How and Why Assets Move Between Binance Wallets

Main Takeaways

The transparency of blockchain is a feature, not a bug. It ensures that this new financial system is open to the scrutiny of users across the globe – unlike traditional finance, where corruption and criminal activity can go undetected for decades.

In the spirit of blockchain’s transparency, Binance publishes its cold and hot wallet addresses, which allows outsiders to view the exchange’s core wallet operations.

Some media publications have recently taken to publishing reports where massive leaps to conclusions are made based on incorrect interpretations of the blockchain data. These false conclusions fuel conspiracy theories that are often accepted at face value due to the limited understanding that most media have of the blockchain and how crypto exchanges ensure smooth operations and liquidity and guard users from security threats.

Large crypto exchanges run sophisticated wallet management systems that have to operate dynamically with cold and hot wallets to ensure both liquidity and security. To avoid scrutiny, some exchanges, such as FTX, have decided in the past to keep many of their wallet addresses secret. However, Binance has decided that regardless of the bad press, it will not abandon its commitment to the transparency that blockchain embodies.

We keep an internal ledger that records exactly how much each of our users is entitled to — all verifiable through our proof-of-reserves system.

We welcome scrutiny – it makes us and the industry stronger. But not having the full picture of how our processes work is leading some reporters to incorrect conclusions. Our response here is designed to engage and educate both users and the media as best we can.

Since the implosion of FTX, our industry has been subject to a lot of scrutiny. We get it. No company, particularly one that’s trusted with people’s money, should ever be allowed to operate with impunity. And, as the industry’s leading exchange, Binance has gotten its fair share of tough questions.

One significant source of interest has been in the movement of funds across blockchain wallets, which is the subject of some recent “analyses” that appeared in the media. We’ve seen external sources making huge leaps to conclusions based on flawed observations about assets’ movement on the blockchain. These conclusions are then used to fuel false narratives that confuse investors and attempt to put Binance on par with some of the most unscrupulous actors in the space – all the while collecting a lot of views and clicks.

These misinformed accusations damage not only Binance, but the industry at large undermining responsible players’ attempts to build user and regulator trust. Our hope, at least, is that they are driven by the observers’ inability to accurately interpret data rather than by malicious intent.

Since such “investigations” have become a recurring theme, we see it as an opportunity to engage the public on the logic and to share some technical aspects of how funds move on our exchange, dispelling these unfounded claims.

Before we get into the details, it’s important to note that our users are able to withdraw their funds whenever they wish – as has been demonstrated time and time again, even during times of heavy negative news like in December 2022. This would only be possible if user funds are managed conservatively and carefully.

We don’t think there is more convincing evidence of an exchange run properly than having thrived through multiple bear cycles and massive waves of FUD-driven panic runs that would have made some of the world’s largest traditional financial institutions collapse. Again, a feature not a bug.

Explaining Binance’s Wallet Management System

The average 24-hour trading volume on Binance is currently around $38 billion on multiple blockchain networks. This is significantly greater than any other exchange.

Large crypto exchanges today run sophisticated wallet management systems that most people do not understand. At Binance, we have to operate dynamically with cold and hot wallets to ensure the necessary liquidity to meet every order in real time while mitigating potential security threats. Keep these two aspects of our system in mind (liquidity and security) as they are fundamental to the way our wallets operate.

As we have detailed previously, we maintain a vast network of hot, cold, and deposit wallets to quickly and efficiently move the funds around. We also keep an internal accounting ledger that tracks in real time the assets entitled to each individual user (all verifiable through our proof-of-reserves, or PoR system) – but for an outside observer, accurately interpreting the movement of funds is virtually impossible. It’s also important to note that our PoR system only records funds in custody against user liabilities and funds in reserve – and never includes any assets that are owned by Binance and set aside for its own corporate uses. User assets are tracked entirely separately from Binance’s corporate holdings.

Add to that the fact that the movement of funds between wallets could serve a variety of purposes. A transaction between a Binance cold wallet and a Binance hot wallet is often needed to ensure liquidity for tokens in demand or to support a large one-time user withdrawal – which could be an individual “whale” or a hedge fund with a Binance institutional account. A transaction between Binance wallets in the opposite direction can mean that the funds are headed to offline storage for greater security. The movement of funds between a Binance hot wallet and an outside wallet is usually a user withdrawal, and the opposite is most likely a user deposit.

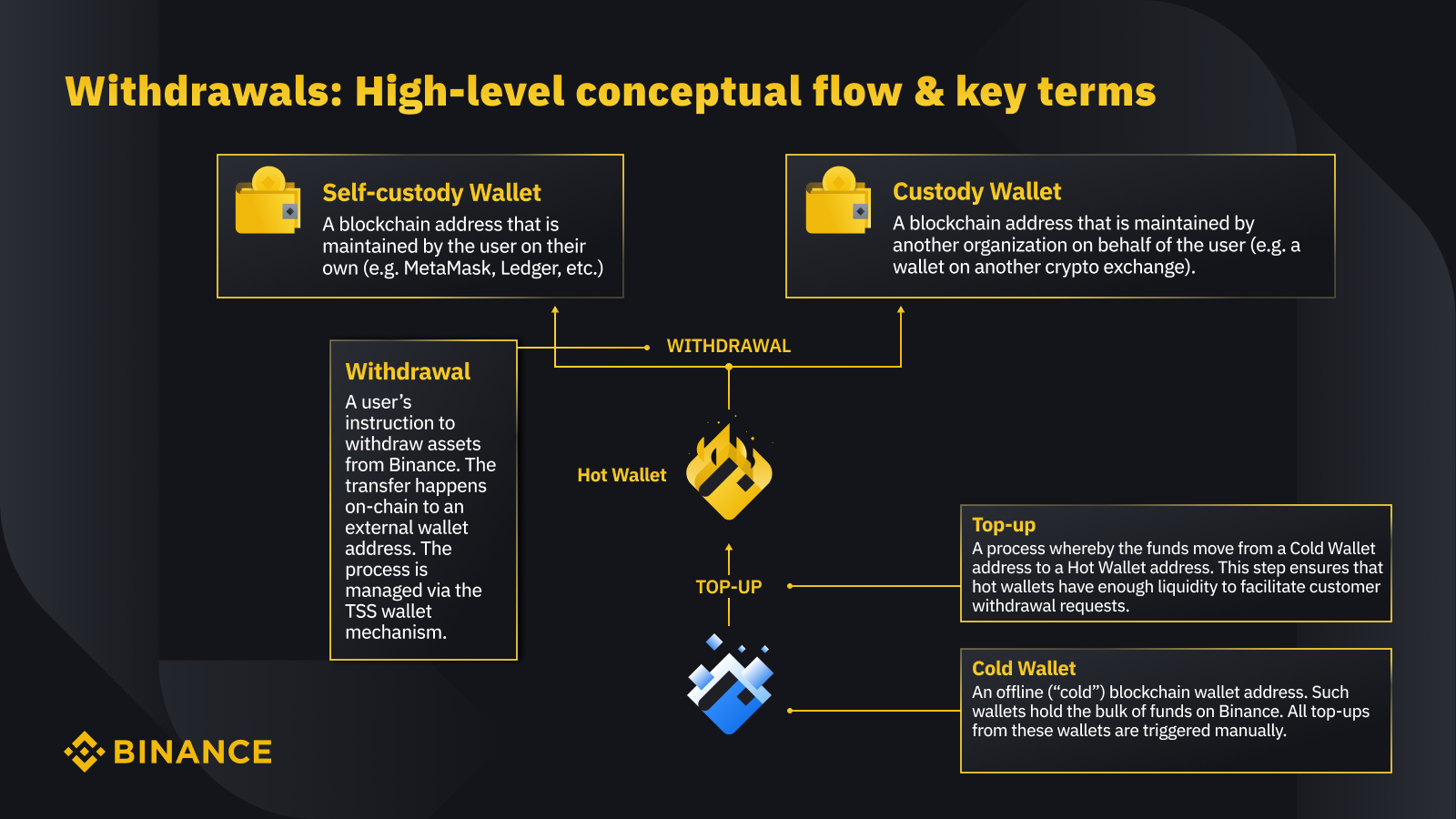

The chart below is designed to give you a high-level insight into how user assets move on Binance. When a user deposits funds to our platform, they go to what we call a deposit wallet and get reflected in the user’s Binance account.

Binance periodically “sweeps” the funds residing in deposit wallets into omnibus hot wallets in a process called consolidation. Hot wallets facilitate withdrawals such that, upon receiving a withdrawal request, our system sends the user funds from the hot wallet, simultaneously deducting the corresponding amount from their account balance. Consolidating funds within the hot wallet helps us meet withdrawal requests while keeping wait times and costs for users low.

Excess funds are moved from hot wallets to safe storage in cold, or offline wallets. We refer to this process as overflow. Once a hot wallet runs low on funds, it might need a top-up from a cold wallet.

What is important to note here is that the sweeping and moving of funds between the deposit, hot, and cold wallets – all visible on the blockchain – occurs totally independently of user account balance updates.

Correcting Recent News Reports

Some media publications have recently taken to publishing reports where massive leaps to conclusions are made based on incorrect interpretations of blockchain data. These false conclusions fuel conspiracy theories that some may accept at face value due to the limited understanding that most media have of the blockchain.

Usually, with these reports, it’s not clear which of our wallets the journalists are trying to analyze, or how they are deciding to decode the different movements of assets on the blockchain. But not having the full picture of how our processes work is leading some reporters to incorrect conclusions about the nature of the transactions they see. This is why they often feature ludicrous leaps to conclusions that leave readers with nothing more than spurious (but legally “grey”) open-ended questions as a conclusion.

The transactions mentioned in the most recent reports are simply a case of institutional clients withdrawing their own assets from our platform — rather than a case of us misusing collateral to “pay off hedge funds,” as one misguided journalist suggested. That sort of wild conclusion could only be made as a result of a fundamental misunderstanding of wallet management.

In fairness, many of these reports, whether old or new, tend to focus on a period when the distribution of user funds, our own funds, and collateral funds between our wallets was not perhaps as straightforward as it could have been. This problem of clarity was further compounded by the frequent internal movement of funds between our multitude of wallets. This seems to have led to outside observers having an insufficient understanding of the processes involved and fundamentally misunderstanding transactions.

All these reports have one thing in common: they fail to understand that at no time were our wrapped tokens undercollateralized, and we always kept sufficient reserves within our accounts. This is why we have worked so hard on further developing our proof-of-reserves and proof-of-collateral systems at the end of 2022 and early 2023.

Binance holds all of its clients’ assets in segregated accounts. User funds are verifiable via our PoR system, which provides proof of user assets in custody as well as user liabilities using zero-knowledge proof, the first of its kind in the industry. The latest iteration of our PoR system includes proof of collateral for B-tokens, and all interested parties can verify the soundness of reserves behind Binance-minted wrapped assets at any time.

While Binance has previously acknowledged that wallet management processes for Binance-pegged token collateral have not always been flawless, at no time was the collateralization of user assets affected. Processes for managing our collateral wallets have been fixed on a longer-term basis and this is verifiable on-chain.

Final Words on Wallet Management

We welcome the scrutiny – we believe it will make the entire industry stronger and rebuild trust in the financial system. That said, efforts to try and paint Binance as behaving like FTX have failed – and they will continue to fail. Why? It’s because we hold user assets 1:1 and have demonstrated, time and time again, that users may withdraw their funds at any time they’d like.

Some will bend over backwards to nitpick minor disruptions that we’ve had in the past around extremely short-term operational challenges, however users see through those types of “whataboutisms.”

Binance maintains completely separate ledgers for user funds, pegged assets, and its own holdings. At any given moment, we know exactly how much money each of our users is entitled to, and we hold sufficient funds to honor any withdrawal request. And, again, it’s all verifiable via the PoR system.

We will continue to do our best to engage and educate journalists and others on how this all works. And, we’re always happy to answer sincere questions from anyone looking to learn more.