Main Takeaways

The approval of spot ether (ETH) ETF exchange applications in the United States marks a monumental shift in the crypto regulatory landscape, enhancing the legitimacy of digital assets beyond bitcoin.

Binance witnessed record-breaking ETH trading activity following the news, reflecting the market's enthusiastic response and continued trust in the platform during pivotal events.

In the days leading up to the approval, Binance saw an 80% increase in institutional registrations, which can also be seen as evidence of accelerating legitimization of ether and crypto more broadly among professional investors.

Late May was rich in significant regulatory and policy developments for crypto. On May 23, the same day that the U.S. House of Representatives passed a bill that aims to create a new legal framework for digital assets, the Securities and Exchange Commission (SEC) took a significant step toward allowing the trading of spot ether (ETH) exchange-traded funds. Although specific products have not yet been authorized for trading, the SEC’s approval of exchange applications signals a monumental shift.

This decision, expected to materialize fully in the coming weeks or months, holds substantial symbolic and market-moving potential. The development, which came as a surprise for many observers, represents a broader narrative shift, underscoring the growing legitimacy of digital assets beyond bitcoin.

The SEC’s move has immediately reverberated throughout the market. Traders and investors have responded enthusiastically to the news, which was evident in soaring prices, surging demand, and record-breaking activity on Binance. As traders flocked to our platform, we successfully processed a massive volume of ETH trades, recording some remarkable activity metrics in the process.

With more than 200 million people trusting us to facilitate their crypto journeys, every event that holds significance for the global crypto community becomes imprinted in the patterns of user activity on Binance – and this time was no different.

Legitimizing Crypto Beyond Bitcoin

The approval marks another critical step in the legitimization of digital assets by both regulators and institutional investors, particularly of assets other than BTC. The recent approval of BTC ETFs in January was a significant milestone for mainstream adoption, setting the stage for broader acceptance of cryptocurrencies. However, the original cryptocurrency has always enjoyed a unique status among digital assets, and it was not immediately clear if others can hope for similar treatment. Now that regulated spot ETFs tracking another blue-chip token are on the horizon, the picture looks more promising for many others.

Notably, the ETF products mentioned in the SEC's decision were defined as “commodity-based trust shares,” suggesting a potential shift away from categorizing ether as a security. This reclassification could have profound implications for ETH’s – and, potentially, other assets’ – regulatory treatment and broader market perception globally.

Immediate and Long-Term Market Effects

In the short term, the approval of ETH ETFs has triggered a significant price surge and heightened demand for ETH. However, as was the case with the approval of BTC ETFs back in January, the impacts of this decision are likely to continue to be felt in the long term as well, strengthening the already growing adoption of cryptocurrencies by mainstream audiences and institutions.

Beyond increased adoption, this development has the potential to reshape the crypto ecosystem’s fundamental economics, especially in relation to staking. If substantial amounts of ETH are locked up in ETFs but not staked, this could lead to a reduced market supply, driving up prices due to increased demand from investors preferring regulated products.

Concurrently, the rising value of ETH might make staking more attractive, yet the scarcity of available ETH for staking could exert additional upward pressure on prices. In such a virtuous-cycle scenario, ETF holders would benefit from the asset’s appreciation.

Tangible Enthusiasm in the Market

As could be expected, the community’s reaction to the ETF approval has been energetic. ETH transaction volumes started to pick up as the news came in on May 20: according to CryptoQuant’s data, the number of transactions shot up from 6.6 million on that day to 9.8 million on May 28 — a surge of 48%. This uptick indicated the growing engagement and activity within the Ethereum network, driven by the positive sentiment surrounding the news.

Interestingly, a significant price breakthrough occurred a few days earlier, kicking off on May 20, when Bloomberg ETF analysts reassessed the odds of spot ETH ETF approval from 25% to 75%. The price of ether went up from around $3,080 on May 20 to the high of $3,910 on the day of the approval, going further up above $3,950 in the next few days. Still, the all-time high above $4,800, achieved in November 2021, remained out of reach.

Source: CryptoQuant

However, increased interest in ETH is not only with the aim of making a short-term profit from the surge in prices. According to CryptoQuant’s analysis, ETH demand was significantly bolstered by Permanent Holders – addresses that accumulate ETH without selling – who purchased over 100,000 ETH on May 20, marking the highest daily level since September 2023.

Supporting this bullish trend was the rise in open long positions in the futures market. Ether’s total open interest, which represents the total number of active positions in a specific contract, in the derivatives market surged from 2.8 to 3.2 million ETH within hours on May 20.

ETH’s Historic Week on Binance

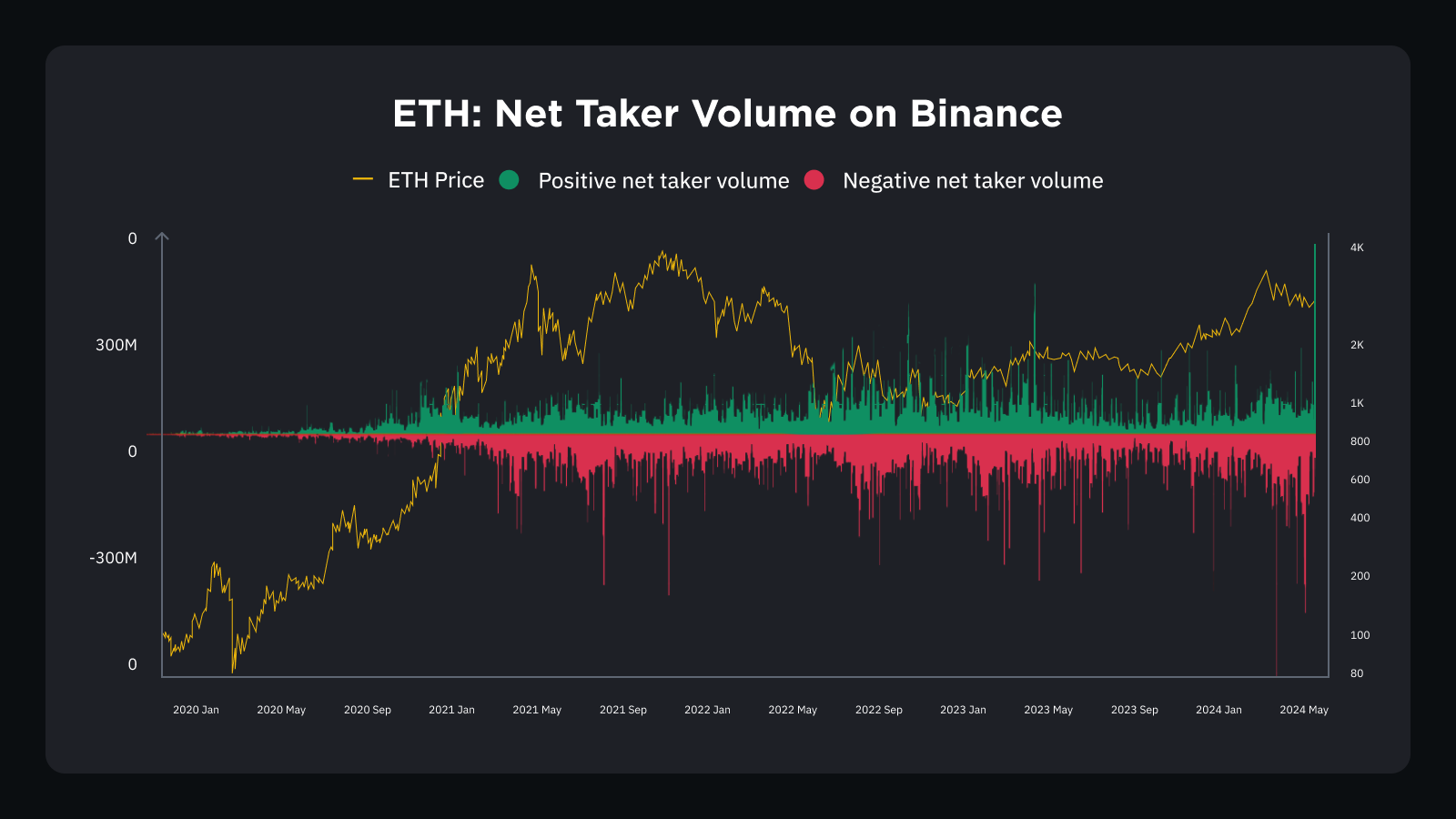

In the wake of the ETH ETF news, Binance has experienced record-breaking ETH trading activity. Net Taker Volume, a key metric that measures the difference between buying and selling volume via market orders, spiked dramatically as Binance users started executing significant long ETH positions on May 20, 2024.

Source: CryptoQuant

Furthermore, within only one candle, Taker Buy Volume exceeded Taker Sell Volume by $530 million — the largest such ETH candle ever recorded on Binance. In the Net Taker Volume chart, this dynamic is represented by the towering green bar on the far right, accompanied by a very short red Taker Sell bar looking downward.

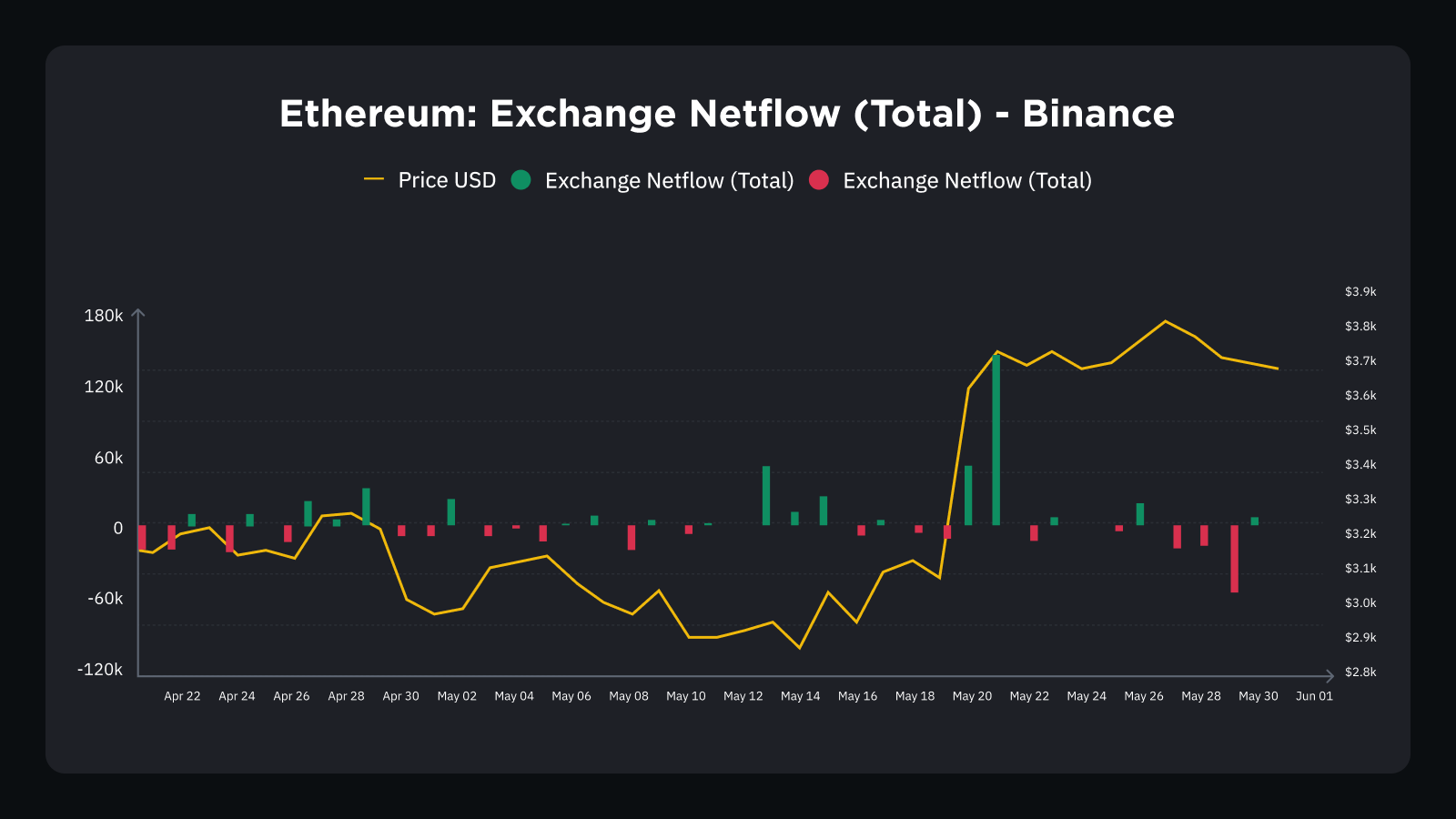

Ether inflows to Binance have also been noteworthy in this period. On May 21, Binance recorded netflows of 145,777 ETH, the highest daily netflow since May 2023, and continued to be strong in the following days. Notably, it was not just retail traders powering this surge. Between May 19 and May 23, the day of the SEC approval, we saw a 80% increase in institutional registrations on Binance, which supports the idea of increased legitimization of ether and crypto more broadly among institutional investors.

Source: CryptoQuant

In addition to indicating increased interest in ETH, this surge also highlighted the crypto community’s trust in Binance as a platform of choice to facilitate their trading needs during pivotal market events.

Richard Teng, Binance’s CEO, celebrated the news of the spot ETH ETF approvals with the crypto community:

This is a key development that signals increasing recognition and wider acceptance of digital assets within the traditional frameworks, particularly in an influential market such as the U.S. It adds to an already active market for digital-asset ETFs. We are optimistic that this latest step forward will lead to further regulatory acceptance, paving the way for more mainstream adoption of digital assets globally — be it for ETH, BTC, or others.

As retail traders and institutional investors respond to regulatory strides with enthusiasm, Binance continues building the robust infrastructure needed to support this growing demand from a rapidly expanding user base.