Hotairballoon has selected important information, investment and financing conditions of the crypto market last week, as well as on-chain data of current popular tracks such as LSD and RWA. In addition, it has also counted projects with relatively large unlocking volumes recently for your reference.

1. Important information about the crypto industry last week

Take a quick look at important industry information of the week.

1. Policy/Regulation

1. Sichuan Province officially issued a special policy on the Metaverse, planning to build the "China Metaverse Valley"

On September 18, according to the official website of the Sichuan Provincial Department of Economy and Information Technology, the Sichuan Provincial Department of Economy and Information Technology and 16 other departments jointly issued the "Sichuan Metaverse Industry Development Action Plan (2023-2025)". This is the fourth provincial-level metaverse special policy after Shanghai, Henan Province, and Zhejiang Province.

2. Kazakhstan establishes a separate regulatory agency to be responsible for CBDC development and implementation

On September 18, according to Cointelegraph, the National Bank of the Republic of Kazakhstan (NPCI) established a separate entity to lead the development and implementation of the central bank digital currency (CBDC) - digital tenge, namely the National Payment Company (NPC). The entity will be established on the basis of the former Kazakhstan Interbank Payment Center and will be responsible for overseeing the country’s national payment system, including interbank clearing services, remittances and digital identification, as well as the development of "digital financial infrastructure", including the implementation of digital tenge.

3. The New York State Department of Financial Services issued a proposed regulatory guide to guide crypto companies on how to draft token listing and delisting policies

On September 18, according to the Wall Street Journal, New York financial regulators want cryptocurrency companies regulated by the state to be more transparent about how to list and delist cryptocurrencies. In the proposed guidelines released on Monday, the New York State Department of Financial Services clarified its expectations for how cryptocurrency companies evaluate token issuance before adoption, based on the previous version of the framework. The regulator also described its expectations for the steps and standards that cryptocurrency companies must consider before delisting tokens.

4. Malta plans to revise its cryptocurrency regulatory policy to follow MiCA regulations

On September 18, according to CoinDesk, the Malta Financial Services Authority (MFSA) is seeking public opinions on proposed changes to the regulatory rules for cryptocurrency companies. The regulator is rewriting the rules for exchanges, custodians and portfolio managers to adapt to the rules set out in the EU Crypto Asset Market Regulation (MiCA). And hopes to require cryptocurrency providers to develop an "orderly phase-out plan."

5. Qiu Dagen: The Hong Kong Parliament is conducting a second round of consultation on stablecoins and hopes to announce regulatory conditions by the middle of next year

On September 19th, at the 2023 Shanghai Blockchain International Week and the 9th Blockchain Global Summit, Hong Kong Special Administrative Region Legislative Council member Qiu Dagen delivered a keynote speech entitled "Steady and Prudent Promotion of the Sustainable Development of Web3 in Hong Kong". Qiu Dagen said that after Hong Kong began licensing virtual asset service providers on June 1, the next step will be to explore what types of products can be bought and sold, develop innovative products, who can buy these products, and who cannot buy those products. These will be divided into professional investors and retail investors.

6. Thailand plans to tax cryptocurrency traders’ overseas income

On September 19, BeInCrypto reported that Thailand is planning to tax the foreign income of crypto traders, while the country has previously touted itself as a crypto-friendly country. The new government is eager to find ways to pay for its planned economic stimulus measures, including nationwide airdrops.

7. Head of the U.S. SEC Crypto Enforcement Division: Crypto Exchanges and DeFi Will Face More Charges

On September 20, according to CoinDesk, David Hirsch, head of the crypto assets and network division of the U.S. Securities and Exchange Commission (SEC), said there may be more enforcement actions against crypto exchanges and DeFi projects. Hirsch spoke at the Securities Enforcement Forum in Chicago on Tuesday and said that the SEC may bring new charges against crypto brokers, traders, exchanges, clearing agencies and other institutions that have not made proper disclosures or registered with the SEC. The SEC is aware of and is investigating companies involved in similar activities, and DeFi may also become a focus.

8. Fed Chairman Powell: We are committed to reducing inflation to 2% and will raise interest rates further if appropriate

On September 21, Fed Chairman Powell said at a monetary policy press conference that he was firmly focused on the dual mission. The FOMC is firmly committed to reducing the inflation rate to 2%, and there is still a long way to go to achieve this goal. The current policy stance is restrictive. In view of the progress that has been made, the FOMC decided to keep the interest rate unchanged.

9. The U.S. House of Representatives Financial Services Committee approved a bill to ban the issuance of CBDCs and will submit it to the House of Representatives for deliberation

On September 21, according to CoinDesk, the U.S. House of Representatives Financial Services Committee approved a bill to prevent the United States from issuing central bank digital currency (CBDC) with the support of Republicans, and will submit it to the House of Representatives for deliberation. Patrick McHenry, chairman of the committee, said that the bill will ensure that "any U.S. CBDC must be clearly authorized by Congress" and "protect the privacy of Americans and our financial system from the risks that CBDC may bring."

10. Busan, South Korea plans to establish a city-level blockchain mainnet and set up a $75 million blockchain fund

On September 21, according to News1, the city of Busan in South Korea passed the "Busan Digital Asset Exchange Establishment Promotion Plan and Future Agenda" plan, which will promote the development of the blockchain mainnet as a medium- and long-term issue. It plans to establish a municipal blockchain mainnet that is compatible with Ethereum, Cosmos and other blockchain mainnets, and will be carried out as a separate project.

11. US SEC solicits public opinions on ARK and VanEck’s Ethereum spot ETF

On September 22, the U.S. Securities and Exchange Commission (SEC) is reviewing the Ethereum spot exchange-traded fund (ETF) applications from two asset management companies, ARK Invest and VanEck. Yesterday, the SEC solicited public opinions on the potential benefits and risks of approving these ETFs. The regulator has opened a 45-day public comment period for the two documents.

12. Chief Executive of the Hong Kong Monetary Authority: A "minimum viable product" will be launched to pave the way for the gradual commercialization of the multilateral central bank digital currency bridge project

On September 23, according to the financial industry, Hong Kong Monetary Authority Chief Executive Yu Weiwen said at the fifth Bund Financial Summit: "Soon, we will launch the so-called 'minimum viable product', which aims to pave the way for the gradual commercialization of mBridge (Multilateral Central Bank Digital Currency Bridge Project). "

(II) Project Information

1. Optimism has started the third round of airdrops, and 19 million OP will be distributed to more than 31,000 addresses

On September 19, according to official news, Optimism announced on Twitter that it has started the third round of airdrops. 19 million OP will be distributed to more than 31,000 unique addresses. The airdrop started at 4:10 am Beijing time on September 19, and the tokens will be distributed directly to the addresses that delegated their OP voting rights between January 20 and July 20, 2023. There is no need to apply for this airdrop, and it is being sent directly to the addresses that meet the requirements.

2. dYdX Chain testnet has completed the final reset

On September 19, the decentralized derivatives exchange dYdX stated on the X platform that the final reset of its dYdX Chain testnet has been completed and now has more than 30 markets, conditional orders, and spam filtering.

3. The Lido community preliminarily passed the proposal to "add 7 node operators" and will conduct an on-chain vote on October 3

On September 19, the Snapshot page showed that the Lido community had voted to approve the snapshot vote for the proposal to "add 7 Ethereum operators", with a support rate of 99.99%. The proposed 7 Ethereum operators include a4x Inc., Develp GmbH, Ebunker Technology LIMITED, Gateway.fm AS, Numic, ParaFi Technologies LLC and Rockaway Blockchain GP Ltd. It is reported that Ebunker.io is the only Chinese company shortlisted this time.

4. MakerDAO once again increased its RWA assets by $191 million, bringing the total RWA assets of the protocol to over $2.9 billion

According to data from makerburn.com on September 21, MakerDAO has increased RWA assets by $191 million through Monetalis Clydesdale and BlockTower Andromeda since September 19. Among them, $97 million of RWA assets were added through Monetalis Clydesdale, and $94 million of RWA assets were added through BlockTower Andromeda. In addition, the total RWA assets of the current agreement exceed $2.9 billion.

5. The decentralized social protocol friend.tech has launched a web version

On September 21, according to the official X account, the decentralized social protocol friend.tech has launched a web version, and users can use friend.tech in the browser.

6. Tether CTO: Tether's new global strategy will be fully implemented in 2024

On September 22, Tether Chief Technology Officer Paolo Ardoino tweeted that Tether’s new global strategy will be fully implemented in 2024.

7. Ethereum client Nethermindv released version v1.20.4, Holesky will restart on September 28

On September 22, blockchain tool and infrastructure developer Nethermind tweeted that the Nethermind client v1.20.4 has been launched and Holesky will be restarted at 20:00 Beijing time on September 28. According to previous news, the Ethereum Holesky test network failed to start due to a network configuration error, and developers plan to restart it soon.

8. FTX reminds: September 29 is the deadline for customers to submit claims

On September 22, FTX reminded its customers on the X platform that the final submission date for customer claims is 4:00 pm Eastern Time on September 29, 2023 (4:00 am Beijing Time on September 30), and suggested that users log in to the customer claims portal to start the claims process. FTX requires customers to provide KYC information during the claims process, and the KYC review and verification process will continue after the deadline.

9. Polkadot will support 1,000 parachains in the future

According to reports on September 22, Polkadot’s core developers are looking to expand the ecosystem’s current parachain limit to 100, with the goal of eventually making it available in the future following a planned software update called “Async Support.” Join 1,000 parachains. Asynchronous support represents a significant enhancement to Polkadot’s parachain consensus protocol. The update aims to halve parachain block time from 12 seconds to 6 seconds and increase the block space per block by 5–10 times.

10. Arkham: Coinbase holds $25 billion worth of Bitcoin reserves, making it the largest Bitcoin holding entity

On September 23, Arkham, an on-chain data platform, tweeted that it had identified Coinbase's bitcoin reserves worth $25 billion (about 1 million bitcoins) on the chain. This makes Coinbase the world's largest bitcoin holding entity, owning nearly 5% of bitcoins, almost as much as Satoshi Nakamoto. Arkham said it has identified and marked more than 36 million bitcoin deposits and holding addresses used by Coinbase, and its largest cold wallet contains about 10,000 BTC. According to their latest financial data, Coinbase may have thousands of bitcoins that have not yet been marked.

11. dYdX will cancel the trader fee discount and return to normal fees on September 30

On September 21, according to official news, dYdX announced that it is updating the v3 fee plan, and will cancel the fee discounts for all dYdX traders and restore normal fees at 1:00 am Beijing time on September 30. Starting from September 30, Hedgie holders will be eligible for a 3% fee discount, and holding multiple Hedgies will not increase the discount percentage.

12. Aave community’s ARFC proposal on “GHO liquidity strategy upgrade” has been approved

On September 24, according to the Snapshot voting page, the Aave community's ARFC proposal on "GHO liquidity strategy upgrade" has been passed with an approval rate of 99.99%. The proposal aims to improve GHO's anchoring and promote diversified liquidity on multiple trading platforms. The strategy covers multiple DeFi platforms, including Maverick, Uniswap, Bunni, Liquis, Balancer, and Aura. Each platform provides different liquidity solutions to meet the different needs of GHO tokens.

13. Starkware launches new synthetic platform Satoru Starknet, token-free and completely open source

On September 24, Starknet tweeted about Satoru Starknet, a new synthesis platform launched by the Starkware Exploration Team. The project aims to build a decentralized synthesis platform for Starknet written in Cairo language, inspired by the design of GMX V2 and not limited by Solidity. Its architecture is modular, and different modules interact with each other. Routing is the main entry point for users.

(III) Others

1. The bidding of SVB Capital, the venture capital arm of Silicon Valley Bank, has entered the final stage, with Skybridge Capital and other companies participating

According to Cointelegraph on September 18, SVB Financial Group, the parent company of the former Silicon Valley Bank, is close to reaching an agreement to sell its venture capital division SVB Capital. People familiar with the matter said that Anthony Scaramucci's SkyBridge Capital and Atlas Merchant Capital are competing with San Francisco company Vector Capital in the final stage of the bidding process.

2. Hong Kong Police: JPEX case suspected of conspiracy to defraud, the amount involved has reached HK$1.2 billion

On September 19, at the briefing on the virtual asset trading platform JPEX case, Senior Superintendent Kong Qingxun of the Commercial Crime Investigation Bureau of the Hong Kong Police stated that the JPEX case was suspected of conspiracy to defraud, using advertisements, social media and different platforms, through over-the-counter exchange shops and online celebrities KOLs to actively promote the platform's services and products to the public, touting "low risk and high returns" to attract investors to join. The police attach great importance to this case and set up a hotline to call on people who suspect they have been deceived to report the case as soon as possible. As of 12:00 last night, the police had received 1,641 reports involving a total amount of HK$1.2 billion. After the SFC issued a warning, JPEX still raised the withdrawal limit to 999 USDT, making it impossible for users to withdraw funds in disguise. Yesterday, the police arrested 8 people, including the owner and person in charge of the over-the-counter exchange shop.

3. Wanxiang Blockchain Xiao Feng: Blockchain is moving towards a new stage of large-scale application, and the next three years will be a critical moment

On September 19, Xiao Feng, chairman of Wanxiang Blockchain, delivered a speech at the 2023 Shanghai Blockchain International Week and the 9th Blockchain Global Summit, saying that blockchain is moving from the infrastructure construction stage to a new stage of large-scale application, and the next three years will be a critical moment for blockchain applications. Because in the next three years, the technical framework of blockchain will be roughly mature, and of course there will be many details, performance, and other aspects that need to be optimized and polished.

4. Grayscale has submitted a second Ethereum futures ETF application to track Ethereum futures contracts

On September 20, according to Be In Crypto, Grayscale Investments has submitted its second application for Ethereum futures ETF, which aims to track the value of Ethereum futures contracts. The company had previously applied for an Ethereum futures ETF, but the way it applied this time was different.

5. Morgan Creek founder: If Bitcoin spot ETF is approved, it will attract $300 billion in funds to the market

According to Bitcoin Magazine on September 22, Mark Yusko, CEO and CIO of Morgan Creek Capital, said in an interview that the approval of the Bitcoin spot ETF by the U.S. Securities and Exchange Commission (SEC) could attract $300 billion to the market. He stressed the importance of the U.S. approval of the Bitcoin spot ETF, noting that it provides a bridge for institutional investors to enter the Bitcoin market. Eric Balchunas, senior ETF analyst at Bloomberg, said that after the Bitcoin spot ETF is approved, about $150 billion will flow into the market, but Yusko believes that the actual inflow of funds may be more. He said: "I would further point out that it is more likely to be $300 billion. By then, the price of Bitcoin will rise sharply."

6. Changpeng Zhao: If the market is predictable, then it is no longer a market and there is no profit

On September 24, Binance CEO Zhao Changpeng tweeted that if the market is predictable, then it is no longer a market and there is no profit. If you want to "buy low and sell high", you must take corresponding actions at low levels. But it is simpler to invest and hold.

2. Investment and Financing Situation Last Week

1. DeFi

1. Hybrid crypto exchange GRVT completes $7.1 million financing at a valuation of $39 million

Hybrid crypto exchange GRVT announced that it has completed two rounds of financing totaling $7.1 million at a valuation of $39 million. GRVT said that the seed round of financing was $5 million, led by Matrix Partners and Delphi Digital, with participation from Susquehanna Investment Group, CMS Holdings, Hack VC, Matter Labs (zkSync developer), and others.

2. Web3

1. Web3 social application Orb completes $2.3 million pre-seed round of financing

Orb, a Web3 social application based on Lens Protocol, announced the completion of a $2.3 million pre-seed round of financing, with participation from Superscrypt, Founders, Inc., Foresight Ventures, Aave Companies, Aave Companies, Lens Protocol founder Stani Kulechov and Polygon co-founder Sandeep Nailwal.

2. Decentralized information market protocol Freatic completes $3.6 million in financing, led by a16z Crypto

Decentralized information market protocol Freatic has completed US$3.6 million in financing, led by a16z Crypto, with participation from Anagram, Archetype, Not3Lau Capital, Robot Ventures, Arweave, Stefano Bernardi, Meltem Demirors, Stephane Gosselin, Jutta Steiner, MacLane Wilkison and others.

3. Decentralized hackathon platform BeWater completes $1 million angel round of financing, led by ABCDE and OKX Ventures

BeWater, a decentralized hackathon platform and global open source developer organization, announced the completion of a $1 million angel round of financing. This round of financing was jointly led by ABCDE and OKX Ventures, and followed by ScalingX, Galaxy Mercury Asia, Contentos, and individual investors such as Blake Gao.

(III) NFT/chain games

1. Blockchain game company Proof of Play completes $33 million seed round financing, led by Greenoaks and a16z

Blockchain gaming startup Proof of Play announced the completion of a $33 million seed round of financing, led by Greenoaks and a16z, with participation from Balaji Srinivasan, Twitch founders Justin Kan and Emmett Shear, Mercury, Firebase, Zynga and Alchemy.

(IV) Asset Management

1. Cryptocurrency startup Bastion completes $25 million in financing, led by a16z crypto

Crypto startup Bastion has completed a $25 million seed round of financing, led by a16z crypto, with participation from Laser Digital Ventures, Robot Ventures, Not Boring Capital, etc. under Nomura Group. It is reported that Bastion provides services such as cryptocurrency custody.

2. Digital asset startup Fuze completes $14 million seed round of financing, led by Further Ventures

Middle Eastern digital asset startup Fuze announced that it has completed a $14 million seed round of financing, led by Abu Dhabi venture capital firm Further Ventures and participated by Liberty City Ventures, an early-stage venture capital firm in New York, USA.

3. Crypto payment company Mesh completes $22 million Series A financing, led by Money Forward

Mesh (formerly Front Finance), a crypto transfer and payment service startup, has completed a $22 million Series A financing round led by Money Forward, with participation from Galaxy, Samsung Next, Streamlined Ventures, SNR.VC, Hike VC, Heitner Group, Valon Capital, Florida Funders, Altair Capital, Network VC and several angel investors.

5. Infrastructure

1. Privacy Layer 1 Network Swisstronik Completes $5 Million Seed Round Financing

Swisstronik, a privacy Layer 1 network based on Cosmos, announced the completion of a $5 million seed round of financing. Two investors, Constantin and Anton Polianski, have now joined the team as CEO and executives.

2. Essential, an intention-based encryption infrastructure company, completes $5.15 million in seed round financing, led by Maven11

Essential, an intent-based encryption infrastructure company, has completed a $5.15 million seed round of financing, led by Maven11, with participation from Robot Ventures, Karatage, Batuhan Dasgin, Skip, James Prestwich, Brandon Curtis, Eclipse founder Neel Somani and others.

VI. (Others)

1. Blockchain data visualization startup Bubblemaps completes $3.2 million seed round of financing, led by INCE Capital

Bubblemaps, a Paris-based startup focused on blockchain data visualization, has raised $3.2 million (€3 million) in a seed round led by INCE Capital, with participation from Stake Capital, Momentum 6, Lbank, V3ntures, Ledger’s Nicolas Bacca, Hacken’s Dyma Budorin, and French influencer and entrepreneur Owen “Hasheur” Simonin.

2. French cyber insurance startup Stoïk raises $10.7 million, led by Munich Re Ventures

French cyber insurance startup Stoïk has raised $10.7 million in funding led by Munich Re Ventures, with participation from Opera Tech Ventures, investors Andreessen Horowitz and Alven.

3. Blockchain medical data exchange platform Briya completes $11.5 million Series A financing, led by Team8

Blockchain medical data exchange platform Briya announced the completion of US$11.5 million in Series A financing, led by Team8, with participation from Insight Partners, Amiti Ventures, Innocare Health Investments, and the George Kaiser Family Foundation.

4. Blockchain technology company Jiritsu completed US$10.2 million in financing and launched the asset tokenization platform Tomei RWA

Jiritsu, a blockchain company focused on verifiable computing, announced the completion of two rounds of financing totaling US$10.2 million, led by gumi Cryptos Capital, with participation from Susquehanna Private Equity Investments, LLLP, Republic Capital and others.

5. Database company MotherDuck completes $52.5 million in Series B financing, with participation from a16z and others

MotherDuck, a startup that commercialized the lightweight database platform DuckDB, announced the completion of a $52.5 million Series B financing round led by Felicis, with participation from a16z, Madrona, Amplify Partners, Altimeter, Redpoint and Zero Prime.

6. Crypto data analysis platform CoinScan completes $6.3 million in financing

Crypto analysis platform CoinScan has completed a $6.3 million financing round, with participation from Shalom Meckenzie, the largest individual shareholder of sports betting company DraftKings (DKNG), Mor Weizer, CEO of betting software development company Playtech (PTEC), and Tectona, a digital company listed on the Tel Aviv Stock Exchange.

7. DCS Fintech Holdings, a financial technology company, received $10 million in strategic financing from Foresight Ventures

Singaporean fintech company DCS Fintech Holdings has received a strategic investment of US$10 million from Foresight Ventures to create a cryptocurrency-fiat deposit solution. It is reported that DCS Card Centre (formerly Diners Club Singapore), a credit card issuer regulated by the Monetary Authority of Singapore, under DCS Fintech Holdings, will use the funds to develop new payment solutions to provide seamless connections between Web2 and Web3.

3. Last week’s main track data

1. RWA

According to defillama’s statistics, the total TVL of the RWA track has reached US$2.38 billion, a slight increase from last week. The total locked value (TVL) ranks 8th. Defillama has included 25 RWA protocols.

Among these RWA (real world asset) tokenization projects are U.S. Treasury tokenization and real estate tokenization.

According to data from the rwa.xyz platform, the scale of U.S. Treasury bond tokenization has reached US$620 million, with an average yield of more than 5%.

Among these U.S. Treasury tokenization projects, Franklin Templeton Benji Investments Market Cap on Steller has the highest market value, reaching US$274 million, with a yield of 5.19%.

MakerDAO

As of the time of writing, the size of Dai in the DSR has increased by 297 million from last week to 1.63 billion, a significant increase from the previous week. The total amount of Dai has increased to 5.515 billion, a slight increase from last week. The DSR deposit rate is 5%.

Among them, sDAI was 1.077 billion, a slight increase from last week.

Let’s take a look at the distribution of DAI.

The share of DAI in DEX and Lending has been declining since October 2022, while the holding rate of DAI in EOA accounts has been rising, reaching 53.2%, a slight decrease from last week. Since the DSR adjusted the interest rate, the share of DAI Savings has become larger and larger, currently reaching 29.4%, a slight increase from last week.

Currently, the ones with the highest proportion are: EOA, DAI Savings, and Bridge.

The TVL of Maker's own lending protocol Spark reached 609 million, a slight decrease from last week.

According to dune platform statistics, RWA accounts for 63.6% of MakerDAO's revenue, an increase of two percentage points from last week. The high proportion is related to MakerDAO's vigorous layout in the RWA track.

2. LSD

Currently, the amount of ETH staked in the beacon chain has reached 26.98 million ETH, a slight increase from last week, accounting for 22.46% of the total ETH supply, and the number of nodes is 843,400.

The current ETH staking yield is approximately 3.63%. As the quality increases, the yield is decreasing.

Among the three major protocols, in terms of ETH staking, Lido decreased by 4.64% in a week, Rocket Pool decreased by 4.33% in a week, and Frax decreased by 5.03% in a week.

Judging from the price performance of the three major protocols, LDO fell 6.35% in a week, RPL fell 6.48% in a week, and FXS price fell 4.58% compared with last week.

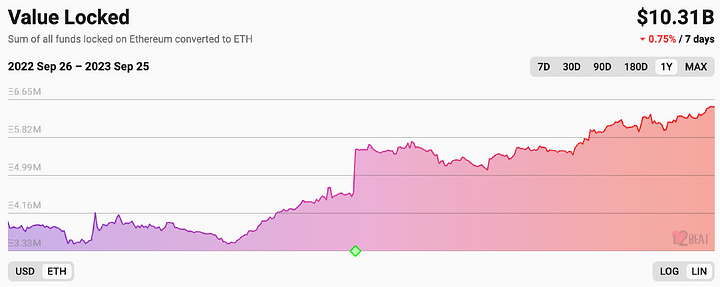

3. Ethereum L2

According to data from the l2beat platform, Ethereum Layer2 TVL has dropped by 0.75% in the past week and is currently at $10.31 billion.

In Ethereum Layer2, Arbitrum still has the highest TVL, accounting for 54.69%. The fastest growing one in recent times is of course zkSync, with its TVL increasing by 0.47% in the past week to US$417 million.

4. DEX

TVL

According to data from defillama, the total locked value of the DEX track is US$11.48 billion, a slight decrease from last week.

Uniswap ranks the highest in terms of locked value, followed by Curve, PancakeSwap, Balancer, SUN and Sushi. The TVL of most DEXs has decreased compared to last week.

Among them, the DEXs with the highest TVL on the Ethereum mainnet are Uniswap, Curve, Balancer, Sushi, and Loopring.

The above are the top 6 DEXs in terms of TVL on Arbitrum, OP Mainnet, zkSync Era, Starknet, and Base chain.

The above are the top 6 DEXs in terms of TVL on other Layer1 chains.

Trading volume

The decentralized exchange (DEX) has a trading volume of nearly 1.32 billion US dollars in the past 24 hours, which is an increase from last week. The total trading volume of global cryptocurrency exchanges in the past 24 hours was 32.5 billion US dollars, of which DEX trading volume accounted for only 4.1%.

Among DEXs, the exchanges with relatively high trading volumes include Uniswap, ApeX, Pancakeswap, and Ferro.

5. Derivatives DEX

TVL

Judging from the data from defillama, the TVL of derivatives DEX has been declining recently. On the one hand, it is because of the drop in token prices, and on the other hand, it is because the overall trading volume of the derivatives track is declining.

In the derivatives track, GMX has the highest TVL, followed by dYdX, Gains Network, ApolloX, and NUX Protocol.

Trading volume

According to data statistics from the coingecko platform, the decentralized derivatives trading platform with the highest trading volume is dYdX, with a trading volume of US$290 million in the last 24 hours, far higher than the trading volume of other decentralized derivatives platforms.

4. Recent Token Unlock

Recently, there are 8 projects whose token unlocking is worth noting. Among them, the unlocking amounts of Optimism and Sui are relatively large, which deserves everyone's attention.