P2P Trading: How to Avoid Cheque Scams

Main Takeaways

Binance P2P does not offer Cheques as a payment method due to the high risks associated with it.

Cheque scams have been a popular method of defrauding P2P traders, mainly relying on mechanisms like time differences or bounced cheques.

Legitimate traders will never ask or tell you to use cheques. Always remember to double-check the transaction details directly on your bank account. Do not release your crypto based on the counterparty’s payment screenshots of receipts.

When you spot they’ve made a payment via cheque, do not release the funds and raise the issue with customer support.

Whether you’re familiar with P2P trading or just started getting into it, one thing to always keep in mind is the risks of such transactions. P2P, or peer-to-peer trading, is one of the first ways users could buy, sell, and trade cryptocurrency. It allows people to trade directly in person or via online platforms where buyers and sellers can meet.

With older P2P models came higher risks of thefts, threats, and scams. Improvements have been made to the process with escrow methods, trusted facilitators (like Binance), and know-your-customer (KYC) validation, but, naturally, some risks still remain. This guide will help you spot and avoid common scams on P2P platforms, mainly cheque scams, and trade safely and securely.

Common P2P Scams

All trading activity comes with risks, and P2P is no exception. Even with better safeguards in place, you could still fall victim to a scam. Binance prioritises your safety in the design of its products and platforms, but the first line of defence for any user is being aware of the most common frauds and scams and the ways to avoid them. Many of these schemes are applicable to any P2P model, so it’s always worth being vigilant.

Fake receipt scams

It’s important that you check all information being sent to you when P2P trading online. Scammers can manipulate photos or screenshots they send to you, claiming they’ve completed their part of the trade. In doing so, they pressure you into doing your part, so you might forget to check if you received the money they claimed to have sent. In this scenario, you potentially lose the money and get nothing in return.

Wrong transfer scams

Bad actors might also attempt to void the P2P transaction. Once the transaction is complete, the scammer may ask the bank to cancel it by claiming that the transfer was faulty or that their account was stolen. Thereby, the seller loses their money (after releasing crypto) and can be scared by the scammer into not reporting the cancelled transaction to the police.

Chargeback scams

Scammers can also take advantage of the chargeback features present on different P2P payment platforms. Chargeback is the return of money to the payer. This means that once the transaction is complete, the scammer might trigger the chargeback feature demanding to undo the payment they made. Similar to the fake receipt scam, the seller might be rushed to approve the transaction without double-checking that the money is already in their account.

What Is a Cheque Scam?

Cheque scams are just some of the many fraud schemes that P2P traders might fall victim to. One of the newer and rising P2P scams is the cheque scam. So while Binance P2P offers 700+ payment methods for P2P traders, cheques aren’t one of them. Cheques as a P2P payment method are accompanied by risks and uncertainty, which makes them unreliable.

Thus, in order to protect our users, Binance P2P does not support this payment method. Unfortunately, many users have fallen prey to forced cheque scams wherein criminals choose any of the supported payment methods at first, but then insist on using a cheque – almost always with the intention of defrauding the counterparty of their crypto. The two most common cheque scams that scammers engage in are cancelling cheques after invoicing and bouncing cheques.

Cancellation after invoicing, or the time difference cheque scam

This scam takes advantage of the time it takes for a cheque to be processed. A scammer issues a cheque but immediately cancels it. They may also create fake receipts to communicate to their counterparty that they have paid by cheque. For example, imagine that a user is selling BTC for HK dollars on a P2P platform. A buyer, who intends to pull off a scammer, selects the ad to trade with, choosing a legitimate payment method like a bank transfer.

However, instead of sending the seller the payment via bank transfer, they issue a cheque and send the seller a fake receipt via chat with their correct details, making it seem like an authentic payment made via bank transfer.

The seller then releases the BTC and completes the trade. They don’t know that the buyer has written a cheque that they will cancel with their bank immediately. As the cheque won't clear, this leaves the seller defrauded of their BTC and with no HKD received in return.

Bounced cheque

In a similar malicious fashion as above, scammers can try sending payments with bounced cheques. A bounced cheque is one that isn't cleared due to insufficient funds in the sender’s account. Cheques can even be cleared before “bouncing” due to the time it takes for account balances to update.

In a P2P scam, a buyer could select an ad with a legitimate payment method such as bank transfer, but would pay with a cheque knowing it will bounce. They might try convincing the seller to accept a cheque or even send it without a warning. The seller will release the funds before realising that there is not enough money in the counterparty’s account to clear the cheque.

How to Spot and Avoid a Cheque Scam

Now, how can you spot and avoid these cheque scams? The first method is simple: don’t ever accept payment in the form of a cheque. Binance P2P doesn’t support cheques due to the reasons laid out above. However, you still must be extra vigilant. You might expect the payment to be completed via the payment method mentioned in the ad, but a scammer will ignore that and send you a cheque instead. There are two scenarios in which they might do this:

The buyer might tell you that they had selected the bank transfer payment method (or any other payment method listed on your ad) but cannot use it anymore. This could be due to an issue with their account, and they want to pay by cheque instead. An informed user would know this behaviour is suspicious and immediately refuse to proceed.

A more common scenario is when the buyer does not even ask you to use a cheque. Instead, they will directly use a cheque deposit and transfer the money to your account, in which case you are unable to reject it.

How do you avoid these scams?

Here are a few tips on how to keep yourself safe:

1. If the buyer mentions wanting to pay with a cheque, immediately say no. If they try to pressure or convince you, stand your ground and raise an appeal to ask for customer service’s help to cancel the trade.

2. If the buyer has sent you the cheque without informing you and made you believe they have completed the payment using the listed payment method, don’t be convinced with just a quick glance at their receipt. The screenshots or receipts they usually provide can be very convincing and you usually wouldn’t be able to spot anything suspicious. For example, you wouldn’t find any “Cheque” on the screenshots or receipts, see the reference below.

3. Always remember to double-check the transaction details directly on your bank account. Do not release your crypto based on the counterparty’s payment screenshots of receipts: Photos can always be edited. One way to identify a cheque payment is to check whether the transaction details on your account state that it is a cheque deposit or not. When it is a cheque deposit, you will always see “Cheque Deposit” or “CDM” (Cheque Deposit Machine) on the payment. When you spot they’ve made a payment via cheque, do not release the funds and raise the issue with customer support.

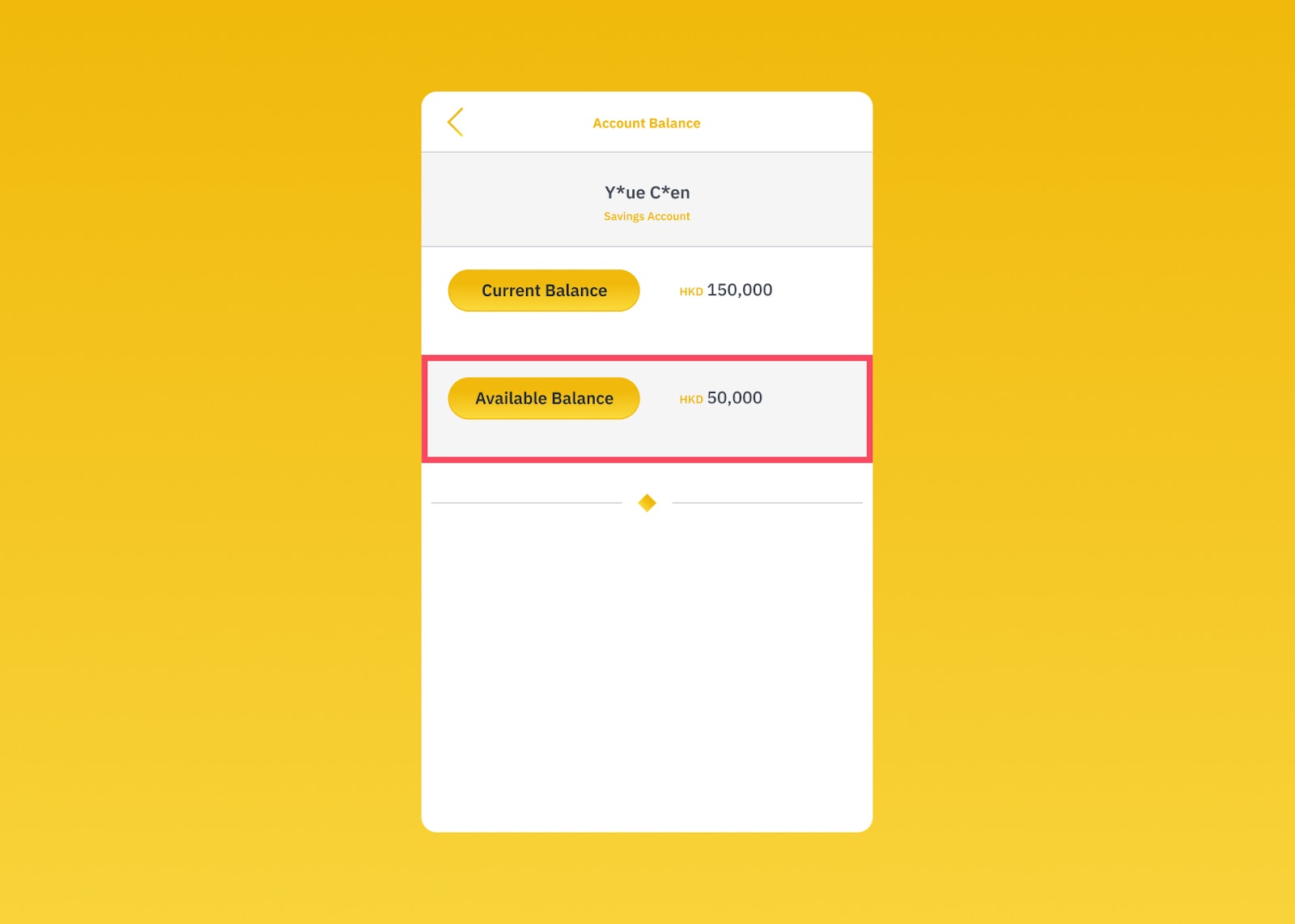

4. Another way to identify and avoid a cheque payment is by specifically checking your available balance in your bank account. Remember that available balance and current balance are two different things. Just because the amount appears on your current balance doesn’t mean that the money is available to you. As you can see in the screenshot below, your available balance doesn’t include the payment of 100,000 HKD claimed to be made by the buyer. This would be an indicator of a fraudulent payment made by cheque.

You can also verify the funds’ availability by attempting to transfer said payment right away. If you are unable to, it’s a scam. If you suspect a scam, always raise the issue with our customer support team or start an appeal.

Keep Yourself Safe From Cheque Scams

You should always pay attention to details and be vigilant when trading crypto P2P. As mentioned, make sure that payments are only made to you by methods that Binance supports and always study payment details carefully. While the Binance P2P platform prioritises your security with its escrow service, it’s always beneficial to notice, spot, and avoid scams yourself.

Trading on Binance P2P

With Binance P2P, even more people can access cryptocurrencies with their local fiat currency. On-ramping into crypto hasn’t always been easy, but the process is now much easier with 100+ fiat currencies supported and 700+ payment methods. And best of all, P2P users benefit from Binance’s support and safeguards too.

For more support and information, refer to the following articles:

(Support) How to Buy Crypto Through Binance P2P on the Website and the App.

(Support) How to Sell Crypto Through Binance P2P on the Website and the App.

(Support) How to Post Trade Ads on Binance P2P Through the Website and the App.

And more Binance P2P FAQ topics

Disclaimer: Your use of Binance P2P services and all information and other content (including that of third parties) included in or accessible from Binance P2P services is at your sole risk. Our only responsibility is to handle crypto transactions. All payments are final upon completion unless otherwise required by law. The Binance P2P platform has neither the right nor obligation to resolve any disputes arising from a completed payment. Neither the Binance P2P platform nor merchants shall be responsible for your loss in a completed payment.