Blockchain technology has the potential to revolutionize the way that businesses and organizations operate, offering increased security, transparency, and efficiency. However, one of the challenges facing the widespread adoption of blockchain is that different networks often operate in isolation, with limited ability to communicate and exchange information and assets. A bridge is a solution to this problem, allowing two separate blockchain networks to communicate and exchange information and assets. LayerZero is building the future of omnichain and advancing cross-chain communication.

How does LayerZero differentiate itself from other bridges?

Cost-effective: It’s designed to carry lightweight messages across a bevy of chains via gas-efficient, non-upgradeable smart contracts. Running smart contracts on Layer 1 can be extremely expensive. Therefore, LayerZero exports storage and fetches transaction data to Oracles and Relayers, the two off-chain entities whose relationship ensures valid transactions, allowing the Ultra Light Node endpoints to be small and cost-effective. Furthermore, its lightweight clients’ low operating costs allow for the quick incorporation of new chains.

Simplicity: User applications building with LayerZero simply need to implement two functions - send and receive. It can be written in Solidity, Rust, etc. Furthermore, two chains can interact with each other without constraint in a fully trustless manner without a middleman in the system.

New Use Cases: Due to its ground-level as a messaging protocol, omnichain liquidity can be tapped by liquidity networks, yield aggregators, lending protocols and other dApps to unlock new use cases and enable higher capital efficiency.

Trackability: Cross-chain transactions can be tracked on a single database via LayerZero Scan, which allows users and developers to pull the state, status and timing of transactions.

How does the communication flow of LayerZero work?

Here’s the core concept of LayerZero:

Source

When a user application sends a message from chain A to chain B, the message is first sent through the LayerZero endpoint on chain A (sender). The endpoint then informs the designated Oracle and Relayer of the message coupled with a transaction on the sender chain and its destination.

The Oracle then forwards the block header to the endpoint on chain B (receiver), and the Relayer submits the transaction proof.

The message will be delivered to the intended recipient if the proof is verified on the destination chain. You may be wondering how did the assets move between chains? That’s a great question! Indeed, LayerZero operates as a messaging protocol. This asset transfer was made possible through:

The use of two endpoints for the "application", one on Chain A and one on Chain B

The implementation of a DEX/app that can manage the supply of assets across endpoints, preventing shortages

Stargate Finance provides this balancing technology. Their delta algorithm ensures that cross-chain liquidity is maintained and readily available.

LayerZero Ecosystem

Stargate Finance

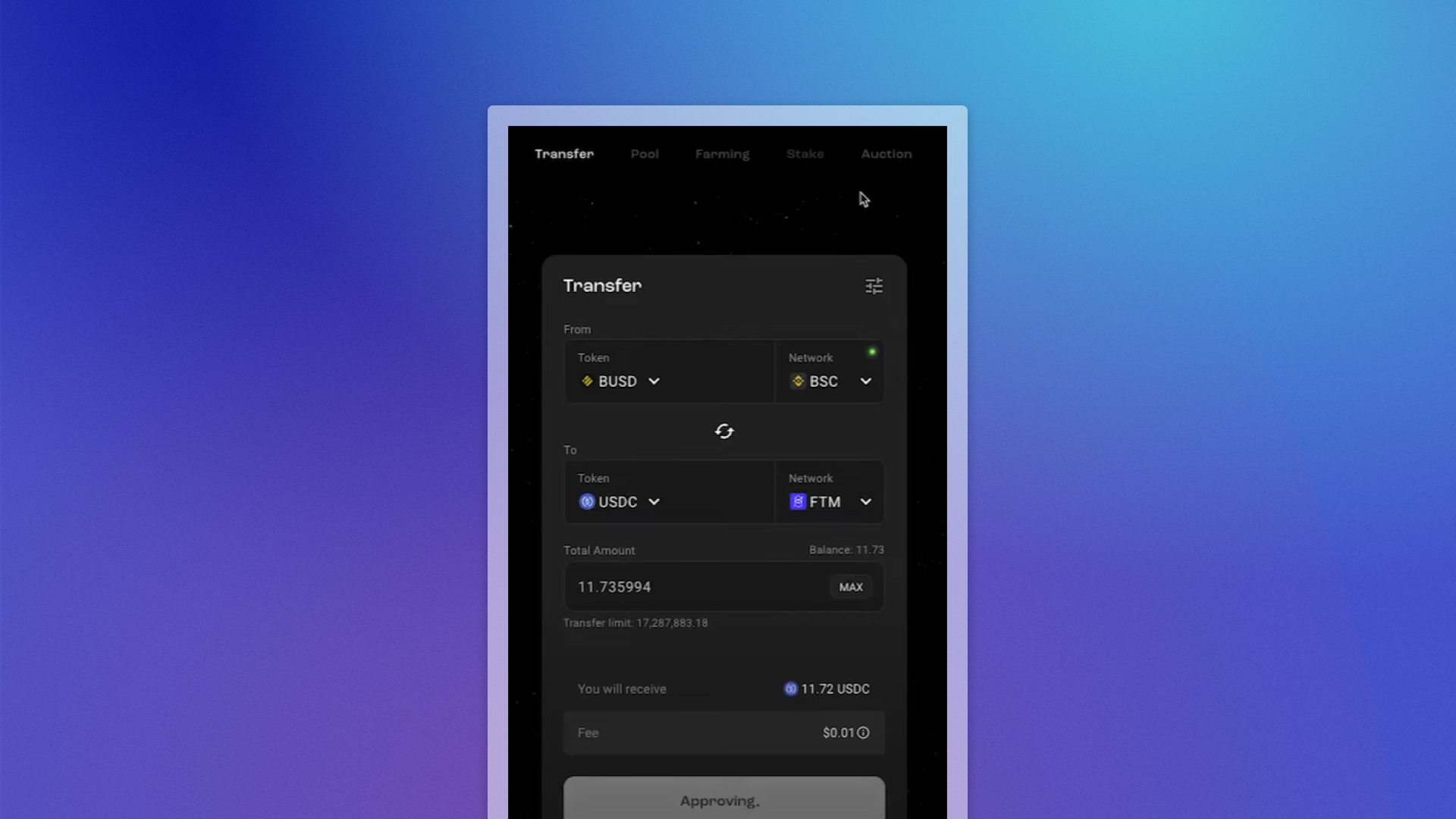

Stargate Finance allows the transfer of assets across different chains with minimum slippage due to unfragmented liquidity. As of April 06, 2022, they have reached $4B TVL, and they continue to scale. The recent news regarding the deployment of MetisDAO, will take advantage of LayerZero technology to leverage greater flexibility for projects to manage their funds, treasury, and yield strategies.

There are currently seven chains to transfer assets from, with the most available assets in stablecoins (USDC, BUSD, USDT). Here’s a brief rundown of how it works.

Connect

Choose the asset to transfer

Choose which chains

Approve and transfer

Wait for about 45 seconds

Ta-da

This is a significant breakthrough for blockchain applications, opening the doors for a wide range of possibilities, from unified DeFi liquidity to NFTs that can exist across multiple chains.

Pudgy Penguins

Pudgy Penguins has recently partnered with LayerZero to enable cross-chain transactions in an attempt to reach millions of Web3 users. The project has chosen to work with Polygon, BNB Smart Chain, and Arbitrum thanks to their “rapidly growing usage and exposure.” The current infrastructure is limiting the onboarding of new customers. Using LayerZero’s technology, Pudgy Penguins can communicate and operate across Ethereum, Polygon, Arbitrum, and the BNB Smart Chain.

Gh0stly Gh0sts

This is the first omnichain NFT minted on all seven blockchains compatible with LayerZero. A Gh0stly Gh0sts NFT with a red bg minted in Avax reached 1ETH within the first 24hrs of launch. The project had a good BD similar to the BinanceNFT and CoinbaseNFT partnerships. The project has been laying low since then, but as stated in their last announcement, it focuses on empowering the community. Moreover, only 4% of it is listed on Opensea (ETH).

TapiocaDAO

Simply put, TapiocaDAO allows you to borrow and lend assets across 12+ chains without worrying about defragmented liquidity or the need for bridging. $USD0 will soon be introduced as the first Omnichain stablecoin. Why is that big news?

Imagine lending your ETH in Ethereum to borrow stablecoins (USD0) in Arbitrum. This isn't possible in existing DeFi protocols, but TapiocaDAO is making it happen. The project uses Kashi, an isolated risk market lending and borrowing engine, and Yieldbox (BentoboxV2) for their smart contracts.

Rage Trade

Rage Trade is the best example that has unlocked omnichain liquidity through LayerZero by allowing users to deposit yield-generating assets (LPs in AMMs, money markets, derivatives) from LayerZero compatible chains. In Rage Trade, Arbitrum is the host chain where it holds the perp and vaults.

Other chains serve as LP chains where LP collateral is held and managed. LayerZero’s cross-chain message protocol is utilized to convey messages to/from Host Chain and LP Chain. Moreover, it uses Stargate to bridge USD PnL to/from the vaults. This allows Rage Trade to aggregate other DeFi protocols’ liquidity with vAMM to provide better liquidity depth for users.

What are some of the other potential use cases that we envision?

Technical solution backing multichain games

Multichain lending and borrowing market

Arbitrage multichain bots

Multichain liquidity for DEXs

Multichain NFTs

We will dive deeper into each of these in a separate article in the future.

Potential flaws with LayerZero

Like any new technology, LayerZero has its potential challenges. One concern is the possibility of project owners acting maliciously and stealing funds. To mitigate this risk, LayerZero relies on the user application to set the number of block confirmations that the oracle and relayer must wait for before delivering the proof.

Lately, there has been a heated discussion about a different type of system’s vulnerability.

A vulnerability known as "backdoor" exists when a trusted party has the ability to compromise the entire system. Unfortunately, this vulnerability is a part of the upgradability system and cannot be fully addressed. Many projects have implemented LayerZero. However, only ten are taking steps to address this risk by changing the default security parameters.