Top 5 Lessons from CZ on MasterClass

Main Takeaways

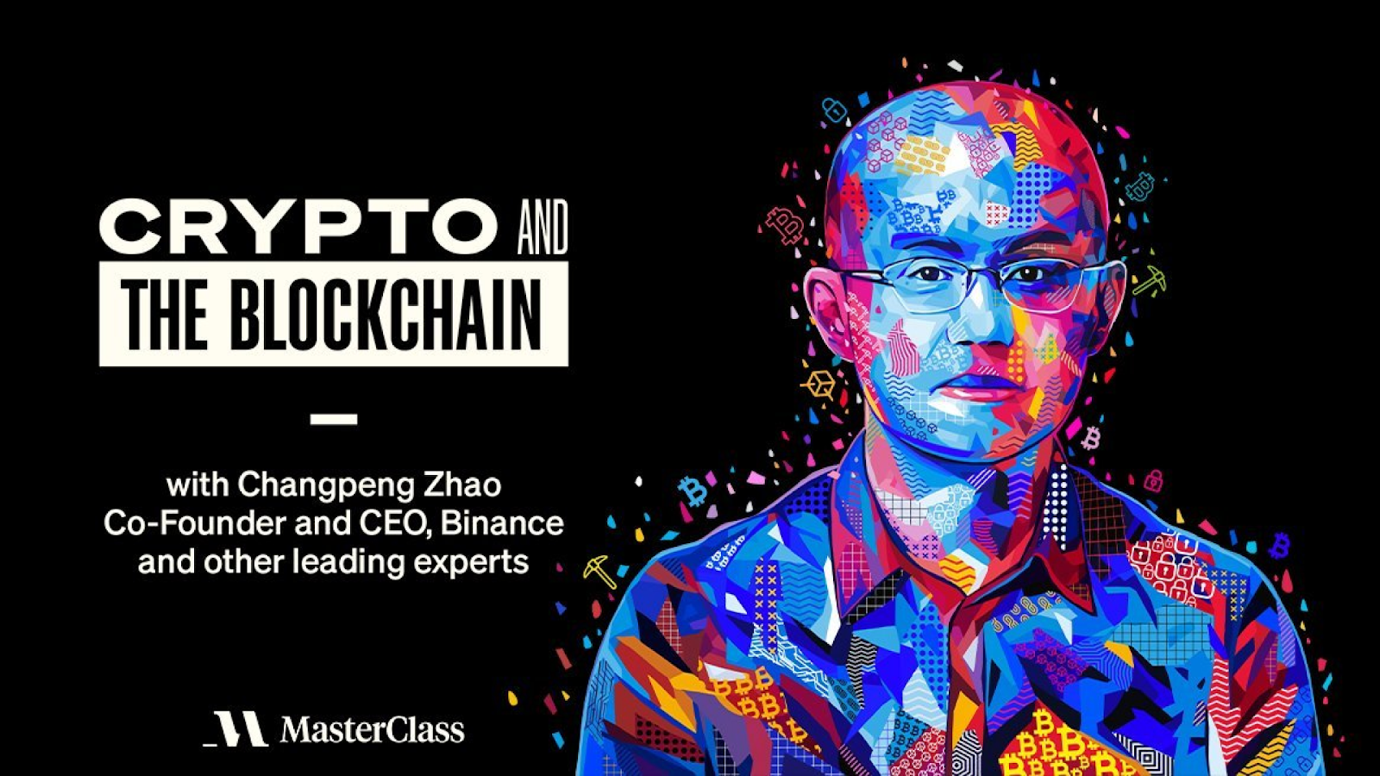

MasterClass is a streaming platform with hundreds of video lessons. In December 2022, they released a new class on crypto and blockchain.

CZ was one of four experts selected to teach the class on crypto, which has been one of the most requested topics on MasterClass.

Consisting of three hours and 40 minutes of video material, split across 18 lessons, the class is available to anyone with a MasterClass subscription.

During the class, the four experts, including CZ, share insights on key topics such as the transfer of value, crypto custody, decentralization, risk management, and the future of crypto.

CZ, Binance’s CEO, joined fellow experts Emilie Choi, Chris Dixon, and Paul Krugman as one of the instructors for MasterClass’s class ‘Crypto And The Blockchain’. We dive into some of CZ’s insights from the nearly four hours of lessons as a taste of what to expect.

MasterClass is a streaming platform with hundreds of video lessons taught by 180+ of the world’s best. These online video lessons mean that anyone, anywhere, can access this expert knowledge and be inspired. On December 8, Binance’s very own Changpeng ‘CZ’ Zhao, CEO and co-founder, became a MasterClass instructor, thanks to the release of a new class on the platform called Crypto And The Blockchain.

CZ was one of four experts selected to teach the class on crypto, which has been one of the most requested topics on MasterClass. Consisting of three hours and 40 minutes of video material, split across 18 lessons, the class is available to anyone with a MasterClass subscription. Anyone who subscribes to MasterClass unlocks access to all 180+ classes on the platform. Read on for five key insights shared by CZ in his class on MasterClass.

On The Transfer Of Value

Thoughts from CZ [Lesson 2]: “Blockchain is just a new way of transferring value . . . The pizza transaction [the first known purchase of physical goods with bitcoin] was actually a milestone. At some point it [bitcoin] reached one dollar. People said: ‘That’s impossible. This is magic internet money’. Then it went to 10 dollars, to 30 dollars . . . Then guess what? It crashed to two dollars again . . . ‘Oh, this is a scam’ . . . All the things we see today, we saw many times. And slowly the market recovers.”

Main takeaway: although crypto and blockchain are often covered in the media in relation to speculation and investment, CZ’s lesson here is that we shouldn’t ignore or forget about crypto’s key use cases, such as payments and value transfer.

The view from Binance: more and more people around the world are now using cryptocurrencies such as BNB, BTC, and BUSD to transfer value. Large retailers, such as Microsoft and Starbucks, as well as a multitude of small businesses, accept crypto for their goods and services. Don’t speculate. Focus on crypto’s use cases.

On Holding Crypto

Thoughts from CZ [Lesson 2]: “There is still one key missing piece, which is that it’s not easy for an average person to hold crypto securely. The technology has to improve quite a bit for the industry to reach mass adoption.”

Main takeaway: for crypto to reach the masses it needs to be easy. At the moment, anyone can hold crypto themselves in a self-custodial digital wallet, but that also puts pressure on users to handle their own security. Setting up a wallet needs familiarity with how a seed phrase works, and how to keep it safely, without putting funds at risk. Make a mistake and there’s no one to help you.

The view from Binance: we believe that Binance is a good gateway into crypto as it helps users look after their digital assets via a custodial service. This means there’s always someone to help, and Binance always puts customer security first.

On Decentralization

Thoughts from CZ [Lesson 9]: “Decentralization versus centralization is not black and white. Many people have a very simplistic view . . . Some people, for example, say, ‘Okay, if I hold my keys in my wallet, this is decentralized, while if I hold it on an exchange then this is not.’ But it is not that black and white . . . Most average people don’t think about centralization versus decentralization . . . What they do care about is freedom of transactions, low cost, security and ease of use.”

Main takeaway: decentralization is not binary. There are multiple aspects to it. Every aspect is part of a gradient. It’s also important to remember that decentralization is part of the journey towards something better — not the goal itself. The goal is freedom, security, and ease of use.

The view from Binance: centralized exchanges such as Binance provide an incremental step for users to access crypto, and can act as a bridge between centralized and decentralized systems. At Binance, we believe in taking incremental steps as well as providing users with options for all available tools.

On Managing Risk

Thoughts from CZ [Lesson 17]: “Do your own research, don’t put all your eggs in one basket, especially if it’s high return. High return is always high risk . . . I always say one thing . . . How to measure risk . . . Look, in the worst case, if your investment went to zero, your life is still okay . . . If your answer is no, and your life will be impacted, you’ve invested too much. You need to reduce your portfolio size.”

Main takeaway: responsible trading is about having complete control over your trades and taking responsibility for your actions. Trading responsibly ultimately means not spending beyond your means. In other words, don’t risk money that you can’t afford to lose.

The view from Binance: minimizing risk is a priority for many investors and traders. However, there's more to risk management than simply choosing less risky trades or investments. A comprehensive toolset of risk management strategies is available, many of which are suitable for beginners.

On The Future

Thoughts from CZ [Lesson 18]: “I think that crypto . . . there is the short term and the long term. Short term: there will be a lot of fluctuations; the industry players are still building. In the long term I think we will see massive adoption of the technology . . . 20 years from now it will reach 80-90% adoption.”

Main takeaway: if you’re only now just getting interested in crypto, remember that you’re still early. The potential of this technology and space is huge, and mass adoption is very much still to come.

The view from Binance: we only turned five in 2022. Since 2017, the team has grown over 200 times. We support 18 different languages, and have served more than 120 million users. Binance is now the leader in one of the world's fastest industries. It’s a great responsibility that we’ll never take for granted.

MasterClass’s Crypto Experts

As well as CZ’s contributions, the course features three other experts who act as instructors throughout the class. Their knowledgeable voices offer unique perspectives on where crypto has come from, how things are now, and where it’s going.

Changpeng Zhao (CZ), Founder and CEO of Binance Exchange

Emilie Choi, President and COO of Coinbase

Chris Dixon, Founder and managing partner of a16z crypto and general partner at Andreessen Horowitz

Paul Krugman, author, NYT columnist, and Nobel Prize-winning economist

Since Bitcoin’s launch in 2009, crypto has offered the hope of a stronger, more democratic financial system. And it’s raised plenty of questions as it continues to evolve. The insights above are just a small sample of what’s discussed in the class “Crypto and the Blockchain” on MasterClass. Check out the full class on MasterClass for even more detailed knowledge that will take your crypto understanding to the next level.

Learn more about MasterClass:

Read the following articles on Binance to learn more about CZ, crypto, and blockchain:

Risk Disclaimer: Cryptocurrency prices are subject to high market risk and price volatility. You should only invest in products that you are familiar with and where you understand the associated risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment. This material should not be construed as financial advice. Past performance is not a reliable indicator of future performance. The value of your investment can go down as well as up, and you may not get back the amount you invested. You are solely responsible for your investment decisions. Binance is not responsible for any losses you may incur. For more information, please refer to our Terms of Use and Risk Warning.