Exploring the World of Liquid Staking Tokens (LSTs) and ETH Staking

This is a general article. Products and services referred to here may not be available in your region.

Main Takeaways

Liquidity staking tokens (LSTs) are DeFi products that allow users to trade, transfer, and utilize yield-bearing staked assets that are otherwise subject to a lock-up period.

LSTs enable greater capital efficiency and increased liquidity on proof-of-stake blockchains. Users can then leverage staking benefits and DeFi opportunities simultaneously.

Wrapped Beacon ETH (WBETH) is a versatile LST representing staked ETH and its rewards.

Earning opportunities with WBETH include buying and holding, liquidity farming, lending, borrowing, and participating in structured products.

Earning with WBETH offers a range of options, from simple yield generation to more complex DeFi strategies.

It’s hard to overstate how much cryptocurrencies and blockchain technology have shaken up the financial world. We’ve seen a whole community emerge and develop new digitized forms of exchange and even financial products themselves.

Many of these products solve unique blockchain issues. In the decentralized finance (DeFi) ecosystem, where staked assets are common, improving liquidity is a prevalent goal. The popularity of liquidity staking derivatives (LSDs) is a great example of the community’s ingenuity in reaching this goal.

If you’ve got staked assets such as Ether (ETH) and are looking for more ways to capitalize on them, LSDs may be what you’re looking for. With Binance, you’ve already got LSD earning opportunities at hand.

Understanding LSDs and WBETH

LSDs are DeFi products that allow holders of staked assets to trade or invest their staked tokens while still receiving staking rewards. This process effectively provides liquidity to otherwise illiquid staked assets. LSDs are common with ETH staking, which involves locking up Ethereum in a network-supporting smart contract in return for ETH rewards.

Let’s look at a quick example. When staking ETH via Binance, you’ll receive Beacon ETH (BETH) at a 1:1 ratio. The on-chain rewards you earn from your staked ETH are then distributed to you in additional BETH. When you want to retrieve your ETH, you simply turn in your BETH to unlock your initial deposit.

Introducing WBETH

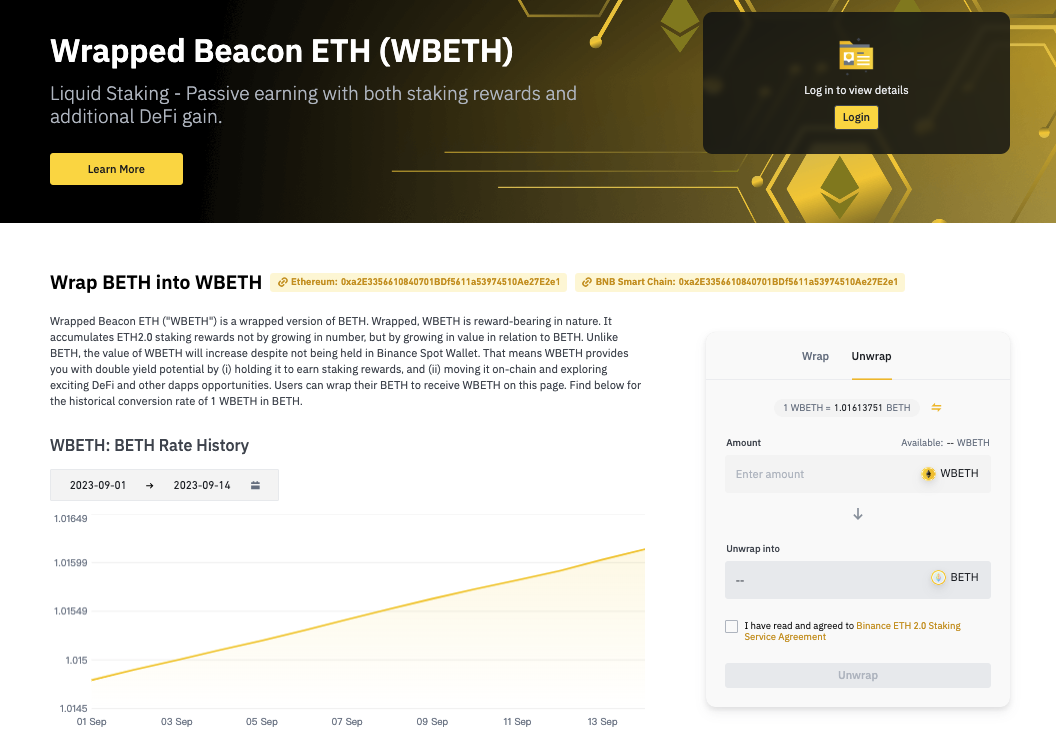

You can now also wrap your BETH, transforming it into Wrapped Beacon ETH (WBETH). 1 WBETH represents 1 BETH plus the staking rewards accrued.

We call this nature “reward-bearing,” as the underlying value of WBETH increases over time in relation to ETH. The conversion rate between BETH and WBETH changes on a daily basis in accordance with the daily accrued rewards from ETH staking.

You can use WBETH to participate in DeFi projects outside Binance and still receive the corresponding ETH staking rewards accrued.

There Are Multiple Ways to Earn With WBETH

Binance Spot

By simply buying and holding WBETH, you can earn BETH rewards that are redeemable for ETH. Acquiring WBETH from Binance is a straightforward process and you can find the exact details with our How to Buy Wrapped Beacon ETH (WBETH) Guide.

Once you’ve received your WBETH, you’ll automatically start accumulating rewards. The daily staking reward won’t be distributed to your Binance Spot Wallet as held BETH; instead the reward will accumulate and auto-compound at the token's conversion rate until claimed.

Once your WBETH is unwrapped, the BETH amount you get back will be more than the pre-wrapped amount, reflecting the reward you’ve received.

Liquidity farming

Liquidity farming is a popular earning mechanic in DeFi. It involves providing liquidity to decentralized exchanges (DEXs) and earning rewards for doing so. Stakers can then compound their rewards manually or with smart contracts to increase their earnings.

To start liquidity farming, you’ll need to provide a pair of tokens to a liquidity pool. In our case, we could use WBETH and ETH. Users who swap between the pairs in the pool pay a fee to you as a liquidity provider. Note, however, that there is always the risk of impermanent loss when entering liquidity pools.

Lending and borrowing protocols

WBETH can be leveraged within lending and borrowing protocols to earn yields or enhance capital efficiency. For example, you could deposit WBETH into a lending platform that allows you to earn interest on your assets.

Your WBETH would then be lent to other users who pay a fee for the service. Additionally, WBETH can be used as collateral to borrow other assets, effectively leveraging your holdings to access additional liquidity. This can be particularly useful when you want to access additional funds without liquidating your WBETH holdings.

If you’re interested in learning more about crypto lending, head to our Binance Loans page. There, you can see exactly how much you could borrow with the loan-to-value (LTV) figures available.

Structured products and yield aggregators

Structured products and yield aggregators offer advanced DeFi opportunities for optimizing returns on your crypto assets. As mentioned previously, you could use a smart contract to reinvest and automatically compound your liquidity pool earnings.

WBETH can be used as an asset within these services to access more structured investment strategies. These products take simpler services and put them together, often referred to as “DeFi Legos.”

Structured yield tokens are another popular product among DeFi investors. These tokens represent claims on future yield generated by liquidity providers. WBETH can be utilized within this ecosystem to access these structured yield tokens, allowing you to participate in more complex DeFi strategies.

WBETH Earning Opportunities Are Diverse

In the ever-evolving DeFi world, LSDs have opened up a wide range of earning opportunities. WBETH holders can explore this ecosystem in as much depth as they want.

If you’re looking for simple yields, there’s plenty to find on Binance. You can also head into the decentralized world for more structured products and offerings. As always, make sure to do your own research before investing in a project or product.

Further Reading

Disclaimer: Digital asset prices can be volatile. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions, and Binance is not liable for any losses you may incur. APR is an estimate of rewards you will earn in cryptocurrency over the selected timeframe. It does not display the actual or predicted returns/yield in any fiat currency. APR is adjusted daily and the estimated rewards may differ from the actual rewards generated. Not financial advice. For more information, see our Terms of Use and Risk Warning.