Trade

Disclaimer: In compliance with MiCA requirements, unauthorized stablecoins are subject to certain restrictions for EEA users. For more information, please click here.

Binance BTCDOM Index is a cryptocurrency price index reflecting the market dominance performance of Bitcoin. The BTCDOM Index is a metric that traders can use to quickly get a sense of Bitcoin's value relative to that of the broader cryptocurrency market.

Unlike the real Bitcoin market dominance indicator, which is capped within 0~100%, the BTCDOM index is uncapped and more suitable for derivatives trading. It is calculated with Bitcoin price denominated in the constituent cryptocurrency, e.g. BTC/ETH, BTC/BNB, BTC/ADA, etc.

The BTCDOM Index provides insights into the market and can be used as a tool to speculate on Bitcoin’s relative strength against altcoins. Essentially, the index measures the demand for Bitcoin relative to altcoins.

When altcoins gain market share relative to Bitcoin, the BTCDOM index loses value. Conversely, when Bitcoin gains market share relative to altcoins, the BTCDOM index will gain value.

In certain conditions, if Bitcoin falls in price, but the rest of the cryptocurrency market falls at a similar rate, then Bitcoin dominance is likely to remain the same.

Index Symbol | Index Name | Description | Base Date |

BTCDOMUSDT | USDT BTCDOM Index | BTCDOM index denominated in USDT | 2021-06-21 02:30AM (UTC) |

The base level is 1000.

3.1. Sample Universe

The sample universe includes the top 20 cryptocurrencies by market capitalization listed on Binance and Binance Futures excluding Bitcoin and stablecoins.

3.2 Constituents Selection

All cryptocurrencies listed on Binance and Binance Futures are prioritized and ranked by market capitalization for index inclusion.

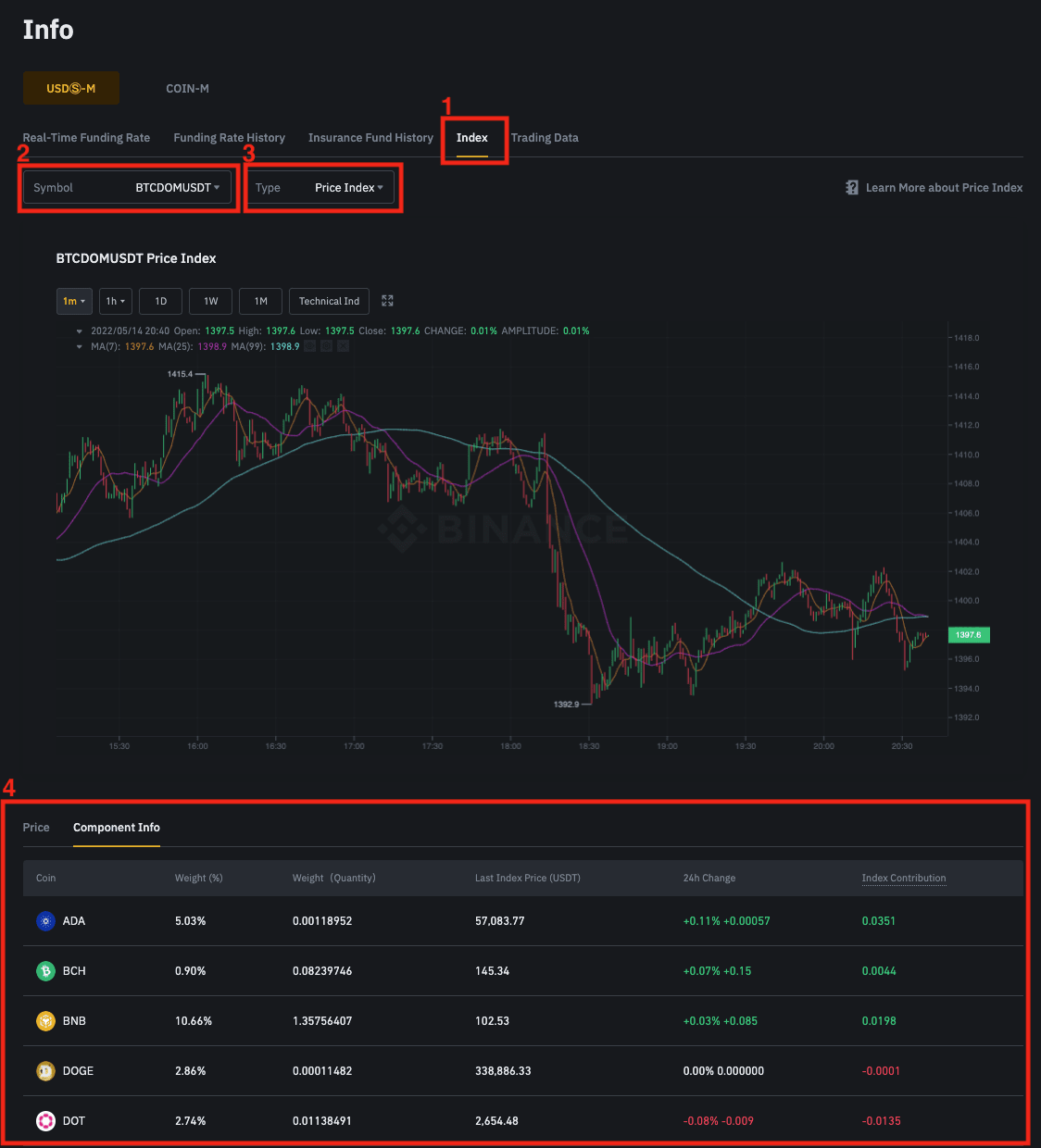

To review the constituents selected, click here and go to [Index], select [Symbol] - BTCDOMUSDT], select [Type] - [Price Index], scroll down and click on [Component Info].

The BTCDOM Index is calculated with the weighted average prices of its constituents. The price used for the BTCDOM index is different from other indices because it is calculated with Bitcoin price denominated in the constituent cryptocurrency, e.g. BTC/ETH, BTC/BNB, BTC/ADA, etc.

The formula is:

In which n is the constituents count, pi is the latest price of constituent i (denominated in the index denomination), wit is the weight of constituents i at the latest reported time t, Divisort is the latest stable divisor, which ensures a continuous change of index constituents/weight and the index price affected only by the constituents price change.

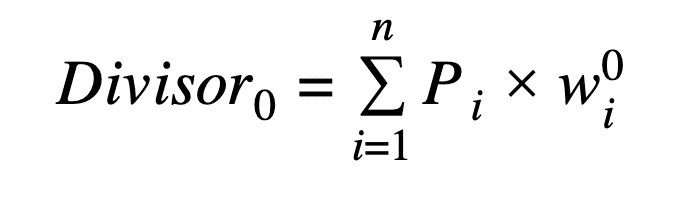

The divisor on base-day is:

And at report time t:

In which nt is components count at report time t, and nt-1 is the components count from previous report time.

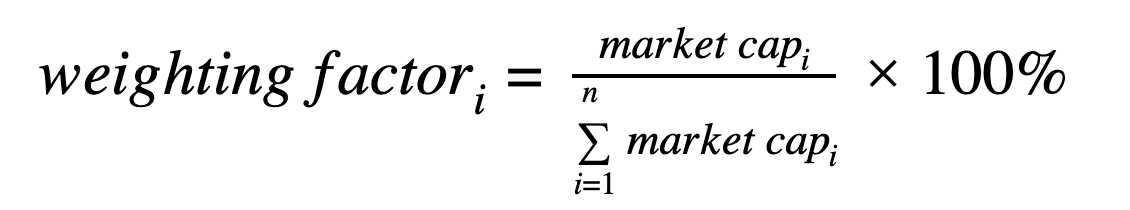

The weight is calculated by a weighting factor (the weight will remain unchanged between rebalances):

The weighting methods for Binance BTCDOM Index is market cap weighting with a weighting factor calculated as follow:

The market cap i (at rebalancing time) is the market cap of constituent i, all metrics are measured with the index denomination.

The following table shows an example of how the BTCDOM Index is calculated:

Quote | Name | Market Cap ($) | Weight in % | 1/Price in BTC (Last Rebalance) | Weight (Quantity) | Index (Last Rebalance) |

ETH | Ethereum | 292,557,000,000 | 46.81% | 13.4164 | 34.890348 | 1000.0 |

BNB | Binance Coin | 54,315,456,382 | 8.69% | 95.8330 | 0.906859 | |

ADA | Cardano | 50,706,647,036 | 8.11% | 21,795.0988 | 0.003723 | |

DOGE | Dogecoin | 42,579,375,329 | 6.81% | 103,940.8784 | 0.000655 | |

XRP | XRP | 40,452,252,991 | 6.47% | 39,115.2834 | 0.001655 | |

DOT | Polkadot | 20,675,304,866 | 3.31% | 1,561.9197 | 0.021180 | |

UNI | Uniswap | 13,532,527,083 | 2.17% | 1,444.2265 | 0.014993 | |

ICP | Internet Computer | 10,131,327,403 | 1.62% | 413.9978 | 0.039157 | |

BCH | Bitcoin Cash | 11,200,711,819 | 1.79% | 57.1861 | 0.313398 | |

LINK | Chainlink | 10,419,611,988 | 1.67% | 1,421.4694 | 0.011729 | |

LTC | Litecoin | 10,757,890,575 | 1.72% | 212.4470 | 0.081023 | |

SOL | Solana | 11,319,309,882 | 1.81% | 782.4009 | 0.023148 | |

POL | Polygon | 9,340,119,522 | 1.49% | 23,415.1680 | 0.000638 | |

THETA | THETA | 9,011,782,488 | 1.44% | 3,718.5453 | 0.003878 | |

XLM | Stellar | 8,104,336,974 | 1.30% | 98,814.2293 | 0.000131 | |

VET | VeChain | 7,297,692,808 | 1.17% | 298,474.5654 | 0.000039 | |

ETC | Ethereum Classic | 6,619,071 | 1.06% | 601.1873 | 0.017617 | |

FIL | Filecoin | 5,922,606,778 | 0.95% | 454.4575 | 0.020851 | |

EOS | EOS | 4,834,691,030 | 0.77% | 6,786.0051 | 0.001140 | |

TRX | TRON | 5,204,848,964 | 0.83% | 466,725.3963 | 0.000018 | |

Total | 624,982,564,708 | 100.00% | ||||

5.1 Regular Rebalances

The index constituents and their weight will be rebalanced every Thursday at 08:00:00 UTC to adapt to changes in the market.

5.1 Special Adjustment

Special adjustments are deemed necessary when one or several constituents face drastic changes (e.g. delist or no organic volume). Two kinds of adjustment can occur: exclude and recalculate weight (and Divisort); and exclude and fill up with constituents from the alternate list, where recalculation is also needed.

5.2 Hard Fork/Airdrop/Mapping Adjustment

The cryptocurrency price index, which is based on blockchain, will be adjusted for hard fork/airdrop/mapping following these guidelines:

*Disclaimer: The numbers in this article are subject to change without further notice. Please refer to the English version for the most updated numbers.