CZ’s Statement on the Recent STEEM Hard Fork

Binance CEO Changpeng Zhao (CZ) released a statement about Binance’s actions in light of a recent STEEM hard fork that turned asset balances on a few addresses on the STEEM network into zero.

Once again, we find ourselves spending what would otherwise be a much more productive Friday night (and Saturday) on another issue about STEEM. This one is trickier than before. There are also some deeper insights and implications. Again, in our tradition of transparency, here is my perspective on it.

Here’s the background: There is another STEEM upgrade/hard fork, and this time, we are more careful about it. There is no power-up and no voting involved. But this one is tricky. The recent upgrade turned asset balances on a few addresses on the STEEM network into zero.

We are very much against zeroing other people’s assets on the blockchain. This goes against the very ethos of blockchain and decentralization. The fact that this can happen on a blockchain means it is overly centralized.

We don’t want to support this upgrade. But there is a flip side. If we don’t support it (technically), no users can withdraw any STEEM coins. The wallet stopped syncing at a certain height, and there are no other forks. We waited to see what other exchanges would do. And soon enough, other exchanges did the upgrade and enabled withdrawals. Lots of our users demand it as well.

We are faced with a tough decision. We could hold all of our STEEM users’ funds indefinitely, or we could do the upgrade and let them withdraw. Our team asked me to weigh in on this one.

I went through our first principles. We protect our users. This includes protecting their ability to get forked coin rewards and their freedom to withdraw. And we want to stay neutral.

Typically, if there is a disagreement in a coin’s community, a fork is the way to settle it in a decentralized world. And we generally try to support most reasonable forks so that our users get the “forked coins,” usually worth something - however small.

In this case, it was tricky as there is no other fork present. But this is a hard fork, by the term’s very technical definition. So we should support it, technically.

When other forks become available, we would support the other forks too (assuming they have a decent number of users following it). In this case, I would almost encourage the community to create a new fork, especially given that the few victims involved seem to have the capability to create forks. They forked out HIVE from STEEM not long ago. It’s not a pleasant situation for them; it’s a lot of extra work. It’s also definitely not a pleasant situation for us either; it’s a lot of extra work for us too, without much return. But a fork is the standard method to deal with this type of issue in a decentralized world.

We do not want to block people’s funds. In this case, we should allow users to withdraw their funds, whether we willingly support this hard fork or not.

So, I gave the go-ahead on the technical upgrade and enabled withdrawals for Binance.com. At the same time, we agreed that we will likely support any other reasonable community forks (assuming it does not contain other issues). We will also reduce the support for STEEM over time, reducing the number of pairs announced, and not ruling out other actions too.

Most people in the community are supportive of our approach. We also have received some interesting and controversial opinions.

A number of users say we should freeze STEEM tokens indefinitely. (We can’t.) Others said we should delist STEEM immediately, but this also hurts many other innocent people who hold STEEM. I think most of these comments come from people who do not hold STEEM. It’s easy to say something when you have no skin in the game. Then I see this reaction:

While I feel for Dan’s loss, I don’t think it reasonable to hold other users’ STEEM assets indefinitely. The best advice I can give to Dan is to create a fork of STEEM just before the hard fork, and we will likely support that. This is not for “convenience.” We choose to do the extra work precisely because we value the responsibility we have to our users.

This also reveals a deeper issue. Blockchains are susceptible to 51% attacks and potential centralization. We don’t like to talk about it. We like to think of blockchain as 100% immutable, but that’s not always the case. I think we should face reality, understand the risks, and manage it accordingly. If a blockchain gets overly centralized, we should fork away from it.

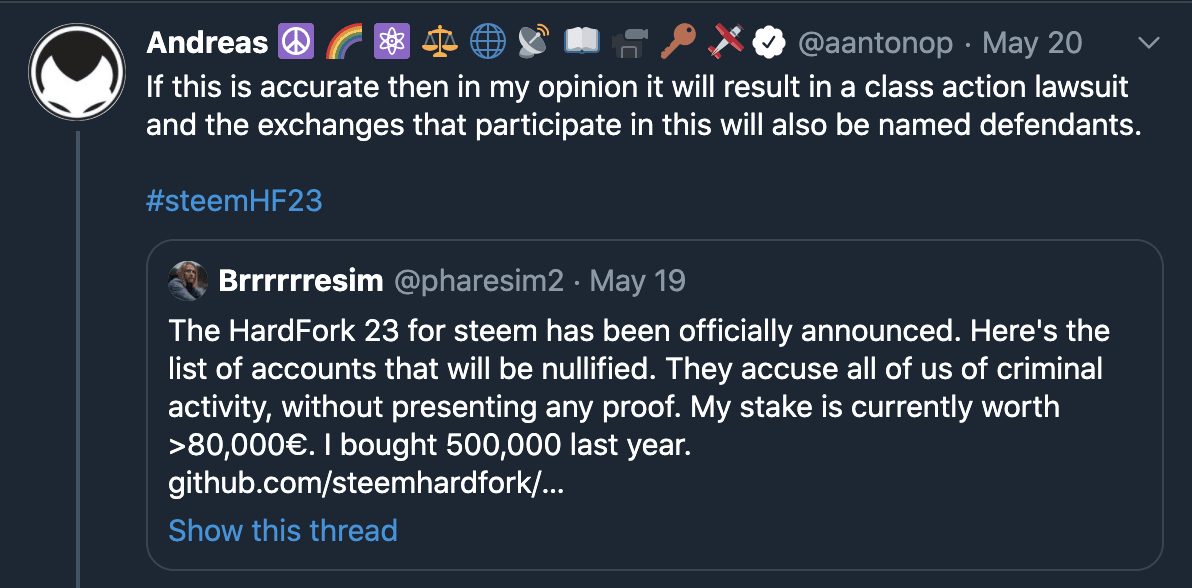

One other interesting tweet I came across was from Andreas Antonopoulos, three days prior.

Andreas Antonopoulos was briefly my colleague at one point. We meet at conferences. He is someone I truly admire for his decentralization content (books and podcasts). It is for this reason that I was very surprised to see him suggesting “a class action lawsuit” to settle blockchain hard forks, consensus, and decentralization issues. I would have thought that would go against everything he is preaching. In a decentralized world, anyone should be able to support any fork. Exchanges providing choices for users to get a “forked coin” is no different by definition. The reverse is a problem (i.e., if exchanges prevent users from getting the coins they are supposed to get, either via a fork or withdrawals.) But anyway, that’s that.

Overall, I hope the above shows the intricacies of the decisions we have to make as an exchange, some of the misunderstandings and blame we have to carry, and some of the fallacies we face in a decentralized world. I don’t recommend any misconceptions about decentralization being a utopia. I do believe decentralization solves many of the problems we face today, but at the same time, it will create its own set of problems, which we have to work together to solve so that we build a healthier decentralized ecosystem.

- CZ