TL;DR (SUMMARY)

MakerDAO is a Decentralized Finance (DeFi) project with a stablecoin collateralized in cryptocurrencies and anchored to the US dollar, and is called DAI. The currency is managed by its community through a Decentralized Autonomous Organization (DAO). Users generate DAI by locking cryptocurrencies in a Maker Vault with a specific settlement rate. For example, a 125% settlement rate requires $1.25 of cryptocurrency collateral for every $1 of DAI.

The stablecoin is overcollateralized to take into account the price volatility of cryptocurrencies, and a stability fee is also charged. Your cryptocurrency is liquidated and used to recover any losses if your collateral falls below the liquidation rate.

DAI remains stable because your DAO controls the stability fee and the DAI savings rate. The stability fee affects the supply of DAI by changing the cost of minting DAI. The DAI savings rate affects the demand for the coin, which changes investors' profits from staking DAI. When DAI strays from its anchor, the DAO uses these two mechanisms to route it back to its anchor.

DAI has similar advantages to other cryptoassets and stablecoins. It is easy to transfer internationally, can be used to make payments or secure profits and losses. You can also use DAI as leverage and invest it in the DAI savings rate contract to earn interest.

To participate in governance surveys and executive votes, users purchase MKR tokens which provide them with voting power. These tokens are used to modify the stability fee, DAI savings rate, equipment, smart contracts, and other issues.

Introduction

Stablecoins are very popular cryptocurrencies that offer a middle ground between traditional finance and digital assets. Because they imitate fiat currencies, but operate like cryptocurrencies, these blockchain-based tokens are attractive for locking in profits and losses.

To date, the stablecoins with the largest market capitalizations have been those backed by fiat. These operate by maintaining a supply of reserves that back the stablecoin. However, cryptocurrency-backed stablecoins are also popular. In this article, we'll examine one of the most famous examples, MakerDAO, and exactly how it maintains the $1 anchor via volatile collateral.

What is MakerDAO?

MakerDAO is an Ethereum (ETH) project launched in December 2017 by Rune Christensen. It is focused on the creation of DAI, a cryptocurrency-collateralized stablecoin pegged to the US dollar. Instead of being run by a group of developers or a single entity, the MakerDAO ecosystem uses the MKR governance token for proposals and decisions about the project. This governance model is known as DAO (Decentralized Autonomous Organization).

Users access MakerDAO through the Oasis DApp. Here they can create collateralized loans, participate in governance, and manage their Maker Vaults. These interactions are based on smart contracts and game theory, allowing DAI to maintain a relatively stable value. DAI can be used identically to fiat-backed stablecoins and offers the same advantages.

What is DAI?

DAI is MakerDAO's stablecoin pegged to the US dollar, and is among the largest stablecoins and cryptocurrencies by market cap. The supply of the ERC-20 token is unlimited as long as users continue to provide collateral to generate more DAI.

MakerDAO uses cryptocurrency collateralization to maintain its anchorage, rather than a vault with fiat currency reserves. It may be a little disconcerting that cryptocurrencies, known for their volatility, can act as a backstop for a stablecoin. Simply put, the cryptocurrencies a user deposits to create DAI have a much higher value than the stablecoin they receive. This provides a margin for downward movements in the price of the cryptocurrencies that act as collateral.

As with any other stablecoin, the use of DAI has several advantages:

1. It is most suitable for expenses that require stability. Retailers and individuals do not always want payments in cryptocurrencies whose value can change overnight.

2. DAI benefits from all the advantages of the blockchain. Stablecoins can be transferred internationally without a bank account. Plus, they are incredibly safe if stored correctly.

3. You can use it to ensure profits and losses, and as a risk hedge. DAI offsets some of the overall risk of your portfolio, and is a useful way to enter and exit positions without having to go off-chain.

How does a cryptocurrency collateral work?

Collateral is a common concept in traditional finance that you may already be familiar with. When applying for a loan, you must provide something of value as collateral. This is used to cover the loan if you cannot pay it.

Physical and fiat guarantee

A pawn shop is a good example. You can give jewelry (collateral) in exchange for a cash loan. You can then repay the loan plus a fee to recover your collateral, or let the pawn shop keep the collateral and compensate for your loss. The collateral acts as a safety net, and the same concept applies to mortgages and auto financing. In these cases, the assets (property or car) act as collateral.

Fiat-backed stablecoins like BUSD are collateralized by fiat currencies. A user hands over their money (the collateral) and receives tokens in exchange. You can then return the tokens to the issuer if you wish, but in the event that you don't, the latter keeps the money. This mechanism facilitates the arbitration that maintains the anchoring of the stablecoin. You can read more about it in our article What is a stablecoin?

Cryptocurrency guarantee

Cryptocurrency-collateralized stablecoins, such as DAI, accept crypto as collateral instead of fiat. A smart contract with rules manages these funds: issue X amount of stablecoin tokens per Y amount of ETH deposited. Return Z amount of ETH when X amount of stablecoins are returned. The exact amount of collateral required depends on the project issuing the token. This rate will depend mainly on the volatility and risk of the asset that acts as collateral.

What is DAI overcollateralization?

Stable, relatively low-risk assets such as fiat money, precious metals and real estate are typically favorites as collateral. As we have discussed, using cryptocurrencies as collateral is riskier for lenders, given that their price can change wildly. Imagine a project that requests $400 of ETH as collateral, for 400 tokens pegged to USD.

If the price of ETH suddenly drops, the lender's collateral will not cover the loan it gave. The solution here is overcollateralization: instead, the lender requests $600 of ETH as collateral when lending 400 tokens of their USD-pegged stablecoin.

What are Collateralized Debt Positions (CDP)?

For years, MakerDAO has used overcollateralization to maintain a reasonably secure anchor. Since smart contracts control the DAI generation process, it works efficiently and without human interference. When you want to borrow the DAI stablecoin, you lock cryptocurrencies in a CDP smart contract. This CDP will set a settlement rate, for example, 1.5x, which means you will need to put up $150 of ETH for $100 of DAI. A user can add more if they wish, to reduce the risk. If the escrow amount falls below 150% (1.5x), you will incur a penalty fee. Eventually, the user risks liquidation if they fail to pay the DAI with the additional interest rate (the stability fee).

What are Maker Vaults?

Maker Vaults are where users deposit their collateral and generate DAI. These allow you to use multiple different cryptocurrencies as collateral simultaneously. The Maker Vault also burns DAI when a user returns it. The process is the following:

1. You deposit cryptocurrencies supported in the Maker Protocol.

2. The deposit opens a Maker Vault position.

3. You can withdraw DAI according to the amount of your guarantee. You will also have to pay the stability commission.

4. To recover your cryptocurrency collateral, you must pay the withdrawn DAI.

You are free to generate or return DAI and add or withdraw your collateral at any time. You must, however, maintain the settlement rate shown in the Vault. If you fall below this rate, the Vault will liquidate your collateral.

How does the value of DAI stay stable?

Aside from reducing MakerDAO's risk as a lender, the CDP mechanism helps anchor DAI to USD. MakerDAO can also vote to modify the stability fee and the DAI savings rate (the interest paid to smart contract stakers from the DAI savings rate), thereby manipulating the supply and demand of DAI. These three tools work together to keep DAI pegged at $1. Let's see how this happens:

1. When DAI falls below the anchor, the system makes it attractive for users to pay off their debts, withdraw their collateral, and burn their DAI. This can be achieved by raising the stability commission, which makes loans more expensive. The DAO could also increase the DAI savings rate, thereby raising investment demand in the token.

2. When DAI is above its anchorage, the opposite occurs. The DAO creates incentives to generate DAI if the stability fee is reduced. This generates new DAI and increases the total supply, reducing the price. MakerDAO could also decrease demand for DAI by reducing the DAI savings rate, meaning investors will look for other places to earn interest.

DAI Use Cases

As we have mentioned, DAI is used in the same way as any other stablecoin and shares the same advantages. You don't even need to generate it yourself, you can buy DAI on cryptocurrency exchanges such as Binance. DAI also presents some unique use cases:

1. Leverage: Imagine you have $1,000 of ETH and you believe the price will rise. However, you do not currently have additional funds to purchase ETH. You can use ETH as collateral, generate DAI, and then use it to purchase more ETH. If the price of ETH rises and you want to withdraw money, you can sell a portion of ETH for DAI tokens and get your collateral back.

2. DAI Savings Rate: You can earn interest by depositing DAI into the DAI Savings Rate smart contract. This rate varies as the DAO tries to control the price of DAI.

Where can I buy DAI?

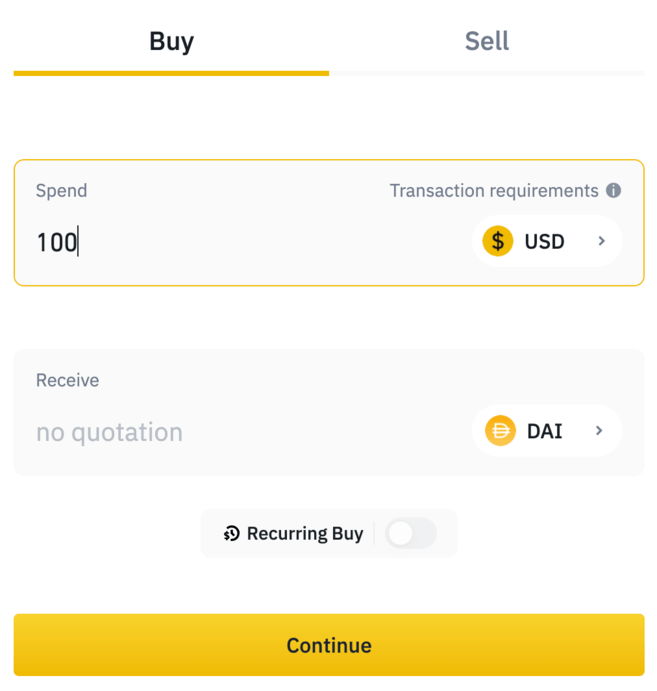

It is possible to buy DAI on large cryptocurrency exchanges, such as Binance. After creating an account and completing KYC checks, you can purchase DAI directly with a credit or debit card.

Choose the fiat currency you want to pay with in the field above and select DAI below. Below you will see clear instructions on how to add your card to your account. If you wish, you can also use the exchange view to exchange DAI for another cryptocurrency.

How do I participate in the MakerDAO governance system?

To review and vote on MakerDAO, you must have the project's governance token, MKR. The token has a maximum supply of 1,005,577 MKR, and approximately 40% was distributed to team members and early investors when it was implemented. The DAO keeps the rest for future sales.

MKR holders can vote to change the platform stability fee, DAI savings rate, settlement rate, and other aspects. Their vote is proportional to the amount of MKR they own. You can head to the MakerDAO governance portal to view ongoing voting and participate.

Governance Surveys

A governance poll allows users to create non-technical proposals for other MKR holders to vote on. For example, this could be a change in governance, objectives, team or budgets. A governance survey uses the instant settlement mechanism, which means that your choice can be ranked among multiple options.

Executive votes

Executive votes are linked to technical changes in smart contracts. Proposals use a rolling approval voting system, meaning new competing proposals can always be submitted. An executive vote will lead to profound changes to the smart contract code, such as adjusting fees or collateral levels. Executive votes are necessary to implement some of the changes voted on in governance polls.

Conclusions

As a dominant cryptocurrency-collateralized stablecoin, DAI has proven to be a huge success. The system mitigates the volatility of cryptocurrencies without the need to collateralize through fiat, which is quite a feat. Nor should we forget its importance in the history of DAOs. It is one of the largest and longest-running DAOs, which has paved the way for many others. If you decide to experiment with DAI, don't forget that it is subject to the same risks as other stablecoins.