Introduction

When you think of a safe-haven asset, precious metals like gold or silver probably come to mind. They’re investments that individuals flock to as hedges against turmoil in traditional markets.

The debate over whether Bitcoin follows in the footsteps of these assets rages on. In this article, we’ll look at some of the main arguments for and against Bitcoin being a store of value.

What is a store of value?

A store of value is an asset that’s capable of retaining value over time. If you purchased a good store of value today, you could be reasonably certain that its value would not depreciate over time. In the future, you would expect the asset to be worth just as much (if not more so).

When you think of such a “safe haven” asset, gold or silver probably come to mind. There are a handful of reasons why these have traditionally held value, which we’ll get into shortly.

Sneak a peek at the latest Bitcoin (BTC) prices today.

What makes a good store of value?

To understand what makes a good store of value, let’s first explore what might make a poor store of value. If we want something to be preserved for long periods of time, it stands to reason that it needs to be durable.

Consider food. Apples and bananas have some intrinsic value, as humans require nutrition to live. When food is scarce, these items would no doubt be highly valuable. But that doesn’t make them a good store of value. They’ll be worth a lot less if you keep them in a safe for several years because they’ll obviously degrade.

But what about something intrinsically valuable that’s also durable? Say, dry pasta? That’s better in the long run, but there’s still no guarantee that it holds value. Pasta is cheaply produced from readily-available resources. Anyone can flood the market with more pasta, so the pasta in circulation will depreciate in value as supply outweighs demand. Therefore, for something to maintain value, it must also be scarce.

Some consider fiat currencies (dollars, euros, yen) a good way to store wealth as they retain value in the long term. But they’re actually poor stores of value because the purchasing power drops significantly as more units are created (just like the pasta). You could withdraw your life savings and stash them under your mattress for twenty years, but they won’t have the same purchasing power when you eventually decide to spend them.

In the year 2000, $100,000 could buy you a lot more than it can today. This is mainly due to inflation, which refers to the increase in the price of goods and services. In many cases, inflation is caused by an excessive supply of fiat currency due to the government practice of printing more money.

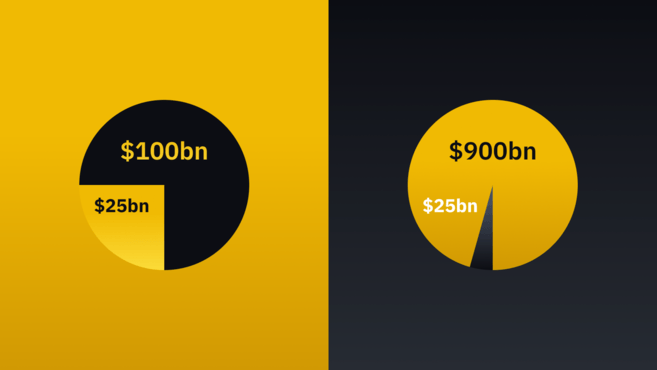

To illustrate, suppose that you hold 25% of the total supply of $100 billion – so, $25 billion. Time goes on, and the government decides to print, for instance, an additional $800 billion to stimulate the economy. Your piece of the pie has suddenly dropped to ~3%. There’s a lot more money in circulation, so it stands to reason that your share doesn’t hold as much purchasing power as it used to.

The loss of purchasing power over time.

Like our pasta mentioned earlier, dollars are not expensive to produce. The above can happen in a matter of days. With a good store of value, it should be challenging to flood the market with new units. In other words, your piece of the pie should dilute very slowly, if at all.

Taking gold as an example, we know that its supply is finite. We also know that it’s very difficult to mine. So even if the demand for gold suddenly rises, it’s not a matter of firing up a printer to create more. It has to be extracted from the ground, as always. Though there’s an influx in demand, supply can’t be materially increased to cater to it.

The case for Bitcoin as a store of value

From the early days of Bitcoin, proponents have made the case for the cryptocurrency being more akin to “digital gold” than simple digital currency. In recent years, this narrative has been echoed by many Bitcoin enthusiasts.

The store of value thesis for Bitcoin argues that it’s one of the soundest assets known to man. Proponents of the thesis believe that Bitcoin is the best way to store wealth such that it isn’t devalued over time.

Bitcoin is known for wild volatility. It might seem unintuitive that an asset that can lose 20% of its value in a day is considered by many as a store of value. But even factoring in its many drops, it remains the best performing asset class to date.

So, why has Bitcoin been hailed as a store of value?

Scarcity

Perhaps one of the most persuasive arguments for the store of value thesis is that Bitcoin has a finite supply. As you may remember from our article What is Bitcoin?, there will never be more than 21 million bitcoins. The protocol makes sure of this with a hardcoded rule.

The only way that new coins can be created is through the process of mining, which is somewhat analogous to how gold is mined. But instead of drilling into the Earth, Bitcoin miners must crack a cryptographic puzzle using computational power. Doing so will earn them fresh coins.

As time goes on, the reward diminishes due to events known as halvings. If you guessed that this halves the reward, you’d be absolutely right. In the early days of Bitcoin, the system rewarded 50 BTC to any miner that produced a valid block. During the first halving, this number was reduced to 25 BTC. The subsequent halving cut it in half to 12.5 BTC, and the next one will slash miners’ reward to 6.25 bitcoins per block. This process will continue on for another 100+ years until the final fraction of a coin has entered into circulation.

Let’s model this similarly to our fiat currency example from earlier. Suppose you bought 25% of the Bitcoin supply (i.e., 5,250,000 coins) many years ago. When you acquired these coins, you knew that your percentage would remain the same because there’s no entity capable of adding more coins to the system. There’s no government here – well, not in the traditional sense (more on this shortly). So if you bought (and HODLed) 25% of the maximum supply in 2010, you still own 25% of it today.

Decentralization

It’s open-source software, you might be thinking. I can copy the code and make my own version with an additional 100 million coins.

You could indeed do that. Let’s say you clone the software, make the changes, and run a node. Everything seems to be working fine. There’s just one problem: there are no other nodes to connect to. You see, as soon as you changed the parameters of your software, members on the Bitcoin network started ignoring you. You’ve forked, and the program you’re running is no longer what’s globally accepted as Bitcoin.

What you’ve just done is functionally equivalent to taking a photo of the Mona Lisa and claiming there are now two Mona Lisas. You can convince yourself that that’s the case, but good luck convincing anyone else.

We said that there was a kind of government in Bitcoin. That government is made up of every user that runs the software. The only way in which the protocol can be changed is if the majority of users agree on changes.

Convincing a majority to add coins would be no easy task – after all, you’re asking them to debase their own holdings. As it stands today, even seemingly insignificant features take years to reach consensus across the network.

As it grows bigger in size, pushing changes will only get more difficult. Holders can, therefore, be reasonably confident that the supply won’t be inflated. While the software is man-made, the decentralization of the network means that Bitcoin acts more like a natural resource than code that can be arbitrarily changed.

The properties of good money

Believers in the store of value thesis also point to features of Bitcoin that make it good money. It’s not just a scarce digital resource, but one that shares characteristics that have traditionally been adopted in currencies for centuries.

Gold has been used as money across civilizations since their inception. There are a handful of reasons for this. We’ve talked about durability and scarcity already. These can make good assets, but not necessarily good forms of currency. For that, you want fungibility, portability, and divisibility.

Fungibility

Fungibility means that units are indistinguishable. With gold, you can take any two ounces, and they’ll be worth the same. This is true of things like stocks and cash as well. It doesn’t matter which particular unit you’re holding – it’ll hold an equal value to any other of the same kind.

Bitcoin fungibility is a tricky subject. It shouldn’t really matter what coin you’re holding. In most cases, 1 BTC = 1 BTC. Where it gets complicated is when you consider that each unit can be linked back to previous transactions. There are cases where businesses blacklist funds that they believe have been involved in criminal activities, even if the holder received them after.

Should it matter? It’s hard to see why. When you’re paying for something with a dollar bill, neither you or the merchant know where it was used three transactions ago. There’s no concept of transaction history – new bills aren’t worth more than used ones.

In a worst-case scenario, however, it’s possible that the older bitcoins (with more history) are sold for less than newer bitcoins. Depending on who you ask, this scenario could be either the greatest threat to Bitcoin or not something to worry about. For now, anyway, Bitcoin is functionally fungible. There have only been isolated incidents of coins being frozen due to suspicious history.

Portability

Portability denotes the ease of transporting an asset. $10,000 in $100 bills? Easy enough to move around. $10,000 worth of oil? Not so much.

Good currency needs to have a small form factor. It needs to be easy to carry so that individuals can pay each other for goods and services.

Gold has traditionally been excellent in this regard. At the time of this writing, a standard gold coin holds almost $1,500 in value. It’s unlikely that you’d be making purchases worth a full ounce of gold, so smaller denominations take up even less space.

Bitcoin is actually superior to precious metals when it comes to transportability. It doesn’t even have a physical footprint. You could store trillions of dollars worth of wealth on a hardware device that fits in the palm of your hand.

Moving one billion dollars of value in gold (over 20 tons currently) requires tremendous effort and expense. Even with cash, you would need to carry several pallets of $100 bills. With Bitcoin, you can send the same amount anywhere in the world for less than a dollar.

Divisibility

Another vital quality of currency is its divisibility – that is, the ability to split it into smaller units. With gold, you can take a one-ounce coin and cut it down the middle to produce two half-ounce units. You might lose a premium for destroying the nice drawing of an eagle or buffalo on it, but the gold value remains the same. You can cut your half-ounce unit again and again to produce smaller denominations.

Divisibility is another area where Bitcoin excels. There are only twenty-one million coins, but each one is made up of one-hundred million smaller units (satoshis). This gives users a great deal of control over their transactions, as they can specify an amount to send up to eight decimal places. Bitcoin’s divisibility also makes it easier for small investors to buy fractions of BTC.

Store of Value, Medium of Exchange and Unit of Account

The sentiment is divided on Bitcoin’s current role. Many believe that Bitcoin is simply a currency – a tool to move funds from point A to point B. We’ll get into this in the next section, but this view is contrary to what many store of value proponents defend.

SoV proponents argue that Bitcoin must go through stages before it becomes the ultimate currency. It begins as a collectible (arguably where we are now): it has proven itself as functional and secure but has only been adopted by a small niche. Its core audience consists primarily of hobbyists and speculators.

Only once there is greater education, infrastructure for institutions, and more confidence in its capability to retain value can it progress to the next stage: store of value. Some believe it has already reached this level.

At this point, Bitcoin isn’t widely spent due to Gresham’s law, which states that bad money drives out good money. What this means is that, when presented with two kinds of currency, individuals will be inclined to spend the inferior one and to hoard the superior one. Users of Bitcoin prefer to spend fiat currencies, as they have little faith in their long-term survival. They hold (or HODL) their bitcoins, as they believe that they’ll retain value.

If the Bitcoin network continues to grow, more users will adopt it, liquidity will increase, and the price will become more stable. Because of stronger stability, there won’t be as much of an incentive to hold it in hopes of higher gains in the future. So we could expect it to be used a lot more in commerce and daily payments, as a strong medium of exchange.

Increased usage further stabilizes the price. In the final stage, Bitcoin would become a unit of account – it would be used to price other assets. Just as you might price a gallon of oil at $4, a world where Bitcoin reigns as money would have you measuring its value in bitcoins.

If these three monetary milestones are achieved, proponents see a future where Bitcoin has become a new standard that displaces the currencies used today.

The case against Bitcoin as a store of value

The arguments presented in the previous section may sound completely logical to some and like insanity to others. There are a handful of criticisms of the idea of Bitcoin as “digital gold,” coming both from Bitcoiners and from cryptocurrency skeptics.

Bitcoin as digital cash

Many are quick to point to the Bitcoin white paper when a disagreement on the topic arises. To them, it’s apparent that Satoshi intended for Bitcoin to be spent from the get-go. In fact, it’s in the very title of the paper: Bitcoin: A Peer-to-Peer Electronic Cash System.

The argument suggests that Bitcoin can only be valuable if users spend their coins. By hoarding them, you’re not aiding adoption – you’re harming it. If Bitcoin isn’t widely appreciated as digital cash, its core proposition is driven not by utility, but by speculation.

These ideological differences led to a significant fork in 2017. The minority of Bitcoiners wanted a system with bigger blocks, which meant cheaper transaction fees. Due to increased usage of the original network, the cost of a transaction could rise dramatically, and price many users out of lower-value transactions. If there’s an average fee of $10, it makes little sense for you to spend coins on a $3 purchase.

The forked network is known now as Bitcoin Cash. The original network rolled out its own upgrade around the time, known as SegWit. SegWit did nominally increase the capacity of the blocks, but that was not its main goal. It also laid the groundwork for the Lightning Network, which seeks to facilitate low-fee transactions by pushing them off-chain.

In practice, however, the Lightning Network is far from perfect. Regular Bitcoin transactions are considerably easier to understand, whereas managing Lightning Network channels and capacity comes with a steep learning curve. It remains to be seen whether it can be streamlined, or whether the solution’s design is fundamentally too complex to abstract away.

Because of the rising demand for block space, on-chain transactions are no longer as cheap at busy times. As such, one could put forward the argument that not increasing the block size damages Bitcoin’s usability as currency.

No intrinsic value

To many, the comparison between gold and Bitcoin is absurd. The history of gold is, essentially, the history of civilization. The precious metal has been a critical part of societies for thousands of years. Admittedly, it’s lost some of its dominance since the eradication of the gold standard but nonetheless remains the quintessential safe-haven asset.

Indeed, it does seem like a stretch to compare the network effects of the king of assets to an eleven-year-old protocol. Gold has been revered both as a status symbol and as an industrial metal for millennia.

In contrast, Bitcoin has no use outside of its network. You can’t use it as a conductor in electronics, nor can you craft it into a massive shiny chain when you decide to launch a hip-hop career. It may emulate gold (mining, finite supply, etc.), but that doesn’t change the fact that it’s a digital asset.

To an extent, all money is a shared belief – the dollar only has value because the government says so and society accepts it. Gold only has value because everyone agrees that it does. Bitcoin isn’t any different, but those that give it value are still a tiny group in the grand scheme. You’ve likely had many conversations in your personal life where you’ve had to explain what it is because the vast majority of people are unaware of it.

Volatility and correlation

Those that got into Bitcoin early have certainly enjoyed their wealth growing by orders of magnitude. To them, it has indeed stored value – and then some. But those that purchased their first coins at all-time high have no such experience. Many had big losses by selling at any point afterward.

Bitcoin is incredibly volatile, and its markets are unpredictable. Metals like gold and silver have insignificant fluctuations in comparison. You could make the case that it’s too early, and that the price will eventually stabilize. But that, in itself, could point to Bitcoin not currently being a store of value.

There’s also Bitcoin’s relation to traditional markets to consider. Since Bitcoin’s inception, they’ve been on a steady uptrend. The cryptocurrency hasn’t truly been tested as a safe-haven asset if all other asset classes are also doing well. Bitcoin enthusiasts might refer to it as “uncorrelated” with other assets, but there’s just no way of knowing that until other assets suffer while Bitcoin remains steady.

Tulip Mania and Beanie Babies

It wouldn’t be a proper criticism of Bitcoin’s store of value properties if we didn’t bring up the comparisons to Tulip Mania and Beanie Babies. These are weak analogies at the best of times, but they serve to illustrate the dangers of a bursting bubble.

In both instances, investors flocked to buy items that they perceived to be rare in the hopes of reselling them for a profit. In and of themselves, the items weren’t that valuable – they were relatively easy to produce. The bubble popped when investors realized that they were overvaluing their investments massively, and the markets for tulips and Beanie babies subsequently collapsed.

Again, these are weak analogies. Bitcoin’s value does stem from users’ belief in it but, unlike tulips, more cannot be grown to satisfy demand. That said, nothing guarantees that investors won’t see Bitcoin as overvalued in the future, causing its own bubble to burst.

Closing thoughts

Bitcoin certainly shares most of the features of a store of value like gold. The number of units is finite, the network is decentralized enough to offer security to holders, and it can be used to hold and transfer value.

Ultimately, it must still prove its worth as a safe-haven asset – it’s too early to say for sure. Things could go both ways – the world may flee to Bitcoin in times of economic turmoil, or it could continue to be used only by a minority group.

Time will tell.