Carefully! Lots of text.

Fundamental analysis of a cryptocurrency involves an in-depth study of all available information about a financial asset. For example, you might consider use cases, the number of people using it, or the team behind the project.

Your goal is to understand whether an asset is overvalued or undervalued. Based on this, you can determine your trading positions.

Introduction

Learning about volatile trading assets like cryptocurrencies requires specific skills. Choosing a strategy, understanding the boundless world of trading, combining technical and fundamental methods of analysis are areas that are required to be studied.

When it comes to technical analysis, some knowledge can be gleaned from traditional financial markets. Many crypto traders use the same technical indicators used in Forex trading when trading stocks and commodities. Tools such as RSI, MACD and Bollinger Bands are aimed at analyzing market behavior regardless of the asset being traded. Thus, these technical analysis tools are extremely popular in the cryptocurrency space as well.

In fundamental analysis of cryptocurrencies (despite the fact that the approach is similar to that used in traditional markets), it will not be possible to use proven tools to evaluate cryptoassets. To conduct an objective FA of cryptocurrencies, you need to understand how they gain value.

In this article we will define indicators based on which you can create your own indicators.

What is fundamental analysis (FA)?

Fundamental analysis (FA) is an approach used by investors to determine the "intrinsic value" of an asset or business. The main goal is to determine whether an asset or business is overvalued or undervalued by considering a large number of internal and external factors. This information is used to make strategic decisions about entering or exiting positions.

Technical analysis also provides valuable trading data, but leads to a different kind of conclusion. Market participants using TA seek to predict future price movements based on information about the past performance of assets. This is achieved by identifying candlestick patterns and studying key indicators.

Traditional fundamental analysts typically look to business metrics to determine the true value of assets. Indicators used in this case include earnings per share (how much profit a company makes on each share issued) or price-to-book ratio (how investors value a company relative to its book value). They may conduct this type of analysis for multiple companies in the same niche, for example to find out how their own potential investments compare with those of other investors.

For a complete introduction to fundamental analysis, read the article “What is Fundamental Analysis?”

Problems of fundamental analysis of cryptocurrencies

Cryptocurrency networks cannot be assessed using traditional business tools. For that matter, more decentralized systems such as Bitcoin (BTC) are closer to the commodity sector. But even when it comes to relatively centralized cryptocurrencies (those issued by organizations), traditional fundamental analysis indicators can only tell you so much.

Therefore, it is necessary to pay attention to other frameworks. First, identify reliable indicators. By “reliable” we mean those that are difficult to manipulate. For example, Twitter followers or Telegram/Reddit users are not a good indicator as it is easy to create fake accounts and buy social media activity.

It is important to note that there is no single metric that gives us a complete picture of the network being assessed. You can pay attention to the sharply increasing number of active addresses in the blockchain. But the number of addresses in itself does not mean anything. As we know, the same entity may be behind them, transferring money between new addresses.

In the following sections, we will look at three categories of cryptocurrency FA metrics: on-chain metrics, project metrics, and financial metrics. This list is not exhaustive, but is sufficient to consider creating indicators based on it.

On-chain metrics

On-chain metrics are characteristics that can be obtained from blockchain data. We could find them out ourselves by launching a node on the network of interest and exporting the data, but this is quite time-consuming and expensive. Especially if we are only considering investments and do not want to waste time and resources on technical details.

The simplest solution is to collect information from websites or APIs specifically designed for making investment decisions. For example, the on-chain analysis of Bitcoin on the CoinMarketCap website provides us with a huge amount of information. Additional sources include Coinmetrics data charts or Binance Research project reports.

Number of transactions

The number of transactions is a good indicator of network activity. By plotting over set periods (or using moving averages), we can see how activity changes over time.

Please note: this metric should be treated with caution. As with active addresses, there is no guarantee that activity on the network is not generated by a small number of participants transferring funds among themselves.

Transaction cost

Unlike the number of transactions, the transaction value shows the total volume of transactions for the period. For example, if there were ten Ethereum transactions worth $50 each in one day, we would say that the daily transaction volume was $500. This characteristic is measured in both fiat currency, such as USD, and the protocol's native coin (ETH).

Active addresses

Active addresses are blockchain addresses that have been active for a certain period. There are various counting methods, but the most popular is one that counts both the sender and recipient addresses of each transaction over a set period (such as days, weeks, or months). You can also check the cumulative number of unique addresses, which means tracking the total number of active addresses over time.

Commissions

For some assets, fees are a function of demand. You can think of them as bidding in an auction: users compete with each other to get their transactions onto the blockchain in a timely manner. Transactions of those who offer higher rates will be confirmed (mined) earlier, and transactions of those who offer lower rates will be confirmed later.

For cryptocurrencies with scheduled supply reduction, this is an interesting metric to study. Blockchains with Proof of Work (PoW) consensus generate block rewards. In some cases, the reward consists of the block reward itself and fees for transactions of other participants. The block reward decreases periodically (for example, as a result of Bitcoin halving).

As mining costs increase over time and block rewards gradually decrease, it is logical to assume that transaction fees should increase. Otherwise, miners will work at a loss and leave the network. This will adversely affect the safety of the circuit.

Hashrate and number of coins staked

Currently, blockchains use many consensus algorithms, each with their own mechanism of operation. Given that they play a critical role in protecting the network, analyzing blockchain protocol data can be useful for fundamental analysis.

A common characteristic of the state of a network of cryptocurrencies operating under the Proof of Work protocol is the hashrate. The higher the hashrate, the more difficult it is to successfully carry out a 51% attack. In addition, a gradual increase in hashrate may indicate a growing interest in mining, for example, due to low costs and higher profits. Conversely, a decrease in hashrate indicates that miners are leaving the network (“miner capitulation”), since it is no longer profitable to protect the network.

The total cost of mining depends, among other things, on the current price of the asset, the number of processed transactions and the amount of commissions. Of course, the direct costs of mining (electricity and computing power) are also an important factor.

Staking (such as in the Proof of Stake protocol) is another concept related to game theory, similar to mining in PoW. As for the mechanisms, staking works differently. The basic idea is that participants stake their savings to participate in block validation. Thus, to assess the interest (or lack thereof) in an asset, you can look at the volume that is being staked at the moment.

Design indicators

While on-chain metrics are concerned with the blockchain data being analyzed, project metrics involve a qualitative approach that takes into account factors such as team performance (if any), whitepaper and roadmap.

Whitepaper

Before you invest in any project, we strongly recommend that you read its whitepaper. This is a white paper that provides an overview of a cryptocurrency project. A good whitepaper should define the goals of the network and ideally provide insight into the following characteristics:

technology used (is the code open source?);

the use cases the project wants to develop;

roadmap for updates and new features;

distribution and distribution scheme for coins or tokens.

It is appropriate to evaluate this information in the context of the project discussion. What do other people say about him? Are there any red flags? Do the goals seem realistic?

Team

If there is a specific team behind a cryptocurrency network, the track record of its members can indicate whether it has the necessary skills to implement the project. Have team members previously had successful projects in this industry? Is their experience sufficient to achieve the intended goals? Were they associated with any questionable projects or scams?

If there is no team, what does the developer community look like? If the project has GitHub, check its number of contributors and activity. A coin that is constantly in development is more attractive than one whose repository has not been updated for two years.

Competitors

A good whitepaper should give us an idea of the use case that the crypto asset is aimed at. At this stage, it is important to identify the projects it competes with, as well as the existing infrastructure it seeks to replace.

Ideally, a fundamental analysis of competing projects follows. The asset itself may look attractive, but the performance of similar crypto assets may show it to be a weaker choice than others.

Tokenomics and initial distribution

Some projects create tokens, and thereby create problems for themselves. This is not to say that the project itself is not viable, but the token associated with it may not have sufficient utility. Thus, it is important to determine its possible usefulness. And in a broader sense, to understand whether the market recognizes this usefulness, and if so, how much it will appreciate it.

Another important factor: how were the funds initially distributed? Through ICO, IEO, or could participants mine them? In the first case, the whitepaper should indicate what the share of the founders and team is, as well as how much is available to investors. In the second case, you can study the organization of pre-mining (mining on the network before the official announcement of the project).

Distribution analysis can provide insight into the risk present. For example, if the vast majority of the supply is owned by a small group of individuals, one may conclude that it is a risky investment since these parties may end up manipulating the market.

Financial indicators

Fundamental analysis requires information about how an asset is currently trading, how it has traded previously, what its liquidity is, etc. However, there are other interesting metrics in this category - those related to the economics and incentives of the crypto asset protocol.

Market capitalization

Market capitalization (or network value) is calculated by multiplying the supply in circulation by the current price of the asset. Essentially, it represents the hypothetical cost of purchasing each available unit of a crypto asset (assuming no slippage).

Market capitalization itself can be misleading. In theory, it would be easy to issue a worthless token with a supply of ten million units. If each token traded for $1, the market cap would be $10 million. This assessment is clearly incorrect - it is unlikely that the general market will be interested in a token without a value proposition.

Additionally, it is impossible to determine exactly how many units of a particular cryptocurrency or token are in circulation. You can burn your coins, lose your keys, and simply forget about your funds. Therefore, they usually use approximate estimates that take into account the number of coins not in circulation.

However, market capitalization is widely used to determine the potential growth of networks. Some crypto investors believe that small-cap coins are more likely to rise than large-cap coins. Others believe that large caps have a stronger network effect and therefore have a better chance than unidentified small caps.

Liquidity and volume

Liquidity is a measure of how easy it is to sell or buy an asset. A liquid asset is an asset that can be easily sold at a market price. Related to this is the concept of a liquid market - a market flooded with offers to buy and sell (leading to a narrower bid-ask spread).

In an illiquid market, we may be unable to sell our assets at a “fair” price. This means that there are no buyers willing to complete the transaction, and we are left with two options: reduce the sale price or wait for increased liquidity.

Trading volume is an indicator that helps determine liquidity. It can be measured in several ways and shows the value of assets involved in trading over a period of time. Typically, charts show daily trading volume (expressed in per unit of asset or in dollars).

Understanding liquidity can be useful in the context of fundamental analysis. It serves as an indicator of market interest in a potential investment asset.

Distribution schemes

For some investors, one of the most interesting characteristics from an investment perspective is the distribution patterns of a coin or token. Among Bitcoin investors, the popularity of such a model as Stock-to-flow (S2F) is growing.

The decision is influenced by characteristics such as maximum supply, supply in circulation and inflation. The supply of some coins decreases over time, making them attractive to investors who believe that the demand for new units of the crypto asset will exceed their availability.

On the other hand, some investors consider a rigid maximum unit maximum to be harmful in the long term. The concern is that this model discourages the use of coins/tokens as users prefer to hoard them. Another argument against the deflationary model is that it disproportionately rewards early adopters, when a stable inflationary policy would be fairer for new adopters.

Indicators, metrics and fundamental analysis tools

We identified both quantitative and qualitative data used in the baseline analysis. But these metrics alone often don’t tell the whole story. To further understand the coin, you should study the concept of indicators.

An indicator typically combines several metrics through statistical formulas to simplify the analysis of relationships. However, there are still many similarities between a metric and an indicator, making the definition rather vague.

While the number of active wallets is important, we can combine this characteristic with others to draw deeper conclusions. As an indicator, you can consider the percentage of active wallets from their total number or divide the market capitalization of the coin by the number of active wallets. This calculation will show the average value of assets held in each active wallet. Both indicators allow us to draw conclusions about the activity of the network and the confidence of users that they own the asset. We'll look at these indicators more in the next section.

Fundamental analysis tools make it easy to collect all the metrics and indicators. While it is possible to view raw data in blockchain explorers, with an aggregator or dashboard you can perform analysis more quickly and efficiently. Some tools allow you to create your own indicators with metrics of your choice.

Combining indicators and creating FA indicators

Now that we understand the difference between ratios and indicators, let's talk about how to combine indicators to better understand the financial health of the assets you're studying. Why do this? As we noted in previous sections, each individual indicator has disadvantages. Additionally, if you simply look at the set of numbers for each cryptocurrency project, you are missing out on a lot of important information. Consider the following scenario:

If we compare two assets, then the number of active addresses alone does not mean anything. It's safe to say that Coin A has had more active addresses than Coin B in the last six months, but this is not a comprehensive analysis. How does this figure compare to market capitalization? Or with the number of transactions?

It would make more sense to create some kind of ratio that can be applied to the statistics of coin A and compare it with the same ratio for coin B. Then there would be no need to blindly compare the individual performance of each coin. Instead, we will create an indicator to evaluate coins independently.

For example, the relationship between market capitalization and the number of transactions is much more revealing than market capitalization alone. In this case, we can divide the market capitalization by the number of transactions. For coin A this ratio is 5, and for coin B it is 0.125.

Based on this ratio alone, we can conclude that Coin B is more valuable than Coin A because the calculated number is lower. This means that the number of transactions of coin B is much greater than its market capitalization. Therefore, one can conclude that Coin B has greater utility or that Coin A is overvalued.

None of these observations should be construed as investment advice. This is just an example of how you can analyze a small part of the bigger picture. Without understanding the goals of the projects and the functions of the coins, it is impossible to determine whether the comparatively lower number of transactions of Coin A is a positive or negative aspect.

A similar ratio that is also used in cryptocurrency markets is the NVT ratio. The ratio of network value to transaction volume, developed by analyst Willy Wu, has been called the “price-to-earnings ratio of the cryptocurrency world.” This indicator is equal to the ratio of market capitalization (or network value) to the amount of transactions over a period (usually on a daily chart).

Right now we are just scratching the surface of the types of indicators that can be used. Fundamental analysis is the development of a system that can be used to comprehensively evaluate projects in all aspects. The more qualitative research we conduct, the more data we have to work with.

FA Key Indicators and Metrics

You can use a huge number of indicators and metrics. If you are just starting to understand FA, we recommend using the most popular ones first. Each indicator provides only a partial picture of the state of affairs, so we recommend combining them during the analysis.

Network Value to Transaction Volume (NVT) Ratio

If you have heard of the price-to-earnings ratio used to analyze stocks (P/E indicator), then the Network Transaction Cost (per day) indicator is its equivalent in the cryptocurrency market. It is calculated by dividing the market capitalization of a coin by its daily transaction volume.

We use daily transaction volume as a proxy for the underlying, inherent value of a coin. The essence of this indicator is that the larger the volume of an asset is transferred to the network, the greater the value of the project. If the market capitalization of a coin increases significantly but the daily transaction volume does not, then the market may become a bubble. Prices are rising without a corresponding increase in the underlying cost. On the other hand, the price of a coin or token may remain stable while the daily transaction volume increases. This situation can serve as a signal to buy.

The higher the coefficient, the greater the likelihood of a bubble occurring. The limit is an NVT value above 90-95. A decreasing ratio indicates that the cryptocurrency is becoming less overvalued.

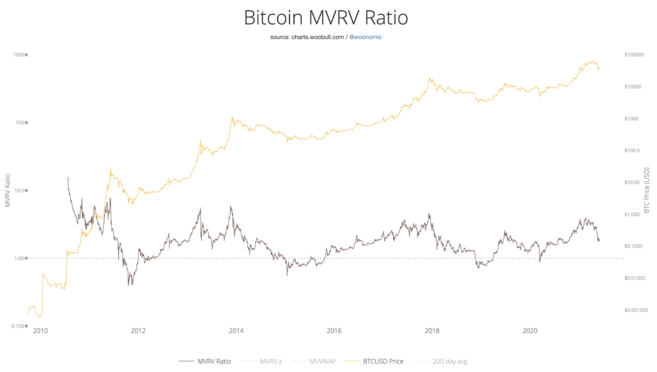

Market to Realized Value Ratio (MVRV)

Before we dive into the numbers, we need to understand what realized value means for crypto assets. Market value (also known as market capitalization) is the total number of coins multiplied by the current market price of the asset. Realized value takes into account lost coins in inaccessible wallets.

We cannot know exactly how many are lost, so coins stored in wallets are valued at the market price at the time of their last movement. For example, a Bitcoin lost in February 2016 would be worth about $400.

To calculate the MVRV indicator, you need to divide the market capitalization by the realized one. If the market capitalization is much higher than realized, we will get a relatively high ratio. A ratio above 3.7 indicates a potential sell-off because traders are taking profits due to the coin being overvalued.

This coefficient value means that the coin may currently be overvalued. As an example, consider two major Bitcoin sell-offs: in 2014 (MRVR approximately 6) and in 2018 (MRVR approximately 5). If the value is too low and less than 1, then the market is undervalued. This situation is optimal for buying, since buying pressure increases and raises the price.

Stock-to-flow model

The Stock-to-flow indicator is popular for evaluating cryptocurrencies with limited supply. The model views each cryptocurrency as a fixed, scarce resource, similar to precious metals and stones. Since the supply of the asset is known to be limited with no new sources available, investors use it as a store of value.

The indicator is calculated by dividing the total supply of an asset in circulation by the number of coins that appeared per year. For Bitcoin, this indicator is easy to calculate using available circulating value figures and data on recently mined coins. A decrease in mining profits increases the coefficient reflecting its scarcity, which makes the asset more valuable. We can see the periodic halving of the reward for Bitcoin on the graph of the influx of new coins.

As you can see, the stock to flow ratio was a fairly good indicator of the price of Bitcoin. Bitcoin price is superimposed on a 365-day average and shows good agreement. However, this model has disadvantages.

For example, gold currently has a stock-to-flow ratio of approximately 60. This means that it would take 60 years to mine the current supply of gold at the current flow. Bitcoin's stock-to-flow ratio in 20 years is expected to be around 1,600, which could make its price and market cap greater than the world's current wealth.

Stock-to-flow models are not suitable for flow when deflation occurs because it assumes a negative price. Due to people losing wallet keys and no more Bitcoin being produced, the ratio will be negative. If we display this situation graphically, we will see that the graph of the ratio of stock to consumption tends to infinity and then becomes negative.

If you are interested in learning more about this model, read our guide, Bitcoin and the Stock-to-Flow Model.

Examples of tools for fundamental analysis

Base rank

Baserank is a cryptoasset research platform that collects information and reviews from analysts and investors. Based on the average rating of all reviews, the cryptocurrency receives a total score from 0 to 100. Although premium reviews are only available to subscribers, a comprehensive list of reviews has been created for free users, divided into sections (such as team, utility and investment risk). If you are limited in time and need a quick overview of a project or coin, an aggregator like Baserank is what you need. And yet, before investing, make it a rule to dive as deeply as possible into the projects that interest you.

Crypto Fees

As you might have guessed from the name, this resource shows the commission of each network for the last 24 hours or seven days. This simple metric can be used to analyze the traffic and usage of a blockchain network. Networks with high fees tend to be in high demand.

However, this metric should not be taken so literally. Some blockchains are built with low fees in mind, making them difficult to compare to other networks. In such cases, it is better to consider the asset based on the number of transactions and other indicators. For example, large market cap coins such as Dogecoin and Cardano rank low in the overall charts due to their low transaction fees.

Glassnode Studio

Glassnode Studio offers a dashboard that displays a wide range of on-chain metrics and other data. Like most of the tools offered, it is available by subscription. However, for amateur investors, a free list of network data will be enough - it is so detailed. It is much easier to find all the information in one place than to collect it yourself using blockchain explorers. The main advantage of Glassnode is the huge number of categories and subcategories of metrics available for viewing. However, if you are interested in Binance Smart Chain projects, there is not much data on them anymore.

For those who want to use FA metrics with technical analysis, Glassnode Studio has a built-in TradingView interface with all the charting tools. When making decisions, investors and traders often combine several types of analysis. The advantage of Glassnode is the ability to do it all in one place.

Summary

When done correctly, fundamental analysis can provide invaluable information about cryptocurrencies - information that cannot be obtained through technical analysis alone. Knowing how to separate market price from the “true” value of a network is a great skill to have in trading. Of course, there are things that are only accessible through technical analysis and that cannot be predicted using fundamental analysis. Therefore, most traders today combine both methods.

As with many other strategies, there are no universal rules for fundamental analysis. We hope this article helped you understand some of the factors to consider before entering and exiting positions in the cryptocurrency market.