【Summary】:

Market Summary: The debt ceiling crisis continued to plague the market at the beginning of the week; however, significant progress was made in the latter half of the week. Nvidia’s better-than-expected earnings report sparked a chase for core technologies such as AI and chips, leading to a surge in the US stock market. Meanwhile, defensive assets declined as funds focused on the technology sector.

Economic Indicators: PMI data showed a divergence in the economy in May, with the service sector remaining strong and manufacturing rebounding. Durable goods sales and PCE reflected persistent inflation, indicating a resilient economy, which caused expectations of a rate hike in June to rise while expectations of rate cuts for the year disappeared.

Cryptocurrency Market: Driven by the extreme optimism in the technology sector, the cryptocurrency market also rebounded. However, expectations of an increase in the terminal point of interest rates, along with the anticipation of the TGA withdrawing market liquidity, created resistance to its rebounding sustainability.

Debt Ceiling Negotiations: US President Biden and House Speaker McCarthy reached a budget agreement in principle, raising the debt ceiling for 19 months. Market attention shifted to Wednesday and Friday when the House and Senate would vote on the matter. Given the expected depletion of funds by Friday, the voting process is not expected to encounter any surprises.

Opinions: June to August is a critical time window as four major contradictions will become very apparent. These four major contradictions include the issuance of new national bonds, extreme polarization in the stock market, the Federal Reserve raising the terminal point of interest rates, and the strong attractiveness of fixed income to funds. The development of AI is expected to reduce investors’ reliance on interest rate changes, and while valuations are already high, they are not unreasonable, leaving room for the bubble phase to continue. The optimistic sentiment is likely to spread to the crypt

Weekly Market Overview:

Last week, global stock markets showed divergent trends as negotiations to raise the US debt ceiling progressed and optimism surrounding artificial intelligence (AI) grew. The US and Japanese stock markets ended the week strongly, while European markets rebounded on Friday but ultimately closed lower. The Chinese stock market remained weak throughout the week, ending with losses.

In the US stock market, AI was undoubtedly the hottest theme of the week, with the technology sector surging over 5% and the communication sector rising over 1%. On the other hand, defensive sectors such as consumer staples and materials lagged behind, both declining over 3%. This indicates that funds continued to move away from defensive assets and towards industries with higher growth potential.

Last week, strong economic data and the tough rhetoric from central bank officials sounded the alarm on interest rate expectations, as people realized that inflation would remain sticky for a longer period. This led to a continued rise in US Treasury yields:

The 30-year Treasury yield reached the key level of 4%, reaching the highest level since the end of last year.

The 10-year Treasury yield rose from 3.66% to 3.81%, and the 2-year Treasury yield increased from 4.24% to 4.57%, both reaching the highest levels since March this year.

Short-term Treasury yields, including the 1-month and 3-month rates, experienced slight declines, indicating reduced market concerns about debt ceiling risks.

In addition, US crude oil rose by 1.2% to $72.67, as major oil-producing countries released conflicting information about future supply adjustments.

Spot gold prices saw a slight increase of 0.33% to $1,946.69 per ounce. This can be attributed to the cooling of the debt ceiling negotiation crisis and market bets on another interest rate hike by the Federal Reserve, which reduced the demand for safe-haven assets like gold. The rise in real interest rates also negatively impacted interest-free assets like gold, which theoretically could exert potential pressure on the price of BTC.

CFTC Futures Position Changes:

Overall, net long positions in US stocks (Asset managers + Leveraged funds) saw a slight increase last week. However, there was a significant divergence among the three major indices. Net long positions in the Nasdaq increased to their highest level since early 2022, while net long positions in the S&P 500 slightly decreased. Net short positions in the Russell 2000 significantly reduced and are now almost back to a neutral level. These position changes align with the trends observed in the spot market.

In the bond market, net short positions increased to nearly record highs, with net short positions rising for the 2-year, 5-year, and 10-year maturities, while net short positions decreased for the 30-year maturity. In the foreign exchange market, net short positions on the US dollar slightly decreased, primarily due to a slight reduction in net long positions on the euro.

Global equity fund flows:

According to EPFR data, as of the week ending on the 24th, global equity funds continued to experience net outflows, amounting to -$4 billion for the week. This represents an improvement compared to the previous week’s -$8 billion. Developed market equity funds led the outflows, with US equity funds seeing outflows for the sixth consecutive week, albeit at a significantly slower pace than the previous week. Emerging market equity funds also experienced net outflows.

Debt Ceiling Negotiations:

US President Biden and House Speaker McCarthy have reached a tentative budget agreement to raise the debt ceiling for 19 months until May 18, 2025. As this agreement represents a compromise, any compromise solution is almost certain to lose opposition from both the far left and far right, so the market’s focus has shifted to whether the agreement will pass in both chambers of Congress this week.

Currently, the leaders of both parties are expressing confidence that the debt ceiling agreement will pass. The bill needs to secure 218 votes in the House of Representatives and 51 votes in the Senate. President Biden strongly urges Congress to pass the US debt agreement immediately and expects no situations that could undermine the agreement. McCarthy claims that 95% of lawmakers in the party are “excited” about the agreement, but he acknowledges that the bill “doesn’t have everything everyone wants, but in a divided government, this is what we end up with.”

Treasury Secretary Yellen has updated the date when the government will exhaust its funds to June 5 (four days later than the original estimate), urging Congress to reach a negotiation outcome as soon as possible to avoid a debt default.

It is expected that the Senate will vote on the bill on Wednesday, and the House of Representatives will vote on Friday at the earliest, as Friday is already the Treasury Department’s expected last date for cash depletion. Therefore, the progress this week needs to be error-free. Although the possibility of unexpected events disrupting the passage of the bill is currently low, any unexpected occurrence during the voting process that delays the bill’s passage beyond the X-Date and into next week will increase market uncertainty.

Key Economic Data from Last Week:

The most influential economic data released last week were the Personal Consumption Expenditures (PCE) Price Index and Durable Goods Sales, which had a significant impact. They indicated that inflation remains stubborn, and the economy remains resilient, further increasing expectations of a rate hike in June.

The April PCE index rose by 0.4% on a monthly basis, surpassing expectations of 0.3% and the previous month’s 0.1% increase. On a year-over-year basis, it increased by 4.4%, also surpassing expectations of 4.3% and the previous month’s 4.3%. The core PCE index, which excludes food and energy, also rose by 0.4% on a monthly basis, exceeding expectations of 0.3% and the previous month’s 0.3% increase. On a year-over-year basis, it increased by 4.7%, surpassing expectations of 4.6% and the previous month’s 4.6%.

Clearly, these data indicate that inflation remains persistent. Despite the Federal Reserve’s 125 basis points rate hike since December last year, the core PCE index has remained around 4.7% without a decline. This data further supports expectations of future rate hikes by the Federal Reserve.

As soon as the actual data was released, CME interest rate futures immediately priced in a 70% probability of a rate hike at the next FOMC meeting, compared to only 17% the previous week. This means that the market previously believed there would be a pause in rate hikes, but last Friday, the expectations shifted towards continued rate hikes.

There are several important data releases in the future, including the May Non-Farm Payrolls and Consumer Price Index (CPI). If either of these reports shows strong performance, the hope for a pause in rate hikes at the June and July meetings will diminish. Considering that consumers will also engage in summer travel, this will further stimulate consumption and contribute to inflationary pressures.

In addition to inflation, Friday’s data also showed growth in personal income and consumption. Personal income rose by 0.4% on a monthly basis, exceeding the previous month’s 0.3% increase. Consumption, on the other hand, surged by 0.8% on a monthly basis, compared to only 0.1% the previous month. On the services side, this was driven by financial services, insurance, and healthcare, while on the goods side, it was driven by new cars and pharmaceuticals.

On the other hand, the savings rate decreased once again, dropping from 4.5% to 4.1%, further confirming the sustained high consumer confidence among Americans.

Speaking of strong consumption, the durable goods report on Friday also reflected the same trend: Durable goods sales in April increased by 1.1% on a monthly basis, while expectations were for a decline of 0.8%. The month of March saw a revised increase of 0.1% to 3.3%. The significant increase in March was mainly driven by large orders for Boeing, but if we exclude defense aircraft and military equipment, durable goods sales actually declined. However, the April data showed a solid rebound. Excluding defense aircraft and technology, durable goods sales increased by 1.4% on a monthly basis, significantly higher than the 0.6% decline in March and the 0.2% decline in February. Among the largest contributors, manufacturing increased by 1.7% on a monthly basis, while machinery and equipment rose by 1.0%, and automotive and parts only experienced a marginal decline of 0.1%.

Other key data from last week:

The final reading of the University of Michigan Consumer Confidence Index for May rose to 59.2, surpassing the preliminary figure of 57.7.

The initial jobless claims in the United States were 229,000, lower than the expected 245,000, with the previous value revised to 225,000. As of the week ending on May 13th, the continued jobless claims stood at 1.794 million, below the expected 1.8 million, with the previous value at 1.799 million.

The annualized quarter-on-quarter real GDP growth rate for the first quarter in the United States was revised from 1.1% to 1.3%. Personal consumption expenditures (PCE) annualized quarter-on-quarter growth rate was revised from 3.7% to 3.8%, while the core PCE (excluding food and energy) annualized quarter-on-quarter growth rate was revised from 4.9% to 5%.

The preliminary Markit Manufacturing PMI for May in the United States was 48.5, below the expected 50, with the previous value at 50.2. The Services PMI was 55.1, higher than the expected 52.5, with the previous value at 53.6. The Composite PMI was 54.5, exceeding the expected 53, with the previous value at 53.4.

Key events this week:

Monday: Memorial Day in the United States and Spring Bank Holiday in the United Kingdom, stock markets closed in both countries.

Tuesday: US Consumer Confidence Index for May.

Wednesday: House of Representatives vote on the debt ceiling.

Thursday: US ADP Employment Report for May.

Friday: US Nonfarm Payrolls for May (consensus is that the labor market is starting to cool), Senate vote on the debt ceiling.

Earnings reports in the US include HP on Tuesday, Salesforce, C3.AI, and Chewy on Wednesday, Dollar General, Macy’s, Bilibili, Lululemon, and Dell on Thursday.

Our Commentary:

The period from June to August is a crucial time window, as four major contradictions will become very apparent (here, we will only discuss the United States; future articles will cover topics such as Japan’s monetary policy, inflation in Europe, and progress in China).

Contradiction 1: Currently, the market expects that within three months of reaching a debt ceiling agreement, approximately $500 billion to $700 billion of new US Treasury bonds will be issued. This represents a negative liquidity drain that should, at the margin, suppress the performance of risk assets.

Possible sources of funds to absorb the issuance of new Treasury bonds include money market funds and reverse repurchase agreements (RRPs), as well as a decline in bank deposits. If these indicators show a decline, it would be seen as a positive sign, suggesting that the liquidity drain has been offset.

Additionally, it should be noted that raising the debt ceiling comes at the cost of reducing government spending over the next two years, although the scale is unlikely to significantly alter the economic outlook.

Contradiction 2: In the stock market, almost every industry’s giants are becoming larger, including technology, banking, energy, retail, healthcare, and defense, among others. This is why we see the market capitalization-weighted S&P index rising, while the equal-weighted S&P index is falling. This trend has been particularly pronounced since March. As this rally is driven by AI as the core driver, the short-term benefits in terms of efficiency or performance may not be reflected across a broad range of industries. There is a possibility of a bubble forming in the AI and technology sectors, especially considering that the P/E ratios of large technology companies are already more than double those of ordinary companies. The market is faced with the question of whether it can still justify investing in stocks with increasingly expensive valuations.

Contradiction 3:

In recent times, there has been a significant increase in hawkish comments from Fed officials, accompanied by sustained strong economic data. As a result, interest rate futures for the second half of 2023 have been consistently declining. Earlier this month, market predictions pointed to a potential rate cut of nearly 100 basis points, but now it is expected that there won’t be any rate cuts (aligning with the Fed’s March dot plot). This rapid shift occurred just last week, and its ongoing impact can be considered as still not fully realized.

Contradiction 4:

Despite the optimistic sentiment in the stock market, there was still a significant inflow of funds into U.S. money market funds last week (+$39.9 billion, the highest in five weeks). This indicates the strong attractiveness of fixed-income assets and suggests that this appeal will remain stable in the coming months, even amid fading expectations of interest rate cuts.

In conclusion, most stocks have not participated in the upward trend, and the current trend is heavily influenced by the technology sector, particularly companies closely associated with AI and chip technologies. The dominance of a few large-cap tech stocks may leave the market vulnerable, and any setbacks for major tech indices like “MAGMA” or “NYFANG,” such as disappointing earnings or changes in industry regulations, could have significant implications for the entire market.

There is also the possibility of more stocks following the upward trend of big tech, which would sustain the bull market in the long run but would require solid earnings data to support it. While AI has indeed reduced investors’ reliance on interest rate changes, it can be expected that several companies will attempt to capitalize on the AI concept in the coming months. However, it will take time to observe which industries can genuinely benefit from AI. Any stock price increases that are not backed by performance or increased dividends are vulnerable.

For example, according to Factset data, only 110 companies in the S&P 500 mentioned artificial intelligence in their latest conference calls.

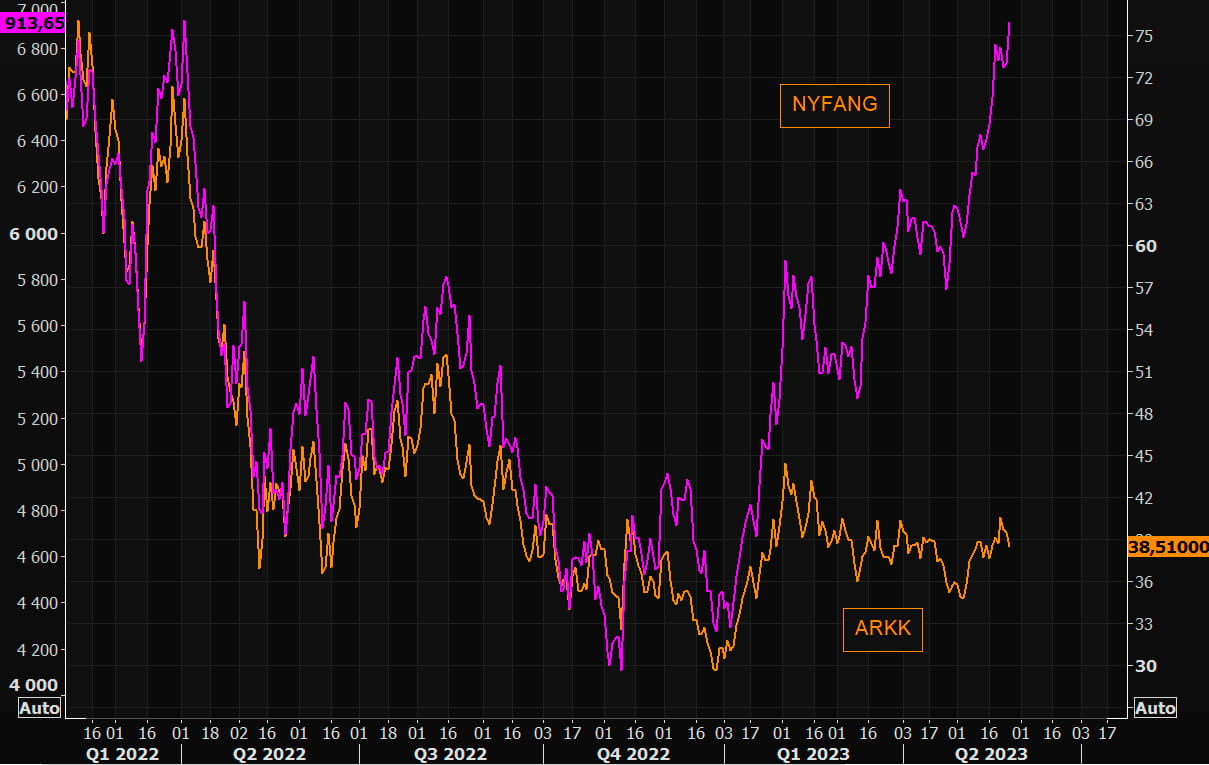

For example, even the so-called innovation-focused ARKK has significantly underperformed NYFANG:

The development of the AI field currently feels like there is a large number of investors who have not fully participated in it. While related companies may have high valuations, they are still far from being in an outrageous situation. We expect to witness the evolution of AI-related investment targets from being expensive to potentially reaching bubble-like or even meme-like levels in the coming months. For instance, last week, the WSB community showed exceptional excitement towards AI concepts.

This sentiment is likely to spread to the cryptocurrency market as well because both cryptocurrencies and AI are targets with significant adoption potential. However, concerns about liquidity and ongoing regulatory pressure may limit the extent of their gains in the cryptocurrency market.

website: ldcap.com

medium:ld-capital.medium.com