saw monthly price declines. Both BTC and ETH fell 11.3%, though they saw some rebound with the Grayscale ruling toward the end of the month.

Despite XRP’s strong performance in the previous month with a favorable ruling for Ripple in its case against the SEC, the coin’s momentum waned throughout August as the SEC filed an appeal against this decision. In light of the appeal, XRP ended the month as the weakest performer among the top 10, with a 26.9% decline overall.

Decentralized finance (DeFi)

Extending this year’s monthly trends, DeFi markets fell by 5.5% in total value locked (TVL) to $38.6B. The composition of the top blockchains by TVL remained generally unchanged, with Ethereum at 59.4%, Tron at 14.2%, and BNB Chain at 7.7%.

TVL share of top blockchains

Source: DeFiLlama (August 31, 2023)

Non-fungible tokens (NFTs)

Monthly trading volume for NFTs

Source: Cryptoslam (August 31, 2023)

Also consistent with the month’s trends, NFT markets experienced significant downturns in August and continue to struggle. Nansen’s NFT-500 and Blue-Chip-10 indexes revealed 55% and 49% decreases in trading volume since the start of the year, respectively.

Upcoming Events

To help users stay updated on the latest Web3 news, Binance Research has summarized notable events and token unlocks for the month to come. Keep an eye on these upcoming developments in the blockchain space.

Notable events in September 2023

Source: Binance Research

Largest token unlocks in US$ terms

Source: TokenUnlocks, Binance Research

Binance Research

The Binance Research team is committed to delivering objective, independent, and comprehensive analyses of the crypto space. They publish insightful takes on Web3 topics, including but not limited to the crypto ecosystem, blockchain applications, and the latest market developments.

This article is only a snapshot of the full report, which contains further insights and an analysis of the most important market charts from the past month. It also explores recent news surrounding the decentralized social network friend.tech, the layer-2 landscape, MakerDAO’s DAI Savings Rate, EigenLayer, and more.

To read the full version of this report, click here. Additionally, you can find other in-depth investigations of the latest Web3 developments by visiting the Insights & Analysis page on the Binance Research website. Take the opportunity to empower yourself with the latest insights from the field of crypto research!

Further Reading

General Disclosure: This material is prepared by Binance Research and is not intended to be relied upon as a forecast or investment advice and is not a recommendation, offer, or solicitation to buy or sell any securities or cryptocurrencies or to adopt any investment strategy. The use of terminology and the views expressed are intended to promote understanding and the responsible development of the sector and should not be interpreted as definitive legal views or those of Binance. The opinions expressed are as of the date shown above and are the opinions of the writer; they may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Binance Research to be reliable, are not necessarily all-inclusive, and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given, and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Binance. This material may contain ‘forward-looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. This material is intended for information purposes only and does not constitute investment advice or an offer or solicitation to purchase or sell in any securities, cryptocurrencies, or any investment strategy, nor shall any securities or cryptocurrency be offered or sold to any person in any jurisdiction in which an offer, solicitation, purchase, or sale would be unlawful under the laws of such jurisdiction. Investment involves risks.