Leveraging Market Momentum with Trailing Up & Trailing Down features in USDⓈ-M Futures Grid Trading

Main Takeaways

Grid trading automates placing buy and sell orders for futures contracts by specifying a configured price range with upper and lower limits, aiming to buy low and sell high.

The Trailing Up function allows traders to take advantage of the uptrend by automatically adjusting the pre-determined trading range.

Likewise, the Trailing Down feature enables traders to also capitalize on market downturns by automatically adjusting the trading range downward.

By adjusting the configured trading range in response to price movements, the function ensures that a trader can not only lock in profits but also adjust their stop loss level upward or downward accordingly.

Disclaimer: Digital asset prices can be volatile. Do your own research. See full terms here and our risk warning here and below. Binance Futures products are restricted in certain countries and to certain users. This communication is not intended for users/countries to which restrictions apply.

The grid trading bot on Binance Futures allows users to automate their trading strategies. Futures Grid Bot enables users to capitalize on both upward and downward trends, offering traders a strategic and automated tool that places buy and sell orders within a pre-determined range.

The bot is programmed to capitalize on movements only within the defined range. This means that a long-grid bot will not place orders beyond its highest range of the grid even if the asset continues to increase due to a potential price breakthrough.

If the price goes above the pre-set range, the bot will stop arbitraging.

To enable users to capture the price breakthroughs in futures grid trading, Binance Futures has introduced the Trailing featured, allowing users to aim for higher profits by taking advantage of price increases or decreases beyond the highest and lowest ends of the grid range.

Before diving into the Trailing function and how it can be used within the futures Grid Trading Bot, let’s first take a brief look at how grid trading works.

Futures Grid Trading

Grid trading automates placing buy and sell orders for futures contracts by specifying the upper and lower limit. The bot will continue to execute orders as long as the price fluctuates between these limits. In the case of long grid trading, the grid bot will incrementally place buy orders as the price falls below the current price and sell orders as the price rises.

Let’s assume that the current market price of the BTCUSDT contract is 70,000 USDT. Bob opens a long-grid trading strategy for BTCUSDT as he expects the market to remain within the range of 65,000 USDT and 75,000 USDT. He configures this range as the upper and lower price limits with 1000 USDT as the preset. This means that the bot would place buy orders when the price of BTCUSDT dips below the current price by 1000 USDT and sell orders at every 1000 USDT above the current price. This process continues until the trader stops the grid bot or the price trends below or above the set range.

If grid trading is enabled without the Trailing function, the bot stops placing orders if the price falls below the lowest configured range (65,000 USDT) or above the upper limit (75,000 USDT).

What Is the Trailing Feature?

The Trailing function allows traders to take advantage of the uptrend by automatically adjusting the pre-determined trading range upward (for trailing up) and downward (for trailing down) if the price goes above or below the price range bounds.

Trailing Up

If Trailing Up is activated, the configured range extends beyond the bound with price breakthroughs to align with the market's upward and downward trends, as shown below.

[Trailing Up] enabled

Traders can leverage profitable opportunities as the grid’s upper and lower limits are adjusted. So it allows traders to secure greater profits by capitalizing on price increases that surpass the upper range of the grid.

Trailing Down

On the other hand, Trailing Down is a grid bot feature that allows traders to extend the grid downwards when the cryptocurrency’s price falls below a preset trading range. It allows traders to capture profits from a falling market by automatically adjusting the trading range if the price falls below the lower price limit to align with the downtrend.

[Trailing Down] enabled

When the Trailing Down function is enabled, traders can take advantage of downward market trends by having the grid’s upper and lower limits adjusted downward.

The Trailing Floor Price, in this case, is the minimum price of the symbol at which the bot stops adjusting the price grid downwards. When the Trailing Floor Price is reached, the bot continues operating normally within the latest lower price range.

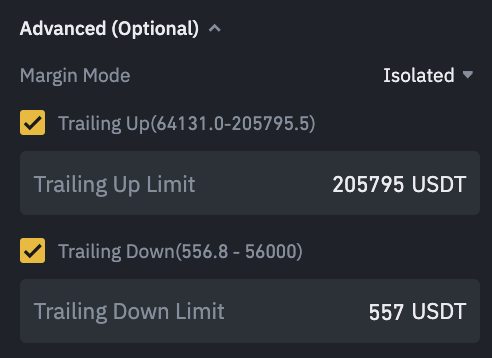

Combined Trailing Up and Trailing Down

Enabling both Trailing Up and Trailing Down allows traders to capture gains from both market uptrends and downtrends without manual adjustments.This combined setup enables traders to dynamically adjust their trading range to continuously align with market movements, optimizing profit potential in both rising and falling markets.

Both [Trailing Up] and [Trailing Down] enabled

TP/SL orders adjustments

When the Trailing Up function is enabled, the stop-loss price also rises to align with the new upper and lower limits of the grid. This adjustment allows traders to secure greater profits by capitalizing on price increases that surpass the upper range of the grid.

Similarly, when the Trailing Down function is enabled, the stop-loss price drops to align with the new range, enabling traders to maximize profits from price decreases that fall below the lower range of the grid.

It is important to note that when both Trailing Up and Trailing Down are enabled simultaneously, the take profit and stop-loss price levels will not be trailed.

Creating an Infinity Grid Strategy using Trailing Up and Trailing Down

To create a near-Infinity Grid strategy, you can configure the trailing limits strategically:

Trailing Up Limit: Set very close to the trailing cap price.

Trailing Down Limit: Set very close to the minimum price (trailing floor price).

By enabling both Trailing Up and Trailing Down and ensuring these limits are near their respective caps, you can create a near-infinity grid. This strategy allows the grid to dynamically adjust and extend its trading range continuously, capturing profits from ongoing market movements without requiring frequent manual intervention.

Example of Trailing Up Futures Grid

In our example above, let’s assume that Bob has enabled the Trailing Up function for his futures grid with a lower limit of 65,000 USDT and an upper limit of 75,000 USDT with a preset grid gap of 2,000 USDT. Here’s how the futures grid would work if the price of the BTCUSDT contract begins to rise above the upper bound of the range.

A new order will be placed when the price surpasses the upper limit price + the price difference between the grid levels, which is 77,000 USDT (75,000 USDT + 2,000 USDT) in our case. Once the price has surpassed that level (reaching 77,010 USDT for instance), the bot will adjust the upper grid and place a buy order at 75,000 USDT. Simultaneously, the bot will cancel the lowest buy order, and the lower grid will also be adjusted upwards by 2,000 USDT, setting it at 67,000 USDT. Consequently, the newly configured trading range will now be 67,000 USDT and 77,000 USDT.

This adjustment ensures that Bob can continue to participate in the market dynamics by capturing gains above his initial upper limit while also raising his stop loss level in response to the market's upward movement.

Example of Trailing Down Futures Grid

Imagine Alice uses the Trailing Down feature in Binance Futures grid trading and the market declines, with the market price dropping below the lower price limit of the initial grid setup. Assume that the grid’s upper range and lower range are 70,000 USDT and 60,000 USDT, respectively.

If the preset grid gap is 3,000 USDT, a new order is placed when the market price falls below the lower limit price - the price difference between the grid levels. That is, 57,000 USDT (60,000 USDT - 3,000 USDT). Hence, if the price falls below this level, say 56,950 USDT, the bot automatically adjusts the lower grid and places a new sell order at 60,000 USDT. The grid bot simultaneously cancels the uppermost sell order and adjusts the upper grid range downwards by the price gap (3,000 USDT in this case). This makes the new upper price limit 67,000 USDT.

Generally speaking, the grid bot extends the grid range with new sell orders, allowing Alice to continue trading as the market declines beyond the preset range. As a result, Alice does not miss out on potential profits due to a downtrending market.

Bottom Line

The Trailing Up and Down feature serves as a strategic tool for traders to capitalise on the upward market trends without constantly monitoring their positions. By adjusting the configured trading range in response to price movements, the function ensures that a trader can not only lock in profits but also raise their stop loss.

The function displays how automation and smart trading can enhance trading efficiency for both novice and experienced traders using futures grid bot.

Further Reading

(Blog) Step-by-step Guide to Grid Trading on Binance Futures

(FAQ) How to Use the Trailing Up and Trailing Down Functions in USDⓈ-M Futures Grid Trading?

Risk Warning:

No Representation

This content is presented to you on an "as is" basis for general information and educational purposes only, without representation or warranty of any kind. It is not intended or should not be construed as financial or investment advice, nor is it to recommend or intend to recommend the purchase or sale of any specific product(s) or service(s).

Hypothetical Performance Results

Digital asset prices can be volatile. The value of your investment may go down or up, and you may not get back the amount invested. Any results posted herein are intended as examples only to provide you with a reference of what potentially could have made or lost trading with the technical indicators and tools, but are in no way a reflection of what you could have made or lost in the same situation. Therefore, you should not rely on the results as a representation of what your returns or losses would have been utilizing such technical indicators. There are numerous other factors related to the market in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance.

Responsibilities

You are solely responsible for your investment decisions, and Binance is not liable for any losses or damages you may incur. The risk warning described herein is not exhaustive, therefore you should carefully consider your investment experience, financial situation, investment objective, risk tolerance level and consult your independent financial adviser as to the suitability of your situation prior making any investment. For more information, see our Terms of Use and Risk Warning and Responsible Trading Page.

The products and services referred to herein may be restricted in certain jurisdictions or regions or to certain users in accordance with applicable legal and regulatory requirements. You are solely responsible for informing yourself about and observing any restrictions and/or requirements imposed with respect to the access to and use of any products and services offered by or available through Binance in each country or region from which they are accessed by you or on your behalf. Binance reserves the right to change, modify or impose additional restrictions with respect to the access to and use of any products and/or services offered from time to time in its sole discretion at any time without notification.