Chapter list

Cryptocurrency

How does Blockchain work?

How to invest in cryptocurrency?

Frequently asked questions about cryptocurrency

Chapter 1 - Cryptocurrency 101

Content

What is cryptocurrency?

What makes cryptocurrency unique?

Why is it called cryptocurrency?

What is public key cryptography?

Who invented cryptocurrency?

What is the difference between cryptocurrency and token?

What is a cryptocurrency wallet?

What is cryptocurrency?

Cryptocurrency (or “cryptocurrency”) is a form of digital cash that allows individuals to transmit value in a digital environment.

You might be wondering how this system is different from PayPal or the banking apps you usually use on your phone. On the surface they may seem to have similar uses – paying friends, buying from your favorite website – but fundamentally, they are completely different.

What makes cryptocurrency unique?

In fact, cryptocurrencies are very unique. Although, cryptocurrencies have key functionalities that operate similarly to many electronic cash systems. However, the entire system is not owned by any one party.

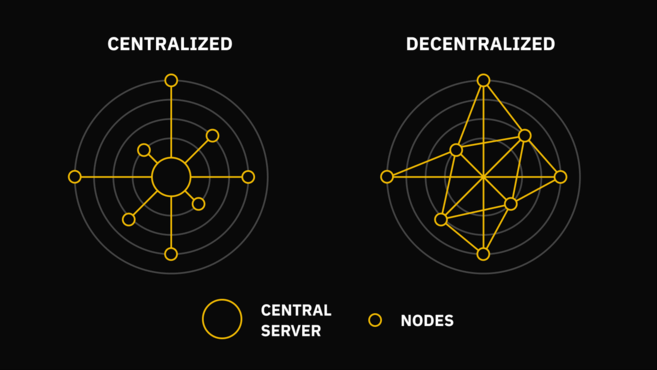

A good cryptocurrency must ensure decentralization. No central bank or small collection of users can change the rules without consensus. Participants in the network (nodes) run software that connects them to other participants so they can share information with each other.

Compare centralized and decentralized networks.

On the left is a simulation of how the traditional banking system operates. To communicate, users must go through the central server. The model on the right has no hierarchy: nodes are connected and relay information to each other.

The decentralization of cryptocurrency networks makes them effectively resistant to sudden shutdowns and censorship. In contrast, to cripple a centralized network, you only need to disrupt the main server. If a bank has its database wiped clean and there are no backups, it will be difficult to determine a user's balance.

With cryptocurrency, each node keeps a copy of the database. Each one effectively functions as an individual server. Some individual nodes can go offline, but other nodes on the same network can still get information from other nodes.

Therefore, cryptocurrencies can operate 24 hours a day, 365 days a year. They allow value to be transferred anywhere around the globe without the intervention of intermediaries. This is why we often refer to it as permissionless: anyone with an Internet connection can transfer money.

Why is it called cryptocurrency?

The term "cryptocurrency" is a portmanteau of cryptocurrency and currency. These currencies use cryptographic techniques to secure user-to-user transactions.

What is public key cryptography?

Public key cryptography is the foundation of cryptocurrency networks. It is what helps users send and receive money.

In public key cryptography, you have a public key and a private key. Basically, the private key is a huge number that no one can guess. This number is so large that it is difficult to imagine.

For Bitcoin, guessing the private key is as difficult as guessing the correct outcome of 256 coin tosses. In fact, with modern computers, you can't crack anyone else's key before the universe explodes.

Anyway, as the name suggests, the private key is for you to keep for yourself. From this keyword, you can generate a public key. The public key can be securely given to anyone. Technically, one cannot trace back from your public key to your private key.

You can also create digital signatures by signing data with your private key. It is similar to signing a document in the real world. The difference is that anyone can confirm whether a signature is valid or not by comparing it with the corresponding public key. This way, users do not need to reveal their private key, but can still prove ownership of it.

In cryptocurrency, you can only spend your coins if you have the corresponding private key. When you make a transaction, you are telling the network that you want to move your currency. This is announced in a message (i.e. transaction), which is signed and added to the cryptocurrency's database (blockchain). As mentioned, you need a private key to create a digital signature. And since anyone can view the database, they can check if your transaction is valid by checking the signature.

Who invented cryptocurrency?

There have been many attempts to create digital cash in the past, but it was not until 2009 that the first cryptocurrency, Bitcoin, was released. Bitcoin was created by a person or group of people using the pseudonym Satoshi Nakamoto. To date, the true identity of Satoshi Nakamoto remains a mystery.

Bitcoin was the start of a large number of cryptocurrencies that followed - some intended to compete, some sought to integrate features not available in Bitcoin. Today, many blockchains not only allow users to send and receive money, but also enable decentralized applications to be run using smart contracts. Ethereum is the best example of such a blockchain.

What is the difference between cryptocurrency and token?

At first glance, cryptocurrencies and tokens seem identical. Both are traded on exchanges and can be sent between blockchain addresses.

Cryptocurrencies can only be used as money, as a medium of exchange, a store of value, or both. Each unit is functionally interchangeable, meaning each coin has equal value.

Bitcoin and other cryptocurrencies were originally designed as currencies, but developers have found many ways to do more on the blockchain than that. For example, Ethereum provides more than just a monetary function. It allows developers to run code (smart contracts) on a distributed network and create tokens for various decentralized applications.

Tokens can be used just like cryptocurrencies, but they are more flexible. You can mint millions of identical tokens or create some with unique properties. Tokens can serve as anything from digital receipts, representing shares in a company to representing customer loyalty points.

On a protocol that supports smart contracts, the base currency (used to pay for transactions or applications) is separate from its tokens. For example, in Ethereum, the native currency is ether (ETH) and it must be used to create and transfer tokens within the Ethereum network. These tokens are implemented according to standards such as ERC-20 or ERC-721.

What is a cryptocurrency wallet?

Essentially, a cryptocurrency wallet is what holds your private keys. It can be a purpose-built device (hardware wallet), an app on a PC or smartphone, or even a piece of paper.

The wallet is the interface that most users will rely on to interact with the cryptocurrency network. Different types of wallets will offer different functionalities – and to be clear, paper wallets cannot be used to sign transactions or display the current value in fiat currency.

For convenience, software wallets (e.g. Trust Wallet) are considered optimal for use with everyday payments. As for security, hardware wallets are virtually unrivaled in their ability to protect private keys from prying eyes. Cryptocurrency users tend to keep funds in both types of wallets.

Chapter 2 - How does Blockchain work?

Content

What is Blockchain?

How are blocks added to the blockchain?

How does mining on Ethereum work?

Is it possible to scale cryptocurrencies?

Who gets to make decisions for cryptocurrency software?

What is Blockchain?

Blockchain is a special type of database where data can only be added to (and not deleted or changed). Transactions are periodically added to a blockchain, inside what we call blocks (which are made up of transaction information and other important metadata).

We call this structure a chain because each block's metadata includes partial information linking it to the previous block. Specifically, it includes a hash of the previous block, which you can imagine as a unique digital fingerprint.

The probability that two pieces of data will give you the same output from a hash function is very low. Therefore, if someone tries to modify an older block, its hash will be different, which means the next block's hash will also be different, and so on. Therefore, if one block is changed, all following blocks will also be changed.

The hash of each block is placed in the next block. This forms chains of blocks (blockchain).

Network participants must download the entire blockchain. Earlier, we mentioned that anyone can authenticate transactions and signatures using public key cryptography? When a node receives a block, it performs some checks. If anything is invalid, the block will be rejected.

When a node receives a valid block, it creates a copy of the block for itself and then propagates the block to other nodes. Other nodes execute similarly until the block has spread to the entire network. This process also happens for unconfirmed transactions – that is, transactions that have occurred, but have not yet been included in the blockchain.

See also: Beginner's Guide to Blockchain Technology.

How are blocks added to the blockchain?

The integrity of the blockchain would be undermined if false financial information could be recorded. Yet, there is no administrator or leader in a decentralized system that maintains the ledger – so how can we ensure that participants are acting honestly?

Satoshi proposed a Proof of Work system , which would allow anyone to propose a block to be attached to the blockchain. To come up with a block, users must sacrifice computing power to guess a challenge set by the protocol.

Proof of Work is the most used and tested scheme to achieve consensus among users, but it is not the only one. Alternatives like Proof of Stake are being deployed more and more, although they have yet to be properly implemented in their true form (although hybrid consensus mechanisms have been around for a while ).

See more: What is Blockchain consensus algorithm?

How does mining on Ethereum work?

The process mentioned above is called mining. If miners solve the puzzle, the block they build will extend the chain. As a result, they will receive a reward in the blockchain's principal.

Solving this cryptographic puzzle involves hashing the data multiple times to produce a number that is lower than a specific value. Hashing with a one-way function means it's almost impossible to guess the input from the output. But with input, verifying the output is straightforward. This way, any participant can verify the miner produced a ‘correct’ block and reject invalid ones. In this case, if miners try to forge an invalid block, they will not receive the reward and spend their resources.

This is the result of applying game theory. If you try to cheat, you will pay a heavy price; But you will benefit if you act honestly. No malicious actor has enough resources to attack a strong network indefinitely. So, to recoup their investment, users must participate properly.

See more: What is cryptocurrency mining?

Is it possible to scale cryptocurrencies?

As mentioned, distributed networks are not very efficient. Unfortunately, cryptocurrencies can only be secure and censorship-free if all nodes can synchronize their copy of the blockchain. However, the lower the demand for speed, the easier it is for people to participate.

You can see why a blockchain that only adds a small block every ten minutes is preferable to a blockchain that can add a block every five minutes. With the 5-minute option, the nodes must be high-powered computers to maintain synchronization. From there, they push low-power computers into offline mode. This will lead to centralization, as there are fewer computers on the network.

But with smaller blocks, we cannot achieve as many transactions per second (TPS). It also means that, during busy periods, transactions can take a while to be added to the blockchain. It's inconvenient if you want fast payments, but that's the price you pay for decentralization.

Scalability is a difficult problem of blockchain. A system that scales well is one that can easily increase throughput, with minimal downsides. It is difficult to scale blockchains – as mentioned, if we increase throughput by using larger blocks, we will make the network less decentralized.

To increase TPS without harming the decentralization of the network, off-chain scaling appears to be a viable approach. This includes a variety of solutions - centralized and decentralized - that allow transactions to be carried out without logging them into the blockchain.

Learn some more examples of off-chain scalability: Blockchain Scalability: Sidechains and Payment Channels .

Who gets to make decisions for cryptocurrency software?

Cryptocurrency networks operate on a voluntary basis. No one forces you to run software you don't want. With a good protocol, the code will be open source so users can be sure of the fairness and security of the system.

In general, cryptocurrencies allow everyone to participate in their development. New features or code tweaks are tested by the developer community before being approved and published. From there, users can test the code themselves and choose to run them or not.

Some updates will be backward compatible, meaning updated nodes will still communicate with older nodes. Other nodes will not be backward compatible – older nodes will be "kicked" off the network unless they have been updated. Read the article Hard Forks and Soft Forks to understand this in detail.

Chapter 3 - How to invest in cryptocurrency?

Content

Which cryptocurrency should I buy?

What should I learn before investing in cryptocurrency?

Where to buy cryptocurrency

Centralized Exchange (CEX)

Decentralized exchange (DEX)

P2P trading

How to buy cryptocurrency

How to buy cryptocurrency on Binance

How to buy cryptocurrency on Binance DEX

How to buy cryptocurrency on Binance P2P

Which cryptocurrency should I buy?

Only you can make the decision – you should do your own Research (DYOR) and decide based on your analyses. With that said, there are many tools that can help you make better decisions. For example, Binance Research is a provider of reliable market insights & analysis. Binance Research also produces comprehensive reports on individual projects.

If you want to analyze cryptocurrencies, the first basic thing you need to learn is how Bitcoin works. To understand better, you can read the article What is Bitcoin? ours!

What should I learn before investing in cryptocurrency?

Should start where? There are many ways to analyze financial markets. In general, professional investors will use a variety of different strategies. However, at a high level, there are two main schools of thought for evaluating an investment: fundamental analysis (FA) and technical analysis (TA).

Fundamental analysis is a method of evaluating and valuing assets based on economic and financial factors. Analysts use an approach that considers macro and micro economic factors, industry conditions or the asset's underlying business (if any). In the case of cryptocurrencies, they can look at public blockchain data, which are sometimes called on-chain metrics.

These metrics can include: number of transactions, addresses, top holders, network hash rate, and countless other information. The goal of this analysis is to come up with a valuation of the asset and compare this valuation with its current valuation. Ultimately, the goal of this approach is to determine whether the asset is undervalued or overvalued relative to its current price.

It must be said that cryptocurrency is a new and growing asset class. There is little chance that fundamental analysis can determine their value. Simply put, there is no standardized framework for determining the value of cryptocurrencies, and most existing models cannot be trusted to a high degree. The success or failure of a cryptocurrency project can depend on many different factors, which no current framework can account for.

Technical analysts have a different approach. Unlike fundamental analysts, technical analysts do not attempt to determine the intrinsic value of an asset. Instead, they evaluate trading and investment opportunities based on past trading performance. They do that by focusing on price movements, chart patterns, indicators, and many other charting tools to gauge market strength or weakness. In essence, technical analysts believe that the past price movements of an asset can be valuable in predicting its future price movements.

Since technical analysis can be applied to any market with historical data, it is widely used by cryptocurrency traders.

So which one should you learn? Well, why not both? Most market analysis tools work best when used in combination with other tools. In either case, it is vital to understand financial risk and risk management, and never invest more than you can afford to lose.

Where to buy cryptocurrency

There are many different ways to buy cryptocurrency. However, the first thing you need to do is convert your fiat currency into cryptocurrency. You can then choose HODL, trade it with other cryptocurrencies or lend it and earn interest. Now, let's take a look at the most popular forms of cryptocurrency trading.

Centralized Exchange (CEX)

You may find the concept of a centralized exchange a bit confusing because cryptocurrencies are often referred to as decentralized. But in short, centralized exchanges are online platforms that connect buyers and sellers.

As for how centralized exchanges work, users deposit their fiat or cryptocurrency into the exchange and trade within its internal systems. If you are familiar with how cryptocurrency wallets work, you will know that, in this case, your cryptocurrency is held by the exchange. But if you want to withdraw funds and store them in your own wallet, it's also very easy.

Some users may prefer to keep funds on an exchange, either because they trade frequently or for convenience. However, if the exchange is hacked, user funds could be at risk.

Decentralized exchange (DEX)

Decentralized exchanges work differently. When you are using a DEX, there is no custodian involved. More accurately, this type is called an unattended floor.

Here's what happens when you trade on a DEX. Instead of your funds being deposited into the exchange's wallet, you are trading directly from your own wallet. Once a transaction is made, funds are transferred directly on the blockchain using the magic of smart contracts.

Since there is no entity acting as a custodian, some users view this as a safer choice than CEX. Another advantage is that most DEXs do not require you to provide any personal information other than a blockchain wallet address. However, managing your own funds requires some technical expertise and you are fully responsible for your assets.

P2P trading

A peer-to-peer (P2P) exchange also connects buyers and sellers, but it is different from both CEX and DEX. In this case, the exchange itself does nothing but connect buyers and sellers; and then they can settle the transaction in any way they agree to. Therefore, the deposit and payment method can be decided by the buyer and seller for each individual transaction.

How to buy cryptocurrency

How to buy cryptocurrency on Binance

Log in to Binance, or register if you don't have an account yet.

Visit the Buy and Sell Cryptocurrency portal.

Select the cryptocurrency you want to buy and the currency you want to pay with.

Choose your payment method.

Enter your bank card information and complete identity verification, if prompted.

Completed! The cryptocurrency will be credited to your Binance account.

How to buy cryptocurrency on Binance DEX

Using a DEX is a bit more complicated than other options.

You need to prepare:

Crypto wallets can connect to Binance DEX (we recommend Trust Wallet).

Some BNB to pay transaction fees.

Once you have them, follow the next detailed guide about Binance DEX:

Binance DEX: Interface Guide

Binance DEX: Create a wallet

Binance DEX: Access your wallet

How to buy cryptocurrency on Binance P2P

Log in to Binance, or register if you don't have an account yet.

Visit the Binance P2P portal.

Choose whether you want to buy or sell.

Choose your currency, payment method, and other transaction requirements.

Choose a listing that meets your requirements or post your own listing.

Frequently asked questions about cryptocurrency

Content

Is cryptocurrency legal?

Can cryptocurrency die?

Are cryptocurrencies safe?

Are cryptocurrencies anonymous?

Do cryptocurrencies have value?

Are all digital currencies cryptocurrencies?

What is cryptocurrency market capitalization?

Why do you need to pay transaction fees?

I lost my key. Can I get my money back?

What is the future of cryptocurrency?

Is cryptocurrency legal?

Very few countries have outright bans on buying, selling and storing cryptocurrencies. For much of the world, Bitcoin and other virtual currencies are completely legal. But before starting with them, you should check if your area allows it or not.

It is important to remember that each country has a different approach to regulating cryptocurrency activities. Make sure you're not violating any tax or general rules.

Can cryptocurrency die?

The media has declared cryptocurrency dead hundreds of times over the past decade. However, it continues to operate from 2009 to present. That doesn't mean it isn't volatile – there are wild swings in price. For those just trying to profit, a bear market can soon cause disappointment.

However, it would be a mistake to describe cryptocurrencies as “dead”. The market continues to attract new users; while technology and infrastructure are becoming more and more perfect.

The core innovations of Bitcoin and Ethereum will certainly play an important part in reshaping our existing monetary systems, to be more relevant to the current times. Immutability, censorship resistance, trustlessness, or near-instant transactions using a public currency system could radically transform the economic mechanics of the Internet.

Are cryptocurrencies safe?

There is a level of risk with cryptocurrencies. If you forget your password to access your bank account, you can simply reset it through customer support. However, if you forget or lose the private keys that allow you to access your cryptocurrency, there is no one to help you. Using a reputable exchange may be an easier option – it requires trust, but you eliminate the risk of losing your private keys.

The cryptographic public key has not yet been broken. With good security measures in place, you are more likely to have your online accounts hacked than to have your money stolen. The best measures to avoid these are to develop an understanding of common scams (social engineering, phishing, etc.), keep your private keys offline at all times, and back them up in a safe location.

Are cryptocurrencies anonymous?

Your name is not connected to your cryptocurrency address – in fact, information about you looks like random strings of numbers and letters on the blockchain. However, be careful about assuming this makes you anonymous. You have a nickname – a sort of online identity, even if it's not the identity you use in real life.

There are several methods that can allow people to associate your IP address with your activities. In this sense, things like dusting attacks and other analytical techniques can be used to neutralize your anonymity. Remember, blockchains are essentially giant public databases. If you're worried about your privacy, you should find a way to make it harder for others to link your transactions to your identity. By default, cryptocurrencies like Bitcoin are not private by default, but methods like coin mixing and CoinJoins can make Heuristics analysis unreliable.

A subset of cryptocurrencies (called privacy coins) can obfuscate the source, destination, and amount of transactions, using methods such as Secret Transactions. Of course, these methods create stronger privacy, but they are not completely resistant to de-anonymization.

Do cryptocurrencies have value?

In essence, values are shared beliefs. As with anything of value, value is not determined by the cryptocurrency itself – it is assigned by people. In other words, something is valuable if people believe it is valuable. This is true regardless of the valuable object, whether a precious metal, a piece of paper, or some bits in a database.

With all that said, some people view cryptocurrencies and Bitcoin as a scarce digital commodity. Due to its predictable issuance rate and monetary policy, some argue that Bitcoin could act as a future store of value, similar to gold. Since Bitcoin has only been around for a little over a decade, it remains to be seen whether it will withstand the test of time in this regard.

Are all digital currencies cryptocurrencies?

Are not. You may have heard that many countries and central banks are working to create their own versions of digital currencies. However, this is just that – digital currency. In fact, they are often referred to collectively as central bank digital currencies (CBDC). These are essentially digital versions of fiat currencies, and they don't enjoy most of the benefits of cryptocurrencies. They are issued and declared legal tender by the Central Government and do not typically use a distributed ledger, such as blockchain, to keep records of transactions.

You may also have heard about Facebook Libra, another digital currency. On the positive side, Libra is planned to be built on an open source blockchain system. However, unlike Bitcoin or Ethereum, participants will need more than a simple Internet connection to use it. Furthermore, this project and the activities thereon will be operated and managed by an association consisting of a selected number of members.

So, even though CBDCs and other forms of digital currency use blockchain or encryption, they are still completely different from cryptocurrencies like Bitcoin.

What is cryptocurrency market capitalization?

When you are looking at the price of a cryptocurrency, you only see part of the picture. An equally important metric is how many individual units of this cryptocurrency are in existence. In other words, it is its supply.

More specifically, to assess the value of a cryptocurrency network, you need to know how many individual units of it are in existence right now. This is called circulating supply. Different cryptocurrencies may have different release schedules, so it is important to understand how each network releases them.

Market capitalization (or market capitalization) is the price of an individual unit multiplied by the circulating supply.

Market Capitalization = Circulating Supply * PriceAs you can understand, the market capitalization of a cryptocurrency network is a more accurate representation of the value in the network than the price of an individual unit. The network has low-priced coins, but high circulating supply; may have a higher total valuation (market capitalization) than a network with a high-priced coin, but a lower circulating supply. And the opposite can also be true in certain cases.

However, it's worth noting that market capitalization does not represent the amount of money entering a particular market. For example, a common misconception among new users is that they often equate Bitcoin market capitalization with the total amount of money that has been invested in Bitcoin. This is not true because market capitalization depends on price and supply.

Why do you need to pay transaction fees?

If you send a bitcoin to another address, you will notice that that address will receive slightly less coins than what you sent. That's because you pay a small fee to reward miners for adding your transaction to the blockchain.

Many cryptocurrencies use similar mechanisms to incentivize users to secure the network. In a Proof of Work system, transaction fees are typically packaged with newly minted coins (block subsidy) to form block rewards .

You can adjust the fee depending on the urgency of your transaction. Most miners want the highest revenue possible, so they will prioritize transactions with higher fees. You can view current pending transactions to get an idea of average fees and set your own.

I lost my key. Can I get my money back?

If you are sure you have lost your keys, you will most likely never get your money back. The great benefit of cryptocurrencies is that they remove custodians and middlemen from managing financial transactions. However, the flip side of this is that the responsibility of keeping the money is completely in your hands. So you need to be extremely careful not to lose your private keys, as they are what gives you ownership of the funds.

What is the future of cryptocurrency?

What the future holds for cryptocurrency depends entirely on who you ask. Some believe that Bitcoin will rise to replace gold in the digital age and disrupt the current financial system. Others argue that cryptocurrencies will always be a secondary system, existing as a niche market. In the community, there are those who believe that Ethereum will become a distributed computer, serving as the backbone of a new Internet.

Skeptics predict that the industry will eventually collapse, but enthusiasts are still happy with cryptocurrencies and the remaining niche currency systems. There are many possible outcomes – it's simply too early to say for sure what will happen, even if it's another year. But we cannot deny that cryptocurrency has a huge development potential.