Carefully! Lots of text.

A limit stop order combines a stop trigger and a limit order. Stop limit orders allow one to set a desired minimum amount of profit or the maximum amount they are willing to spend or lose on a trade. When you create a limit stop order and the market reaches the specified price, the limit order will be placed automatically even if you are logged out or offline. Stop limit orders can be placed strategically based on resistance and support levels, as well as the volatility of the asset.

The stop price in a limit stop order is the price at which the exchange places a limit order. The limit price is the price at which your order will be placed. You can set a limit price, which is usually set above the stop price for a buy order and below the stop price for a sell order. This difference takes into account changes in the market price between the time the stop price is triggered and the placement of the limit order.

Introduction

If you are looking to actively trade rather than hold (HODL) assets, then you will likely need to use more than just market orders. A limit stop order offers more control and customization. This can be challenging for beginners, so let's look at the key differences between limit orders, stop loss orders, and limit stop orders.

Limit order, stop loss order and limit stop order

Limit orders, stop loss orders, and stop limit orders are some of the most common order types. Limit orders allow you to set a range of prices at which you are willing to trade, a stop loss order sets the stop price for opening a market order, and a limit stop order combines the qualities of both types. Let's look at each in more detail.

Limit order

When you create a limit order, you set a maximum buy price or minimum sell price. The exchange will automatically attempt to fill a limit order when the market price matches your request or offers better terms. These orders are useful if you have a target entry or exit price and are willing to wait for your conditions to be met.

Traders typically place limit orders to sell above the current market price and to buy below the current market price. A limit order at the current market price will most likely be executed within a few seconds (if there is sufficiently high liquidity in the market).

For example, if the market price of Bitcoin is $32,000 (BUSD), then a user can set a limit order of $31,000 to buy BTC at that price or lower. You can also place a limit sell order at $33,000 and the exchange will sell your BTC at that price or higher.

Limit stop order

As noted earlier, a limit stop order combines a stop trigger and a limit order. A stop order adds an activation price to the exchange to place your limit order. Let's take a closer look at this process.

How does a limit stop order work?

The best way to understand how a limit stop order works is to break it down into parts. The stop price acts as a trigger for placing a limit order. When the market reaches the stop price, a limit order is created automatically at the specified price (limit price).

The limit price and stop price can sometimes be the same, but this does not have to be the case. In fact, it is safer to set the stop price (trigger price) slightly above the limit price for a sell order, and slightly lower for a buy order. This will increase the chances of your limit order being executed once the trigger is triggered.

Examples of buy and sell limit stop orders

Buy limit stop order

Let's imagine that BNB is worth $300 (BUSD) and you would like to make a purchase at the start of a bullish trend. However, you don't want to overpay for BNB if it starts to rise very quickly. Therefore, it is necessary to limit in advance the price you will end up paying.

Let's assume that technical analysis predicts the start of an uptrend if the market rises above $310. You decide to use a buy limit stop order to open a position for such an eventuality. You set a stop price at $310 and a limit price at $315. Once BNB reaches $310, a limit order is placed to buy BNB at $315. In this case, your order may be filled at $315 or lower. However, if the market rises too quickly above the specified limit price of $315, your order may not be fully filled.

Sell limit stop order

Let's imagine that you bought BNB for $285 (BUSD), and now it costs $300. To avoid losses, you decide to use a limit stop order to sell BNB if the price drops to the starting price. The limit stop order is set to sell with a stop price of $289 and a limit price of $285 (the price at which you bought BNB). If the price reaches $289, a limit order will be placed to sell BNB at $285. In this case, your order may be filled at $285 or higher.

How to Place a Limit Stop Order on Binance?

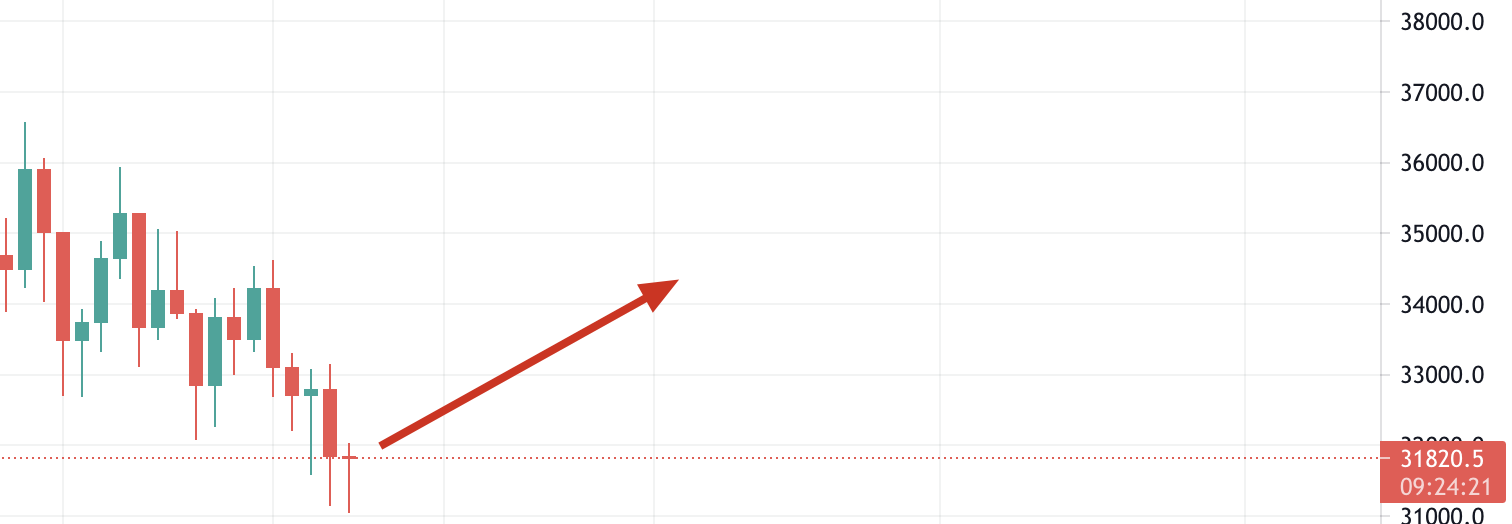

Let's say you just bought five BTC at $31,820.50 (BUSD) because you expect the price to rise further.

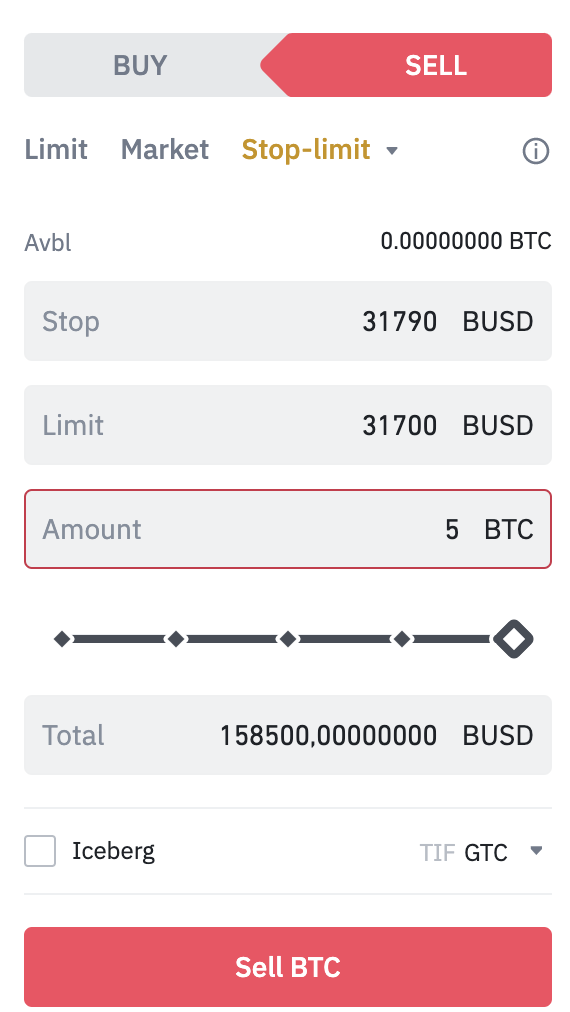

In this situation, you can create a sell limit stop order to reduce your losses if the price does start to fall. To do this, log into your Binance account and go to the BTC/BUSD market. Open the “Stop Limit” tab and set the stop price and limit price, as well as the amount of BTC to sell.

If you think the $31,820 level is safe enough, set a limit stop just below that price (in case it doesn't hold). In our example, we will place a limit stop order for 5 BTC with a stop price of $31,790 and a limit price of $31,700. Let's look at this process in more detail.

When you click "Sell BTC", a confirmation window will appear. Make sure the information you filled in is correct and click “Place Order.” After creating a limit stop order, you will see a message confirming the operation. By scrolling down the page, you will be able to view or manage your open orders.

Please note that a limit stop order will only be placed if the stop price is reached, and a limit order will be executed if the market price reaches your limit price or better. If your limit order is triggered by the stop price, but the market price does not reach the price you set or better, it will remain open.

It is also possible that the price falls too quickly and your limit stop order is not executed. In this case, you will have to use market orders to quickly exit the trade.

Benefits of using a limit stop order

A limit stop order allows you to customize and plan your trades. Tracking prices is not always possible, especially in the ever-changing cryptocurrency market. Another advantage is that such an order allows you to set a suitable amount to take profit. Without a limit, your order will be executed at the current market price, whatever that may be. Some traders prefer to hold rather than sell assets at any price.

Disadvantages of Using a Limit Stop Order

Stop-limit orders have the same disadvantages as limit orders, mainly because they are not guaranteed to be executed. The limit order will begin to be executed only when it reaches the specified or better price. However, this price cannot always be achieved. Even if you create a gap between your limit and stop prices, sometimes this may not be enough, as highly volatile assets can exceed the set spread.

There may also be a liquidity issue if there are not enough takers to fill your order. If you are concerned about orders not being filled completely, try using FOK (Fill or Cancel) orders. Then your order will be triggered only if it is fully executed. However, keep in mind that as the number of conditions increases, the probability of order execution decreases.

Strategies for placing limit stop orders

So we studied limit stop orders. So what's the best way to use them? The following are several trading strategies that can improve the effectiveness of your limit stop orders and avoid some of the negative effects.

1. Research the volatility of the asset you are placing a limit stop order on. We have already recommended creating a small spread between your stop order and your limit order to increase the chances of your limit order getting filled. However, if the asset you are trading is volatile, this spread will need to be increased slightly.

2. Assess the liquidity of the asset you are trading. Limit stop orders are especially useful when trading assets with wide bid-ask spreads or low liquidity (this helps avoid unfavorable prices due to slippage).

3. Use technical analysis to determine price levels. We recommend setting a stop price at the support or resistance level of the asset. These levels can be determined using technical analysis. For example, you can use a limit buy stop with a stop price just above a resistance level to take advantage of a breakout, or a limit sell stop just below a support level to prevent the market from starting to fall.

For more information on support and resistance levels, see our article Introduction to Support and Resistance Levels.

Summary

A limit stop order is a powerful tool that opens up more trading opportunities than simple market orders. These orders are also attractive because they do not require active trading to be executed. By combining multiple limit stop orders, you can easily manage your assets whether the price is falling or rising.