Crypto Futures Basics: What Is Liquidation and How to Avoid It?

Key Takeaways:

Leveraged positions are prone to volatile price swings, which may cause a trader’s equity to plunge into negative balance instantaneously and result in significant losses.

Liquidation mechanisms help prevent traders’ accounts from falling into negative equity.

Multiple strategies can be implemented to prevent liquidation, such as monitoring margin, using stop-losses or lowering the amount of leverage.

Crypto derivatives have gained a lot of popularity over the years, attracting traders from all over the world to Binance Futures. Given the high volatility in the cryptocurrency market, these financial instruments can help increase traders' profits within a short period through the use of leverage. However, it is important to remember that there are also considerable risks associated with leveraged trading. One of the main factors to succeed in futures trading is strategizing each trade carefully and understanding how much capital is at risk.

In futures trading, where leverage is easily accessible, knowing how much capital and leverage is vested into a trade will help you understand your total risk exposure, because in some cases, losing trades can lead to liquidation.

What Is Liquidation in Crypto Futures Trades?

The term liquidation is traditionally used to describe the conversion of assets into cash. But in futures trading, liquidation is something you want to avoid by all means.

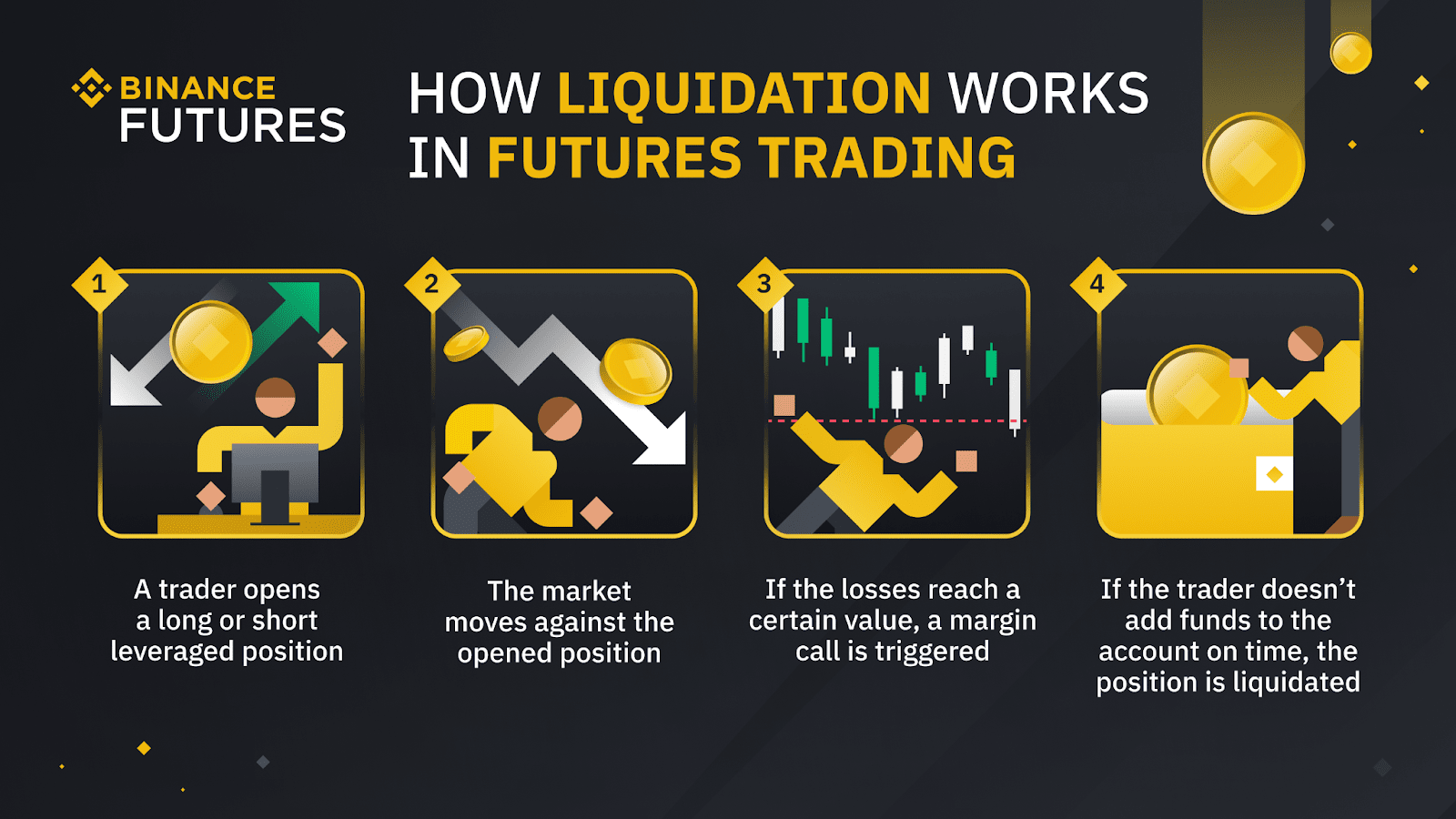

Leveraged positions are prone to volatile price swings, which may cause a trader’s equity to plunge into negative balance instantaneously. In such cases, losses can be more significant than the maintenance margin, leading to liquidation. This process is involuntary and automatic if a trade has come to meet specific price criteria.

Liquidation can happen either slowly or quickly, depending on the amount of leverage used in a trade.

For example, with lower amounts of leverage, liquidation won’t happen as soon as a minor correction occurs in the market. Nonetheless, higher amounts of leverage can deplete traders’ initial investment with little to no effort.

When Would Liquidation Occur?

A forced liquidation process happens when a trader can no longer meet the margin requirements of their leveraged position.

Let’s say you were to open a long BTC/BUSD leveraged position with $100 as your account balance. You used 20x leverage to enter a trade worth $2,000. If the price of BTC were to drop by only 5%, your account balance would be wiped out as you can no longer fulfill the margin call demands to keep the trade afloat. This is what is called liquidation in futures trading.

Although this is a basic example, it is crucial to know your limits and how much you’re willing to lose on a trade to understand how much leverage you should use.

Binance Futures has introduced leverage limits on new accounts to protect users from the dangers and unintended consequences of using high leverage. It is imperative to fully understand the impact of leverage and the circumstances under which it can significantly damage the probability of a profitable trade.

Read more about how to reduce your chances of liquidation.

Quick Tips to Prevent Liquidation

To remain on the safe side, traders must have a plan in place with planned exits before entering any trade.

There are multiple strategies that can be implemented to avoid risks, but you should consider the following to avoid liquidation.

1. Use Stop-Loss Orders

The most obvious answer to avoid liquidation is simply using a stop loss. A stop loss is a trading tool Binance Futures offers, which allows traders to set a price to automatically exit a trade should the price of an asset hit this predetermined level.

Using a stop loss in conjunction with a liquidation calculator, can help protect a trader’s account from incurring significant losses, and especially from liquidation.

Although you may still lose some funds, the stop loss tool will protect you from losing everything on a trade and from having to pay liquidation fees. Besides, who wants to lose and get penalized for it? By using a stop-loss, you can prevent this from happening.

2. Decrease the Amount of Leverage

Leverage has a significant impact on the longevity of a trade. While it may be enticing to use large amounts of leverage, it could also magnify your losses.

As shown in the example above, the high amount of leverage can hurt a trader even when a small price change occurs. Thus, using lower leverage will help you navigate a volatile crypto market smoothly and safely.

3. Monitor the Margin Ratio

Another option that traders can implement is monitoring the margin ratio. When the margin ratio hits 100%, the position will be liquidated. To avoid this outcome, traders can add more margin to their trade to return leverage and reduce their position). This method is akin to keeping a position alive when the trade is heading further in the wrong direction.

Adding more margin or reducing leverage is similar to starting with less leverage in the first place. The difference is that maintaining a specific margin ratio can be done over more extended periods and is a dynamic solution.

In Summary

Liquidation is a scary word that traders would much prefer to avoid if possible. The good news is that traders have several tools and trading strategies that they can implement to avoid being liquidated. From stop losses to monitoring the margin ratio, traders have multiple resources to avoid liquidation.

If you think you might want to learn more about trading, Binance Futures offers everything a trader may need to trade responsibly, like the Ultimate Guide to Trading on Binance Futures. Additionally, the platform offers incredibly competitive rates, fees, and multiple financial instruments for traders.

Read the following support items for more information about trading futures:

(Support) How to Place Stop Loss Order and Take Profit Order

(Blog) How Binance Takes Responsible Trading Seriously, and You Should Too

And many more Binance Futures FAQ topics...